The 1-hour chart is dancing on a fine line between tactical precision and potential chaos. XRP is range-bound at the $3.00 level, tracing a descending channel that’s acting like a cranky doorman blocking entry to the VIP zone above. Bulls charged at $2.94 with a textbook V-shaped recovery, but the party hit resistance near $3.07—where sellers reappeared like bad exes at a reunion.

The price action has turned a little shady in the last few candles, so scalpers are on alert. A tight buy zone between $2.97 and $2.98 looks tempting, but a stop below $2.94 is the seatbelt you need in this ride. Break below? Buckle up, we’re heading south.

XRP/USDC via Binance 1-hour chart on Oct. 5, 2025.

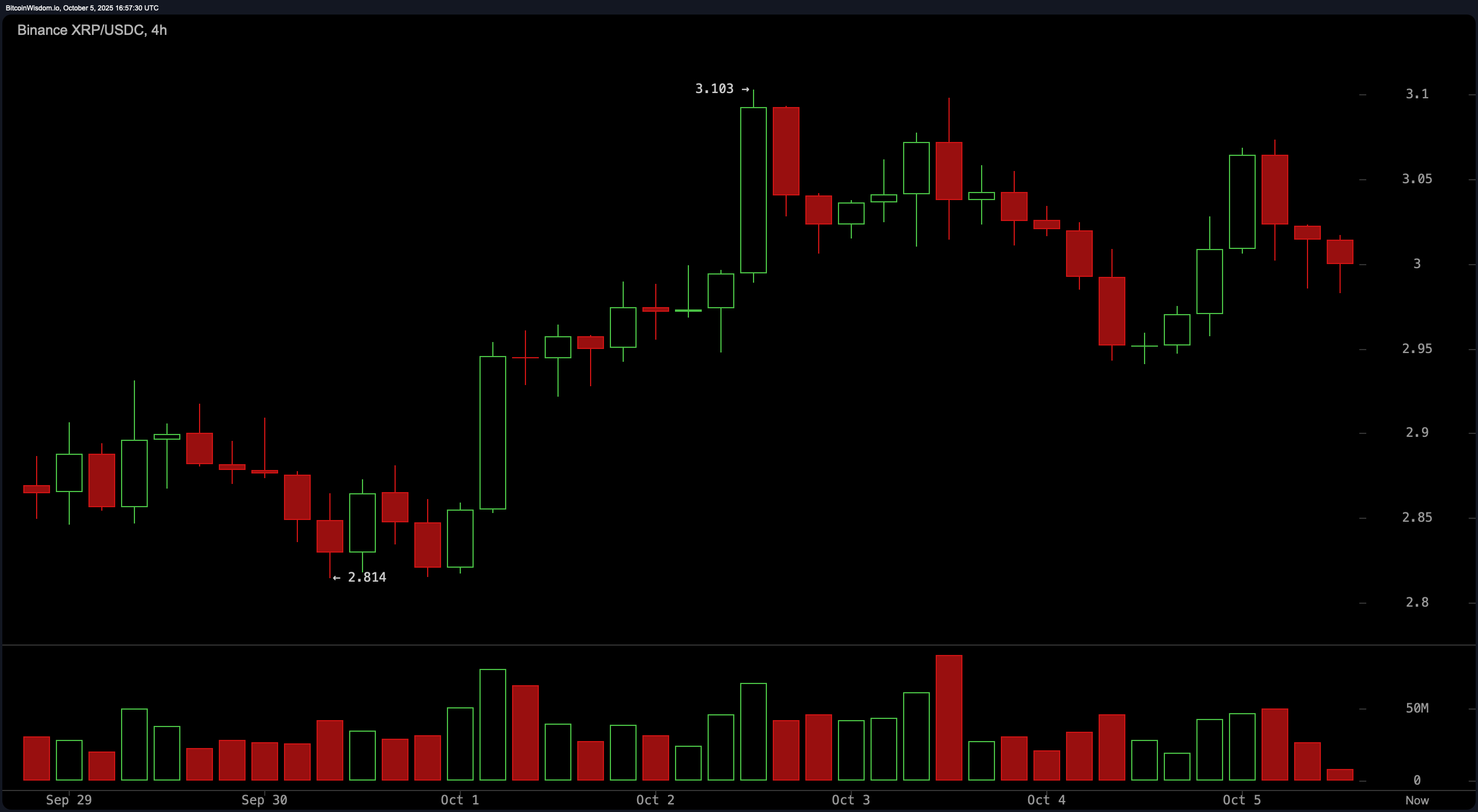

Over on the 4-hour chart, XRP appears to be hitting the snooze button after a brisk run-up. Price hit a high of $3.103 before pulling back, now loitering around $3.00 like it’s not sure whether to commit or ghost the rally altogether. Lower highs and lower lows are creeping in, hinting at short-term exhaustion. The volumes in retreat too—traders are either cautious or already on lunch. For the clever tactician, there are two options: play the breakout at $3.05 or the bounce off $2.95. Anything in between? That’s no-man’s land—avoid the drama.

XRP/USDC via Binance 4-hour chart on Oct. 5, 2025.

