The crypto bull market has moved beyond speculation – it’s gaining real traction. As Q4 begins, leading exchanges are seeing surging volumes, rapid innovation, and growing institutional engagement. With Bitcoin holding firm above key resistance levels and altcoins joining the rally, October – long known as “Uptober” in crypto circles – is shaping up to be a pivotal month.

The third quarter of 2025 closed with meaningful gains across the board. Bitcoin posted steady growth from July through September, while altcoin activity picked up on major platforms like Binance, Coinbase, and BitMart. Regulatory progress in the U.S. is also fueling optimism, with landmark digital asset legislation inching closer to passage.

Institutions are once again paying attention. Derivatives volume hit multi-quarter highs in September, and spot markets are seeing renewed retail participation alongside increasing stablecoin inflows – often a leading signal of capital deployment.

Against this backdrop, the top-performing crypto exchanges are separating themselves from the pack – offering deeper liquidity, faster execution, innovative features, and strong compliance positioning. Below, we rank the 15 best crypto exchanges of Q4 2025 based on trading volume, product development, market share, and ecosystem impact.

The Top 15 Crypto Exchanges of October 2025

| Rank | Exchange | Notable Strengths |

|---|---|---|

| 1 | Binance | ~40% spot share; $698.3B July volume; BNB ATH $1,100+; launched Crypto-as-a-Service; 275M+ users |

| 2 | Bitget | $2.08T Q1 volume; Universal Exchange (UEX) launch; 120M+ users; 440M BGB moved to Morph Foundation |

| 3 | Coinbase | Closed $2.9B Deribit deal; Mag7+Crypto Index futures; 110M+ users; JPMorgan integration; $12K NY crypto-aid pilot |

| 4 | KuCoin | 41M+ users; $2B Trust Project; MiCA license bid; AAA CER rating; KCS monthly burns |

| 5 | Bybit | MNT integration; cmETH listing via EigenLayer; Mantle roadmap; ETH/ SOL liquidity leader |

| 6 | Kraken | $411.6M Q2 revenue; Ink Layer-2 live; NinjaTrader acquisition; SEC lawsuit dismissed; $15B valuation target |

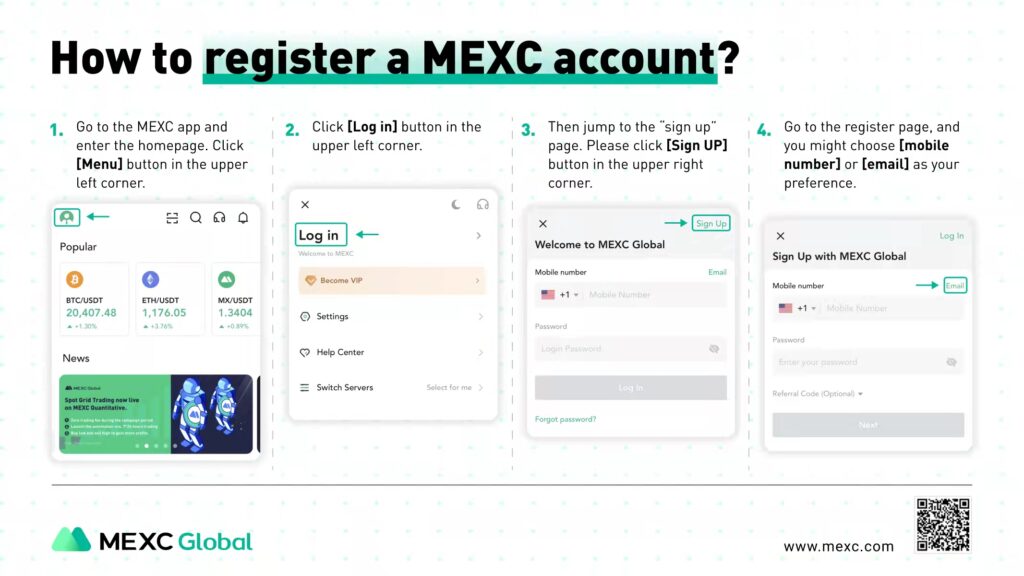

| 7 | MEXC | 9.6% Q2 market share; $150B July volume; 580 Q2 listings; AI/infrastructure tokens up 35,000%+ |

