Author: Tuo Luo Finance

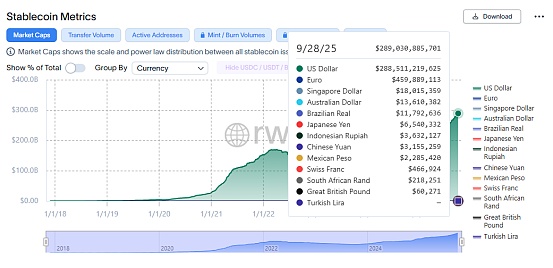

A few months ago, there might have been a need to explain stablecoins, but now, the fervor surrounding stablecoins speaks for itself. In terms of scale, the existing stablecoin market has reached $288.5 billion. According to Citibank's predictions, if the annual trading volume of stablecoins approaches the velocity of fiat currency, the issuance could reach $1.9 trillion by 2030 under a baseline scenario, and even $4 trillion in a bullish market scenario.

Against this backdrop, with the chain reaction of the U.S. Stablecoin Genius Act, the global wave of stablecoins is gaining momentum. In the face of this trillion-dollar market, internet giants, financial institutions, and traditional enterprises are joining forces, envisioning the story of stablecoins and eager to reap the first dividends.

However, from a global perspective, the pace varies significantly from region to region. The U.S. continues to present a strong leading position, with stablecoin giants already at the table enjoying the feast, while other enterprises are vigorously building stablecoin infrastructure. In Europe, although regulations were established earlier, the regional characteristics have led to a delayed response, with banks only recently beginning to follow suit. Turning to China, in response to the overheated speculation surrounding stablecoins, regulators have chosen to hit the pause button.

United States: Initial Dividends Released, Corporate Strategies Differ

In the realm of stablecoins and cryptocurrencies, no region can match the central position of the United States. This is both the foundation of the significant changes in U.S. crypto policy and the practical backdrop of Trump's strategic layout. From the data, the dollar accounts for about 60% of global reserve currencies, but dollar stablecoins hold a staggering 99% share of on-chain stablecoins, indicating that dollar stablecoins are the hard currency of the crypto world.

Distribution of on-chain stablecoin types, source: Rwa.xyz

Based on this, on July 18, Trump officially signed the "Guidance and Establishment of the U.S. Stablecoin National Innovation Act," formally establishing a regulatory framework for stablecoins at the federal level, marking the entry of the U.S. into a new era of "privately issued currency." Following this framework, almost all keen enterprises began to venture into stablecoins. Over 10 banks, including Bank of America, Citibank, and JPMorgan Chase, announced plans to explore stablecoin businesses, while tech companies like Google, Meta, and X have taken the lead in laying out their strategies, and retail giants like Walmart and Amazon are also gearing up.

Two months after the law took effect, the U.S. stablecoin market has not cooled down; in fact, it has become even hotter. From a regulatory perspective, the CFTC and SEC have proposed the "Crypto Sprint Plan" and "Project Crypto," respectively, providing a more directional path for the development strategy of crypto assets and forming a combined force with existing legislation and regulatory frameworks to ensure policy continuity.

On the corporate side, stablecoin giants have already taken the first bite of compliance. Although the first stablecoin stock, Circle, faced setbacks, it still surged from a controversial $7 billion valuation at the time of its listing to a massive $29.3 billion, with its stock price rising from the issuance price of $31 to $126, a threefold increase. Tether, the parent company of the largest stablecoin USDT, reported a profit of $4.9 billion with a 99% profit margin in the second quarter of this year and hopes to raise $15 billion to $20 billion by selling 3% of its equity through private financing. If this fundraising is successful, Tether's market value will reach a staggering $500 billion, which would mean that the valuation of crypto giants will for the first time rival that of the world's largest companies like SpaceX and OpenAI. Notably, OpenAI was valued at $300 billion in its last funding round. There have also been new technological developments, with Tether, Circle, and Stripe building their own blockchains for stablecoins, igniting a trend of general-purpose blockchains shifting towards vertical-specific chains.

U.S. banks are being more cautious; although they continue to push forward, most have not released clear timelines. Only the digital asset bank Anchorage Digital has officially launched a compliant stablecoin, USDtb.

