Stablecoins are the killer application of crypto, license + corridor = moat.

Original author | Frank @IOSG

Core Insights TL;DR

Stablecoins are the killer application of crypto: They are neither NFTs nor meme coins. They have already become the "everyday currency" in the Global South. The market is not focused on creating new coins, but on how to truly integrate existing stablecoins into everyday payment scenarios.

Consumer value is driven by B2B: While P2P remittances and crypto cards between individuals are important, the author believes that the largest Total Addressable Market (TAM) will occur in the cross-border payment sector between enterprises. Those who abstract stablecoins and directly embed them into the transfer systems of large companies through crypto orchestration layers and PSPs can capture significant additional revenue from the massive capital flows and deposits.

License + corridor = moat: Just as infrastructure has shifted from technical competition to distribution, the real barriers in the B2B payment sector are regulatory licenses (MSB/EMI/SVF, etc.), bank partnerships, and the first-mover advantage in cross-border corridors. (For example: Bridge has a US MSB/MTL, RD Tech has a Hong Kong SVF license).

Orchestration > Aggregation: Aggregators are merely market matchmaking platforms with thin profit margins; orchestrators hold compliance and settlement rights. True defensive strength comes from directly holding licenses and being able to manage capital flows independently.

Competition is intensifying: From emphasizing "underlying technology" to competing on "actual usage": similar to consumer applications, the market rewards real adoption and user scale. The rise in TRON transaction fees has already validated the strong demand for stablecoin transactions, and the next phase will involve stablecoin native chains (like Plasma, Arc, etc., which have issuance and distribution channels) actively guiding users to directly use their own stablecoin blockchains for transactions and settlements, thereby avoiding most transaction fees being siphoned off by general-purpose public chains. Meanwhile, users can also directly use the stablecoins they transfer to pay transaction fees, achieving a unification of payment medium and network incentives.

Introduction

Stablecoins and the blockchains built around them are becoming the focus of the industry and news headlines almost daily. Projects like Plasma and Stable from Tether.io, Arc from Circle, Tempo from Stripe, Codex PBC, 1Money, the new generation L1 blockchain being developed by Google, and many more upcoming projects are continuously accelerating this trend. Meanwhile, as one of the most widely used self-custody wallets globally, Metamask has officially announced the launch of its native stablecoin, marking a further expansion of wallet products into payment and value-carrying functions. On the other hand, personal cross-border remittance giant Remitly has announced the launch of a multi-currency fiat and stablecoin wallet—Remitly Wallet, which is currently in testing and is planned to be officially launched in September in collaboration with Circle.

These actions collectively indicate that an increasing number of large payment companies and Web2 and Web3 tech giants are accelerating "vertical integration," directly entering the stablecoin and blockchain payment arena. They are no longer solely relying on third-party infrastructure but are choosing to issue stablecoins themselves, create their own wallet products, and even launch dedicated payment blockchains. Stablecoins are rapidly expanding from crypto-native scenarios into broader payment, remittance, and financial service areas, becoming one of the most practical application directions for blockchain.

Therefore, this article provides a great opportunity for us to discuss:

The current stablecoin payment technology stack

The tracks that have achieved Product-Market Fit (PMF)

Investment frameworks for various payment tracks

Stablecoin Payment Infrastructure

Although there are various definitions in the market, the author believes that the technology stack for stablecoin payments can be broken down from the following perspectives:

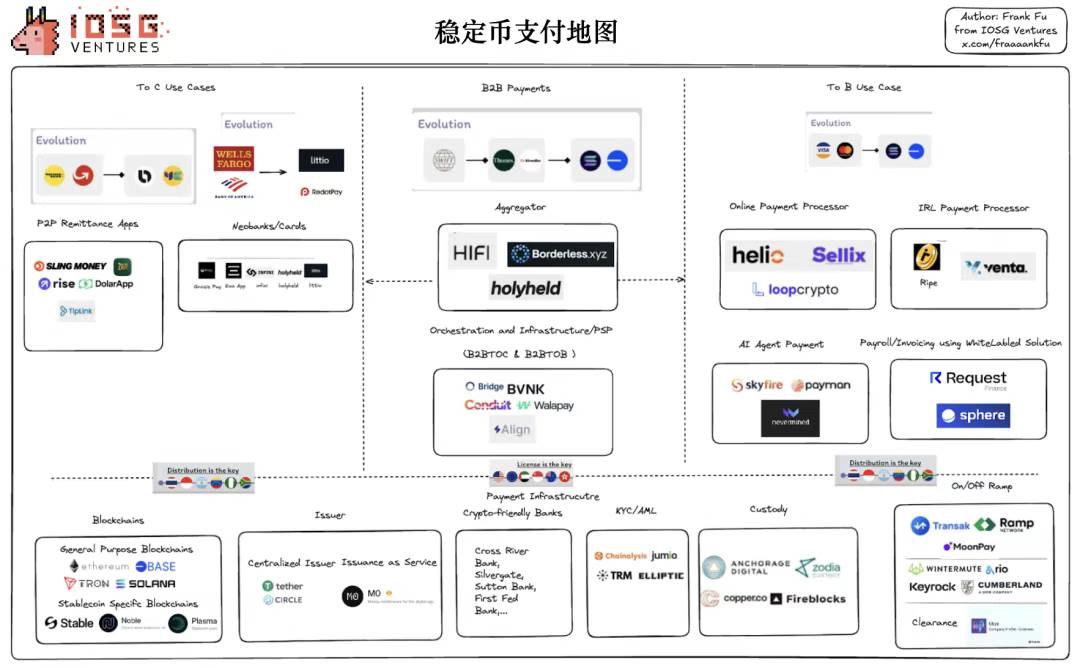

* The mapping used in this article is based on the author's compilation from July. For the latest market map, please refer to ASXN's dashboard (https://stablecoins.asxn.xyz/payments-market-map).