| 8 | LBank | 930+ tokens; ~3.1% spot share; $5B avg daily volume; memecoin EDGE platform; IPO exploration |

| 9 | BitMart | 12M+ users; 120% spot growth; launched BitMart DEX; 3rd-gen engine 2ms latency; AI/fiat tools |

| 10 | BTCC | $957B Q2 volume; 10M+ users; NBA star Jaren Jackson Jr. ambassador; 143% reserve ratio |

| 11 | WhiteBIT | $2.7T annual volume; WBT token ATH $52; Juventus partnership; new Portfolio Margin product |

| 12 | Uphold | 10M+ users; 300+ assets; 100%+ reserves updated every 30s; Uphold Vault assisted self-custody; USD Interest up to 4.9% APY |

| 13 | ChangeNOW | 1,400+ assets; 110+ chains; instant non-custodial swaps; fixed-rate option; B2B APIs & white-label solutions |

| 14 | Swapuz | 3,000+ assets; multi-channel non-custodial system; fixed & floating swaps; affiliate program with BTC rewards |

| 15 | BYDFi | MoonX dual-engine (CEX+DEX); Newcastle United partnership; social trading & bots; active in Asia & LATAM |

Exchange-by-Exchange Breakdown

1. Binance – Best for Liquidity & Institutional Expansion

Binance remains the #1 centralized exchange by trading volume, consistently commanding close to 40% of global market share. In July 2025, it processed $698.3B in spot trading volume, the latest published snapshot from Coingecko – and it has maintained that dominance into Q4 2025. With more than 275 million registered users worldwide, Binance offers unmatched liquidity across spot, futures, staking, lending, and token launches.

Momentum has been amplified by BNB’s new all-time high above $1,100 as of October, driven by network growth, DeFi integrations, and institutional demand. Governments are also engaging directly: in October, Kazakhstan launched the Alem Crypto Fund, appointing Binance Kazakhstan as custodian and making an initial BNB purchase.

Institutional expansion is now a core focus. On September 29, Binance launched Crypto-as-a-Service (CaaS), a white-label solution allowing banks and brokerages to integrate crypto trading under their own branding while relying on Binance’s liquidity, custody, and compliance infrastructure. Meanwhile, its venture arm, rebranded as YZi Labs, manages a $10B portfolio spanning Web3, AI, and biotech.

Takeaway: With unrivaled market depth, a surging ecosystem token, and new institutional products, Binance is both the largest and most forward-looking exchange in 2025.

2. Bitget – Best for Copy Trading & Universal Exchange Innovation

Bitget’s evolution in 2025 has been dramatic. In Q1 alone, it handled $2.08 trillion in trading volume, saw 159% QoQ growth in spot, and surpassed 120 million users globally. In Q2, Bitget executed a 30 million BGB burn (~$138M) to reinforce its deflationary model.

A major structural shift came in September with the launch of Universal Exchange (UEX). This model unifies crypto, tokenized stocks, ETFs, forex, and real-world assets (RWAs) under one account, aiming to break down fragmentation across asset classes. To further cement BGB’s role, Bitget transferred 440 million BGB tokens to the Morph Foundation: 220 million burned immediately, and 220 million locked for ecosystem growth. BGB is now positioned as the gas and governance token for the Morph chain.

At its 7th anniversary in September, Bitget also celebrated the UEX branding, launching its “Gear Up to 7” campaign and pushing its next-gen vision. Meanwhile, Bitget adds new Launchpool listings (e.g. Falcon Finance) to expand user engagement and rewards.

Takeaway: Bitget now combines a sophisticated copy-trading engine with ambitious infrastructure – bridging traditional finance and crypto under one roof. Its tokenomics, utility upgrade, and Universal Exchange pivot make it a standout in 2025.

