Written by: Luke, Mars Finance

An envelope that seems ordinary could become the fulcrum to leverage the $93 trillion retirement market.

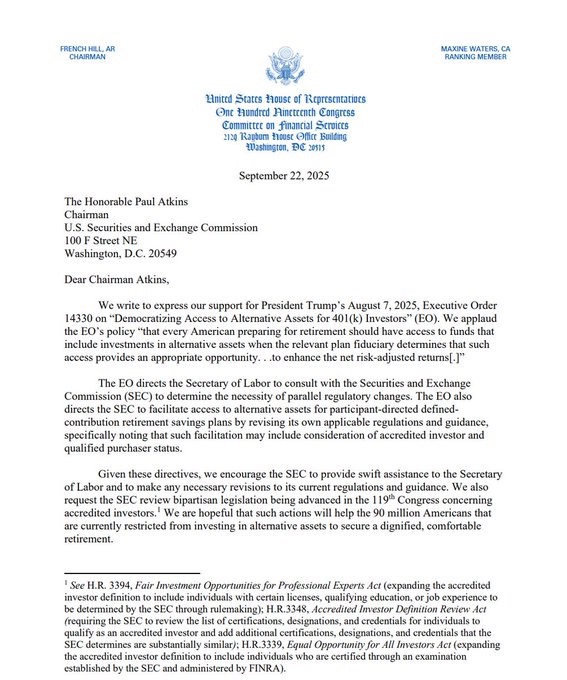

On September 22, 2025, a letter from the U.S. House Financial Services Committee broke the delicate calm between Washington and the crypto world. The letter was co-signed by the committee chairman, Republican French Hill, and senior member, Democrat Maxine Waters—this alone is a noteworthy signal. One is a staunch supporter of cryptocurrency, while the other has long held a cautious and even critical stance as a regulatory hawk. Their common goal is singular: to urge SEC Chairman Paul Atkins to promptly execute Executive Order 14330, signed by President Trump on August 7.

The wording of this executive order is quite significant, titled "Promoting Alternative Asset Investment Channels for 401(k) Investors." Outside the crypto industry, this sounds like yet another dry policy document. But in our industry, the immense energy contained in the phrase "alternative assets" is enough to make even the calmest traders' hearts race. This is because, according to a subsequent explanatory document released by the White House, the "alternative assets" defined in the order explicitly include "actively managed investment tools that invest in digital assets."

In simpler terms: The highest levels of the U.S. government have sent a clear signal—it's time for the retirement funds of ordinary Americans to officially enter the world of cryptocurrency.

This is not merely a policy adjustment; it could be the beginning of a "final battle" that determines the ultimate market position of crypto assets. The core battleground of this battle is the $93 trillion 401(k) retirement plan in the U.S. If even a tiny percentage of this massive fund flows into the crypto market, it will trigger an unprecedented "buying spree." Now, both parties in Congress are actively pushing this matter forward.

The Shackles of the "Prudent Man" and BlackRock's "Turnaround"

