Author: hejaswini M A

Translation: Baihua Blockchain

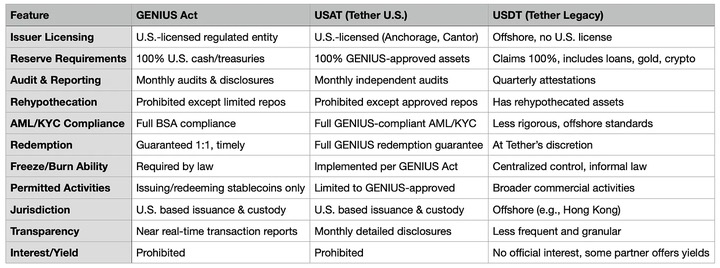

On September 19, 2025, Bo Hines resigned from the White House Cryptocurrency Committee to become the CEO of Tether's new U.S. division. His mission is to launch USAT, a stablecoin that fully complies with the GENIUS Act. USAT will undergo monthly audits, with reserve assets limited to cash and short-term U.S. Treasury bonds, operating under the supervision of the U.S. Federal Bank.

Meanwhile, Tether's other stablecoin, USDT, has a monthly trading volume exceeding $1 trillion, with reserve assets including Bitcoin, gold, and secured loans, managed by offshore entities, and has never undergone a comprehensive audit.

The same company, two distinctly different stablecoin strategies.

Last year, Tether earned an astonishing profit of $13.7 billion with its "move fast and ask for forgiveness later" model. In contrast, Circle successfully went public through strict compliance and proactive communication, achieving a valuation of $7 billion.

This news should have been a moment of celebration.

For years, Tether has faced regulatory controversies, ongoing transparency issues, and questions about its reserve assets. Now, Tether finally offers a product for the U.S. market that meets all regulatory requirements: fully compliant, independently audited, regulated custodians, and reserves composed solely of cash and short-term U.S. Treasury bonds.

However, the focus of the discussion has shifted to regulatory arbitrage, competitive advantages, and the intriguing awkward moments when revolutionary technology collides with traditional order. People pretend that everything is going according to plan, but the reality is that through clever corporate structuring, Tether seems to have found a way to serve two entirely different needs simultaneously.

Tether's Extraordinary Achievement: USDT's Global Dominance

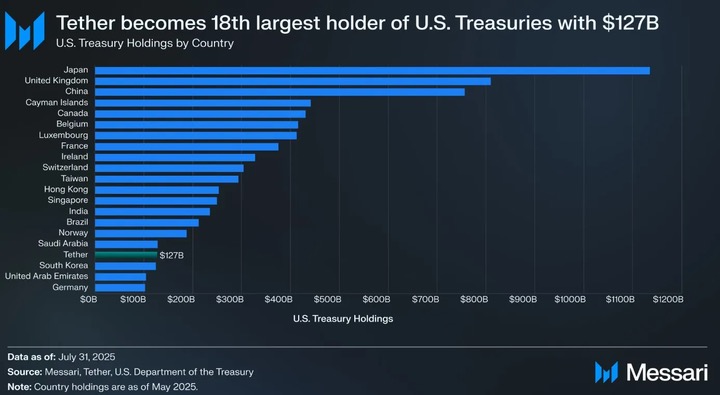

Before delving into USAT, let's appreciate the astonishing scale of USDT. The total circulation of USDT reaches $172 billion, processing over $1 trillion in transactions monthly across the global cryptocurrency market. If Tether were compared to a country, its holdings of $127 billion in U.S. Treasury bonds would make it the 18th largest holder of U.S. debt globally.

Even more astonishing is that Tether achieved a profit of $13.7 billion last year—note that this is net profit, not revenue. This places it among the most profitable companies in the world, surpassing many Fortune 500 companies.

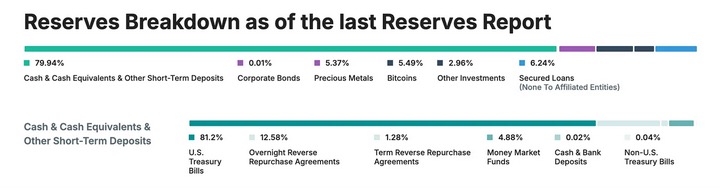

Behind all these achievements, Tether has not undergone comprehensive audits, nor has it adhered to the transparency requirements that traditional financial institutions are accustomed to. Instead, it relies on quarterly "proofs" rather than full audits, with reserve assets including gold (3.5%), Bitcoin (5.4%), secured loans, and corporate bonds—assets that are prohibited under strict stablecoin regulatory frameworks. Furthermore, Tether primarily operates through offshore entities in Hong Kong and the British Virgin Islands.

