Author: Zhou, ChainCatcher

On September 22 at 14:00 Beijing time, BTC fell below $114,000 and quickly lost several key levels, dipping to $111,800 before fluctuating around $112,600. ETH dropped from around $4,500 to $4,077, while SOL fell to a low of $214.5, with mainstream and altcoins generally experiencing significant pullbacks.

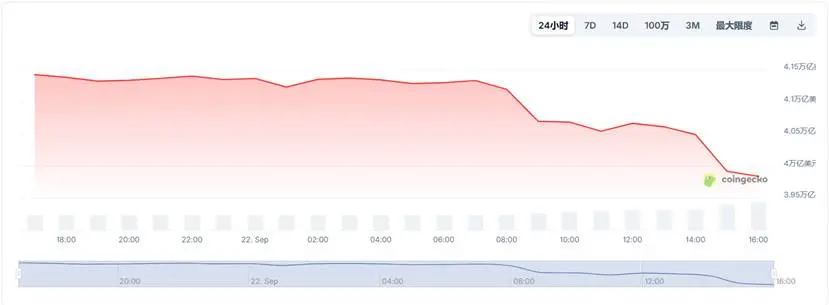

According to CoinGecko data, as of September 22 at 18:00, the global cryptocurrency market capitalization was $3.97 trillion, with a change rate of -3.98% over the past 24 hours. This means that the total market capitalization of cryptocurrencies evaporated by nearly $160 billion.

The latest liquidation data shows that approximately $1.7 billion was liquidated across the network in the past 24 hours, affecting over 400,000 people, with long positions amounting to about $1.616 billion, setting a new single-day high for long liquidations since 2021; the largest single liquidation occurred in the BTC-USDT contract on OKX, amounting to approximately $12.74 million.

As the market experiences a sharp pullback, is this a technical correction or a structural turning point?

Market Sentiment is Clearly Divided

Under the heavy sell-off, market sentiment is being pulled in two directions. One trader stated that this is the last washout before a bull market, suggesting that BTC may still dip near $112,000, and altcoins need to drop by 20-30% before stabilizing. Another trader warned that BTC is most likely to experience a second drop in the $115,000-$116,000 range, and if no new funds are seen before October, volatility in the fourth quarter may be even more severe.

The optimistic camp emphasizes positioning and rotation. Some view this drop as a routine pullback in September, noting that a quick rebound after breaking key levels is not uncommon and can provide a trading window for re-entry. They pointed out that Bitcoin's dominance has dropped to around 58%, with funds flowing from BTC into sectors like AI, DeSci, RWA, and DePIN, suggesting that small-cap resilience will be stronger in the later stages.

On-chain and funding sides are also pulling in different directions. According to monitoring data, before the crash, Trend Research's associated addresses redeemed 16,800 ETH, nearing liquidation, while some institutional funds chose to withdraw liquidity first. As the market overall declined, another whale deposited $15 million USDC into HyperLiquid, opening 20x leveraged long positions in BTC and SOL, as well as 10x leveraged long positions in HYPE, with a total position size of about $26 million, indicating that some funds are choosing to bet on rebounds at lower levels. Meanwhile, panic selling still shows contrarian behavior, with a whale again dumping 1,000 ETH; this address has consistently sold high and bought low over the past two months, reflecting more emotional trading rather than systemic selling pressure.

In fact, on-chain funds had already taken action before the crash. On September 18, whales holding Ethereum cashed out a total of $2.15 billion in a single day. However, Matrixport holds a more cautious view on Ethereum, believing that the risk-reward for previous longs was better, but technical indicators can easily fail during rapid surges. A similar large cash-out occurred after ETH broke $3,500 in July, but it did not trigger a price drop due to some U.S. treasury companies buying in. Currently, treasury companies still play a major buying role, but as net assets shrink with falling prices, their ability to add funds may be limited, leading to a decrease in marginal buying strength, and risk management should be prioritized in the short term.

Additionally, there are other viewpoints. Glassnode's BTC cost distribution heatmap considers the area around $117,000 as a supply dense zone, indicating that an effective upward breakout is needed to open further supply reduction channels; failure to break through would mean prolonged consolidation or repeated pullbacks. In terms of time, Weiss Crypto's rhythm judgment leans towards sideways movement for 30 to 60 days, suggesting that a phase low is more likely to occur around mid-October.

Joao Wedson, founder of Alphractal, stated that Bitcoin has shown signs of cycle exhaustion, but few have noticed. Multiple on-chain signals indicate that Bitcoin's rebound may have lost momentum. Bitcoin's output profit ratio (SOPR, a metric measuring the overall profitability of all spent Bitcoin transactions on the blockchain) shows declining profitability, increasing the likelihood of a deeper pullback. The Sharpe ratio is below 2024 levels, indicating reduced risk, return, and profit potential. He also noted that this will not attract as many institutional investors as most believe. Even if Bitcoin reaches new highs, profitability will remain low, with the real focus shifting to altcoins.

Why is the Market Falling?

There are many voices regarding today's sharp decline, summarized into three points:

First, the passive deleveraging on the derivatives side is the trigger point, with longs crowded in major exchanges. After key levels were breached, liquidation hotspots ignited in succession, creating a waterfall of liquidations. Corresponding data shows approximately $1.7 billion in liquidations over 24 hours, with ETH liquidations exceeding BTC, explaining why high Beta and ETH fell faster.

Second, the options structure is applying simultaneous pressure. According to market news, the nominal value of BTC options expiring this Friday is about $17.47 billion, with a maximum pain point around $110,000; the nominal value of ETH options is about $5.48 billion, with a maximum pain point around $3,700, raising the probability of price testing the pain point repeatedly.

Third, macro-wise, this is a pullback after expectations were fulfilled. The Federal Reserve's 25bp rate cut has been implemented, and the increase since early September extended to $117,900 after the decision, followed by a phase of profit-taking and data observation. Additionally, this week there are PCE and official speeches, leading traders to prefer reducing leverage before determining direction, resembling a process of gradual reduction rather than a single black swan event.

Furthermore, comments from BitMEX co-founder Arthur Hayes conveyed some negative sentiment to the market. He stated that we are entering the mid-stage of this cycle, and if one only focuses on a few months' window, those who bought six months ago may be disappointed; however, those who allocated years ago are mostly seeing significant gains, far exceeding the depreciation of the dollar and other fiat currencies. Therefore, there is no need to be emotional just because Bitcoin is not setting new historical highs every day. He also predicts that a major DAT incident will occur at the bottom of this cycle: FTX exploded during the bottom phase, and BlockFi also had issues at the bottom, similar to scenarios where Bitcoin retraces 70% from $1,000,000.

Next, investors may need to observe whether BTC and ETH can stabilize prices or continue to break upward with increased volume; whether the maximum pain point of options near expiration moves up or at least does not move down; if the pain point moves down, it indicates that sellers' hedging is still suppressing prices; and whether there is large-scale net inflow on-chain, especially focusing on net issuance of stablecoins and net outflows from exchanges, as well as the actions of whales.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。