Original Title: Tether's Compliance Adventure

Original Author: Thejaswini M A, Token Dispatch

Original Translation: Block unicorn

Introduction

In August of this year, Bo Hines resigned from his position on the White House Cryptocurrency Advisory Committee and quickly took on the role of CEO of Tether's newly established U.S. division. His mission is to launch USAT, a stablecoin compliant with the GENIUS Act. USAT will undergo monthly audits, with its reserves held entirely in cash and short-term U.S. Treasury securities, operating under comprehensive federal oversight.

Meanwhile, USDT continues to handle over $1 trillion in transactions each month, with reserves that include Bitcoin, gold, and secured loans. These assets are managed through offshore entities that have never undergone comprehensive audits.

The same company, two completely different product approaches.

Last year, Tether made a profit of $13.7 billion with its "seeking forgiveness, not permission" model. In contrast, Circle went public with a valuation of $7 billion, thanks to its due diligence and the right questions asked before advancing its business.

This announcement should have been a celebration.

After years of regulatory struggles, transparency issues, and ongoing questions about reserve backing, Tether finally provided the U.S. market with what critics have long demanded: full compliance, independent audits, regulated custodians, and reserves that hold only cash and short-term U.S. Treasury securities.

However, we find ourselves discussing regulatory arbitrage, competitive moats, and those delightful awkward moments when revolutionary technology clashes with the established order, while everyone pretends this has always been part of the plan.

It turns out that as long as you are creative enough in your corporate structure, you can serve two masters at once.