This is a classic case: Tether has built a financial empire by completely diverging from regulatory preferences.

Challenges of the GENIUS Act

In July 2025, the U.S. introduced the GENIUS Act, the first comprehensive regulatory framework for stablecoins in the country. Suddenly, the most important and influential U.S. cryptocurrency market faced a set of strict new rules:

100% of reserves must be in cash and short-term U.S. Treasury bonds (prohibiting Bitcoin, gold, secured loans, etc.).

Independent audits must be conducted monthly, with the CEO and CFO providing certifications.

Issuers must be registered in the U.S., and custodians must be U.S.-regulated.

Full compliance with anti-money laundering (AML) and know your customer (KYC) requirements, with asset freezing capabilities.

Prohibition on paying interest to holders.

Complete transparency regarding reserve asset composition.

In light of USDT's existing structure, these requirements clearly pose a significant challenge. The GENIUS Act explicitly distinguishes between "foreign" stablecoins and U.S.-domestic stablecoins. USDT, issued by Tether entities in the British Virgin Islands and Hong Kong, cannot simply adjust to meet compliance requirements. This necessitates a complete overhaul of its corporate structure, reserve asset composition, and operational model.

More challenging is that compliance means Tether must provide the transparency it has historically avoided. As of 2025, Tether still only provides quarterly "proofs" rather than comprehensive audits, with about 16% of its reserves (gold, Bitcoin, secured loans, and corporate bonds) clearly violating the requirements of the GENIUS Act.

Why Not Revamp USDT, But Launch USAT?

Given this, why doesn't Tether simply make USDT compliant instead of launching a brand new USAT?

The answer is simple: revamping USDT would be akin to converting a speedboat into an aircraft carrier while it's speeding along. Currently, USDT serves 500 million users globally, who choose USDT precisely because it is not bound by strict U.S. regulatory constraints. Many users are in emerging markets, and USDT provides them with a dollar channel to bypass unreliable or expensive local banking systems.

If Tether suddenly imposed U.S.-level KYC requirements, freezing capabilities, and audit protocols on USDT, it would fundamentally alter USDT's core value. Imagine a small business owner in Brazil using USDT to avoid currency volatility risks; they do not want to face U.S. compliance requirements; a crypto trader in Southeast Asia also does not need to receive monthly certification documents from the CEO.

A deeper reason lies in market segmentation. By launching USAT, Tether can offer a "premium" compliant product in the U.S. market to meet institutional needs while retaining USDT as the "mass standard" for global users. It's like having both a luxury brand and a mass-market brand—one company providing different products for different customers.

Positioning and Challenges of USAT

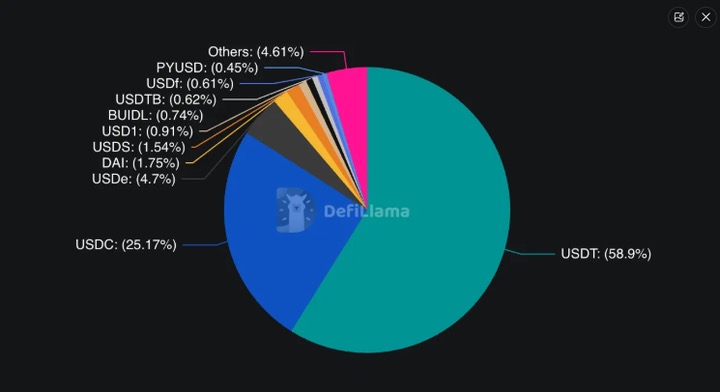

So, what unique value can USAT provide that distinguishes it from Circle's USDC? The answer is somewhat vague.

Technically, both USAT and USDT are based on Tether's Hadron platform, allowing for seamless integration with existing infrastructure while maintaining regulatory separation. Legally, liquidity can flow between the two systems, but compliance "firewalls" ensure that each token operates independently within its jurisdiction.