At the very bottom of the entire payment map is the blockchain itself, which serves as both the infrastructure and the foundation.

Recently, when Matt Huang from Paradigm explained why Stripe chose to build a new L1 Tempo instead of building on Ethereum L2, he provided a long list of reasons. While many of these reasons have been criticized by the Ethereum community and various VC investors, one point regarding Fast Finality clearly reveals the current issues facing Ethereum.

▲ Source: Matt Huang from Paradigm

In blockchain, "finality" refers to the fact that once a transaction is confirmed, it cannot be reversed or changed, nor can it be canceled due to network fluctuations or on-chain reorganizations. "Fast finality" means providing this guarantee in seconds or even sub-second levels, rather than making users wait for several minutes. Moreover, since L2's final confirmation relies on L1, no matter how fast or powerful L2's processing speed is, its security and final confirmation speed still depend on L1.

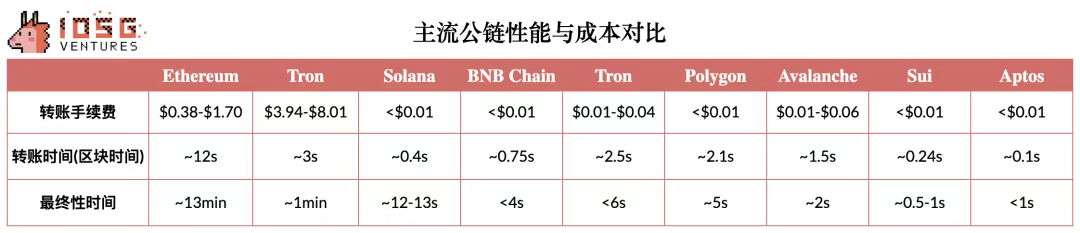

Ethereum's current mechanism is robust but somewhat slow. Blocks are generated every 12 seconds. Transactions can be quickly included, but economic finality takes about 12–15 minutes, which is two PoS epochs. During this time, validators continuously vote to lock in results. While this has been sufficient so far, the market increasingly demands that final confirmation times be reduced to under 2 seconds to meet commercial payment and institutional-level high-frequency settlement needs. If the underlying chain is slow, it cannot support high-speed payments; if the cost of network transfers is high, it cannot fulfill the promise of "low fees"; no matter how good the user experience is, it will be undermined by poor infrastructure.

▲ Source: OKX Gas Tracker (July 23, 2025), Block Time & Finality Time: Token Terminal

Setting aside the perspective of vertical integration, this is also why we see more and more stablecoin issuers and traditional payment giants starting to build their own blockchains. Beyond considerations of commercial profit sharing, the core reason is that all upper-layer applications and user experiences ultimately rely on the underlying infrastructure. Only by achieving transaction fees as low as fractions of a cent, near-instant finality, and token designs that relieve users from worrying about gas fees can a truly smooth and seamless user experience be delivered.

Common core foundational features include:

Stable and low transaction fees, payable directly with stablecoins

Permissioned validator node set

High throughput (TPS)

Compatibility with other blockchains and payment systems

Optional privacy features

What truly determines success or failure often lies beyond technology, including:

