Author: Zuo Ye

TL;DR

- Yield is not a means of appreciation, but a core part [current yield is a subsidy method]

- The last mile of stablecoins is not fiat currency inflow and outflow, but becoming permissionless fiat; when you cannot destroy USDT, launching alternative or permissioned currencies is meaningless

- Banks screen customers, retail investors choose DeFi products

- Risk control and regulation need to be "programmable," integrated into existing business flows

- The region has already been occupied by USDT, leaving only scenarios; flow payments are more imaginative than cross-border payments, representing a new distribution channel, rather than a mechanical "+ stablecoin" attempt by existing giants

In 2008, under the shadow of the financial crisis, Bitcoin attracted the first batch of ordinary users disappointed with the fiat currency system, emerging from the niche community of crypto punks.

At the same time, the term FinTech began to gain popularity around 2008, almost concurrently with Bitcoin, which may be coincidental.

It could be even more coincidental; in 2013, Bitcoin's first bull market arrived, with prices breaking through $1,000, and FinTech began to mainstream. The once-glorious Wirecard and P2P later fell, while Yu'ebao defined the yield system of the internet era, and Twitter founder Jack's new payment solution Square reached a valuation of over $6 billion.

This was not artificially manufactured; since 1971, the growth rates of gold prices and U.S. Treasury debt have been almost synchronized at 8.8% vs. 8.7%. After the gold dollar came the petrodollar; will the new energy dollar be stablecoins?

From a regulatory perspective, FinTech is the salvation of the banking industry, aiming to rebuild or supplement the financial system with internet thinking, hoping to recreate an internet-based financial system amidst the tangled political and business relationships.

Starting from the payment field, it has become a global consensus, encompassing acquiring, aggregation, P2P, cross-border settlement, and micro-lending, crossing boundaries and mixed operations, creating endless prosperity or crises.

Unfortunately, the unintentional success of the willow tree has led to the real change in banks and the traditional financial system being driven by blockchain practices, moving from the margins to the mainstream, all happening outside of regulation.