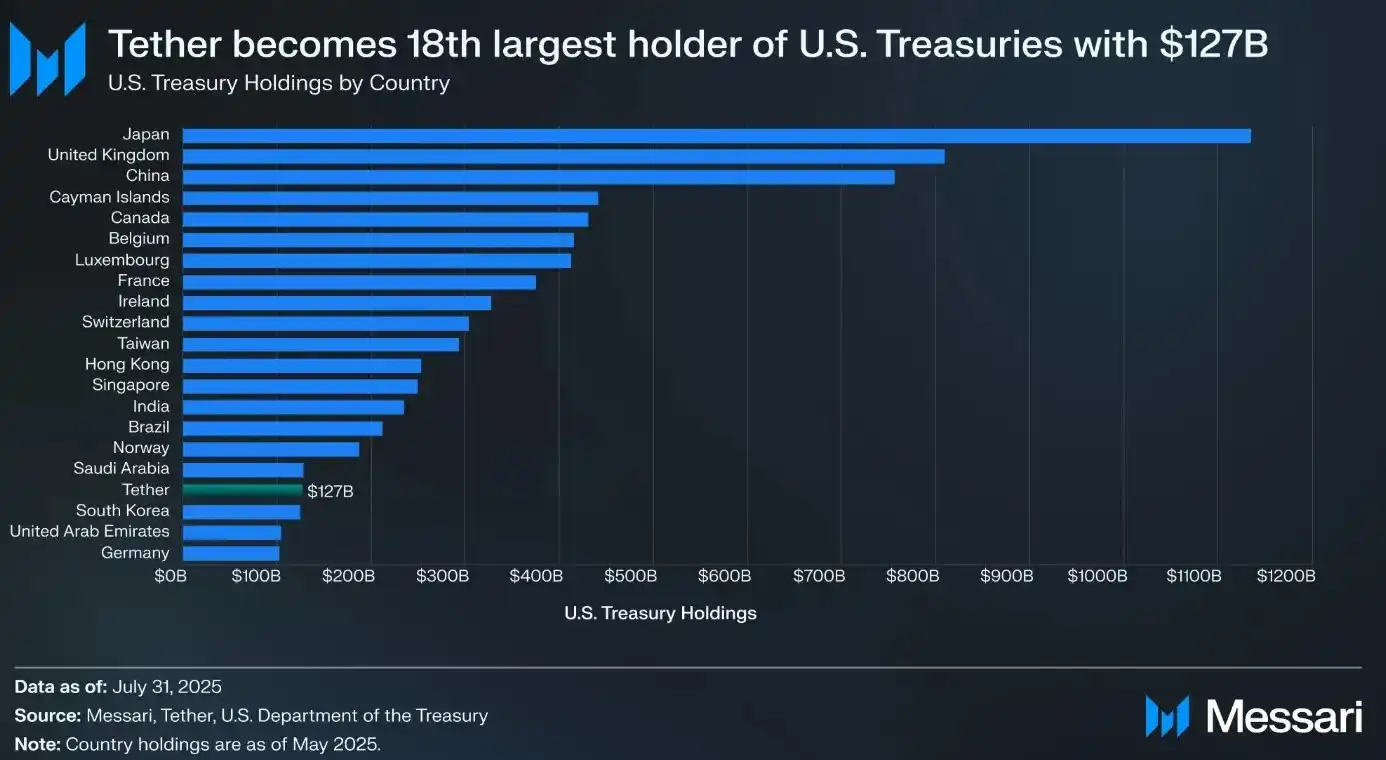

Before delving into USAT, let’s first understand the tremendous achievements Tether has made with USDT. The circulating token value of USDT is as high as $172 billion, processing over $1 trillion in transactions in the cryptocurrency market each month. If Tether were a country, it would be the 18th largest holder of U.S. government debt, with a total of $127 billion in government bonds.

The company made a profit of $13.7 billion last year—not revenue, but profit—placing it among the most profitable companies, surpassing many Fortune 500 firms.

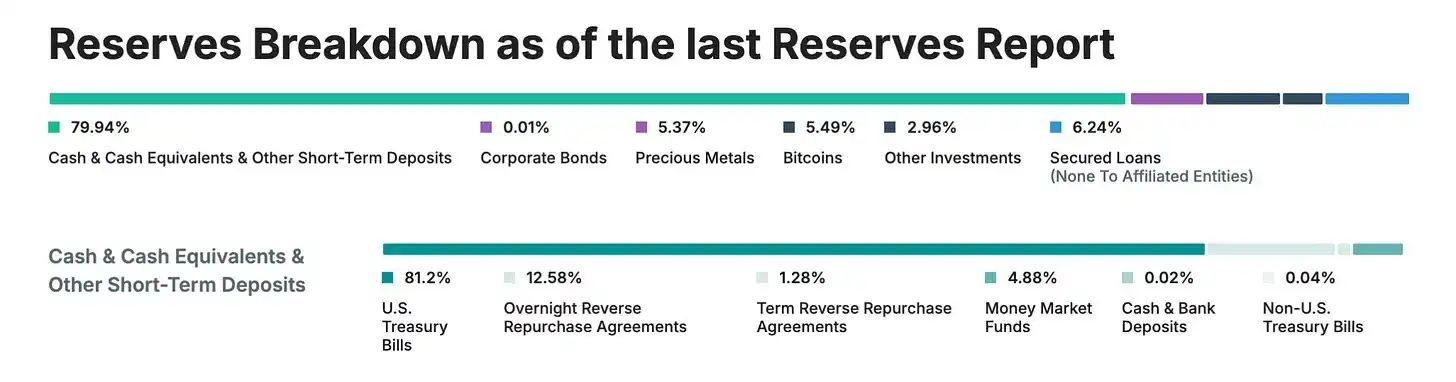

All of these achievements were made without comprehensive audits, full regulation, or the transparency that traditional financial institutions take for granted. Instead, Tether relies on quarterly "proofs" rather than full audits and includes assets like gold, Bitcoin, and secured loans in its reserves—assets that are not permitted under strict stablecoin regulations. Additionally, it primarily operates through offshore entities in Hong Kong and the British Virgin Islands.

This serves as the ultimate example of how sometimes, by completely defying the preferences of regulators, one can still achieve great success.

