Original Author: Arthur Hayes

Compiled & Edited by: LenaXin, ChainCatcher

Background

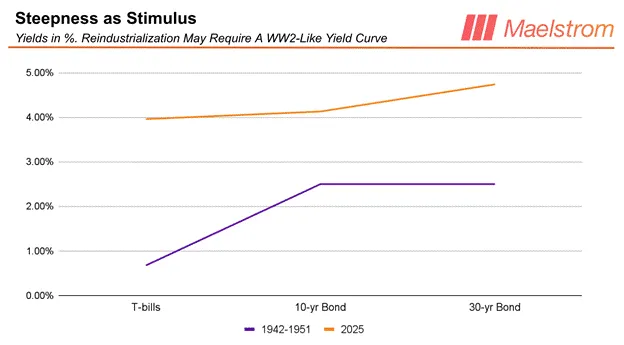

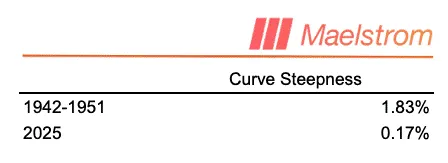

Buffalo Bill Bessent aims to promote the re-industrialization of America, attempting to slow the inevitable decline of "American hegemony" from a quasi-empire to a purely authoritarian nation-state. This plan is not new. The emergency situation during World War II led the Treasury Department to take over the Federal Reserve from 1942 to 1951. Part of the Bessent plan involves reshaping the yield curve, specifically yield curve control. How does the shape of the yield curve during that period compare to today?

The Federal Reserve set the upper limit for short-term Treasury bill yields at 0.675% and the upper limit for 10 to 25-year bond yields at 2.5%. The current yield curve exhibits a dual high characteristic for both short-term and long-term rates, with the key difference being that the slope of the yield curve back then was much steeper than it is today. Before discussing the benefits of the 1951 yield curve shape for various sectors of the U.S. economy, we must first understand how the Federal Reserve uses existing tools to implement such yield curve control.

(Note: Treasury bills have a maturity of less than one year.)

By lowering the Interest on Reserve Balances (IORB) and the Discount Window (DW) rate, the Federal Reserve can control short-term Treasury bill yields, allowing it to anchor short-term yields to target levels. By creating money through the System Open Market Account (SOMA) and purchasing bonds from banks, the Federal Reserve can ensure that yields do not exceed established limits.

This action will expand the Federal Reserve's balance sheet, and the current Federal Reserve toolbox is fully capable of achieving the 1951 yield curve shape. The core question this article seeks to explore is: How will Trump and Bessent achieve such a level of market control politically?

Benefits of the 1951 Yield Curve Shape for Various Sectors of the U.S. Economy

The core of the Bessent plan is to transfer the power of credit creation and the resulting economic growth from the Federal Reserve and non-bank financial institutions like private equity firms to small and medium-sized bank loan officers. In a recent op-ed criticizing the Federal Reserve published in the Wall Street Journal, he described it in populist terms as "supporting Main Street rather than Wall Street."

There is no need to overly concern ourselves with the fact that entering its economic "Valhalla" requires the Federal Reserve to print money, a non-democratic tool. Bessent himself is a two-faced financial official: he harshly criticized "bad girl" Yellen's policies before taking office, yet faithfully implemented the same policies after assuming power.

Regional banks need a steep yield curve to create profitable credit. The following chart shows that although overall interest rates were lower from 1942 to 1951, the slope of the yield curve was steeper, making it safer and more profitable to lend to small and medium-sized enterprises. Small and medium-sized enterprises are the lifeblood of the U.S. economy, contributing about 46% of jobs with fewer than 500 employees.

Bessent Plan: Yield Curve Control and the Power Struggle at the Federal Reserve

However, when the Federal Reserve becomes the primary issuer of credit, these businesses struggle to obtain loans because the liquidity created by printing money flows to large corporations that can access institutional debt capital markets. Additionally, the current yield curve is too flat or even inverted, leading to excessive lending risks for regional banks to such corporations. I discussed this phenomenon in my article “Black and White” and referred to Bessent's monetary policy as "quantitative easing for the poor 4.0."