The strategies of tech companies are even more intriguing, as their approaches differ due to varying positions. Established players in the crypto space like PayPal and Ripple have already scaled their stablecoins, hoping to continue evolving in operations and ecosystem directions. Crypto "newcomer" Google announced on September 16 the launch of a brand new open-source payment protocol, which strengthens support for stablecoins in collaboration with crypto companies like Coinbase and the Ethereum Foundation, marking Google's official entry into the stablecoin field. The startup WLFI has also found shade under the "Trump" tree, with USD1 reaching a scale of $2 billion.

In contrast to the aforementioned companies, Meta has faced regulatory scrutiny due to its "second coming." As early as May this year, Meta was reported to have engaged in preliminary discussions with several crypto infrastructure companies to explore using stablecoins as a payment solution for content creators' income settlements on Facebook and WhatsApp. Mechanically, Meta plans to collaborate with multiple stablecoin issuers for channel partnerships, although it will not intervene in the reserve and clearing processes, it still maintains full control over the flow. The impact of this model was felt in June when Zuckerberg received inquiry letters from U.S. Senators Elizabeth Warren and Richard Blumenthal, questioning whether Meta was attempting to restart private currency under the guise of collaboration, reflecting regulatory concerns over Meta's past transgressions. Previously, Meta had initiated two innovative currency strategies: the "dream" Libra, which was the first to challenge the sovereignty of official currency and was stifled by regulators during its vision phase, and Diem, which inherited Libra's legacy in 2020. Although it shifted from being pegged to a basket of fiat currencies to a single dollar, it still could not escape the "shadow banking" concerns from various regions, ultimately being sold to crypto bank Silvergate for $200 million in 2022. Interestingly, a year later, Silvergate also announced its shutdown.

Overall, after establishing a compliant positioning for crypto assets, the U.S. stablecoin industry is showing a trend of accelerated integration and development. Traditional institutions are increasingly laying out their strategies, with both issuance and custody entities on the rise, and new entities concentrated among large enterprises, including banks with defensive strategies and tech companies actively seeking market opportunities. Traditional enterprises that empower the industry are also included, while startups looking to enter this track face stringent resource requirements.

Europe: Slow Follow-Up, Major Banks Begin to Act

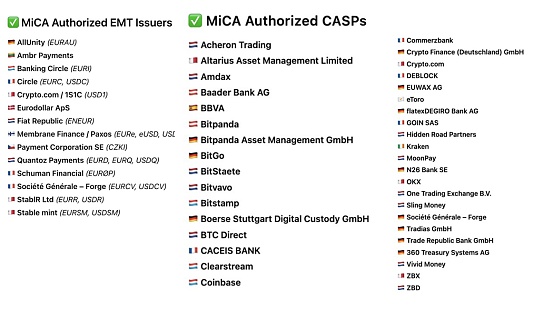

As previously mentioned, Europe was one of the first regions to propose a systematic regulatory framework for crypto assets. In fact, all countries and regions that have completed regulatory coverage have drawn on European experiences when formulating their crypto asset regulations. The EU's "Regulation on Markets in Crypto-Assets" (MiCA) will officially take effect on December 30, 2024, applicable to 27 EU member states as well as Norway, Iceland, and Liechtenstein. Thirty countries will formulate or amend domestic legislation based on MiCA during the transition period, with a deadline of July 1, 2026.

Within the MiCA framework, the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA) are the two main constructing bodies responsible for setting technical standards and judicial interpretations. The framework has clear regulatory requirements for stablecoins: first, authorization before issuance; second, disclosure obligations, with issuers required to publish white papers; and third, issuers must hold a certain amount of their own capital and reserve assets. For stablecoin issuers pegged to a basket of assets, MiCA requires them to hold no less than €350,000 or 2% of the average value of reserve assets over the past six months. Notably, for stablecoin issuers pegged to a single fiat currency, MiCA does not impose requirements for own capital and reserve assets.

