Author: Chloe, ChainCatcher

AI tools like Grok and ChatGPT have become essential for traders engaging in short-term trading. This article analyzes how to use Grok and ChatGPT to instantly detect shifts in market sentiment and translate them into actionable trading plans.

The significant price volatility brought by cryptocurrencies also equates to endless opportunities for retail investors. However, in practice, not everyone can consistently profit. Professional investors, hedge fund managers, and institutional traders can make rational decisions based on extensive market resources, while most retail investors lag behind market information and blindly follow trends in panic.

Even though trading platforms clearly list the open orders or pending orders for specific trading pairs, the sentiment on social media plays a crucial role across the entire crypto market, regardless of how clear the data may be.

According to Cointelegraph, in early June this year, Solana's DeFi activity surged, with TVL climbing to over $9 billion. Traders can use Grok to detect early trend changes, combined with ChatGPT to establish trading setups, including entry plans, stop-loss settings, and profit targets.

How to Use Grok to Find Short-Term Trading Opportunities?

- Grok can track the discussion heat of tokens on X, capturing hype signals to help traders identify trends, hotspots, and discern potential scams. For example, a sudden increase in mentions of a token on X likely indicates a price surge. With the free version of Grok, traders can use 10 messages and 3 image analyses within 2 hours, checking the popularity of one or two tokens daily.

For instance, based on experiments, users can ask Grok, “What's the X sentiment on Pi coin?” Grok will analyze based on the currently popular posts on X.

Grok reports that the overall sentiment on X for Pi coin ($PI) is polarized. Driven by enthusiastic community support and recent technical advancements (such as Onramp Money integration and Stellar protocol upgrades), bulls (about 70% of posts) believe Pi coin has the potential to break through to $0.50-$0.60, benefiting from its large base of 60 million users, AI-driven KYC improvements, and upcoming smart contracts. However, bears (about 20-30%) warn that mainnet delays, liquidity issues, centralization concerns, and KYC barriers could lead to a price drop to $0.25-$0.30, or even lower, especially if unfulfilled promises continue to cause community dissatisfaction.

- Use Grok to check technical indicators. Grok extracts real-time data (e.g., RSI) from sources like CoinMarketCap for trading (e.g., BTC's RSI of 62 indicates bullish momentum).

For example, based on experiments, users can ask Grok: “What's Bitcoin's RSI as of September 24, 2025? Please give me a short answer with proper justification.”

Grok's data indicates that Bitcoin's 14-period RSI (daily timeframe) is about 43, suggesting the market is in a neutral to slightly bearish state (close to oversold territory).

According to CryptoWaves, the RSI is as follows:

- Use Grok to verify token compliance. Grok cross-references X market sentiment and data from various sources (e.g., whitepapers, community feedback) to analyze potential scam factors or assess fundamentals.