This addresses the challenges on the industrial side; to placate the loyal American populace that relies on continuous expansion of the welfare state, the government must lower its own financing costs. By anchoring long-term bond yields, Bessent could issue an unlimited amount of junk bonds, which the Federal Reserve would faithfully purchase with its money printing machine. Interest expenses would plummet, and the federal deficit would collapse.

The value of the dollar relative to other inferior fiat currencies and gold will crash. This would allow American industry to export competitively priced goods to Europe and then to the Global South, competing with China, Japan, and Germany.

Conceptually, it is easy to understand why Bessent wants to control the Federal Reserve and implement yield curve control, but the current Federal Reserve is unwilling to cooperate. Therefore, Trump must place his loyal followers within the Federal Reserve; those who do not submit to "Bill's" will will surely face the consequences. Federal Reserve Governor Lisa Cook is about to experience the 2025 version of the consequences, and if one is unaware of what this entails, they might look at the suppression tactics used by the authorities during civil rights protests in the 1960s.

The Federal Reserve has two committees that control the key policies necessary for the success of the Bessent plan: the Federal Reserve Board (FRB) indirectly controls the Discount Window rate through the management of the reserve rate, while the Federal Open Market Committee (FOMC) oversees the System Open Market Account. How do the voting members of these two committees interact? How are the voting members selected? How can Trump quickly and legally gain control of both committees? Speed is crucial, as there is just over a year until the 2026 midterm elections, and Trump's "Red Team" Republicans will face fierce competition.

If the Republicans lose control of the Senate and Trump fails to gain majority voting rights in both committees before November 2026, the "Blue Team" Democrats will veto all his future nominations. The risk of misjudgment increases significantly when entering purely political realms, as human behavior is full of unpredictability. My goal is to point out the most likely paths to success, and my investment portfolio only needs to be "highly probable" to continue holding a full position in Bitcoin, altcoins, physical gold bars, and gold mining stocks.

A Beginner's Guide to the Federal Reserve Committees

Understanding the bureaucratic decision-making mechanisms of this institution that controls the power to print money is central to my investment strategy. In exploring the operational mechanisms of the global inferior fiat currency system, I have uncovered many operational secrets of various countries' treasuries and central banks.

As complex adaptive systems filled with human decision nodes, these bureaucratic institutions must follow "rules" to function effectively. The non-elected bureaucratic system that governs U.S. monetary policy (the Federal Reserve) is also constrained by specific rules. Therefore, based on how this policy will yield to the will of Trump and Bessent, I will answer the following questions:

- Which institutions have voting rights over the various components of monetary policy?

- How many votes are needed to pass a proposal?

- Who appoints the members of these committees?

- When do committee members change?

First, Trump must secure four seats in the seven-member Federal Reserve Board (FRB) to gain a majority. He can then leverage this majority in the FRB to obtain a majority of seven voting rights in the twelve-member Federal Open Market Committee (FOMC). I will explain the monetary policy authority of these two institutions, the member selection mechanisms, and how Trump can achieve control before the first half of 2026.

Analysis of the Federal Reserve Board (FRB) Structure

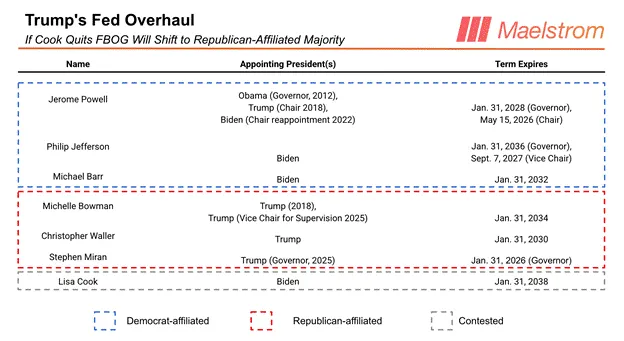

The Federal Reserve Board (FRB) consists of seven members nominated by the president and confirmed by the Senate. The current list of governors is as follows:

The FRB holds two important powers:

- Setting the Interest on Reserve Balances (IORB).

- Voting to approve the selection of each Federal Reserve Bank president for the rotating voting seat on the Federal Open Market Committee (FOMC).

To effectively control short-term interest rates, the FRB must set the IORB within the upper and lower limits of the federal funds rate determined by the FOMC. Therefore, when there is internal coordination, the FRB and FOMC work together, and the IORB will remain within that range.