Although regulation is ahead, considering Europe's highly fragmented crypto market and high regulatory costs, the development of the European crypto industry has limited influence in the global crypto field, instead highlighting its technological attributes. In terms of stablecoins, the scale of euro-pegged stablecoins is only $460 million, but it remains the largest stablecoin market after the dollar. From a licensing perspective, obtaining licenses in Europe is significantly easier than in the U.S. or Hong Kong, making it a compliance reserve for many crypto enterprises. According to Circle's EU policy director Patrick Hansen, as of July this year, 14 stablecoin issuers and 39 crypto asset service providers have been approved to engage in crypto asset businesses.

In the realm of stablecoins, the U.S. has a significant influence on Europe. Before dollar stablecoins, Europe's focus was more on its CBDC—the digital euro. As early as June 2023, the European Commission proposed a legislative draft for the digital euro, but the progress of this strategy has been slow, only entering the pilot phase this year in collaboration with the private sector. However, in March of this year, a malfunction in the EU's TARGET2 payment system significantly undermined public trust in the digital euro, compounded by existing privacy concerns, causing the plan to stall. With the entry of dollar stablecoins into the fast lane, Europe's attitude has noticeably changed, as dollar stablecoins will impact the competitive landscape of digital currencies, and the planning for the digital euro is expected to accelerate. The European Central Bank has stated that it will launch a new round of digital euro experiments next year to explore the feasible functions of the digital euro.

In addition to the digital euro, euro stablecoins have also become a target for banks. This month, nine major European banks, including ING, Banca Sella, KBC, Danske Bank, DekaBank, UniCredit, SEB, CaixaBank, and Raiffeisen Bank International, will jointly launch a euro stablecoin project regulated by MiCA. It is reported that the project will be operated by a new company established in the Netherlands, under the supervision of the Dutch central bank. The stablecoin is expected to be issued for the first time in the second half of 2026, aiming to provide round-the-clock, low-cost cross-border payment services to enhance Europe's strategic autonomy in the digital payment field.

The movements of major European banks reflect the region's political attitude. Overall, Europe, which already does not hold an advantage in the digital currency market, is compelled to adopt a strategic follow-up approach due to the impact of dollar stablecoins. However, the slow progress of the digital euro and the small share of euro stablecoins place Europe in a relatively passive position. Analyzing from the corporate side, aside from banks taking action, other euro stablecoin issuers have limited visibility and also show a concentration effect at the top, with Circle alone issuing EURC, which has reached a scale of $297 million, accounting for 63% of the euro stablecoin market. However, it is worth noting that compared to the high barriers of entry for dollar stablecoins, startups in Europe also have opportunities to enter this track.

China: Centered on Hong Kong, Facing Regulatory Discrepancies Between Regions

From a policy perspective, Hong Kong's regulation adheres to the principle of technological neutrality, maintaining openness to technological applications while strictly preventing systemic risk spillovers. The Hong Kong "Stablecoin Ordinance" officially came into effect on August 1, and a series of supporting regulatory documents have been released regarding the new ordinance, including the "Regulatory Guidelines for Licensed Stablecoin Issuers" consultation summary and the guidelines; the "Guidelines for Combating Money Laundering and Terrorist Financing (Applicable to Licensed Stablecoin Issuers)" consultation summary and the guidelines; a summary explanation of the licensing system and application procedures related to stablecoin issuers; and a summary explanation of the transitional provisions for existing stablecoin issuers.

Although the policies are strict, in the Chinese market, the industry remains stagnant while concepts take precedence. When the "Stablecoin Ordinance Draft" was introduced, the market sparked a narrative frenzy. Listed companies that are associated with the stablecoin concept have seen astonishing stock price increases, with companies like Guotai Junan International, China San San Media, Yaocai Securities, Yunfeng Financial, OKLink, and Sifang Jingchuang all accumulating gains of over 100% this year.

Because of this, even before the ordinance took effect, the Hong Kong Monetary Authority (HKMA) made several attempts to cool down the stablecoin enthusiasm, but it was still difficult to stop the market's fervor for stablecoins. According to requirements, the HKMA will accept the first round of stablecoin issuer license applications from August 1 to September 30, 2025. As of August 31, a spokesperson for the HKMA stated that there were 77 expressions of intent to apply for stablecoin licenses, covering various institutions including banks, tech companies, securities/asset management/investment firms, e-commerce, payment institutions, and startups/Web3 companies.