3. Coinbase – Best U.S. On-Ramp & Institutional Bridge

In August 2025, Coinbase officially closed its $2.9 billion acquisition of Deribit, making it a full-spectrum platform offering spot, futures, perpetuals, and options trading under one roof. Deribit’s July 2025 volume hit $185 billion, with open interest near $60 billion, giving Coinbase instant depth in derivatives markets.

Beyond pure trading, Coinbase is pushing financial innovation. In 2025, it rolled out Mag7 + Crypto Equity Index futures, a hybrid product blending exposure to top tech stocks (the “Magnificent 7”) with crypto ETFs and Coinbase stock itself. This marks a pivot toward multi-asset derivatives and deeper TradFi / crypto integration.

Institutional demand remains a core focus. A Coinbase/EY-Parthenon survey of 352 global investors found 75% expect to increase crypto allocations in 2025, while 59% plan to commit over 5% of their AUM to digital assets. Meanwhile, Coinbase and JPMorgan unveiled a partnership to let Chase customers link bank accounts to Coinbase wallets, buy crypto via credit cards, and eventually convert reward points into tokens.

Coinbase also remains active in public programs: in early October 2025 it launched a pilot in New York giving $12,000 in USDC to low-income residents, an experimental step toward crypto-based aid.

Takeaway: Coinbase is evolving from U.S. retail leader to a full-fledged global derivatives & institutional powerhouse. The Deribit deal, multi-asset futures, bank partnerships, and public initiatives make it one of the most forward-looking exchanges in 2025.

4. KuCoin – Best for Listings, Token Utility & Trust Expansion

In H1 2025, KuCoin showed strong momentum. It now serves over 41 million users worldwide, and launched the $2 billion “Trust Project”, an initiative aimed at bolstering compliance, security, and community support. KuCoin achieved SOC 2 Type II and ISO 27001:2022 certifications, attained an AAA rating by CER.live, and partnered with BitGo’s Go Network to support institutional-grade custody with up to $250M in insurance coverage.

Tokenomics remains central. In September 2025, KuCoin executed its 62nd monthly KCS burn, removing 62,386 KCS (~$726K) from circulation, reinforcing its deflationary model. KCS also expanded utility through KuCoin’s new partnerships – most notably with Vietnam’s national blockchain strategy, aligning KCS with infrastructure and payment system goals in a rising crypto adoption market.

The exchange is pushing rigorously into regulated territories: it submitted a MiCA license application in the EU and launched KuCoin Thailand, a fully regulated local exchange under Thai SEC oversight.

KuCoin also continues to lead in listings and product expansion – releasing 170+ new tokens, 106 futures assets, and expanding its AI-powered trading bots (8.9 million created so far) to meet varied trading preferences. It also launched xStocks.

Takeaway: KuCoin balances innovation and credibility. Its strong push on compliance, aggressive token burn model, and listing momentum make it a standout for users seeking volume, new tokens, and long-term confidence.

5. Bybit – Best for Derivatives, Restaking Innovation & Layer-2 Synergy

Bybit continues to dominate derivatives and advanced products – in 2025 it has pushed into Web3 infrastructure with bold integrations into Mantle (MNT) and restaking. Most notably, Bybit is among the first exchanges to list cmETH, a Liquid Restaking Token (LRT) built on Mantle’s mETH protocol, allowing users to restake ETH and still retain liquidity. Through its On-Chain Earn platform, users can stake ETH → mETH → cmETH, and participate in bonus APR events via EigenLayer integration, no external wallet or bridging needed.

In September 2025, Bybit and Mantle released the “Mantle × Bybit Roadmap”, deepening MNT’s utility across the Bybit ecosystem. The roadmap expands trading pairs (20+), enables MNT to be used for trading fee discounts (spot & derivatives), card payments, VIP benefits, and institutional leverage. That same month, Mantle hit a new ATH around $1.65, boosted by the exchange’s listing and rewards campaigns.