Clear go-to-market (GTM) strategy

Effective business development execution

A sound partner ecosystem

Efficient onboarding and support for developers

Market promotion and external communication

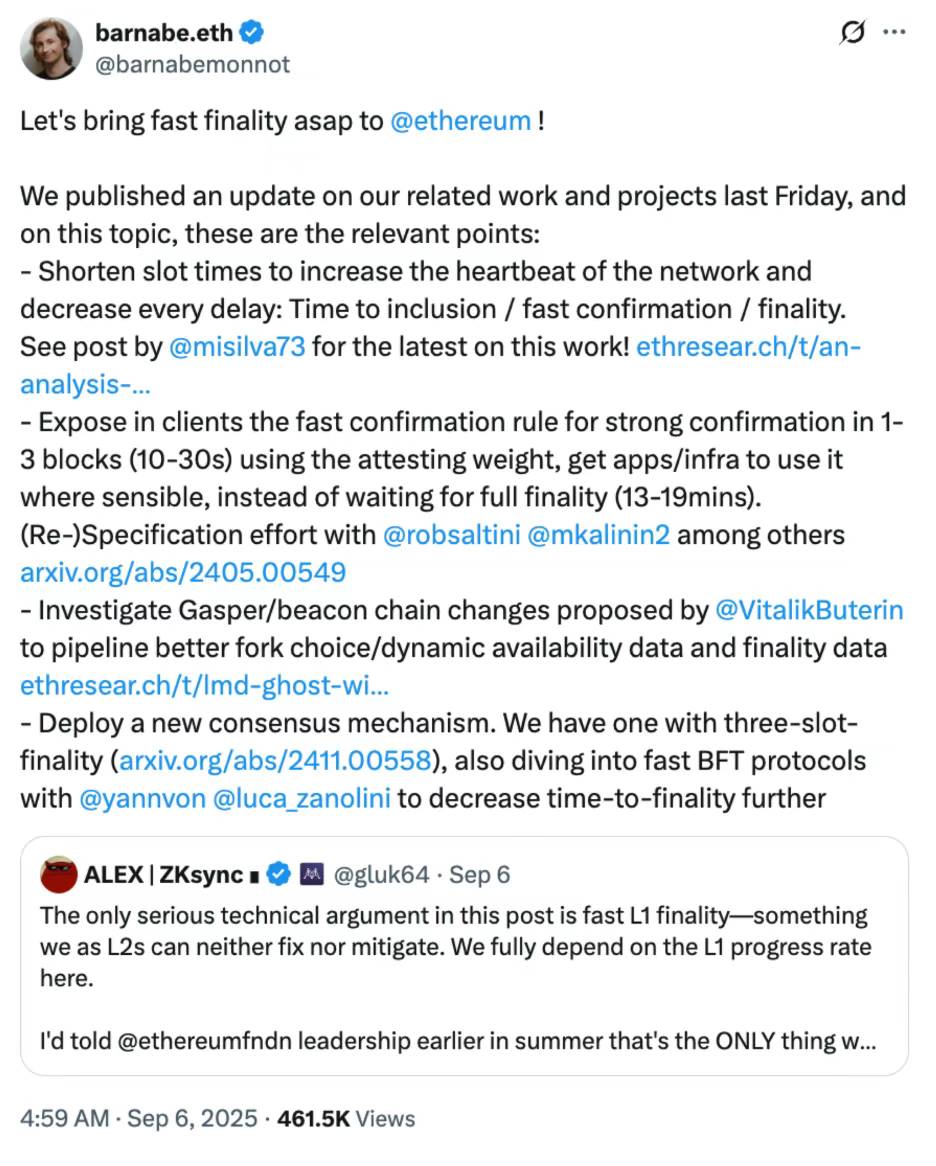

We will provide a more detailed comparison of different blockchains in a subsequent article, so this article will not elaborate further on that. Of course, Ethereum has long recognized the importance of Fast Finality without compromising decentralization. Community members are pushing the Ethereum Foundation (EF) to accelerate this process, and EF's Barnabé Monnot shared the ongoing plans:

Block generation time will be reduced from 12 seconds to 6 seconds, with relevant tests already completed.

After the new "fast confirmation rules" are implemented, transactions will only need to wait for 1–3 blocks (approximately 10–30 seconds) to be strongly confirmed, eliminating the need to wait for complete final confirmation.

They are also trying to optimize the core protocol based on Vitalik's proposed solutions and exploring next-generation consensus mechanisms, such as "three-slot finality."

▲ Source: Barnabé Monnot from EF

In addition to the rapid development of stablecoin networks, the issuance scale of stablecoins themselves is also experiencing explosive growth. The stablecoin issuance platform M0 recently completed a $40 million Series B funding round led by Polychain Capital, Ribbit Capital, and Endeavor Catalyst Fund. M0's Stablecoin-as-a-Service platform allows institutions and developers to issue highly customized stablecoins, giving them complete control over branding, functionality, and yield. All stablecoins built on M0 are inherently interoperable and share unified liquidity. With an open multi-issuer framework and fully transparent on-chain architecture, M0 is breaking through the boundaries of traditional stablecoin issuance.

Since its inception, M0 has been adopted by projects such as MetaMask, Noble, KAST, PLAYTRON, Usual, USD.AI, and USDhl for issuing stablecoins for various purposes. Recently, the total issuance of stablecoins based on M0 has surpassed $300 million, growing by 215% since the beginning of 2025.

Similar to the trend of stablecoin issuers vertically integrating with underlying blockchain infrastructure, application chains that possess creative demand scenarios are also beginning to vertically integrate at the stablecoin issuance level, aiming to establish deeper binding relationships at the ecosystem level.