In the competitive landscape, in addition to existing issuers like JD Coin Chain, Yuan Coin Innovation Technology, and the Standard Chartered Bank consortium, internet giants led by Ant International, as well as several Chinese banks such as Bank of China Hong Kong, China Merchants Bank Hong Kong, China Construction Bank (Asia), and Xinyin International, along with Chinese securities firms' branches in Hong Kong, are also eager to participate.

However, just as everything seemed to be flourishing, regulators pressed the pause button on stablecoins. Initially, the strict KYC requirements from Hong Kong regulators tilted the licensing standards towards large banks. Subsequently, Hong Kong authorities repeatedly indicated that the scope of the first batch of stablecoin licenses would be narrowed to three to four issuers. Then, Reuters reported that Chinese securities regulators had advised some local brokerages to suspend their real-world asset (RWA) tokenization businesses in Hong Kong. Recently, regulation has further tightened. According to Caixin reports, internet platforms, Chinese securities firms, and Chinese banks in Hong Kong have been asked to pause various activities related to crypto assets, including investment, trading, issuing RWAs, and stablecoins. According to Foresight, citing informed sources, mainland regulatory authorities have conveyed relevant guidance to financial institutions, requiring them to maintain a low profile in their business and statements involving stablecoins, avoiding excessive promotion or creating public opinion hotspots, and to strictly manage internal research and public sentiment. Against this backdrop, Chinese financial institutions that were previously actively pursuing stablecoin licenses have paused their business advancements.

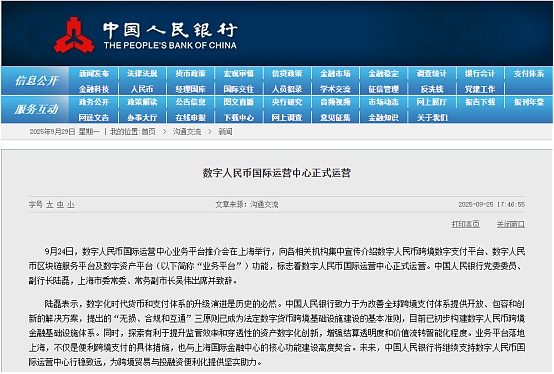

Interestingly, at the same time, the long-silent digital yuan has gained traction. On September 24, the Digital Yuan International Operation Center officially commenced operations. Lu Lei, a member of the Party Committee and Vice President of the People's Bank of China, stated that the upgrade and evolution of the currency and payment system in the digital age is an inevitable historical trend. According to official disclosures, the Digital Yuan International Operation Center is responsible for building and operating the cross-border and blockchain infrastructure for the digital yuan, promoting cross-border connectivity with domestic and foreign financial infrastructures, and advancing the international operation and financial market business development of the digital yuan.

While it may seem forced to draw correlations, the various factors indicate that the domestic leadership is very cautious about stablecoins and crypto assets, even harboring some negative sentiments. Therefore, there is a high level of concern regarding market speculation and institutional participation. In the face of the current digital currency impact, the domestic approach leans towards responding with the digital yuan as the legitimate fiat currency, rather than allowing stablecoins in Hong Kong to develop freely. In fact, this move also somewhat shatters the market's fantasies about a renminbi stablecoin.

Currently, the development of stablecoins in China needs to focus heavily on Hong Kong, but the applicants in Hong Kong are influenced by domestic regulations, thus facing significant uncertainty. Under the current circumstances, the first batch of license recipients is expected to be primarily foreign banks and brokerages.

Conclusion

Of course, aside from the three major regions of China, the U.S., and Europe, Japan, South Korea, Singapore, and other areas are also making strides in the stablecoin field. However, overall, due to the broader coverage and relatively greater influence of the three major regions, their value is correspondingly higher. Analyzing the current situation, the regulatory dividends in the U.S. have not yet been fully released, with strong momentum ahead. Europe, while following suit, remains passive and is wavering between the digital euro and euro stablecoins, lacking a firm strategy. China has the greatest potential, but due to regulatory discrepancies between regions, it also faces a dilemma. Considering the absolute position of dollar stablecoins, the foundational support for U.S. digital currencies is unlikely to be shaken, and other regions can only rely on existing markets to find differentiated breakthroughs. The international struggle for digital currency pricing power seems far from reaching a boiling point.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。