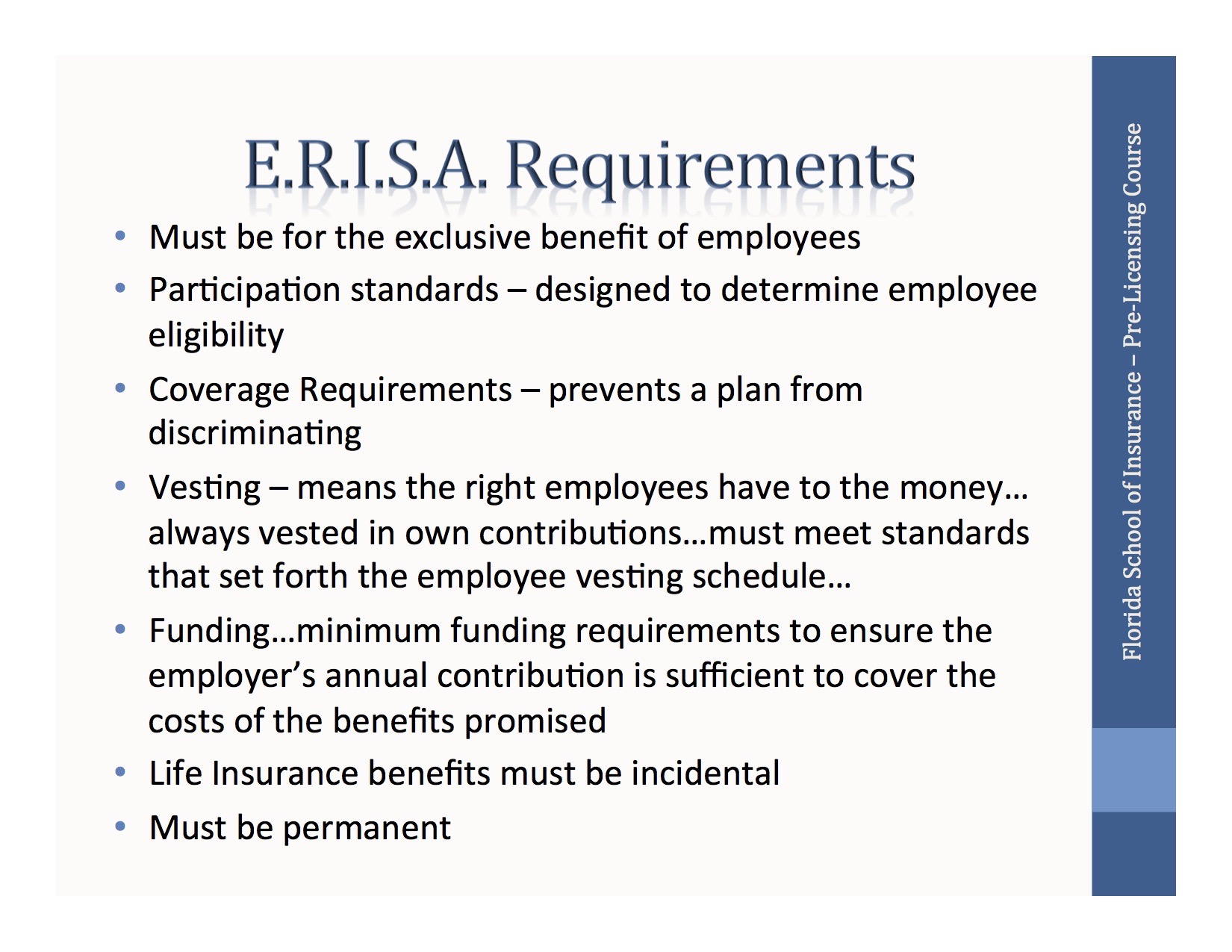

For a long time, a legal wall known as the Employee Retirement Income Security Act (ERISA) has kept crypto assets out of the trillion-dollar retirement market. The cornerstone of this wall is the stringent clause known as "Fiduciary Duty."

In simple terms, this law, which originated nearly half a century ago, has placed a legal shackle called "Prudent Man" on all 401(k) plan managers (usually employers). They must make investment decisions for employees' pensions with extreme caution, ensuring the safety and stable appreciation of funds. If a decision leads to losses, they face the enormous risk of collective lawsuits.

Under such stringent responsibility requirements, investing in highly volatile assets like Bitcoin, which has a relatively short history and has often been portrayed by mainstream media as a "speculative bubble," is akin to a legal gamble. This is why, even though financial giant Fidelity bravely launched a product allowing 401(k) investments in Bitcoin in 2022, the response was minimal. At that time, the Biden administration's Department of Labor even issued a stern guideline warning all plan managers to be "extremely cautious," or face investigations from regulatory bodies. This nearly doused cold water on all eager institutions.

However, the winds changed dramatically in 2025. First, in May, the newly appointed Labor Department under the Trump administration quietly rescinded that stern warning guideline, replacing it with a "neutral" stance, no longer biased against specific asset classes. Then, the presidential executive order in August directly "named" digital assets. Now, the leaders of both parties in Congress are writing to the SEC, urging progress. The purpose of this series of moves is very clear: to loosen the shackles on the "Prudent Man" and reduce the litigation risks they face from allocating crypto assets.

This top-down policy push resonates intriguingly with the changing attitudes of Wall Street giants. The attitude shift of Larry Fink, CEO of the world's largest asset management company BlackRock, is the most representative. A few years ago, he believed that clients had "minimal" long-term investment demand for cryptocurrencies. But by 2025, he not only publicly referred to Bitcoin as "digital gold" but also viewed it as an "international asset" that can combat currency devaluation. In his annual letter this year, he emphasized the importance of "democratizing investment," which aligns with the slogan of the presidential executive order.

When policymakers and capital managers begin to speak the same language, the old rules of the market start to loosen.

The Imagination of Hundreds of Billions: A Game of Digital and Psychological Warfare

Let’s temporarily set aside the complex regulations and examine the potential impact of this transformation through the most direct numbers. According to the latest data from the Investment Company Institute (ICI) as of the second quarter of 2025, the total asset size of the U.S. 401(k) market is $93 trillion.

What does this mean? It exceeds the annual GDP of any country other than China and the U.S.

Now, let’s make a simple projection:

Where is the bottleneck? The "Last Three Miles" to the Trillion-Dollar Market

Even though the presidential executive order has been issued and Congress is actively pushing, this does not mean that trillions of dollars will flood into the crypto market starting tomorrow. The entire process resembles a series of dominoes that need to fall in sequence, and currently, it is stuck at several key nodes, which can be summarized as the challenges of the "last three miles":

First Mile: The "Final Push" of Regulatory Rules

This is the most direct and core node at present. The letter from Congress is a "urging," not a "command." The ball is now in SEC Chairman Paul Atkins' court. The SEC must collaborate with the Department of Labor (DOL) to translate the macro spirit of the presidential executive order into specific, executable regulatory rules or safe harbor provisions.

These rules need to clearly answer the most pressing questions for plan sponsors (employers): What percentage of crypto asset allocation is considered "prudent"? What specific risks need to be disclosed to employees? Under what circumstances can they be exempt from legal liability due to market volatility? Until these specific "game rules" are established, the vast majority of companies will not dare to take on the enormous litigation risks of proactively adding crypto assets to their employees' retirement plans.