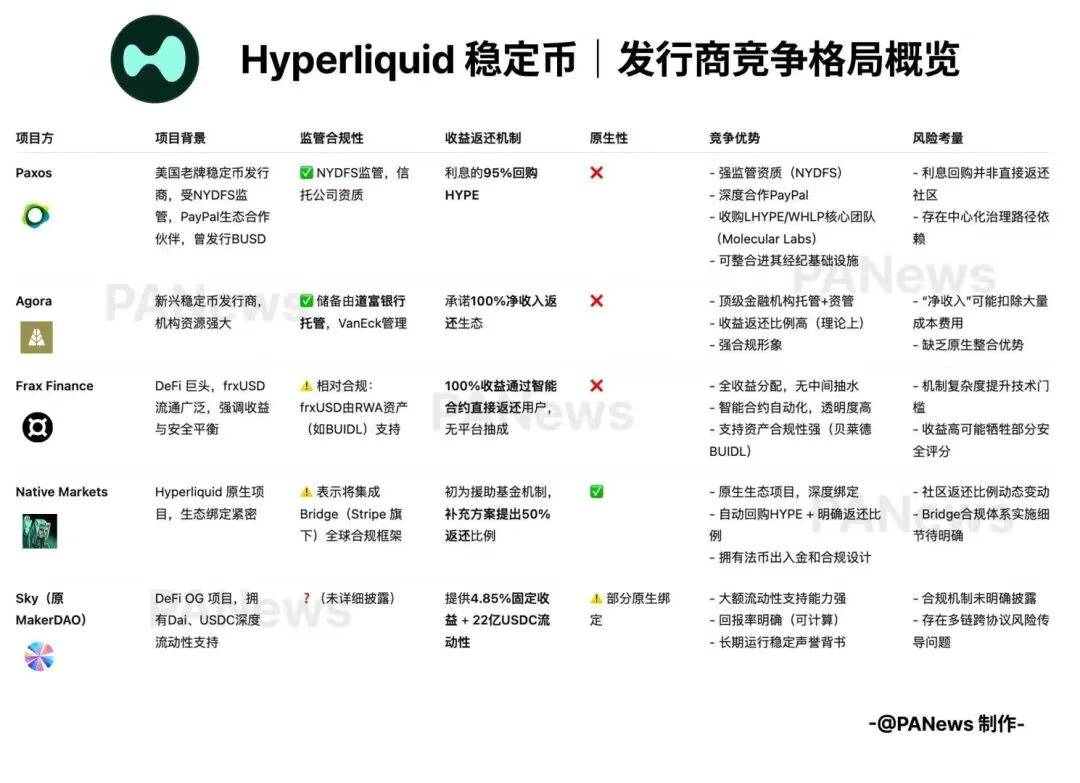

Last Friday, Hyperliquid dropped a bombshell on Discord: it plans to launch a native stablecoin, USDH, within its HyperEVM ecosystem and will select the issuer through on-chain voting and public bidding. In the following week, various stablecoin issuers submitted their bidding proposals, with the final winner to be decided by a majority vote from $HYPE stakers. To highlight the characteristics of decentralized governance, although the Hyperliquid Foundation holds a significant amount of $HYPE staked, it chose to abstain, completely handing over the decision-making power to the community.

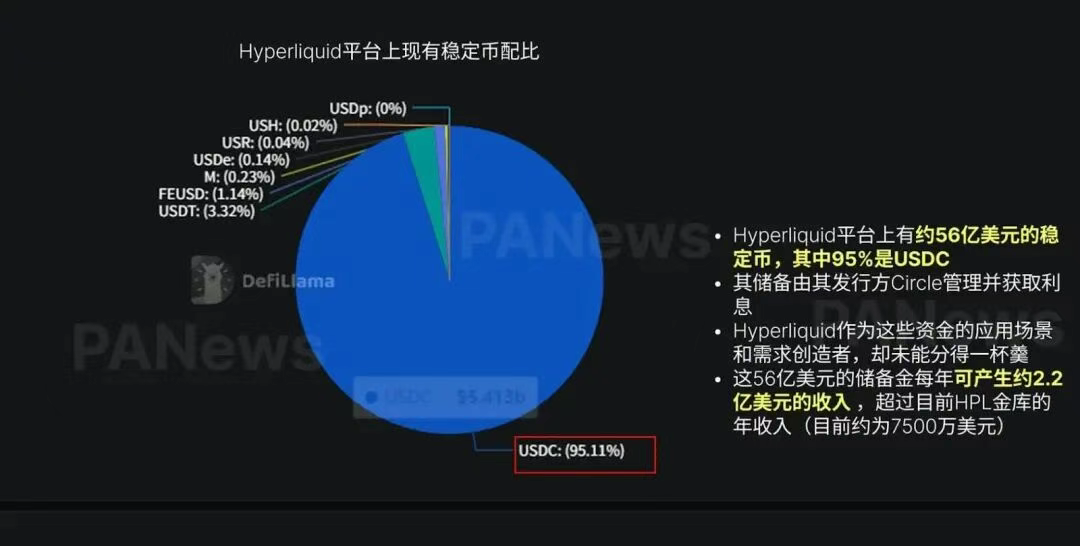

The motivation behind Hyperliquid's launch of USDH is quite straightforward: the platform currently holds approximately $5.6 billion in stablecoin assets, of which 95% is USDC. This portion of funds is held in reserve by the issuer Circle, earning interest, while Hyperliquid, as the application scenario and demand creator, cannot share in the profits. If this $5.6 billion in existing funds could be replaced with USDH, based on treasury bond rates, it is expected to generate over $220 million in annual interest income, far exceeding the platform's current HLP annual revenue (approximately $75 million). This additional revenue will be used to buy back and distribute $HYPE, thereby benefiting the ecosystem.

▲ Source: PA News

Among the various bidding proposals, the proposal from Hyperliquid's native project Native Markets ultimately won. Relevant details can be found here: https://www.theblock.co/post/370570/native-markets-team-wins-hyperliquid-usdh-stablecoin-bid-eyes-test-phase-within-days

▲ Source: PA News

In addition to the importance of blockchain and stablecoins, we can also clearly see the critical role of on/off ramps (the channels for fiat and crypto asset inflows and outflows) in user experience. Whether users can smoothly and cost-effectively exchange fiat for stablecoins or other crypto assets often directly determines whether the entire application can achieve true mass adoption.