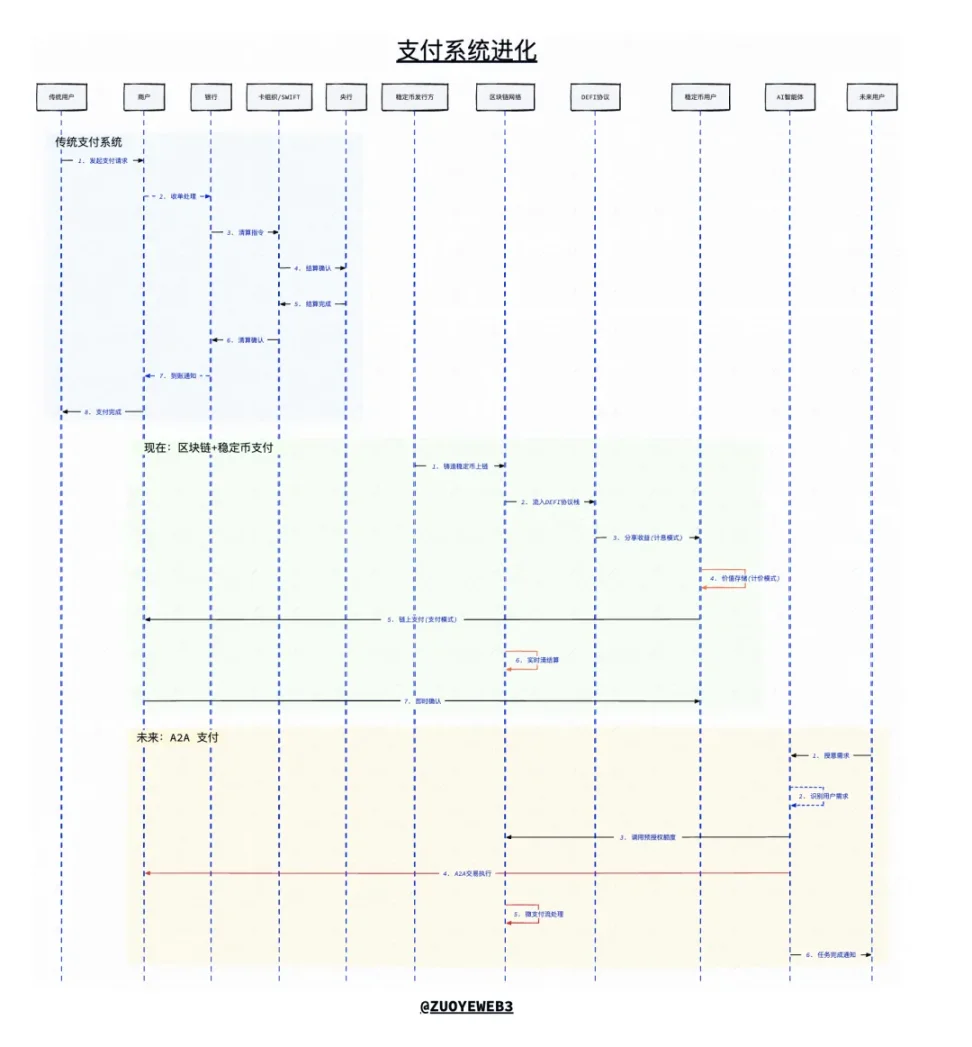

Image caption: Evolution of payment systems, image source: @zuoyeweb3

Payments Rooted in Code Rather Than Finance

Yield-bearing stablecoins using USDT for dividends serve as a marker for maturity.

Payments, for hundreds of years, have operated with the banking industry at their core; all electronic, digital, or internet-based advancements have been building bricks for the banking industry until the emergence of blockchain.

Blockchain, especially stablecoins, has created an inverted world, completely reversing the order of payment, clearing, and settlement; only after confirmation can clearing and settlement occur, thus completing the payment process.

Within the traditional banking system, the payment issue is essentially a bifurcated process of front-end transfers and back-end clearing, with the banking industry at the absolute center.

Under FinTech thinking, the payment process is about aggregation and B-end services; the internet's customer acquisition mindset demands that no acquiring traffic be overlooked, as traffic determines the confidence of FinTech companies in facing banks. Fake it till you make it; both UnionPay and margin requirements are accepted as the final result.

In the blockchain mindset, stablecoin systems like USDT, with Tron as the earliest stablecoin L1 and Ethereum as a large-scale clearing and settlement system, have achieved the "programmability" that should have been realized by the internet.

The lack of interconnectivity is an external manifestation of platforms competing for territory; the core issue is the insufficient degree of dollar internetization. The internet is always just a supplement to the fiat currency system, but stablecoins are a native asset form for blockchain; USDT on any public chain can be exchanged with each other, and friction costs depend solely on liquidity.

Thus, based on the characteristics of blockchain, only after verification can clearing and settlement occur, allowing for pre-confirmation of payments. Gas fees are determined by market mechanisms, and once confirmed, they can circulate in real-time.

A counterintuitive thought is that blockchain did not give rise to stablecoin systems through unregulated arbitrage, but rather the efficiency brought by programmability has shattered the traditional financial system.

Payments are an open system rooted in code rather than finance.

We can provide a counterexample: the reason traditional bank wire transfers are time-consuming is not just due to compliance requirements and outdated network architecture; the core issue is that participating banks have a "retention" demand. Massive funds generate continuous yields, and users' time becomes passive compounding for the banking industry.

From this perspective, after the Genius Act, the banking industry is still frantically preventing yield systems from entering the banking system. The superficial reason remains yield, or paying interest to users would distort the banking industry's deposit and loan mechanisms, ultimately leading to systemic crises in the financial industry.

The on-chain programmability of yield systems will ultimately replace the banking industry itself, rather than create more problems than the banking industry, as this will be an open system.