Bybit also backed Mantle’s v1.3.1 upgrade (August 2025), signaling strong technical alignment and commitment to Layer-2 performance enhancements. Meanwhile, the platform continues to lead in derivatives volume and social trust, having recovered soundly from past incidents and maintaining high uptime and transparent operations.

Takeaway: Bybit is evolving beyond a derivatives powerhouse – it’s becoming a restaking infrastructure hub, especially with cmETH and Mantle integrations pushing it toward a hybrid DeFi + CeFi future.

6. Kraken – Best for Security, Multi-Asset Vision & DeFi Bridge (2025)

Kraken continues to reinforce its reputation for security and institutional reliability while expanding its multi-asset and on-chain ambitions. In Q2 2025, Kraken reported $411.6 million in revenue, up ~18% year-over-year, amid total exchange volume of $186.8 billion. Earlier in 2025, the firm posted $472 million in Q1 revenue, a +19% YoY increase.

A key recent milestone: Kraken officially launched its Layer-2 blockchain, Ink, ahead of schedule in August 2025. Ink is built on Optimism’s OP Stack and is intended to bridge centralized exchange users into DeFi environments – enabling faster, lower-cost transactions and integrated access to dApps. Kraken has also rolled out enhancements to Ink: users now can self-withdraw to Ethereum, challenge rollups, and interact with a security committee to safeguard disputes.

On the expansion front, Kraken’s strategic acquisition of NinjaTrader (closer to $1.5 billion) pushes its reach into futures and traditional markets. Meanwhile, the exchange is in talks to secure fresh funding at a valuation of $15 billion, and even $20 billion (in speculative rounds), potentially fueling moves toward an IPO.

Meanwhile, regulatory headwinds eased in early 2025 when Kraken announced that the U.S. SEC agreed to dismiss a pending civil lawsuit, effectively removing a major legal overhang from its operations. Also, it secured a MiCA License to expand its regulated crypto services across 30 EU states.

Takeaway: Kraken’s strength has always been trust and reliability – in 2025, it’s evolving into a full multi-asset and DeFi gateway. Its Ink L2 launch and deeper product expansion make it a key bridge between CeFi and DeFi for serious users.

7. MEXC – Best for Altcoin Discovery & Explosive Spot Momentum

MEXC has emerged as one of the fastest-rising exchanges in 2025. In Q2, its spot market share jumped 2.4 percentage points, climbing from 7.2% to 9.6% and making it one of the top gainers among major exchanges. In July 2025, MEXC captured 8.6% spot share, processing $150.4B in trading volume – a 61.8% MoM gain – which momentarily elevated it into the top-2 spot by volume.

Token listings remain core to its strategy. In Q2, MEXC added 580 new tokens, many delivering triple- or quadruple-digit peak returns. July alone brought 255 new listings, with AI and infrastructure projects dominating gains – some returning up to +35,920%. The platform now hosts nearly 2,000 spot pairs and 350+ derivative pairs and maintains an active listing calendar to keep traders ahead of trends.

Beyond listings, MEXC is pushing deeper into product evolution and ecosystem building. Its Q2 “Ecosystem & Growth Report” emphasizes infrastructure diversification (ZK, Restaking, cross-chain), enhanced security reserves, and Web3 integrations.

Takeaway: MEXC is doubling down on what it does best – fast, speculative listings combined with strong spot performance. For traders chasing the next breakout alt, it’s a go-to platform – just be mindful of liquidity, slippage, and listing risks.

8. LBank – Best for Token Discovery & Meme Coin Innovation

LBank is ascending fast within the exchange rankings. As of September 2025, it captured ~3.1% of the global 24-hour spot trading market, a sign of its growing footprint in high-velocity trading. In Q2 2025, LBank’s average daily trading volume reached ~$4.98 billion, with 24.5% growth QoQ, reinforcing its strength in memecoin and altcoin listings.