IOSG invested in Transak five years ago, a global leading on/off ramp service provider. Transak is dedicated to providing seamless fiat entry and exit channels for wallets, exchanges, and payment applications, supporting users in over 150 countries and regions. Recently, in its latest funding round, Transak secured $16 million led by Tether (the parent company of USDT) and IDG. In addition to Transak, IOSG has also invested in Kravata, a project rooted in Latin America's fiat and cryptocurrency inflows and outflows, providing B2B APIs to enterprise clients and offering B2B2 APIs that can be integrated by third-party applications. As of Q2 2025, there are over 90 clients globally operating in three countries. This move not only proves the market's long-term optimism for the on/off ramp sector but also reaffirms IOSG's accurate judgment of the value of industry infrastructure during the early investment phase.

It is foreseeable that as stablecoins and blockchain payments gradually move towards the mainstream, on/off ramp infrastructures like Transak will become key hubs that connect the two: serving as the entry point for users into the crypto world and as the bridge for stablecoins to integrate into the global payment system.

Tracks with Product-Market Fit (PMF)

Once the payment infrastructure is complete, cross-border payments will become the most direct and obvious breakthrough. The global annual cross-border capital flow reaches as high as $150 trillion, while the existing system often takes 3 days and charges about 3% in fees, involving multiple intermediaries. If replaced with stablecoins based on efficient "rails," the entire process could take only 3 seconds, with fees as low as 0.01%, enabling direct peer-to-peer settlement. The efficiency gap is so vast that adoption is almost an inevitable trend.

B2B enterprise cross-border payments represent a perfect product-market fit (PMF) in the cryptocurrency space today. Currently, 40% of blockchain fees come from transferring USDT, with hundreds of millions of emerging market users using it daily to combat currency devaluation and inflation in their home countries. Setting aside infrastructure and speculative consumption cycles, payments (especially B2B cross-border payments) are the area in crypto reality most likely to supplement SWIFT. The real winners may not be new chains or general stablecoin issuers, but orchestrators who hold licenses and have distribution capabilities in key cross-border corridors.

This is also why we saw earlier that Airwallex, a Web2 giant in cross-border transfers, has genuinely felt the threat from stablecoin cross-border payment companies, making defensive statements on Twitter while openly recruiting stablecoin developers on its job site.

The "Payment Orchestration Layer" integrates fiat and stablecoins, various payment methods, channels, and processing services to provide end-to-end payment/settlement solutions. It emphasizes the ability to "support stablecoins": not only facilitating fiat collection/payment but also supporting stablecoin collection/cross-border transfer/stablecoin conversion back to fiat.

Cross-border payments often form a path of "fiat → stablecoin → fiat," meaning local fiat is exchanged for stablecoins → stablecoins are used for international transfers/settlements → the receiving end converts back to local fiat. The role of the payment orchestration layer is to optimize this path, reducing friction, saving time costs, and improving efficiency.

While traditional giants like Airwallex and Stripe are actively laying out stablecoin payments, startups often have advantages in innovation and execution speed. For example, Align focuses on the cross-border remittance needs of large multinational corporations, while ArrivalX targets the overseas payment scenarios of Chinese merchants. The author believes that the future is more likely to form regionally focused solutions rather than a single global unified model, similar to the competitive landscape on the on/off ramp side.

This is because each region is significantly influenced by local regulations, laws, and banking/financial infrastructure. In the context of the rapid development of stablecoin payments, if small and medium-sized startups can effectively position themselves as "local + regional + orchestration layer," there remains ample space in specific payment corridors. The core advantages, besides licenses, also lie in providing bidirectional circulation of stablecoins and fiat, with strong compatibility in payment/settlement services, which is a key differentiator. Compliance and risk control will be crucial in determining long-term success.

▲ Source: ASXN

https://stablecoins.asxn.xyz/payments-market-map

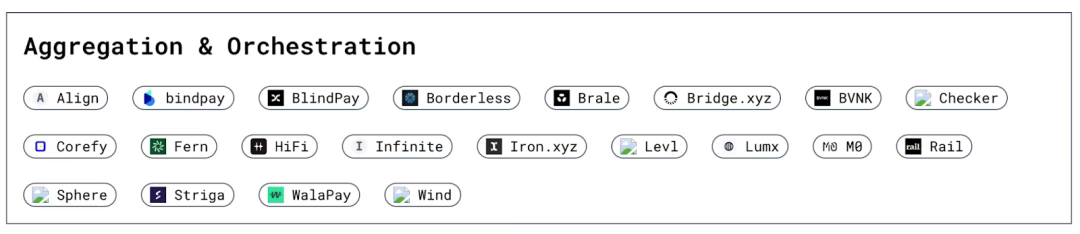

Moreover, in many articles about payments on the market, we can see Aggregation and Orchestration listed in the same quadrant, but we believe there are differences between the aggregation layer and the orchestration layer in capturing B2B transaction value. The aggregation layer, lacking licenses, can be understood as a wrapper for the orchestration layer; although it can connect to more regional platforms, it is constrained in price negotiation due to its profit-sharing side, which can be seen as a business model similar to Circle—growing larger makes it harder to achieve high profits.