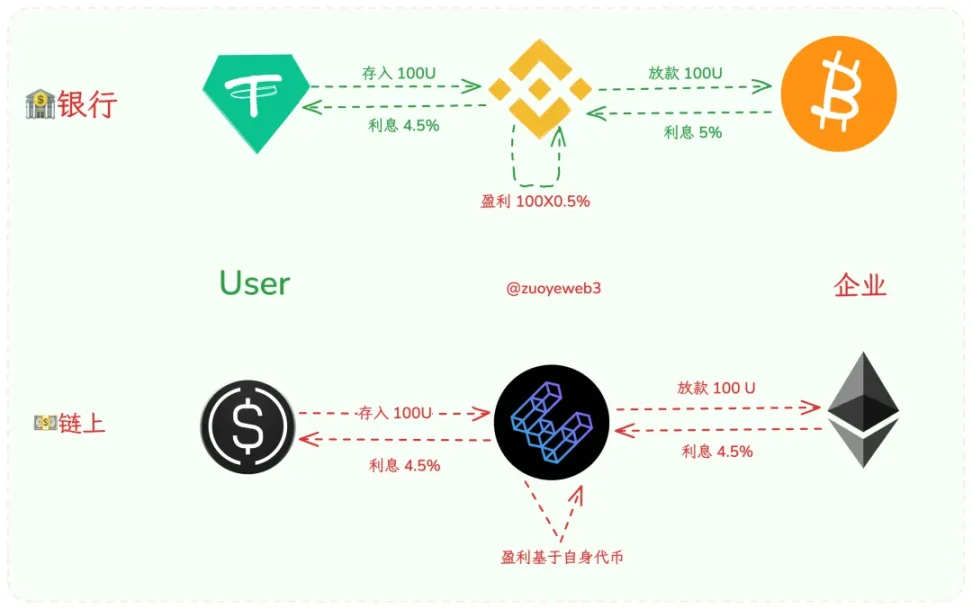

Traditional banking earns from the interest spread between user deposits and loans to businesses/individuals, which is the foundation of all banking operations.

The interest spread mechanism gives the banking industry the dual power to select customers, creating unbanked populations on one side while selecting businesses that do not meet "standards" on the other.

Ultimately, losses caused by triangular debts or financial crises created by banks are borne by ordinary users. In a sense, USDT is similar; users bear the risk of USDT, while Tether takes the issuance profits of USDT.

YBS (Yield-bearing Stablecoins) like Ethena do not rely on the dollar for issuance and do not operate under the traditional banking interest spread mechanism, but are entirely based on on-chain facilities like Aave and public chains like TON for payment attempts.

Currently, yield-bearing stablecoin systems have created a globally liquid payment, interest calculation, and pricing system, with the banking industry becoming the target of transformation by stablecoins, not through altering the participation methods of payment processes, but by changing the intermediary status of credit creation in the banking industry.

In the face of the offensive from yield-bearing stablecoins, small banks are the first to bear the brunt. Minnesota Credit Union has already attempted to issue its own stablecoin, and previous Neo Banks are rapidly moving on-chain, such as Nubank starting to reattempt stablecoins.

Even SuperForm and others are beginning to transform themselves into stablecoin banking systems, allowing users to share in the profits generated by banks, thereby correcting the distorted banking system.

Image caption: The impact of YBS on the banking industry, image source: @zuoyeweb3

In summary, yield-bearing stablecoins (YBS) are not merely customer acquisition channels, but the prelude to reshaping the banking industry; the on-chain migration of credit creation is a more profound transformation than stablecoin payments.

FinTech has not replaced the role of banks but has improved areas that banks are unwilling or unable to engage in. However, blockchain and stablecoins will redefine banks and currency.

We assume that YBS will become the new dollar circulation system; payment itself is synonymous with on-chain payment. Again, note that this is not a simple on-chaining of the dollar; unlike the internetization of the dollar, on-chain dollars are part of the fiat currency system.

At this stage, the traditional payment system's view of stablecoins remains limited to clearing and cross-border areas, which is a completely erroneous established mindset. Please grant stablecoins freedom; do not embed them into outdated and obsolete payment systems.

Blockchain inherently does not distinguish between domestic and foreign, card/account, individual/business, or receiving/payment; everything is merely a natural extension and variation of transactions. As for stablecoin L1's enterprise accounts or privacy transfers, they are merely adaptations of programming details, still adhering to the basic principles of blockchain transactions: atomicity, irreversibility, and immutability.

Existing payment systems remain closed or semi-closed; for example, SWIFT excludes specific regional customers, and Visa/Mastercard require specific software and hardware qualifications. A comparison can be made: the banking industry rejects unbanked individuals without high profits, while Square and PayPal may refuse specific customer groups, whereas blockchain accepts all.

Closed systems and semi-open systems will ultimately yield to open systems; either Ethereum becomes the stablecoin L1, or stablecoin L1 becomes the new Ethereum.