The exchange currently supports over 930 tokens, making it one of the broadest catalogs among mid-tier CEXs. Its Launch IDO/EDGE platform has become a go-to hub for high-volatility memecoin premieres – several listings in EDGE delivered triple-digit to quadruple returns post-launch.

Recent listing updates show active new pairs appearing daily, including PEPE2025/ USDT and WING (Aladdin Booster), highlighting LBank’s priority on meme or high-volatility assets.

In governance & expansion, LBank is reportedly exploring a U.S. IPO and stronger compliance posturing, although nothing has been confirmed officially yet.

Takeaway: LBank is staking its reputation on rapid listings and meme market dominance. If your strategy is early discovery and high risk, high potential returns, LBank should be a key stop – but prioritize risk controls (position sizing, exit strategy) when trading volatile assets.

9. BitMart – Best for Innovation & Hybrid CEX-DEX Strategy

BitMart continues to punch above its weight by combining high throughput, asset discovery, and latest infrastructure – making it standout among mid-tier exchanges in 2025. As of mid-2025, BitMart surpassed 12 million registered users globally, with spot trading volume up over 120% HoH and its 3rd-generation engine processing orders in ~2ms at 80,000 orders/second.

Recently, BitMart launched BitMart DEX, an on-chain trading interface designed to blend the accessibility of centralized platforms with decentralized transparency and security. It aims to reduce fragmentation and bring CEX users into the on-chain world with ease.

BitMart is also actively tweaking futures contracts and leverage settings: in September it announced delistings of multiple perpetual pairs and adjustments to funding intervals and leverage tiers across futures markets. On the listing front, BitMart continues to add new assets: recent additions include UCHAIN (UCN) and OMNILABS AI protocols.

BitMart’s product ecosystem is expanding too: its X Insight AI tool, BM Discovery Zone, copy trading, and fiat on-ramp features continue to evolve, underpinned by its emphasis on tech and discovery.

Takeaway: BitMart is no longer just a fast-growing exchange – it’s building a hybrid future. With CEX speed, a newly launched DEX, aggressive listing growth, and smart product layering, it’s positioning itself as a bridge between centralized and decentralized finance in 2025.

10. BTCC – Historic Exchange Doubling Down on Trust & Growth

BTCC, launched in 2011 and one of the longest-running exchanges in crypto, is rewriting its narrative for 2025. In Q2, it reported $957 billion in total trading volume and over 9.1 million users – a strong showing for its 14th anniversary. Recently, BTCC crossed the 10 million user milestone, citing global expansion and a renewed push into Web3.

In September 2025, BTCC named NBA All-Star Jaren Jackson Jr. as its global brand ambassador, launching a $500,000 USDT trading competition with high-profile rewards and community engagement. The partnership is a clear push into mainstream visibility.

Transparency is a major focus. In its September 2025 Proof of Reserves report, BTCC revealed a total reserve ratio of 143%, confirming that it holds more assets than user liabilities – boosting confidence in security and solvency. The reserves cover major assets such as BTC, ETH, USDT, and more, all showing over-collateralization.

The exchange continues listing actively: in July it added 80+ new spot pairs, lifting its catalog to 300+ spot markets and 380+ futures pairs. BTCC also announced plans to triple its global workforce to 3,500 staff over the next six months, marking the next phase of its Web3 infrastructure ambitions.

Takeaway: BTCC is leaning into its heritage with renewed vigor – not relying solely on being “oldest,” but on transparency (143% reserves), a high-impact ambassador strategy, and volume expansion. It’s positioning itself as a legacy player evolving for the future.

11. WhiteBIT – Best for Institutional Tools & Token Momentum

WhiteBIT, consistently ranked as one of Europe’s highest-traffic crypto exchanges, is sharpening its institutional edge in 2025. In late September, it rolled out Portfolio Margin, a new product tailored for institutions – market makers, hedge funds, and prime brokers – enabling crypto-backed loans up to 10× leverage without selling existing holdings. At the Liquidity 2025 summit, WhiteBIT served as a Golden Partner, unveiling a broader suite of institutional services including OTC trading, institutional-grade custody, and Crypto-as-a-Service (CaaS) integration options.