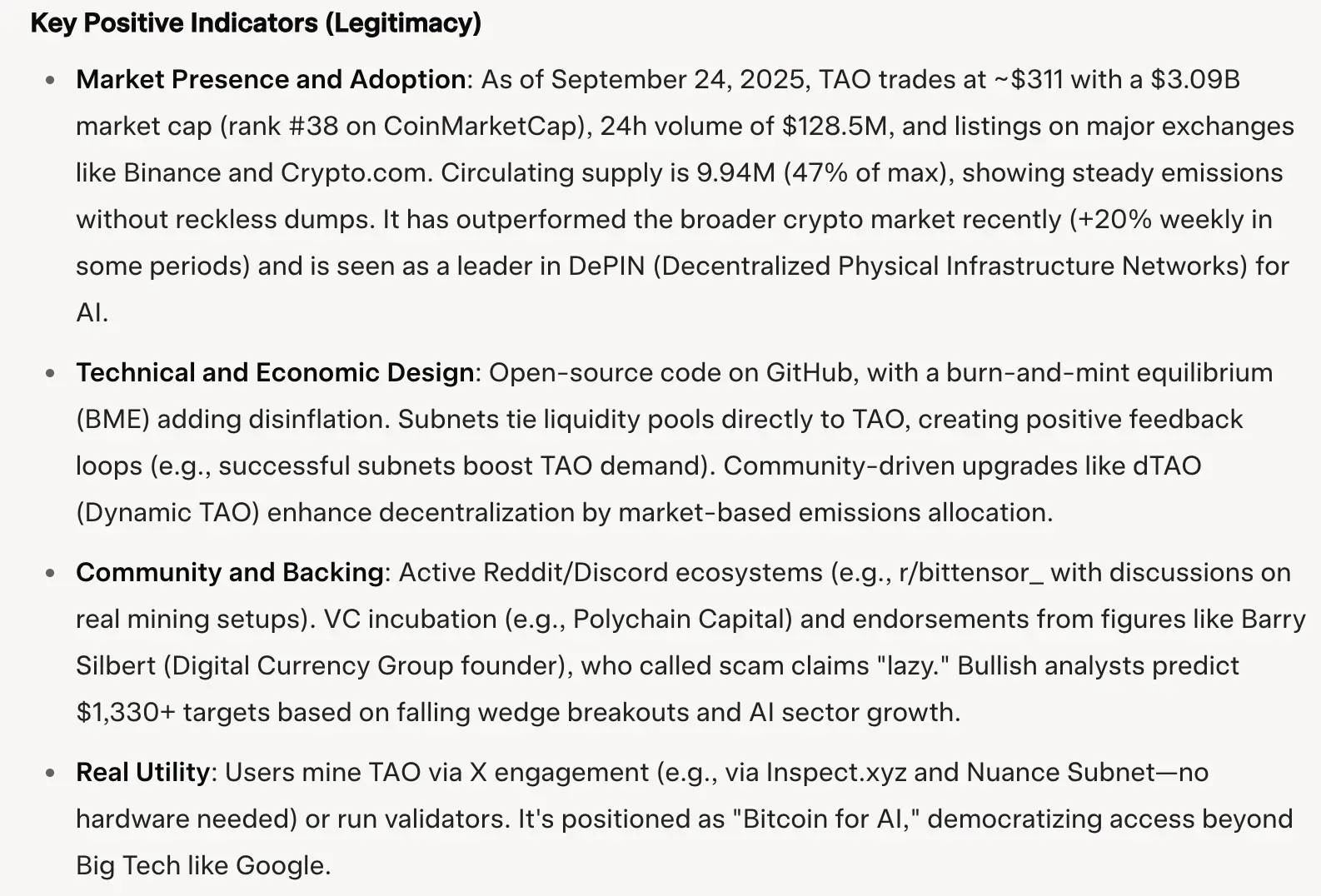

For example, based on experiments, users can ask Grok: “Is Bittensor (TAO) a scam token?”

Grok's data indicates that TAO scores high on legitimacy metrics (e.g., listed on CoinGecko/CoinMarketCap, open-source audits), but its early transparency is low, making it riskier than blue-chip coins like Bitcoin.

It is a high-return investment in decentralized AI (subnet play could yield 20-100x returns), but one must do their own research (DYOR) and only invest funds they can afford to lose.

If one is optimistic about the fusion of AI and crypto, its valuation is lower than XRP (approximately $11,000/TAO equivalent market cap). For bears, the insider-led setup resembles "affinity scams." Overall, TAO is a legitimate project driving Web3 AI, not a complete scam.

It is important to note that Grok can serve as a market detection tool in short-term trading. By combining X sentiment, technical indicators (like RSI), and fundamental checks, it provides early momentum signals and risk assessments, particularly suitable for meme coins or emerging tokens.

However, the limitations of Grok's free version, potential inaccuracies in sentiment analysis, and lack of real-time trading integration mean that this AI can only serve as an auxiliary tool rather than an independent professional trading analysis platform.

Traders should use precise prompts and supplement with real-time data sources to optimize trading strategies and reduce timing risks in highly volatile markets.

How to Use ChatGPT to Establish a Cryptocurrency Trading Framework?

- After using Grok to identify community signals, the next step is to convert them into a structured trading plan. ChatGPT can assist traders in defining entry points, stop-loss points, exit points, and even reflecting after the trade is completed.