This is not blockchain engaging in regulatory arbitrage, but a dimensionality reduction brought about by efficiency upgrades. Any closed system cannot form a closed loop; transaction fees will diminish at various stages to compete for users, either leveraging monopolistic advantages to increase profits or using regulatory compliance to exclude competition.

In an open system, users possess absolute discretionary power. Aave has not become the industry standard due to monopolization; rather, the DEX and lending models of Fluid and Euler have yet to fully explode.

However, regardless, on-chain banks will not be tokenized deposits of the banking industry but rather tokenized protocols rewriting the definition of banks.

Replacing banks and payment systems will not happen overnight; PayPal, Stripe, and USDT are products from 20, 15, and 10 years ago, respectively.

Currently, the issuance volume of stablecoins is around $260 billion, and we will see an issuance volume of $1 trillion in the next five years.

Web2 payments are a non-renewable resource.

Credit card fraud handling largely relies on experience and manual operations.

Web2 payments will become the fuel for Web3 payments, ultimately completely replacing rather than supplementing or coexisting.

Participating in the future based on Tempo is the only correct choice for Stripe; any attempt to incorporate stablecoin technology into the existing payment stack will be crushed by the flywheel—again, it's an efficiency issue. On-chain YBS rights and usage are bifurcated; off-chain stablecoins only have usage rights, and capital will naturally flow towards appreciation tracks.

While stablecoins strip the banking industry of its social identity, they also liquidate the established thinking of Web2 payments.

As mentioned earlier, the issuance of stablecoins is gradually breaking away from mere imitation of USDT. Although completely breaking away from the dollar and banking system is still far off, it is no longer a complete fantasy. From SVB to Lead Bank, there will always be banks willing to engage in cryptocurrency business, a long journey of persistent effort.

By 2025, not only will the banking industry accept stablecoins, but the major obstacles that have troubled blockchain payment businesses will gradually thaw. The resonance of Bitcoin has already become the booming sound of stablecoins.

- Inflow and outflow: No longer pursuing the finality of fiat currency, people are willing or inclined to hold USDC/USDT to earn yields, use directly, or preserve value against inflation. For example, MoneyGram and Crossmint are collaborating to handle USDC remittances.

- Clearing and settlement: Visa has completed $1 billion in stablecoin clearing volume, with Rain as its pilot unit, and Samsung is an investor in Rain. The anxiety of old giants will become a funding source for stablecoin payments.

- Large banks: RWA or tokenized deposits are just appetizers; considering competition with DeFi is not far off. Evolution is the passive adaptation of traditional finance, and internet alliances like Google AP2 and GCUL represent the unwillingness and struggle of old-era hegemons.

- Issuance: From Paxos to M0, traditional compliance models and on-chain packaging models are advancing simultaneously, but yield systems will be taken into account. Although Paxos's USDH plan has failed, empowering users and tokens is a common choice.

In summary, the competition for positioning in stablecoin on-chain payments has ended, and the combination race has begun, focusing on how to push the network scale effect of stablecoins globally.

In a sense, USDT has already pushed stablecoins into Asia, Africa, and Latin America, where there is no new growth space in terms of geography, only "scenarios." If existing scenarios are to be enhanced by payment players with "+ blockchain," then we can only seek new "blockchain +" or "stablecoin +" scenarios. This is the clever use of internet strategies in Web3, exchanging spending for growth, cultivating new behaviors, and the future will define today's history; Agentic Payment will definitely be realized.