The Emergence of the GENIUS Act (and the Issues)

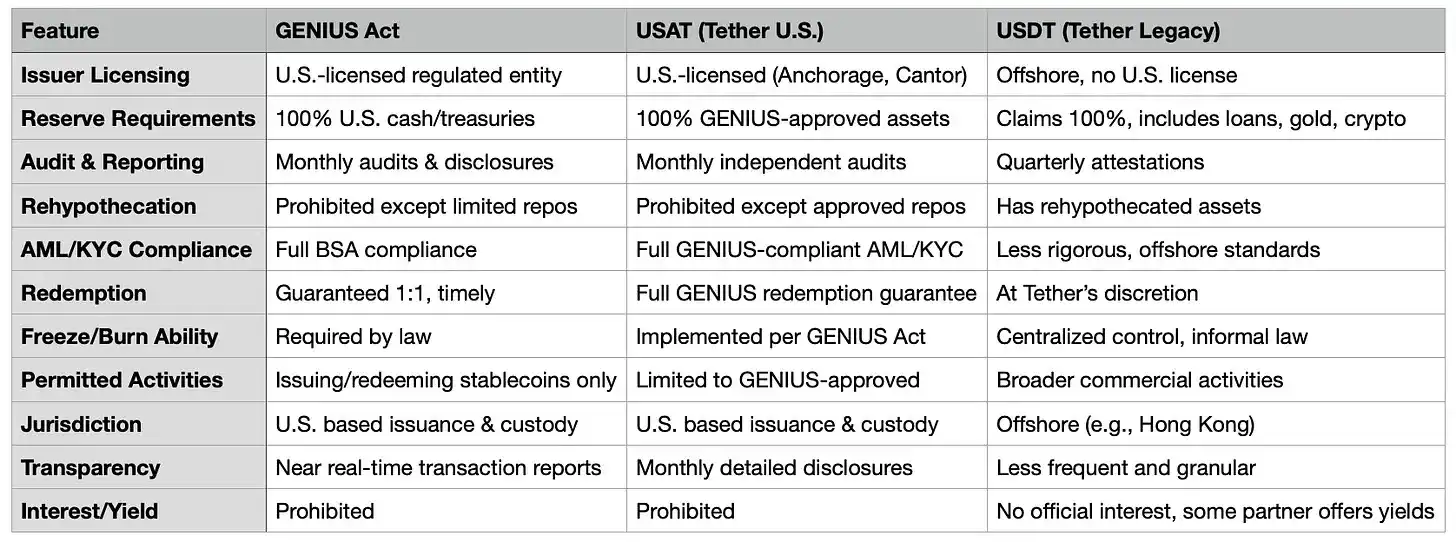

Then, in July 2025, the GENIUS Act was introduced, marking the first comprehensive stablecoin regulatory framework in the U.S. Suddenly, the U.S. market—the most profitable and influential cryptocurrency market in the world—had new strict rules:

- 100% reserves in cash and short-term U.S. Treasury securities (excluding Bitcoin, gold, or secured loans)

- Monthly independent audits, with certifications from the CEO and CFO

- Issuers holding U.S. licenses and regulated custodians

- Full compliance with anti-money laundering (AML) / know your customer (KYC) requirements, with freezing capabilities

- No interest paid to holders

- Complete transparency of reserve composition

Looking at this list and then at the existing structure of USDT, the challenges are evident. The law effectively draws a clear line between "foreign" and U.S.-based stablecoins. USDT, issued by Tether entities in the British Virgin Islands and Hong Kong, cannot simply become compliant at the push of a button. It requires a complete overhaul of its corporate structure, reserve composition, and operational framework.

For Tether, the trickier part is that true compliance with the GENIUS Act requires the kind of transparency the company has long avoided. As of 2025, Tether still provides quarterly "proofs" rather than full audits. Approximately 16% of its reserves consist of assets explicitly prohibited by the GENIUS Act: gold (3.5%), Bitcoin (5.4%), secured loans, and corporate bonds.

So why not just fix USDT directly?

Why launch an entirely new token instead of simply making USDT compliant?

In simple terms, transforming USDT into a compliant token is like trying to convert a speedboat into an aircraft carrier while it’s still sailing. USDT currently serves 500 million users globally, who choose it precisely because it is not subject to the stringent U.S. regulations. Many of these users are in emerging markets, where local banking systems are unreliable or costly, and USDT provides them with a way to access U.S. dollars.

If Tether suddenly imposed U.S.-level KYC requirements, freezing capabilities, and audit protocols on all global USDT users, it would fundamentally change the nature of USDT's success. A Brazilian small business owner using USDT to avoid currency fluctuations does not want to deal with U.S. regulatory compliance, and a cryptocurrency trader in Southeast Asia does not need monthly certifications from the CEO.