In addition to serving as the underlying service for B2B aggregation layers, these orchestrators also further support the application side of the entire payment network, which can be broken down into To C applications and To B applications.

To C applications currently focus mainly on P2P payment applications, such as Sling, as well as neobanks like infini and Yuzu.Money that provide more stablecoin earning scenarios for consumers, and stablecoin cards that address the challenges of stablecoin consumers in the real world.

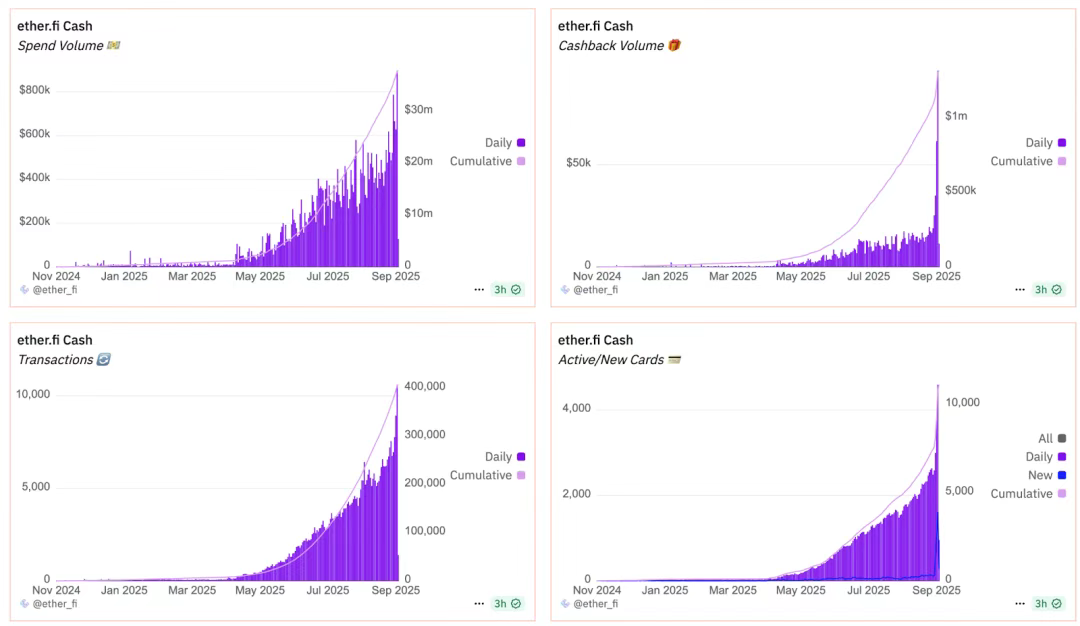

IOSG has actually been laying out in the To C application side for some time and has invested in Ether.fi, a super payment application that can earn interest. Its card transaction volume, cash back amount, transaction count, and issuance volume all reached historical highs in September.

▲ Source: Ether.fi Dune Dashboard

On-chain capital is clearly profit-driven: approximately 45% of DeFi TVL (around $56 billion) is chasing yields, primarily distributed across protocols like Aave, Morpho, and Spark. The market capitalization of yield-bearing stablecoins is rapidly growing, soaring from $1.5 billion to $11 billion, accounting for 4-4.5% of the entire stablecoin market ($255 billion). Projects centered around DeFi yields continue to attract attention, including Ethena, Pendle, Aave, Spark, and Syrup.