USAT will be issued by the federally chartered cryptocurrency bank Anchorage Digital Bank, with reserves held by Cantor Fitzgerald, fully complying with the GENIUS Act's requirements, including monthly audits, transparent reserves, and all regulatory features required by institutional users. Under the leadership of former White House cryptocurrency advisor Bo Hines, USAT also has a strong political background and connections in Washington.

However, Circle's USDC has already met all these conditions. USDC boasts deep liquidity, mature trading platform integrations, extensive institutional partnerships, and an impeccable compliance record. It has become the preferred stablecoin for U.S. institutional investors.

Tether's advantage lies in its brand and scale. As the largest stablecoin issuer globally, Tether has a massive market share and $13.7 billion in annual profits to support its expansion. CEO Paolo Ardoino has stated, "Unlike our competitors, we do not need to rent distribution channels; we have our own network."

But USAT faces a dilemma: it needs to build liquidity from scratch. This means persuading trading platforms to list USAT, attracting market makers to provide liquidity, and getting institutional clients to actually use it. Even with Tether's strong financial backing and extensive distribution network, this is not an easy task.

Currently, USDC holds about 25% of the global stablecoin market share but dominates the compliant U.S. market; USDT, on the other hand, has a 58% global market share but is almost excluded from the compliant U.S. market.

Potential Advantages of USAT

Despite the challenges, USAT still has unique competitive strengths. Tether's global distribution network includes "hundreds of thousands of physical distribution points," as well as digital partnerships like the $775 million investment in Rumble. This infrastructure has been built over more than a decade and is difficult to replicate.

In the first half of 2025, Tether achieved a profit of $5.7 billion, providing ample funds for market promotion, liquidity incentives, and partnership expansion. Unlike competitors that need to "rent" distribution channels, Tether has its own infrastructure.

Another significant advantage of USAT may be compatibility. If USAT can seamlessly integrate with the existing USDT infrastructure, users will not need to make significant adjustments to their systems. For developers who have already spent months integrating USDT, switching to another Tether token is far easier than re-engaging with a completely new supplier.

Additionally, some institutions or risk-averse users may wish to diversify their risk by holding multiple compliant stablecoins. If Circle or USDC encounters issues, institutions may need another fully compliant alternative. Tether's relationships with partners like Cantor Fitzgerald may also offer better terms or services.

Time is of the Essence and Market Realities

Time is critical. USAT is scheduled to launch by the end of 2025, meaning Tether must establish liquidity, ensure trading platforms list it, and build relationships with market makers in a short timeframe. In financial markets, first-mover advantage often determines everything, and users typically prefer established, liquid options over newcomers.

Critics argue that USAT is merely a "compliance performance"—Tether is attempting to enter the U.S. market but is unwilling to address the transparency and operational issues of its core business. This criticism has some merit: the choice to launch USAT instead of making USDT fully compliant indicates that Tether values current operational flexibility over comprehensive regulatory legitimacy.

But from another perspective, this is precisely how the market should operate. Different customer segments have different needs and risk preferences. U.S. institutions require compliance and transparency, while users in emerging markets prioritize accessibility and low costs. Why can't a company meet both needs through different products?

Conclusion: Tether's Dual Kingdom

Tether's dual stablecoin strategy reflects the deep tensions in the crypto industry between regulation, decentralization, and institutional adoption. The industry faces a core challenge: how to balance the original "permissionless" spirit of cryptocurrency with the regulatory frameworks needed for mainstream adoption.

USAT represents Tether's dual bet: securing regulatory legitimacy for institutional users while retaining flexibility for global retail users. The success of this strategy depends on execution, market acceptance, and the ever-changing regulatory environment.

The regulatory landscape continues to evolve. While the GENIUS Act provides some clarity, its specific implementation and enforcement remain uncertain. Changes in government or shifts in regulatory priorities could profoundly impact the strategies of stablecoin issuers.

The more fundamental question is whether the launch of USAT raises inquiries about the nature of Tether's original success: is USDT's dominance built on regulatory arbitrage and therefore unsustainable? Or does it reflect genuine innovation in global financial infrastructure, where compliance can enhance rather than limit its potential?

The answer will determine whether USAT is Tether's evolution toward a mature financial institution or a recognition of the limitations of its original model. Regardless, the launch of USAT marks a new chapter in the competition and regulation of stablecoins.

Tether is building a second kingdom. Whether it can simultaneously rule both remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。