Political and Bureaucratic Rules Limiting the Federal Reserve

If the FRB supports Trump and believes the monetary policy set by the FOMC is too tight, can the FRB take action to force the FOMC to lower the federal funds rate?

The FRB can set the IORB at a level far below the federal funds rate. This will create arbitrage opportunities for member banks of the Federal Reserve, which can lower the Discount Window (DW) rate in line with the IORB and borrow at the lower DW rate to lend at the SOFR rate.

(Note: The technical details of how the Discount Window rate is linked to the reserve rate are beyond the scope of this article. The rate for borrowing from the Discount Window is determined by the presidents of the various Federal Reserve Banks, while the Federal Reserve Board (FRB) controls the appointment and removal of these positions by approving the nominations made by the boards of directors of the district banks. The Secured Overnight Financing Rate (SOFR) is an alternative benchmark to the London Interbank Offered Rate (LIBOR).)

The Federal Reserve would become the loser, as it is essentially printing money to give to arbitrage banks. To avoid being harvested by financial titans like Jamie Dimon, the Federal Open Market Committee (FOMC) must lower the federal funds rate to match the IORB level, even if it is reluctant to cooperate.

(Note: Jamie Dimon is the CEO of JPMorgan Chase and is considered one of the most powerful bankers in the financial empire.

"Trump Derangement Syndrome" (TDS) refers to the condition where a person opposes a policy simply because Trump supports it, even if they would have originally agreed with it.)

If Trump holds a four-seat majority in the FRB, he can force the Federal Open Market Committee (FOMC) to quickly lower rates to his desired level. How many governors currently pledge loyalty to Trump?

With the weak and ineffectual "softie" Jerome Powell's term as Federal Reserve Chair ending in May 2026, some members of the board are competing for his position. To show loyalty to Trump, they openly discuss the Federal Reserve's policy direction and, on certain occasions, voice dissent in FOMC meetings, as evidenced by Bowman and Waller voting against in the July 2025 meeting.

(Note: In the latest FOMC meeting in September, although Bowman and Waller did not advocate for a larger 0.5% rate cut like Milan, analysts believe they achieved their policy goals by lowering the neutral rate in the dot plot and adopting a dovish forward guidance.)

Adriana Kugler suddenly resigned from her position this summer, and the Senate has confirmed Trump's nominee Stephen Miran to take over. Rumors suggest that Kugler's husband was trading securities during the Federal Reserve's quiet period.

For readers lacking political connections, such behavior can be termed insider trading, and once the Department of Justice intervenes, it’s a one-way ticket to prison. Kugler voluntarily resigned before being publicly humiliated by the Trump administration. With Kugler's departure and Miran's appointment, Trump's camp has secured three seats, just one short of the majority target.

Federal Reserve governors can also abuse their power. They engage in insider trading, while Governor Cook has been accused of falsifying mortgage applications. Bill Pulte, the Director of the Federal Housing Finance Agency, has accused Cook of mortgage fraud and called for her resignation, but she has steadfastly refused to step down.

Pulte has referred the case to the Department of Justice, where Secretary Pam Bondi is reviewing whether to present the case to a grand jury for bank fraud charges. Grand juries almost always approve indictments, making it easy for the Department of Justice to prosecute Cook, so I speculate that her hesitation is merely a tactic to leverage a formal indictment to force her resignation.

It is alleged that Bessent also engaged in irregularities in bank financial applications. It’s important to note that in America, everyone is a criminal, regardless of their ultimate innocence; the Department of Justice has a conviction rate of nearly 100%. If Cook does not resign, she will surely be "cooked." I deduce that her stubborn stance is purely a negotiation strategy aimed at securing a high-paying, idle position in a government or academic institution offered by the Trump administration. In any case, she will not remain in her position into early 2026.

Once Trump secures four voting rights, he can instruct the FRB to lower the Interest on Reserve Balances (IORB), quickly locking in the upper limit for short-term Treasury bill yields. Next, the FRB can, at Bessent's behest, lift the absurd regulatory constraints on regional banks, allowing them to lend to small and micro enterprises on Main Street.