Its native token, WBT, has been a standout. In 2025, WBT delivered triple-digit gains, briefly peaking above $52.27, and saw renewed momentum following a partnership with Juventus, where WhiteBIT became the club’s “official exchange” and sleeve sponsor. The collaboration led to a >30% intraday jump in WBT’s price.

In branding and outreach, WhiteBIT strengthened ties with global institutions – hosting an “Institutional Night” at FC Barcelona Museum with LTP and Global Dollar Network, targeting high-value stakeholder engagement. Meanwhile, the exchange touts having processed $2.7 trillion in annual trading volume and commanding a valuation around $38.9 billion in early 2025.

Takeaway: WhiteBIT is pivoting from retail growth to institutional backbone. Its Portfolio Margin, custody solutions, and WBT token strength make it a serious contender for institutions and power users who want both infrastructure and upside.

12. Uphold – Best for Multi-Asset Access & Assisted Self-Custody

Uphold has built a reputation as a global multi-asset trading platform, serving over 10 million users across 150+ countries. Unlike many crypto-only exchanges, it bridges both digital assets and traditional currencies, with access to 300+ tokens and fiat pairs. Its “Trade Anything to Anything” engine allows seamless swaps between assets without first converting to USD or USDT, while liquidity is sourced from 30+ exchanges to ensure competitive pricing.

The platform is designed to serve both beginners and active traders. Features include take-profit and stop-loss tools, repeat transactions, and limit orders, alongside curated Uphold Baskets for easy diversification. Early token support makes it a destination for users seeking access to new or low-liquidity projects, and UK users can spend directly with the Uphold Card.

What sets Uphold apart is its transparency and security model. It operates a 100%+ reserve system, publishing proof of assets and liabilities refreshed every 30 seconds. In 2025, it introduced Uphold Vault, the first assisted self-custody solution on a major platform, offering direct trading, recovery options, and secure access for supported assets like BTC, XRP, SOLO, and COREUM.

Uphold also recently launched a USD Interest Account, offering up to 4.9% APY on deposits over $1,000 with FDIC insurance up to $2.5 million.

Takeaway: Uphold stands out as a hybrid exchange and wallet solution, offering unmatched transparency, multi-asset access, and unique tools like assisted self-custody and interest-bearing accounts.

13. ChangeNOW – Best for Instant, Non-Custodial Swaps & B2B Infrastructure

ChangeNOW has established itself as a leader in non-custodial trading, offering fast, account-free swaps while keeping users in full control of their funds. Supporting 1,400+ assets across 110+ blockchains, the platform aggregates liquidity from both centralized and decentralized sources to minimize slippage and speed up execution. Most swaps complete in just a few minutes, with options for either floating or fixed rates to avoid price volatility.

In 2025, ChangeNOW expanded its toolkit with new fixed-rate swap flows and upgraded API endpoints, allowing users and partners to directly manage refunds and delayed trades without manual support. On the business side, the company is doubling down on infrastructure, promoting its white-label services, exchange APIs, and widgets as turnkey solutions for wallets, fintechs, and exchanges seeking to integrate crypto swaps.

The team is also positioning for a “CeDeFi” future – combining decentralized principles with added safeguards to make token swaps safer and more accessible for mainstream adoption. Trusted by partners like Bitcoin.com, Exodus, and Trezor, ChangeNOW is more than just a retail swap tool: it is becoming an invisible backbone powering the next generation of crypto integrations.

Takeaway: For users, ChangeNOW remains one of the fastest and simplest ways to swap across chains without giving up custody. For businesses, it’s a growing infrastructure provider offering seamless non-custodial integration.

14. Swapuz – Best for Multi-Channel Non-Custodial Trading

Founded in 2020, Swapuz has grown into one of the most advanced non-custodial exchange platforms, now supporting 3,000+ digital assets across millions of trading pairs. Its hallmark is a multi-channel exchange system that blends decentralized finance protocols with centralized user-experience features. This architecture routes trades automatically through the most efficient pathways, delivering optimal pricing and minimal slippage across supported assets.

