Original Title: Hyperliquid's HYPE Slumps as Attention and Capital Rotate to New DEX Tokens & HYPE's Damocles Sword

Original Authors: Akash Girimath & @MaelstromFund

Original Translation: Ismay, BlockBeats

Editor’s Note: The potential selling pressure from the unlocking of HYPE has become one of the most concerning risks in the market. Research institutions like Maelstrom estimate that the current buyback scale can only cover about 17%, with a monthly supply gap of up to $410 million. However, on September 23, Hasu, the strategic director of Flashbots and strategic advisor to Lido, along with Jon, co-founder of DBA, proposed a controversial suggestion: to reduce the total supply of HYPE by 45%. In the context of increasingly fierce competition among Perp DEXs and the dual challenges of narrative and liquidity, whether this supply reform can reshape market confidence or is merely a stopgap remains to be seen.

The following is the original content:

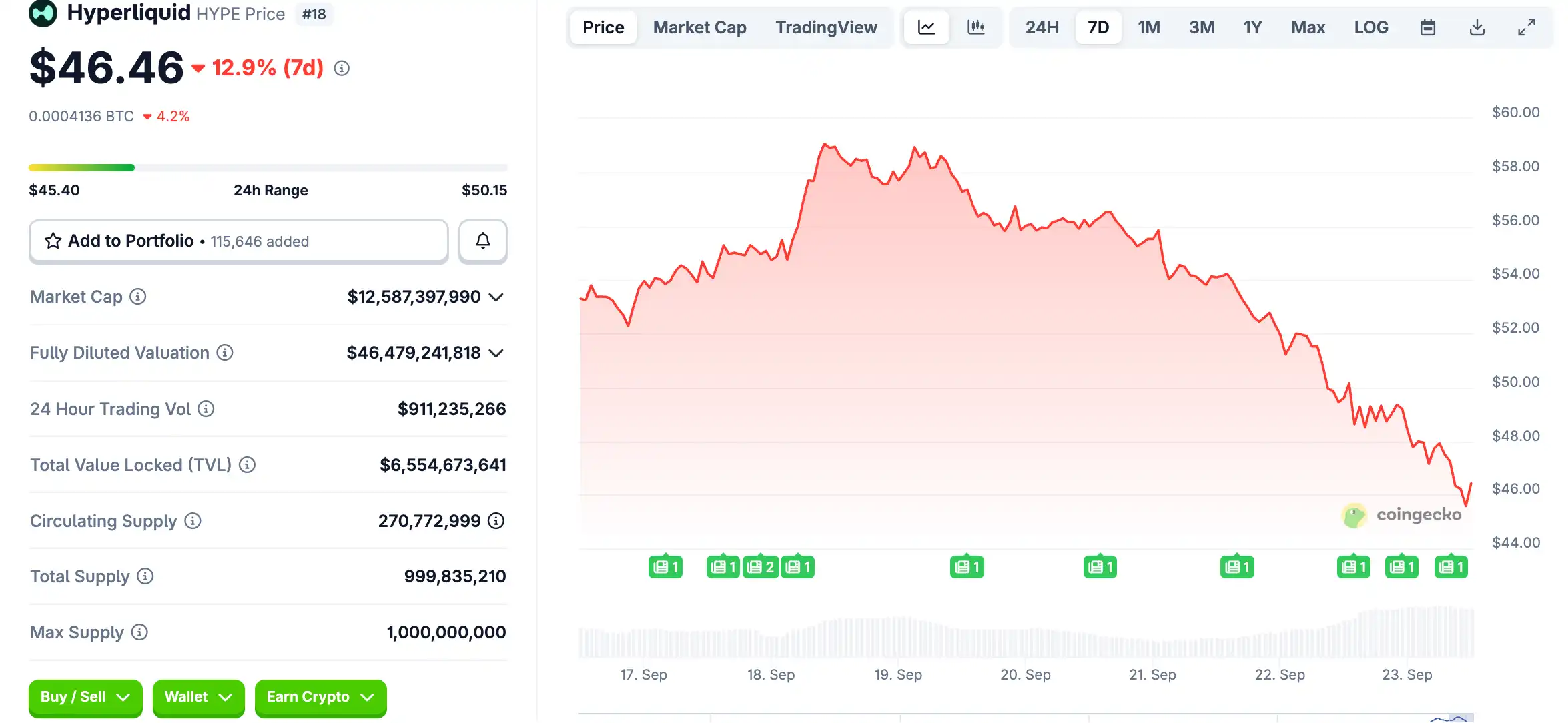

As competition among decentralized exchanges intensifies, Hyperliquid's HYPE token has fallen for four consecutive days, dropping over 16%, while newly launched decentralized exchange tokens have doubled over the weekend.

CEX.IO Chief Analyst Illia Otychenko stated in an interview with Decrypt, "There has indeed been a shift in attention over the past few days." According to TradingView data, DEX tokens Aster, Avantis, and STBL surged 124%, 125%, and 147% respectively over the weekend.

In contrast, Hyperliquid has dropped over 13% since its weekend peak and continued to decline by 7.4% today, briefly touching $47.83 during trading.