The FRB is responsible for the regulatory authority over commercial banks. The final key step is controlling the money supply, anchoring long-term yields at lower levels through the System Open Market Account (SOMA). To achieve this goal, Trump needs to control the Federal Open Market Committee (FOMC).

So how can controlling the FRB help him secure a majority of seven votes in the FOMC?

Federal Reserve Bank Presidents

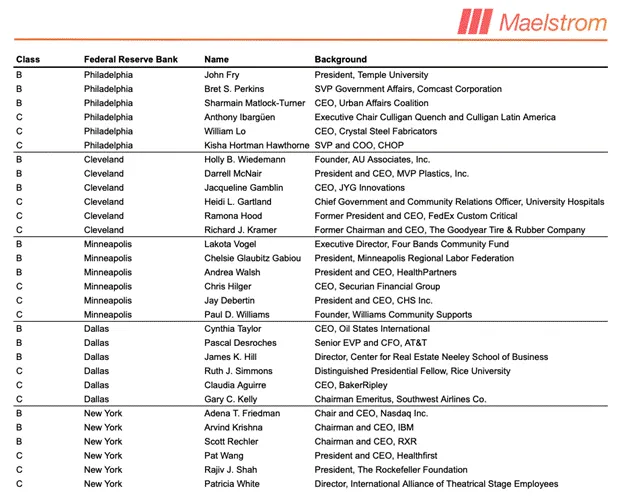

The United States has twelve Federal Reserve Banks. Going back to the agricultural era, the twelve regional banks were established because each district required different interest rates based on the types of goods and services provided to the national economy throughout the year. Each regional bank's nominated president must receive at least four votes from the FRB to enter the FOMC.

Among the twelve regional bank presidents, only five have voting rights in the FOMC, with the New York Fed president holding a permanent voting seat. Therefore, each year, four different regional bank presidents rotate as voting members of the FOMC. In years ending in 1 or 6, the regional bank presidents must be re-elected by their respective Federal Reserve district boards, with a simple majority vote from Class B and Class C directors (four out of six).

All presidents will face re-election next February. Besides New York, the districts with voting rights include:

- Cleveland

- Minneapolis

- Dallas

- Philadelphia

Have you noticed the professional backgrounds of the majority of these board members?

They are either financiers or industrialists. If the money supply is more abundant and financing costs lower, their personal net worth will increase dramatically. These individuals also possess human weaknesses; when given autonomy, humans typically prioritize their own interests.

I may not know their political stances, but I am confident that even if they suffer from TDS, the wealth effect from asset appreciation is precisely the remedy they need. In other words, if the district bank boards know that the FRB only approves candidates for the FOMC who support loose monetary policy, they will naturally make choices that align with both Trump’s and their own best interests.

If the district boards do not nominate dovish candidates for the FOMC seats, the FRB will veto them. Trump now controls four of the seven votes, placing him in the majority.

Trump only needs to ensure that three of the four new voting members are loyal to him to secure a majority of seven votes in the FOMC. The key is to control the Federal Reserve's money printing machine, the "System Open Market Account (SOMA)." At that point, Trump’s loyalists in the FOMC will initiate printing money to purchase the massive amounts of junk debt that Bessent cannot find buyers for.

This is the 2026 version of the "Treasury-Federal Reserve Agreement," complete with a money printing bonanza and yield curve control.

In the dirty fiat currency system, a mixed four-seven bottom card is more powerful than an ace.

Bull Market Calculation

If anyone doubts Trump's determination to print money to "revive American hegemony," they should reflect on the historical context that drives elite politicians to push for radical change. American elite politicians have always resorted to any means necessary to maintain the imperial dividends of the ruling class. The relationship between the descendants of African slaves and European immigrants continues to dominate American political and social discourse.

During the Civil War, Lincoln severely damaged the Southern Confederacy's economy by emancipating the slaves; after the federal victory, the ruling elite allowed the former Confederate states to implement segregation until 1965, when civil rights such as voting were formally granted to former slaves. As the cultural level of the former slave population improved, and the spread of communist ideas advocating for economic and civil rights took hold, the lower-class Black community gradually awakened.

The core issue is that the elite class needs these impoverished Black individuals to fight against communist "Charlie" on the Indochinese front, produce export goods in Northern factories, provide domestic services in wealthy households, and work on Southern farms, while they can no longer tolerate their demands for equal rights broadcasted on television during marches in Washington.