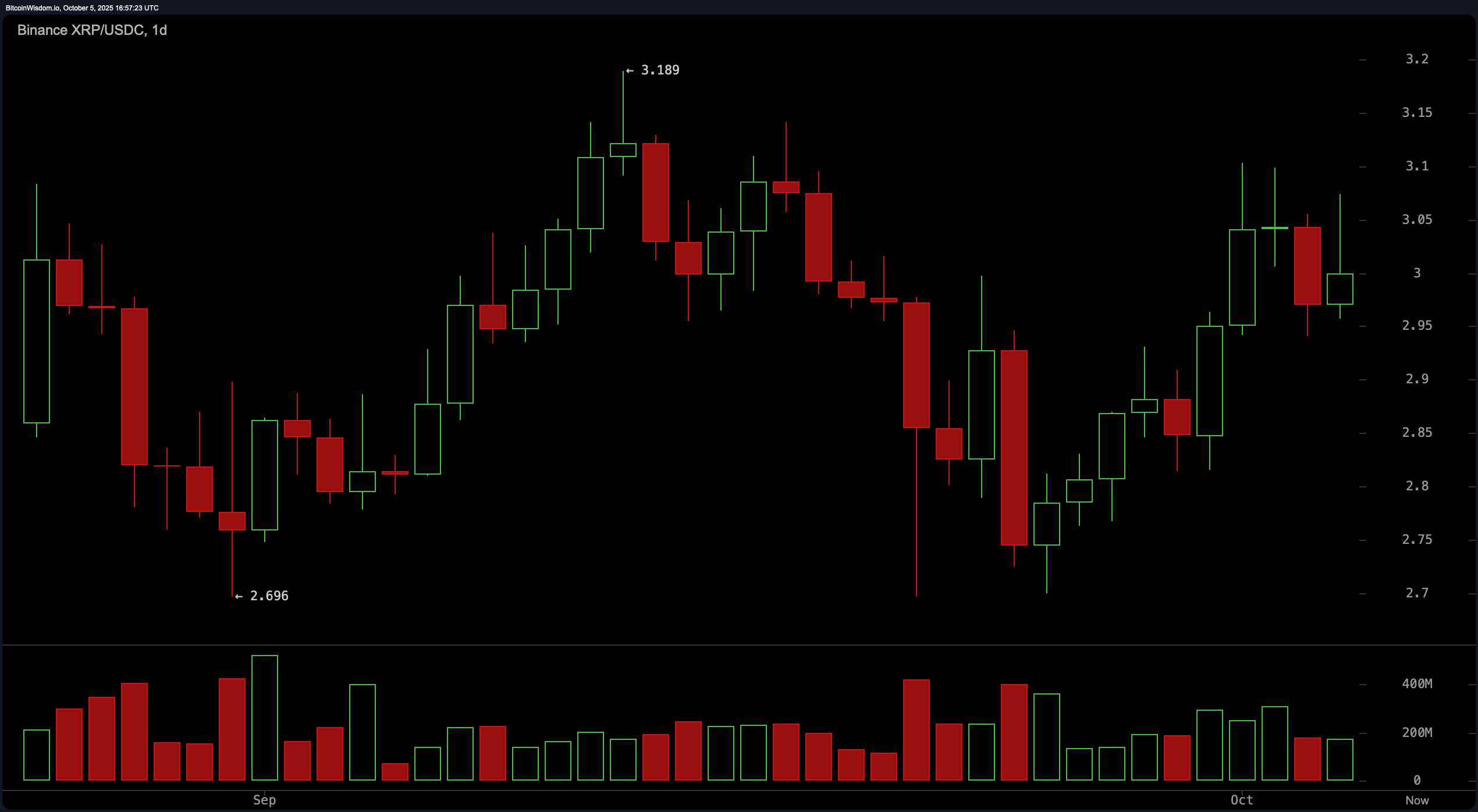

The daily chart paints a more flattering portrait of XRP—she’s in her recovery era. After a dramatic drop from $3.18, buyers showed up strong at the $2.70 reversal zone, sparking a medium-term bounce. Volume surged at the bottom, a classic sign of accumulation, but now tapers off slightly above $3.00—suggesting a bit of hesitation. Resistance stands tall at $3.10 to $3.18, the former throne XRP fell from. Support, meanwhile, is quietly stacking between $2.90 and $2.95. Bulls eye a confirmed breakout and daily close above $3.10 to re-enter the limelight. Anything less is a tease, not a trend.

XRP/USDC via Binance 1-day chart on Oct. 5, 2025.

Now let’s get technical with the oscillators. The relative strength index (RSI) is lounging at 53.81—dead-center and noncommittal, signaling neutrality. The Stochastic oscillator echoes the same with a reading of 75.07. Commodity channel index (CCI) at 55.51 and average directional index (ADX) at a sleepy 14.12 aren’t offering any hot takes either. But wait—momentum says otherwise. The Momentum indicator has perked up at 0.25, sending a subtle bullish whisper. And our trend-following diva, the moving average convergence divergence (MACD), joins the bullish camp with a 0.006 reading. Translation? Momentum’s gently rising, even if the broader sentiment is playing hard to get.

Moving averages, however, are practically singing hallelujah in unison. Every single trendline—whether it’s the exponential moving averages (EMAs) or the simple moving averages (SMAs)—from 10 to 200 periods, are screaming bullish. EMA-10 through EMA-200 and SMA-10 through SMA-200 are all pointing north, supporting a strong structural foundation for XRP’s price. It’s rare to see this level of harmony across such a wide time spectrum—so unless the market throws a tantrum, XRP looks poised for further upside if that $3.10 ceiling cracks. In other words, the bulls have the green light; they just need to press the gas.

Bull Verdict:

If XRP successfully closes above the $3.10 resistance level on strong volume, the bullish structure across all major moving averages and positive momentum indicators suggest further upside potential toward $3.18–$3.20. Buyers appear positioned to maintain control, provided support holds above $2.95, reinforcing a bullish continuation pattern in both short- and medium-term timeframes.

Bear Verdict:

If XRP fails to break above $3.10 and instead loses the $2.94–$2.95 support zone, short-term bearish pressure could accelerate, leading to a retest of lower support levels around $2.90 or below. Weak volume at key resistance levels and a lack of conviction from oscillators could indicate a loss of momentum, placing the current rally at risk of reversal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。