But there is a deeper strategic reason behind this: market segmentation. By creating USAT, Tether can offer a "premium" regulated product for U.S. institutions while keeping USDT as the "global standard" for other markets. It’s like having both a luxury brand and a mass-market brand—one company providing different products for different customers.

The Value Proposition of USAT (as it Stands)

So what exactly does USAT offer that USDC does not? Tether's marketing on this front seems a bit vague.

The technical architecture supports this dual-track strategy. Both tokens leverage Tether's Hadron platform, allowing for seamless integration with existing infrastructure while maintaining regulatory isolation. Where legally permissible, liquidity can flow between the two systems, but compliance "firewalls" ensure that each token operates independently within its jurisdiction.

USAT will be issued by Anchorage Digital Bank (a federally chartered crypto bank), with reserves held by Cantor Fitzgerald. It will fully comply with the GENIUS Act, including monthly audits, transparent reserves, and various regulatory requirements expected by institutional users. Under the leadership of former White House crypto advisor Bo Hines, USAT benefits from strong political support and connections in Washington.

However, Circle's USDC has long met all these conditions. USDC boasts deep liquidity, mature exchange integrations, institutional partnerships, and a solid regulatory track record. It has become the preferred stablecoin for U.S. institutions.

Tether's main advantage is… well, it’s Tether. The company has built the largest stablecoin distribution network in the world, with a massive existing market share and generates $13.7 billion in profit annually to support its growth. As CEO Paolo Ardoino stated, "Unlike our competitors, we don’t need to rent distribution channels; we own them."

Tether needs to build liquidity for USAT from scratch. This means convincing exchanges to list USAT, market makers to provide liquidity, and institutional clients to actually use it. Even with Tether's substantial financial resources and vast distribution network, this is no easy task.