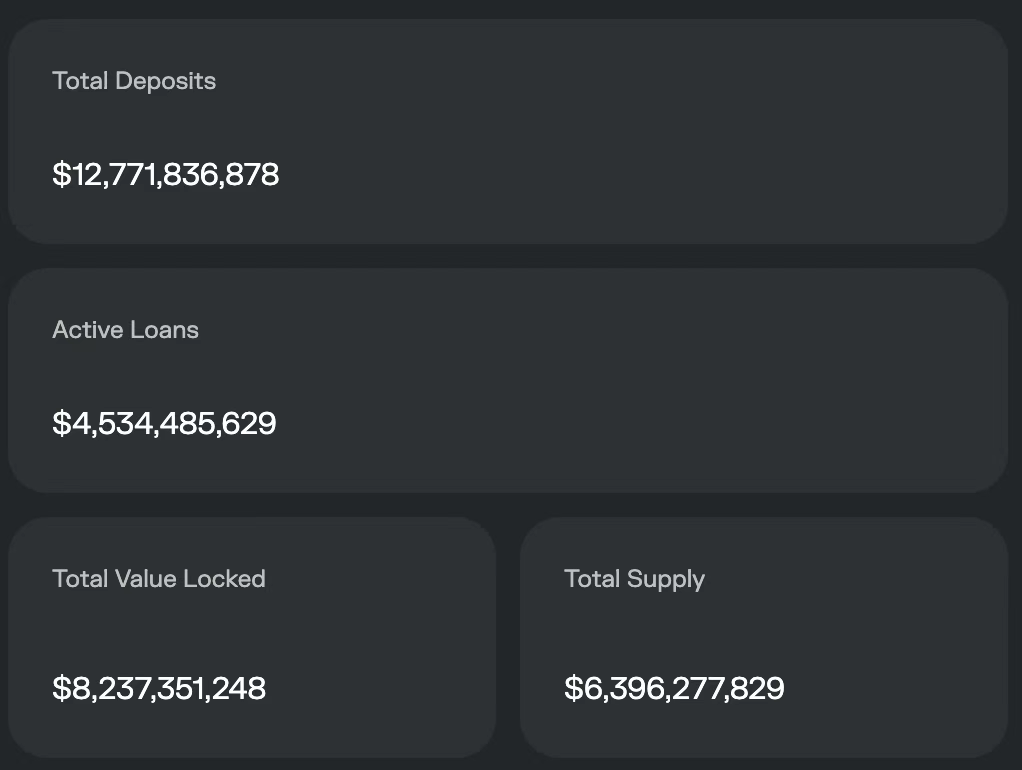

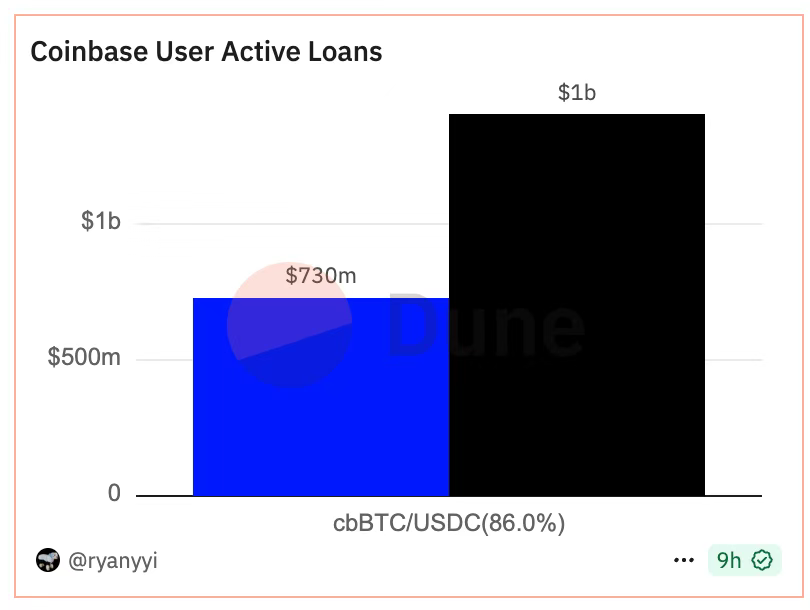

As the number of DeFi protocols increases, the complexity of operations also rises, making the user experience less friendly. To alleviate this pain point, Coinbase has officially integrated Morpho into its exchange and launched a lending product, Coinbase Onchain Borrow, that merges CeFi and DeFi. Users can complete collateralization and borrowing with a single click on the front end, while the underlying support is provided by Coinbase Smart Wallet, completely abstracting the wallet creation and interaction with Morpho, significantly simplifying the user experience. Coinbase Onchain Borrow has provided Morpho with $1.4 billion in deposits and $730 million in active loans, accounting for 11% and 16% of Morpho, respectively. This has also helped Morpho's total deposits reach $12.7 billion, with active loans currently at $4.5 billion.

▲ Source: https://app.morpho.org/ethereum/explore https://dune.com/ryanyyi/coinbase-onchain-loans

Based on the same investment logic of simplifying the user experience on-chain, we chose to invest in Ether.fi early on. It initially focused on ETH staking yields and gradually expanded to more complex third-party Vault strategies, significantly lowering the threshold for stablecoin users in DeFi operations, allowing users to easily earn yields. It even launched a DeFi credit card, enabling users to repay credit card loans with future interest, achieving a true "Buy Now, Pay Never."

The immense potential of stablecoin digital banks and stablecoin credit cards lies in their ability to move credit issuance directly on-chain, fundamentally weakening or even partially replacing the intermediary role of traditional banks. In the traditional model, banks' core revenue comes from the interest spread between deposits and loans, which is the foundation of the entire system. However, this model also gives banks excessive "screening power": on one hand, they exclude a large number of unbanked populations who cannot enter the deposit system; on the other hand, they reject enterprises and individuals who do not meet loan standards (those who can’t qualify for loans or credit cards).

In contrast, the stablecoin system completely reshapes this logic. Leveraging the programmability, atomic settlement, and immutability of blockchain, lenders and borrowers can connect directly on-chain, no longer constrained by traditional banks' entry standards, thus rewriting the way payments and credit participation occur. Based on this, new digital banks for stablecoins construct nearly risk-free lending products by further encapsulating stablecoins, cryptocurrencies, and DeFi lending protocols, combined with an over-collateralization model that requires no trust. This model can manifest as new lending banks like Coinbase Onchain Borrow or as stablecoin credit cards similar to Ether.fi.

In terms of To B commercialization, we also observe some new opportunities. For instance, helping online and offline merchants directly access stablecoin payments to avoid interchange fees from acquiring banks. At the same time, platforms offering more convenient invoicing and global payout services for enterprise clients also have vast development potential. However, especially for products emphasizing enterprise user experience, there may be certain competition in the future as the payment orchestration layer gradually integrates vertically.

AI-Driven New Paradigm of On-Chain Payments

In the future, another very interesting potential area in To B applications is the use of AI Agents as payment application clients. Currently, with the emergence of automated AI Agents in trading and yield farming applications, such as Theoriq, Giza, and Almanak, we can expect to see more fully automated AI Agents that continuously seek new yields 24/7. Meanwhile, these automated AI agents require a wallet to purchase the data, computing power, and even human services they need.