Swapuz’s model goes beyond basic swaps. It integrates DeFi protocols with institutional-grade exchange mechanics, allowing traders to retain full custody of their assets and private keys while still accessing advanced features. These include limit orders, stop-loss settings, and portfolio tracking – tools typically found only on centralized venues. The platform also supports fixed and floating rate swaps, giving traders flexibility in how they manage volatility.

Security is a defining strength. Swapuz layers advanced cryptography, smart contract auditing, multi-signature wallets, and real-time monitoring into its infrastructure, ensuring that trades are both private and protected. Enhanced SSL encryption further safeguards transactions, while the non-custodial model removes counterparty risk entirely.

Swapuz also invests in community growth through an affiliate program offering tiered BTC rewards (0.3%–0.7%) based on referral volume and activity. Its hybrid design of speed, privacy, and feature depth positions Swapuz as a pioneer in the next generation of decentralized exchange technology.

Takeaway: Swapuz is not just a swap tool – it’s a multi-channel non-custodial ecosystem offering security, flexibility, and professional-grade tools, making it one of the most innovative DEX platforms in 2025.

15. BYDFi – Best for Social Trading, Dual-Engine Innovation & Brand Reach

BYDFi (rebranded from BitYard) has pushed aggressively in 2025 toward a hybrid CEX + DEX model, marrying liquidity with on-chain access. Its MoonX tool, launched in 2025, enables users to trade on-chain meme and trending assets directly from the platform, bridging centralized and decentralized rails.

The platform continues to expand its social & automated trading capabilities: Smart Copy Trading, grid bots, demo accounts, and advanced tools built into MoonX (e.g. “Alpha” signal detection, trend ranking) are central to its offering. BYDFi’s “Dual-Engine Strategy” is now part of its core messaging – combining the speed and depth of a traditional exchange with on-chain discovery and trading.

In August 2025, BYDFi became the Exclusive Official Crypto Exchange Partner of Newcastle United, a move to expand brand awareness globally through sports marketing, and also launched its BYDFI Card. At a match on September 28, the exchange displayed its slogan “BUIDL Your Dream Finance” on LED boards, fueling social engagement and messaging about building vs. hype.

Meanwhile, BYDFi is active on the event circuit – officially sponsoring TOKEN2049 Dubai, and participating in Korea Blockchain Week 2025 (KBW 2025) with a booth and Web3 presentations on its dual engine and MoonX roadmap. The exchange also continues to roll out new listings (e.g. ELDE/ USDT, PFVS/ USDT), and has added “one-click withdrawals” to MoonX addresses for quicker on-chain transitions.

Takeaway: BYDFi is positioning itself not just as a beginner-friendly exchange, but as a next-gen platform that blends CEX performance with DEX transparency and discovery. Its branding plays, product layering, and dual-engine ambition make it one to watch in 2025.

Crypto Exchange Trends to Watch in Q4 2025 and into 2026

- Regulatory convergence is accelerating. The U.S. is implementing the GENIUS Act and 401(k) crypto provisions, the EU’s MiCA framework is rolling out, and APAC hubs like Hong Kong, Singapore, and Dubai are cementing their positions as regulated gateways. This global alignment is unlocking compliant trading pipelines at scale.

- Institutional adoption is entering a new phase. Corporate Bitcoin treasury strategies are expanding across the U.S., Brazil, and the Middle East, while partnerships like Coinbase–JPMorgan and Binance’s Crypto-as-a-Service (CaaS) point to deeper TradFi integration in 2026.

- Derivatives dominance continues. Futures, perpetuals, and restaking-linked products (e.g. Bybit’s cmETH, Coinbase + Deribit options) are driving the bulk of growth. Expect more hybrid products combining equities, ETFs, and crypto exposure in 2026.