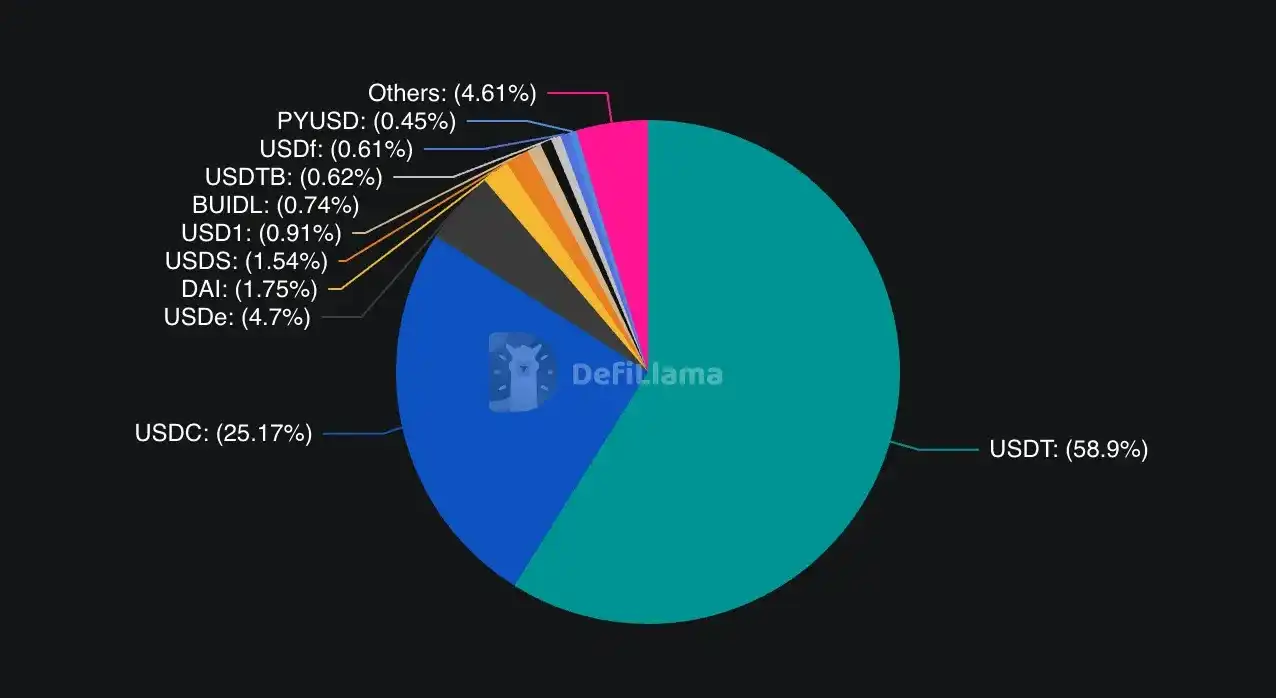

USDC controls about 25% of the global stablecoin market but dominates the regulated U.S. market. USDT holds 58% of the global market share but is largely excluded from the compliant U.S. market.

The company bets that institutional users will need alternatives to mitigate concentration risk. If Circle or USDC encounters issues, institutional users may seek other fully regulated options. Additionally, Tether can leverage its existing relationships (such as its partnership with Cantor Fitzgerald) to offer better terms or services.

Circle's recent moves highlight the intensity of the competition. In June 2025, Circle successfully went public, launched a blockchain specifically for stablecoin finance called Arc, and continued to expand global payment channels. Circle's regulatory-first strategy has clearly paid off in terms of institutional adoption.

But USAT also possesses certain advantages that USDC lacks. According to CEO Paolo Ardoino, Tether's global distribution network includes "hundreds of thousands of physical distribution points," as well as digital partnerships like the $775 million investment in Rumble. This infrastructure has been built over more than a decade and is difficult to replicate easily.

Tether's strength lies in its global relationships and financial power. In the first half of 2025, the company generated $5.7 billion in profit, providing ample resources for market making, liquidity incentives, and partnership development. Unlike competitors that must "rent" distribution channels, Tether owns its infrastructure.

The biggest advantage of USAT may be compatibility. If it can work alongside the existing USDT infrastructure, users won’t need to completely overhaul their systems. For developers who have already spent months integrating USDT, switching to another Tether token is far preferable to starting from scratch with a completely different provider.

Some institutional or risk-averse users may simply want to hold multiple regulated stablecoins for diversification, reducing counterparty risk between Circle (USDC) and Tether (USAT).

The timeline is crucial here. USAT is scheduled to launch by the end of 2025, meaning Tether has limited time to build liquidity, ensure exchange listings, and establish market maker relationships. In financial markets, first-mover advantage can be decisive, as users typically prefer established and liquid options over newcomers.

The timeline is critical here. USAT is set to launch by the end of 2025, giving Tether limited time to build liquidity, secure exchange listings, and establish market maker relationships. In financial markets, first-mover advantage is crucial—users tend to favor established and liquid options over newcomers.