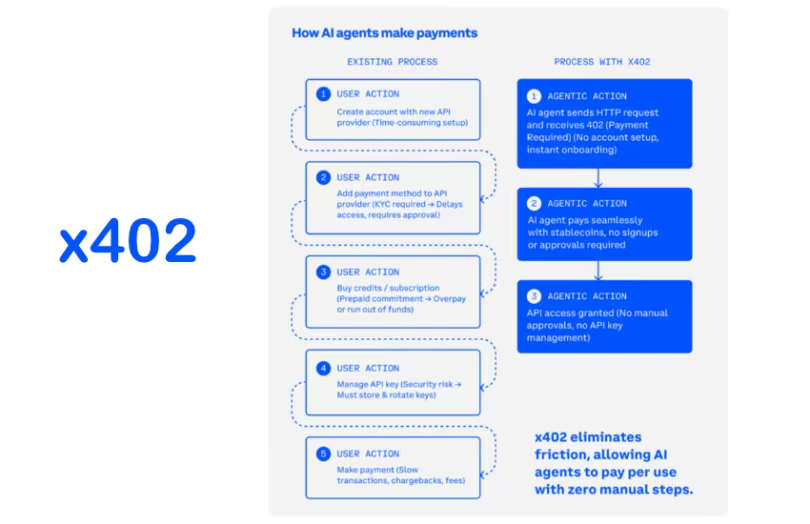

The development of AI Agents requires new on-chain infrastructure, which could also be a potential investment opportunity. Traditional payment systems are slow in settlement, have high chargeback rates, and often rely on manual processes, making them unsuitable for autonomous agents. To address this, Google has launched the AP2 protocol and partnered with Coinbase to release A2A x402. If MCP is the "tentacle," A2A is the "language," then AP2 and x402 represent the "last mile" for AI to achieve complete automation—autonomous payments and value exchange.

The mission of AP2 is to make AI trustworthy, controllable, and traceable in financial transactions. It does not aim to replace Visa or Mastercard but to build a universal trust layer on top of them. Through an authorization mechanism based on Verifiable Credentials, AI can hold digitally signed authorization documents, ensuring transaction security and auditability.

Its Mandates (authorization documents) mechanism has two modes:

Real-time authorization: When AI finds a product, it requires user confirmation on the spot.

Delegated authorization: Users can set complex conditions in advance (e.g., "hotels under $200"), and AI will only execute automatically when the conditions are triggered.

All transactions will form an immutable evidence chain, secured and auditable by Verifiable Credentials, thus avoiding "black box" payments. Google's strategy is clear: to unite financial and crypto giants, not to issue coins or settle directly, but to define "trust" rules.

Notably, A2A x402 is an extension component specifically designed for crypto payments, developed in deep collaboration with Coinbase and the Ethereum Foundation, enabling AI to seamlessly handle on-chain assets like stablecoins and ETH, supporting Web3 native payments. In a sense, Google’s AP2 aims to bring AI into the existing financial system, while Coinbase and the Ethereum Foundation's A2A x402 extension seeks to establish a new economic environment native to crypto for AI.

Google's A2A standard allows different projects' AI agents to interoperate, but under the premise of a "mutual trust environment." To this end, the ERC-8004 introduced by the Ethereum Foundation adds a layer of trust mechanism, similar to a digital passport system, allowing agents to safely discover, verify, and interact with unfamiliar counterparties on Ethereum or other L2s.

The name x402 comes from the HTTP status code "402 Payment Required." Its concept is to integrate payments into internet communication: when AI calls an API, the server returns a "402 bill," allowing AI to complete payments on-chain using stablecoins and instantly receive services. This not only makes automation and high-frequency trading between machines possible but also allows AI services to be finely billed based on requests, duration, or computing power, which is difficult to achieve with traditional payments.

▲ Source: Google

Onchain Agentic Commerce is accelerating its formation under the dual innovation of stablecoin payments and AI Agents. Currently, emerging companies like Skyfire and Crossmint are also working to abstract the AP2 and x402 standards into SDKs and APIs that are easy for developers to call. The ChaosChain team has already completed a prototype, combining AP2 with Ethereum's latest ERC-8004 "trustless agent" standard, and this is just the prologue. The Ethereum dAI team, built and led by Davide Crapis, is further advancing this process. As the underlying layer for future AI agent collaboration, Ethereum is expected to help us transition from the current highly centralized AI system to a censorship-resistant, truly decentralized future. At that time, the combination of payment chains, stablecoin settlements, and AI-driven value innovation will give rise to more interesting SuperApps.

References:

Designing the Ultimate Stablecoin Credit Card - Doğan Alpaslan, Cyber Fund (https://cyber.fund/content/stablecoincreditcard)

Stablecoin On-Chain Payments, Settling Web2 Thinking - Zuo Ye (https://x.com/zuoyeweb3/status/1969367029011644804)

The Final Battle of AI Payments: The Three-Body Game of Google, Coinbase, and Stripe - Luke, Marsbit (https://news.marsbit.co/20250919092805091063.html?utmsource=substack&utmmedium=email)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。