Second Mile: The "Trust Gap" of Plan Sponsors

Even if the SEC issues clear guidelines, the real decision-making power still lies with the thousands of corporate employers. They are the direct managers of 401(k) plans and the ultimate bearers of "fiduciary duty." This is an extremely conservative and risk-averse group.

For them, adding a high-volatility asset option could bring potential legal troubles that far outweigh the "credit" they would gain from seeking higher returns for employees. Therefore, they need to see mainstream financial institutions (such as BlackRock, JPMorgan, Goldman Sachs, etc.) not only verbally optimistic but also launching a series of mature, compliant financial products with risk mitigation mechanisms, backed by professional consulting firms (such as Mercer, Aon) providing strong recommendations. Bridging this "trust gap" will require time and repeated validation from the market.

Third Mile: The "Product Scarcity" of Market Infrastructure

Currently, there are still very few crypto investment products specifically designed for 401(k) plans; Fidelity's attempt is just a starting point. Future products need to be deeply integrated into existing retirement management systems and may take more diverse forms, such as "crypto index funds" that include multiple mainstream assets like Bitcoin and Ethereum, or "alternative asset mixed funds" that allocate a small portion to crypto assets. The lack of such products means that even if plan sponsors are willing, they have "no rice to cook."

Future Roadmap: From Washington to Your Retirement Account

Based on the above nodes, we can outline a possible roadmap for Bitcoin and crypto assets to enter the retirement accounts of ordinary people:

Phase One: Regulatory Calibration (Expected 6-18 months)

SEC and DOL issue joint guidelines: This will be the "starting gun" for all subsequent steps. The guidelines will provide a clear regulatory framework and "safe harbor" for allocating crypto assets in 401(k) plans.

Relaxation of qualified investor definitions: Bills H.R. 3394 and H.R. 3339 pass in the Senate and are signed into law, opening the investment door for more knowledgeable ordinary people.

Phase Two: Product Explosion and Institutional Entry (1-2 years after guidelines are issued)

Wall Street giants rush in: Top asset management companies like BlackRock, Fidelity, and Morgan Stanley will quickly design and launch a series of compliant crypto fund products specifically targeting the retirement market.

Consultants and rating agencies endorsement: Professional pension consulting firms will begin to include these new products in their recommended lists, providing risk ratings and allocation advice to alleviate plan sponsors' concerns.

Phase Three: Corporate Adoption and Market Penetration (3-5 years or longer)

From tech companies to traditional enterprises: The adoption process will be gradual. It is likely that more forward-thinking tech and financial companies will be the first to try, and after achieving good results, gradually expand to a broader range of traditional industries.

Default "Opt-in": Initially, crypto assets will almost never become the default investment option; instead, employees will need to "actively choose" to allocate after fully understanding the risks. The investment ratio may also be limited to 5% or 10% of the total assets in personal accounts.

Phase Four: Long-term Impact and Deep Integration

Continuous capital inflow: As tens of millions of employees regularly invest a portion of their monthly salaries, the crypto market will gain unprecedented long-term, stable buying pressure, helping to reduce extreme market volatility.

Changing market narrative: Bitcoin will no longer just be a code on traders' computer screens but will truly become a concrete and visible component of long-term wealth planning for billions of ordinary people, solidifying its consensus as "digital gold."

This journey is bound to be long and filled with contention, but a clear roadmap has already emerged. Every step of progress is worth our close attention.

Conclusion: When Water Drops Merge into the Ocean

From a digital experiment in a geek circle to a trading target on Wall Street, and now potentially becoming part of the retirement plans of billions of ordinary people, Bitcoin and the crypto world it represents are undergoing a profound identity transformation.

The House's letter is like a starting gun. It signifies that policymakers, regulatory agencies, and market giants have officially placed the topic of "incorporating crypto assets into mainstream asset allocation" on the table. SEC Chairman Paul Atkins' positive attitude almost indicates that regulatory green lights are just a matter of time.

Of course, the floodgates will not open completely all at once. Initially, there may be strict investment ratio limits (e.g., no more than 5% of total assets), and investment methods may be limited to "actively managed funds" rather than direct purchases of spot assets. The cautious attitude of plan sponsors (employers) will not disappear immediately; they will need time to observe the market and assess risks.

But this trend is already irreversible. When tens of millions of ordinary people continuously invest a portion of their salaries into the crypto market through 401(k) plans, the power they gather will be enough to change the entire industry's ecology. It will bring unprecedented long-term, stable buying pressure to the market, dampening some volatility and further promoting the maturity of infrastructure such as compliance, custody, and insurance.

This is no longer a question of "whether it will happen," but rather "when and how it will happen." The $93 trillion "fresh water" is standing outside the floodgates, and the gatekeepers in Washington seem ready to turn the key. For everyone in the crypto industry, this represents both a tremendous opportunity and a more mainstream scrutiny along with stricter challenges. The wheels of history are slowly turning, and we are right in the midst of it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。