Meanwhile, users began to short HYPE over the weekend. Last Sunday, predictors gave HYPE a 62% chance of rising to $69, but by Monday morning, this trend had almost reversed, with users believing HYPE had a 58% chance of falling to $39.

Reasons for HYPE's Decline

Peter Chung, head of research at Presto Research, told Decrypt that the decline in Hyperliquid's price is due to investors taking profits. Otychenko also pointed out that this is a result of "partial capital rotation," with large holders selling HYPE.

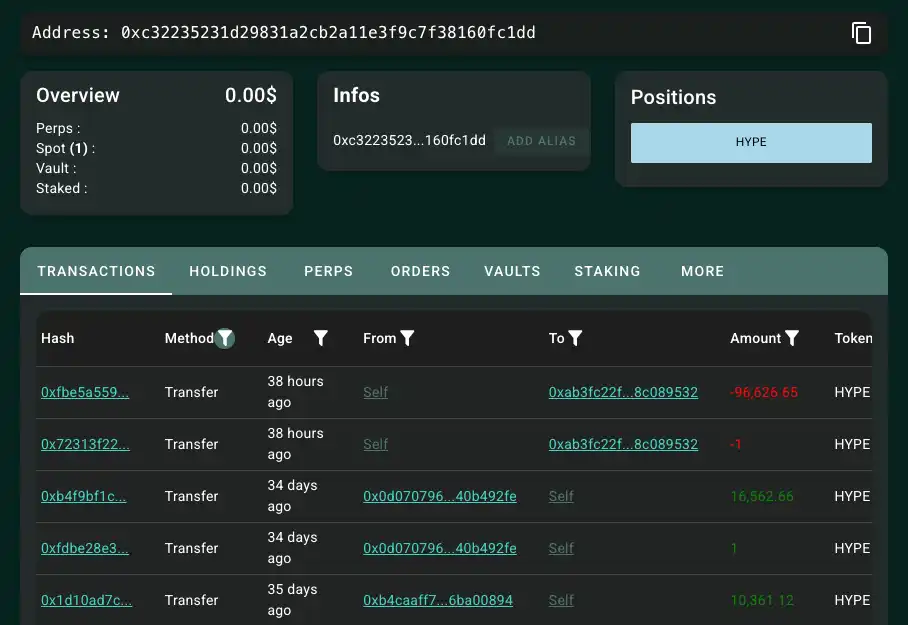

This includes BitMEX founder Arthur Hayes, who sold 96,600 HYPE last Sunday, worth about $5.1 million.

Additionally, Hayes's family fund Maelstrom tweeted on Monday that approximately 237.8 million HYPE will begin to unlock linearly starting November 29. Based on CoinGecko's current price of $49, the nominal value of this batch of unlocked tokens is about $11 billion.

Maelstrom also added that Hyperliquid's buyback and the buying pressure from digital asset treasury companies are "insignificant" compared to the upcoming unlocking scale, which is expected to bring up to $410 million in selling pressure each month.

Market Outlook and Risks

As competition among emerging decentralized exchanges becomes increasingly fierce, Otychenko raised the key question of whether these new tokens can continue to attract market attention after their initial hype fades.

"The risks are currently very high," he added, "especially for Aster, where over 90% of the token supply is concentrated in a few wallets, making it prone to extreme volatility or manipulation."

Related Reading: "ASTER Soars 4x in a Week, Challenging Hyperliquid with Binance's Backing"

Aster is a decentralized exchange based on the BNB Chain, which received a thumbs-up from Binance co-founder CZ last Wednesday, who tweeted, "Not a bad start, keep building."

HYPE's Damocles Sword

Hyperliquid has been on a roll—its ecosystem thriving, trading volumes hitting all-time highs, and the bidding war for USDH being hailed as one of the sexiest "beauty contests" in crypto history. But beneath the crown hangs the sword of Damocles—HYPE is about to face its first real test.

Starting November 29, 237.8 million HYPE will begin to unlock linearly over 24 months. At a price of $50 per token, this means the unlocking of team tokens worth $11.9 billion—equivalent to about $500 million in potential selling pressure entering the market each month.

The problem is that the current buyback efforts can only absorb about 17%, which means there is still $410 million in token supply hanging over the market. Has the market already digested such a massive unlocking scale?

Imagine you are a Hyperliquid developer—having worked tirelessly on this project for years, now a life-changing token fortune is about to unlock, and you can cash it out with just a click. What would you do?

Can DAT Turn the Tide?

With the progress of Sonnet, one of the largest DATs in crypto history is expected to complete in Q4 2025. It has raised about 583 million HYPE tokens and $305 million in cash. However, even if Sonnet is combined with all smaller HYPE DATs, it is still just a drop in the bucket compared to the upcoming massive unlocking wave.

If you move the cheese of the old crypto powers, don’t expect to walk away unscathed. Business is war, and the lifecycle of most crypto products has historically been short—the winners will inevitably attract a host of "vampiric" attackers. Now, competition is intensifying, both from leading exchanges and emerging challengers like Lighter.xyz (a Maelstrom portfolio company). CZ strongly promoting Aster two months before the unlock? Probably not a coincidence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。