America also needs to project an image to the non-aligned world that capitalism is superior to Soviet communism.

When the Declaration of Independence proclaims that "all men are created equal," yet police dogs bark at girls heading to desegregate schools, this image is clearly undignified. Therefore, Southern Democrat President Lyndon Johnson, facing strong discontent from his own class, became the banner bearer for the descendants of cotton-picking slaves fighting for civil rights.

Today, in the face of a more united, prosperous, and militarily powerful Eurasian bloc (Russia, China, India, Iran), America needs to fundamentally change its credit distribution model.

Thus, I dare say that when it comes to printing money, these white elites are not playing around.

Trump and Bessent view restoring America's global dominance as their mission, which requires rebuilding a solid manufacturing base to produce tangible goods rather than "services." Chinese President Xi Jinping reached a similar conclusion in 2018 when responding to Trump's trade war against China; he suppressed the rampant growth of financial capital and tech giants to redirect the economy.

Who would have thought that Alibaba CEO Jack Ma would be invited to Zhongnanhai for "tea" and experience a wealthy prison journey?

Under Xi Jinping's leadership, the best talents in China are no longer building substandard apartments and shared bike applications but are instead tackling green economy, rare earths, military drones, ballistic missiles, and artificial intelligence. After nearly a decade of development, China can now independently produce all the tangible goods necessary to maintain national sovereignty in the 21st century without relying on the United States.

Do not doubt that Trump's team will stop at nothing to print money to meet the funding needs for America's transformation. I want to conduct an experiment: to estimate the scale of credit that the Federal Reserve and commercial banking system will create by 2028.

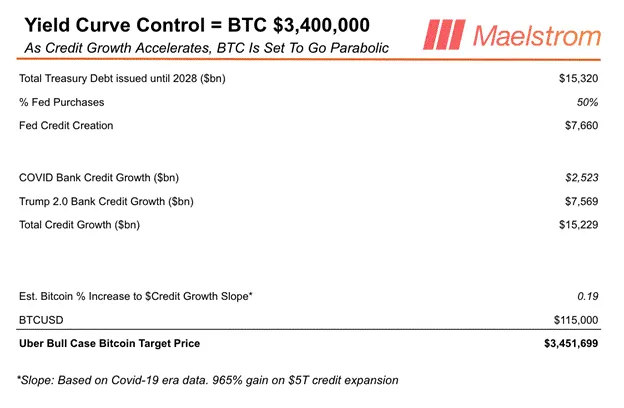

From now until 2028, the Treasury must issue new debt to repay old debt and fill the government deficit. I used the Bloomberg terminal DDIS> function to calculate the total amount of Treasury bonds maturing during this period and assumed that the federal deficit remains at $2 trillion per year, leading to an estimated bond issuance scale of $15.32 trillion.

During the COVID-19 pandemic, the Federal Reserve purchased about 40% of the Treasury bond issuance through SOMA, leading to an expansion of its balance sheet. I believe this purchase ratio will reach 50% or even higher, as more foreign central banks are now aware that Trump will recklessly issue debt and refuse to buy.

Estimating the growth of bank credit is quite challenging. The most convincing method is to refer to data from the pandemic period: during Trump's "quantitative easing for the poor 4.0," bank credit grew by $2.523 trillion. Trump has about three years left to stimulate the market, which, based on this calculation, will generate $7.569 trillion in bank loans.

Do you think Bitcoin will rise to $3.4 million by 2028?

The answer is no. But I firmly believe its price will be significantly higher than the current level of about $115,000. My goal is to accurately grasp the trend direction and be confident that I have backed the fastest horse. The premise is that Trump will indeed print trillions of dollars to achieve his policy goals.

Disclaimer

The content of this article does not represent the views of ChainCatcher. The opinions, data, and conclusions in the text reflect the personal stance of the original author or interviewee, and the compiler maintains a neutral position and does not endorse their accuracy. This does not constitute any professional advice or guidance; readers should exercise caution based on independent judgment. This compilation is for knowledge-sharing purposes only; readers must strictly comply with the laws and regulations of their respective regions and refrain from engaging in any illegal financial activities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。