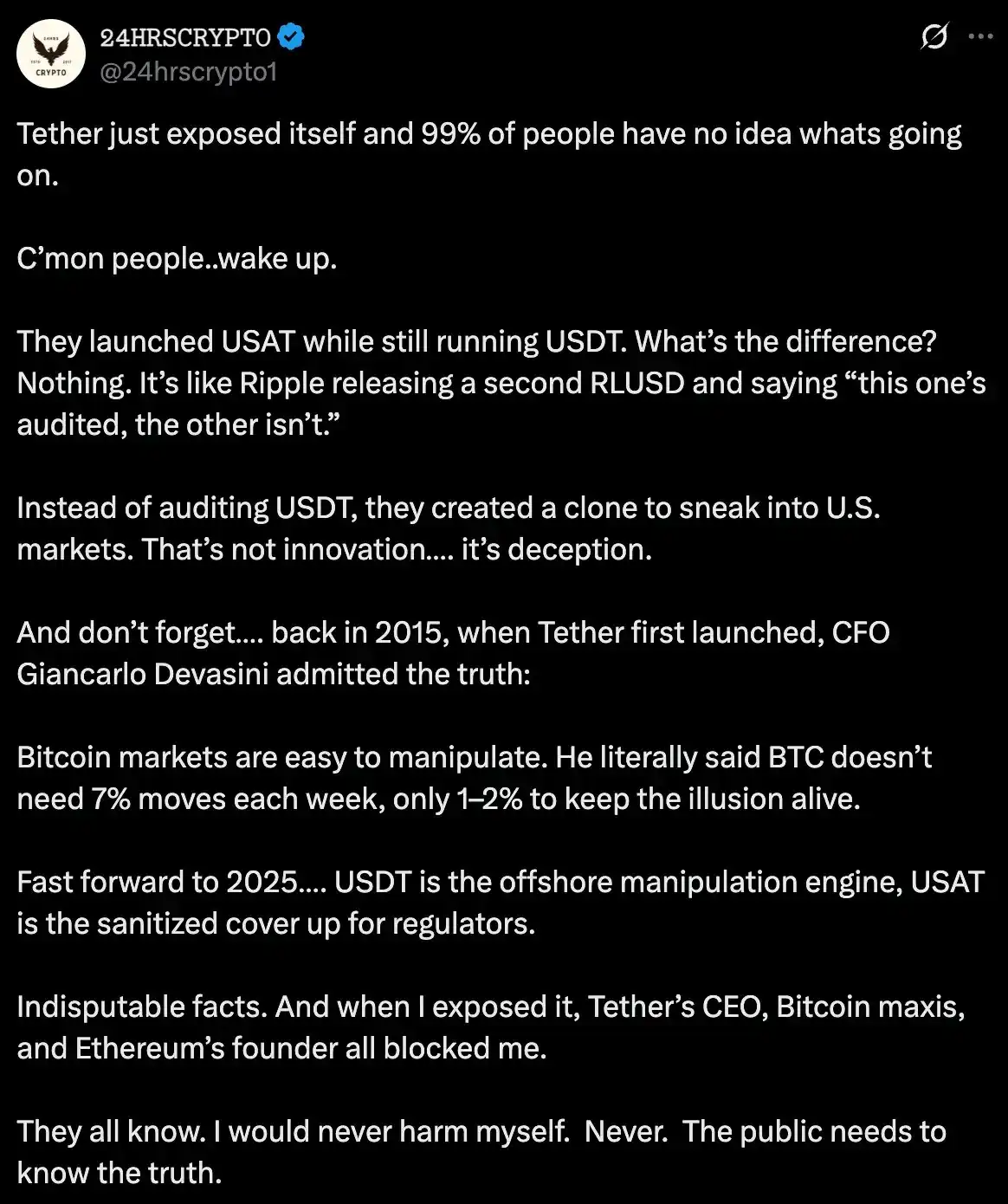

Critics argue that USAT is essentially a "compliance theater"—a way for Tether to enter the U.S. market without addressing the transparency and operational issues at the core of its business.

This criticism has some merit. Tether's choice to launch USAT instead of making USDT fully compliant indicates that the company prioritizes current operational flexibility over comprehensive regulatory legitimacy.

On the other hand, some might argue that this is precisely how the market should operate. Different customer segments have varying needs and risk preferences. U.S. institutions require regulatory compliance and transparency, while users in emerging markets prioritize accessibility and low fees. Why can't a single company meet the needs of both segments through different products?

Conclusion

Tether's dual stablecoin strategy reflects broader contradictions in the crypto industry regarding regulation, decentralization, and institutional adoption. The industry increasingly faces the challenge of balancing the original permissionless spirit of cryptocurrency with the regulatory framework needed to promote mainstream adoption.

USAT represents Tether's bet: that they can achieve regulatory legitimacy for institutional users while maintaining flexibility for global retail. The success of this strategy will depend on execution, market acceptance, and the stability of the ever-evolving regulatory framework.

The regulatory environment is still in flux. While the GENIUS Act provides some clarity, the specific details of its implementation and enforcement remain uncertain. Changes in administrative agencies or shifts in regulatory priorities could significantly impact the strategies of stablecoin issuers.

More fundamentally, USAT raises critical questions about the nature of Tether's initial success. Is USDT's dominance built on regulatory arbitrage, which may no longer be sustainable? Or does it reflect genuine innovation in global financial infrastructure, where regulatory compliance can facilitate rather than hinder such innovation?

The answer to this question may ultimately determine whether USAT represents Tether's evolution toward mature financial institutions or an acknowledgment of the fundamental limitations of its original model. Regardless, the launch of USAT marks a new chapter in the competition and regulation of stablecoins.

The king is building a second kingdom. Whether he can rule both remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。