- Exchange tokens are surging. BNB, BGB, WBT, and MEXC listings are fueling exchange ecosystems, with new use cases spanning governance, gas fees, and RWAs. Exchange tokenization is set to be a major competitive edge next year.

- M&A and expansion are reshaping rankings. Coinbase’s Deribit acquisition, Binance Labs’ evolution into YZi Labs, and BTCC’s global workforce expansion are signs of consolidation and diversification that will intensify through 2026.

- Security and transparency remain key differentiators. Proof-of-Reserves reporting, assisted self-custody (Uphold Vault), and non-custodial swaps (ChangeNOW, Swapuz) are becoming standard expectations heading into 2026.

Final Thoughts

The bull market is showing no signs of slowing as 2025 heads into its final quarter. Exchanges are no longer just trading venues – they are evolving into multi-asset platforms, institutional infrastructure providers, and gateways for real-world adoption. Platforms that combine deep liquidity, strong security, innovative products, and regulatory readiness are emerging as clear leaders.

For traders, this means opportunity but also choice. From global giants like Binance and Coinbase to specialized innovators like ChangeNOW and Swapuz, the best exchanges of late 2025 are shaping the tools and infrastructure that will define crypto markets in 2026. Selecting the right platform today could give both new and experienced users a decisive edge as the next growth cycle unfolds.

FAQ: Crypto Exchanges in Late 2025

Which exchange has the lowest fees in 2025?

Binance, Bitget, MEXC, and BitMart consistently rank among the lowest-fee platforms across both spot and derivatives. MEXC and Bitget, in particular, are known for aggressive promotions and zero-fee campaigns.

Can I trade crypto without KYC in 2025?

Yes – but only to a limited extent. Platforms like MEXC, BYDFi, ChangeNOW, and Swapuz allow swaps or capped withdrawals without full identity verification. However, global regulations (MiCA in the EU, GENIUS Act in the U.S., stricter APAC regimes) mean that full KYC is becoming the norm heading into 2026.

What’s the safest crypto exchange right now?

Kraken and Coinbase remain industry benchmarks for compliance and custody, while Binance has invested heavily in transparency with its Crypto-as-a-Service infrastructure. For non-custodial security, ChangeNOW and Swapuz remove counterparty risk entirely.

Which exchange is best for beginners?

BYDFi and Uphold stand out for their simple interfaces and guided tools. Bitget and Coinbase also provide strong education and intuitive UX, making them suitable entry points for new traders.

Which exchange is best for trading altcoins?

MEXC, LBank, and KuCoin dominate in breadth, with thousands of listings and frequent new-token launches. BitMart is also strong in early-stage assets and hybrid CEX-DEX discovery.

What’s the best exchange for futures trading?

Bybit, Binance, and Bitget remain leaders in derivatives, offering deep liquidity, advanced order types, and integrations with restaking (e.g., Bybit’s cmETH). Coinbase has also entered this arena via its Deribit acquisition.

How important is Proof of Reserves when choosing an exchange?

Very important. Platforms like BTCC (143% reserves), Kraken, and Uphold (100%+ live reserves) lead in transparency. Users should seek exchanges that publish independently verified Proof of Reserves.

What hidden fees should I watch out for?

Beyond trading fees, monitor withdrawal costs, funding rates on perpetuals, and maker-taker spreads. Some platforms also impose inactivity charges or higher fiat on-ramp fees.

- What is Bitcoin?

- What are Altcoins?

- What is a Centralized Exchange?

- What is a Decentralized Exchange?

- How does Crypto Exchange Work?

- How to Choose the Best Bitcoin Wallet

- Download the Bitcoin.com Wallet App

Stay Ahead of the Game

- Access to our updated bonus list

- Weekly picks, promos, and expert insights

- Crypto Casino Radar – Track top promos and hidden gems

- iGaming Alpha – Insider deals and exclusive updates

Sign up now to get smarter about where – and how – you bet with crypto.

Business & Partnership Enquiries

For business or partnership inquiries, contact us at affiliates@bitcoin.com. Our team is ready to assist.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。