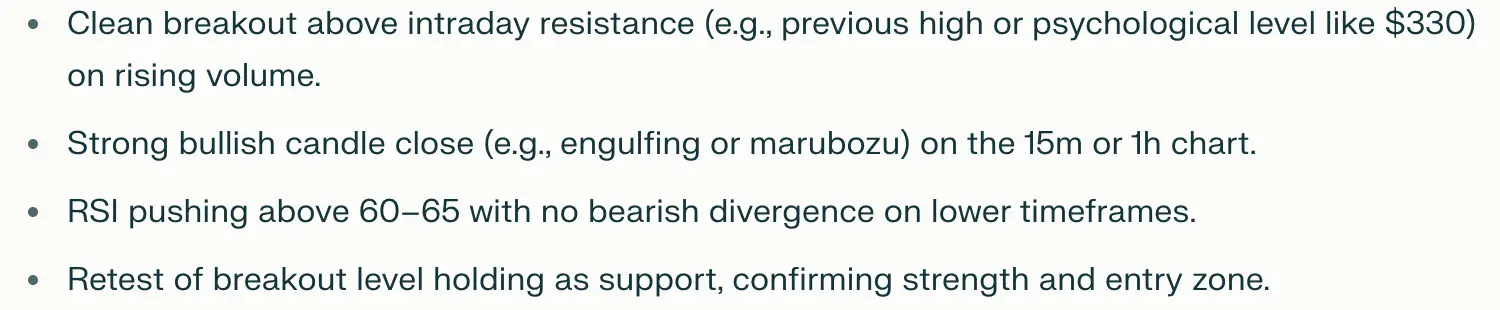

The aforementioned case highlighted by Grok emphasizes the bullish sentiment driven by TAO's user base, integration, and long-term growth potential. Based on experiments, users can further ask ChatGPT: “Based on current bullish sentiment around TAO, what short-term price action would confirm momentum for a day trade?”

- Ask ChatGPT to analyze bearish risk factors.

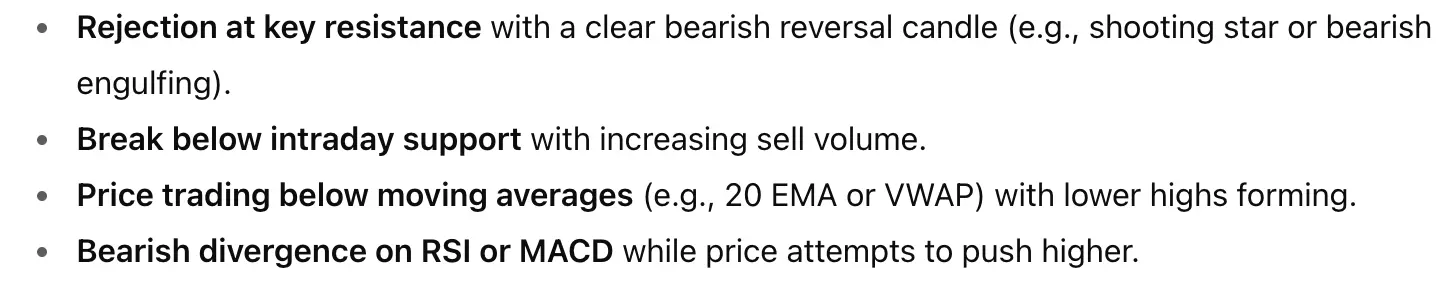

The previous Grok pointed out some issues with the project, such as token centralization, governance opacity, and past hacking incidents. Traders can then use ChatGPT: "Given bearish sentiment and risk factors for TAO, what are safe conditions for a short setup today?"

Here is ChatGPT's response:

Finally, in the trading field, while AI reduces the costs of retail trading, its limitations and challenges cannot be overlooked. These include the inability to predict black swan events and the high dependence of AI accuracy on data quality and sources, as well as user prompts. For general traders, the ideal approach is to combine AI with human judgment to form a complementary relationship.

Many successful institutional cases, such as Renaissance Technologies' Medallion Fund and BlackRock's Aladdin system, demonstrate the powerful potential of AI combined with human oversight.

Click to learn about ChainCatcher's job openings

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。