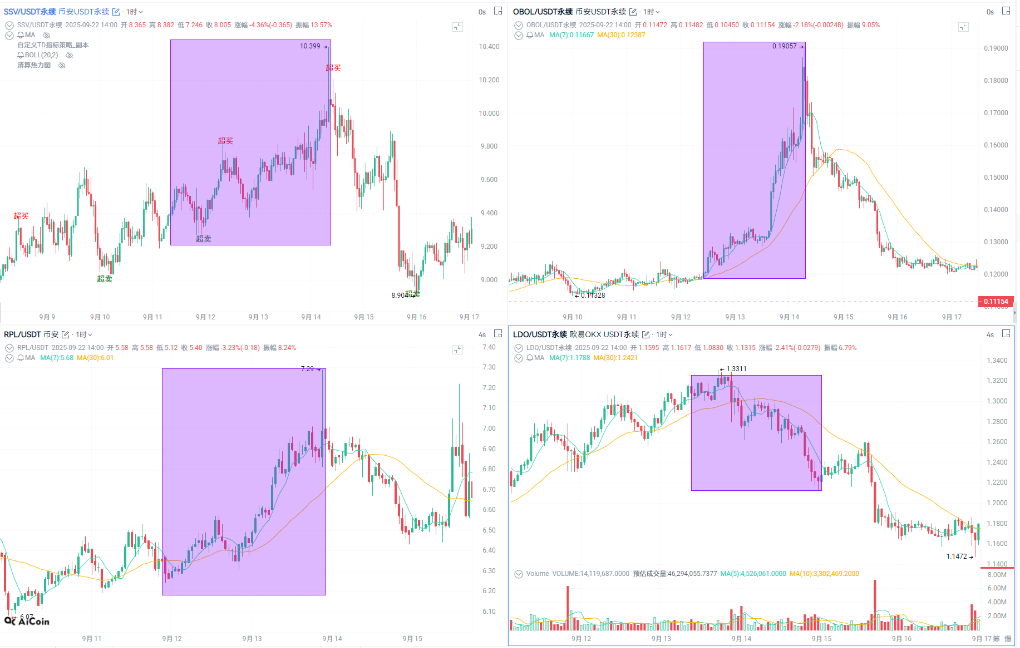

In September 2025, Vitalik Buterin officially proposed the "Rainbow Staking" draft at the Ethereum research forum. This proposal is based on the initial concept put forward by Ethereum Foundation researcher Barnabé Monnot in February 2024 and further systematizes a protocol-level solution to address the centralization risks in the Ethereum staking ecosystem. The draft proposes a dual-layer mechanism that combines "Heavy Staking" and "Light Staking," utilizing Verifiable Delay Functions (VDF) for random selection of nodes. It explicitly incorporates the "self-limiting" clause of liquidity protocols (such as a 25% share cap) into the underlying protocol to promote the decentralization of validation power and the dynamic balance of the ecosystem. The proposal directly responds to the market dominance phenomenon of liquidity giants like Lido, which currently holds 32% of the total staking share. Within 48 hours of the release, tokens from decentralized protocols such as SSV, Obol, and Rocket Pool saw an increase, while LDO dropped by 4.7%, indicating the market's high sensitivity to expectations of "rebalancing" in the Ethereum consensus layer.

1. Centralization Risks Under Lido's Dominance Are Being Highlighted

The Ethereum staking ecosystem is facing the challenge of "re-centralization." With a 32% staking share and a "double centralization" model where the top 5 of its 38 node operators control over half of the signing rights, Lido poses a potential threat to the consensus layer. Its "one token, one vote" governance mechanism concentrates 63% of voting power in the top 100 addresses, and the annual fee of $180 million has not adequately benefited ETH holders. More concerning is that any technical error (such as missed blocks or double signing) could trigger the de-pegging of stETH and lead to a chain liquidation— the 6% discount of stETH in June 2022 still haunts the market. While Lido provides liquidity staking convenience, it objectively suppresses the participation of independent stakers, raising systemic risks. If a single protocol's staking ratio exceeds 30%, the network becomes more susceptible to security threats like 51% attacks, which contradicts Ethereum's pursuit of decentralization.

2. The Core Mechanism of the "Rainbow Staking" Proposal: Layering and Limitation

The "Rainbow Staking" framework proposed by Vitalik aims to enhance system resilience through service unbundling, allowing different types of participants—including independent stakers and professional operators—to choose service types based on their conditions.

Its core design includes two paths:

● Heavy Staking: Targeted at services with high capital efficiency requirements, such as Finality Tools (FFG) and the Gasper mechanism. Participants must run full nodes, sign per slot, and bear slashing risks, making it suitable for professional node operators.

● Light Staking: Focused on censorship resistance and Sybil resistance mechanisms, relying on a lottery mechanism to randomly select participants, with low signing frequency and minimal slashing risk, allowing entry thresholds as low as 1 ETH, making it more suitable for ordinary users.

This mechanism also introduces a 25% protocol share red line, which automatically triggers punitive adjustments if exceeded, while enhancing randomness through VDF and adjusting pool yields through tiered interest rates. The goal is to revert "super protocols" like Lido to neutral technical service channels and curb their excessive expansion.

3. Decentralized Protocols Unite in Response, Competing for Staking Market Share

The concept of "Rainbow Staking" quickly gained support from a number of decentralized protocols, including SSV, Obol, Rocket Pool, and Puffer, all announcing compatibility with this design and actively seeking market share outside of Lido.

Specific developments include: SSV's node count increased by 22% in a week, and it launched a validator fragmentation plugin; Obol partnered with EtherFi to advance multi-operator testnets; Rocket Pool lowered the mini-pool threshold to 8 ETH through community voting and set a 25% self-regulatory cap; Puffer received funding from the Ethereum Foundation due to its low entry point of 1 ETH and hardware isolation technology.

These projects generally emphasize "non-custodial" and "fragmented" characteristics, aiming to enhance the participation opportunities for independent stakers and increase the credibility of LST (liquid staking tokens). Price movements of related tokens in the secondary market also reflect investors' optimism towards decentralized alternatives.

4. Conclusion: Decentralization Has No "Endgame," Only Dynamic Balance

Lido has not passively responded; its recent measures include launching a dual governance mechanism for stETH and LDO, reducing the fee rate to 7%, establishing a decentralized reserve of 20,000 ETH, and introducing a "community staking module" plan to expand node operators to over 100. However, the actual implementation of "Rainbow Staking" still faces numerous challenges, including governance-level disagreements (such as the influence of investment firms like a16z and Paradigm in developer meetings) and the practical timeline for advancing hard forks.

If the proposal can be successfully implemented alongside the 2026 Pectra upgrade, the concentration of the Ethereum staking market is expected to drop to CR5<45% in the next three years, with Lido's share potentially shrinking to 22%-25%, and the annualized yield across the network expected to remain at 3.2%-4.8%.

Ultimately, decentralization is not a one-time achievable ultimate state but a dynamic process of continuous adjustment and iteration among technical mechanisms, economic incentives, and governance culture. Ultimately, decentralization is not a one-time achievable ultimate state but a dynamic process of continuous adjustment and iteration among technical mechanisms, economic incentives, and governance culture.

Join our community to discuss and grow stronger together!

Official Telegram Community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=7JmRjnl3w

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。