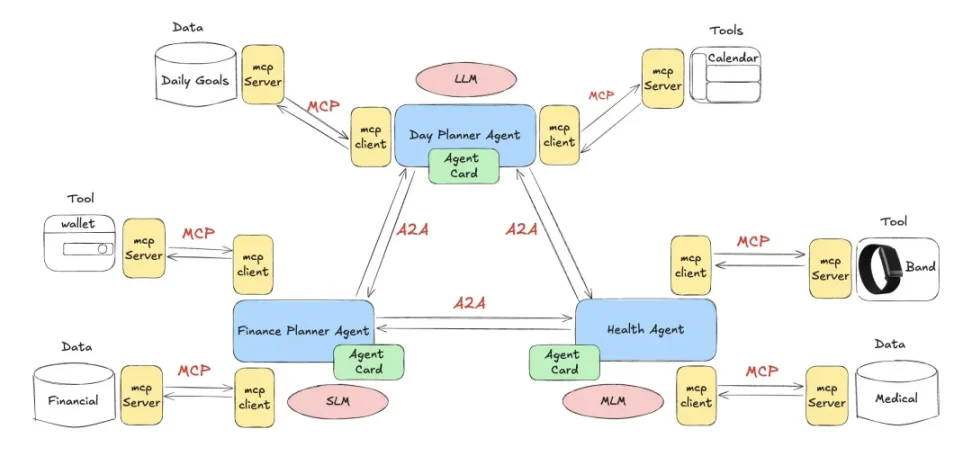

After changing the banking and payment systems, let's delve into the future of payment systems under an agent-oriented approach. Please note that the following discussion completely disregards the scenarios of "+ blockchain" or "+ stablecoin," as it would be a waste of ink; the future will have no market space for existing payment giants.

Yield systems can incentivize end-user usage, but new payment behaviors require accompanying consumption scenarios. For example, using cryptocurrency for consumption within a built-in mini-program on Binance is reasonable, but using a bank card within a WeChat mini-program seems quite strange.

The brand new scenarios, from the perspective of Google, Coinbase, and even Ethereum, can only be A2A (Agent to Agent), requiring no deep human involvement. Web2 payments are a non-renewable resource because in the future, payments will be ubiquitous.

In simple terms, in the future, people will have multiple agents handling different tasks, while the MCP (Model Context Protocol) will configure resources or call APIs within the agents, ultimately presenting us with agents that match and create economic value.

Image caption: Connection between A2A and MCP, image source: @DevSwayam

Human behavior will increasingly manifest in authorization rather than permission; it is essential to relinquish multidimensional data to allow AI agents to meet your intrinsic needs.

- The value of humans lies in authorization

- Machines operate tirelessly

Existing pre-authorization and pre-payment, buy now pay later, acquiring/issuing, clearing/settlement will occur on-chain, but the operators will be agents. For instance, traditional credit card fraud requires manual processing, but agents will be smart enough to identify malicious behavior.

From the perspective of the current payment stack and the "central bank—bank" system, one might indeed think that the above ideas are overreaching. However, do not forget that the digital yuan's "immediate payment and transfer" also stems from a yield perspective, ultimately compromising with the banking system.

It is not that it cannot be done, but that it is practically unfeasible.

Google is pulling in the AP2 protocols built by Coinbase, EigenCloud, and Sui, which have already been highly integrated with Coinbase's x402 gateway protocol. The combination of blockchain + stablecoins + the internet is currently the optimal solution, targeting microtransactions. In their vision, real-time cloud usage, article paywalls, and similar scenarios are all genuine applications.

How to put it? We can be confident that the future belongs to AI agents, transcending clearing and settlement channels, but the specific path through which they will change humanity remains unknown.

The DeFi space still lacks a credit market, which is naturally suitable for corporate development. However, in the long term, the retail or individual market relies on an over-collateralization mechanism to become the main force, which is itself an anomaly.

Technological development has never been able to imagine the path to realization; it can only outline its basic definitions. The same goes for Fintech, DeFi, and Agentic Payment.

The irreversible nature of stablecoin payments will also give rise to new arbitrage models, but we cannot imagine their potential harm.

Moreover, existing distribution channels will not be the core battleground for the large-scale use of stablecoins. While there may be usage volume, it will undermine their revenue potential in interacting with the on-chain DeFi stack. This remains a fantasy, akin to believing that an emperor will use a golden hoe to dig vegetables.

Stablecoin payments can only be considered a Web3 payment system after replacing banks and existing distribution channels.

Conclusion

The path I envision for the realization of a non-bank payment system in the future: yield + clearing and settlement + retail (network effects) + agent flow payments (after breaking free from the self-rescue of old giants).

The current impact is still concentrated on Fintech and the banking industry, with little ability to replace the central bank system. This is not because it is technically unfeasible, but because the Federal Reserve still plays the role of the ultimate lender (the scapegoat).

In the long run, distribution channels are an intermediate process. If stablecoins can replace bank deposits, no channel can lock in liquidity. However, on-chain DeFi has no entry barriers and unlimited users; could this trigger an even more violent financial crisis?

The Soviet Union could not eliminate the black market, and the United States cannot ban Bitcoin. Whether it is a catastrophic flood or a blissful shore, humanity has no way back.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。