Arthur Hayes on US Promoting Stablecoins and Its Monetary Strategy

Why is the US promoting Stablecoins, and is it really about innovation or just a way to manage its growing debt? This question has become central in financial debates after Arthur Hayes, co-founder of BitMEX , shared his thoughts in a recent interview with Kyle Chasse.

Source: X (formerly Twitter)

Hayes suggested that stable coins are less about supporting crypto and more about securing America’s financial dominance.

Growing Demand for Digital Dollars

In many parts of Latin America and Asia, local currencies face sharp inflation while bank deposits fail to keep up with growth.

People want access to US dollars but are blocked by strict regulations. This unavailability has created the space for stable-coins such as Tether (USDT) to become digital dollars for millions.

Hayes clarified that the US supporting Stablecoins could free trillions of dollars from the Global South.

Arthur Hayes also predicted the overall market size of stable coins to be $34 trillion, a tool that could become one of the strongest financial instruments ever conceived.

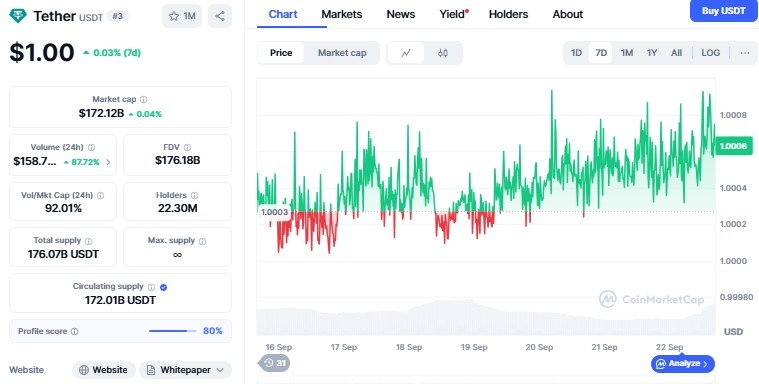

Currently the total market cap of Tether (USDT) is $172.11B, while USDC by Circle has a market cap of $73.93B as per the CoinMarketcap.

Stablecoins as a Debt Solution

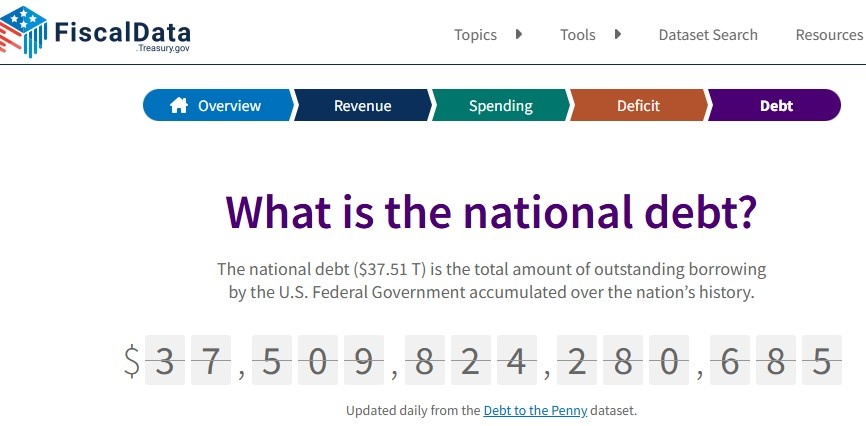

One of the major arguments Hayes presented is that US supporting Stablecoins has a direct correlation with its huge $37.51 trillion national debt .

Source: Fiscal Data Treasury Govt

Tether and Circle, among other issuers of stable coins, back their tokens with US Treasury bills.

When demand for stable-coins increases, the issuers have to buy more Treasuries, becoming a consistent buyer pool for US debt.

This is done to maintain "price-insensitive" demand for Treasuries to replace the gap created by decelerating foreign investment.

For Washington, stable-coins are not about innovation, but a smart method to finance government borrowing.

In July, Trump signed the GENIUS Act into law, creating the first US regulatory framework for stable coins and innovation.

Extending Dollar Dominance

Most analysts agree with Hayes that US promoting Stablecoins is also geopolitically motivated. Rather than establishing a central bank digital currency (CBDC), Washington permits private companies to disseminate stable coins globally. This expands the reach of the dollar without the involvement of the government.

In so doing, the US consolidates its monetary supremacy and takes more control of cross-border transactions. Emerging markets can gain from electronic payments but risk losing sovereignty as their economies become increasingly reliant on the US dollar.

The Digital Dollar on the Rise

Evidence of this shift is already clear. Tether CEO Paolo Ardoino announced that Toyota, BYD, and Yamaha now accept USDT payments in Bolivia . He even called USDT the “digital dollar” for hundreds of millions of people.

Bolivia’s central bank recently reported that crypto-based payments surged to $430 million in one year, a 630% increase since it lifted its crypto ban in 2024. This shows how quickly stable coins are becoming part of everyday trade.

Final Thoughts

The debate around the US promoting Stablecoins is far from over. To some, it looks like an innovation strategy. But as Hayes highlighted, the deeper goal is to support Treasury demand and maintain dollar dominance worldwide. Stablecoins might help emerging markets, but they also tie them more tightly to America’s financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。