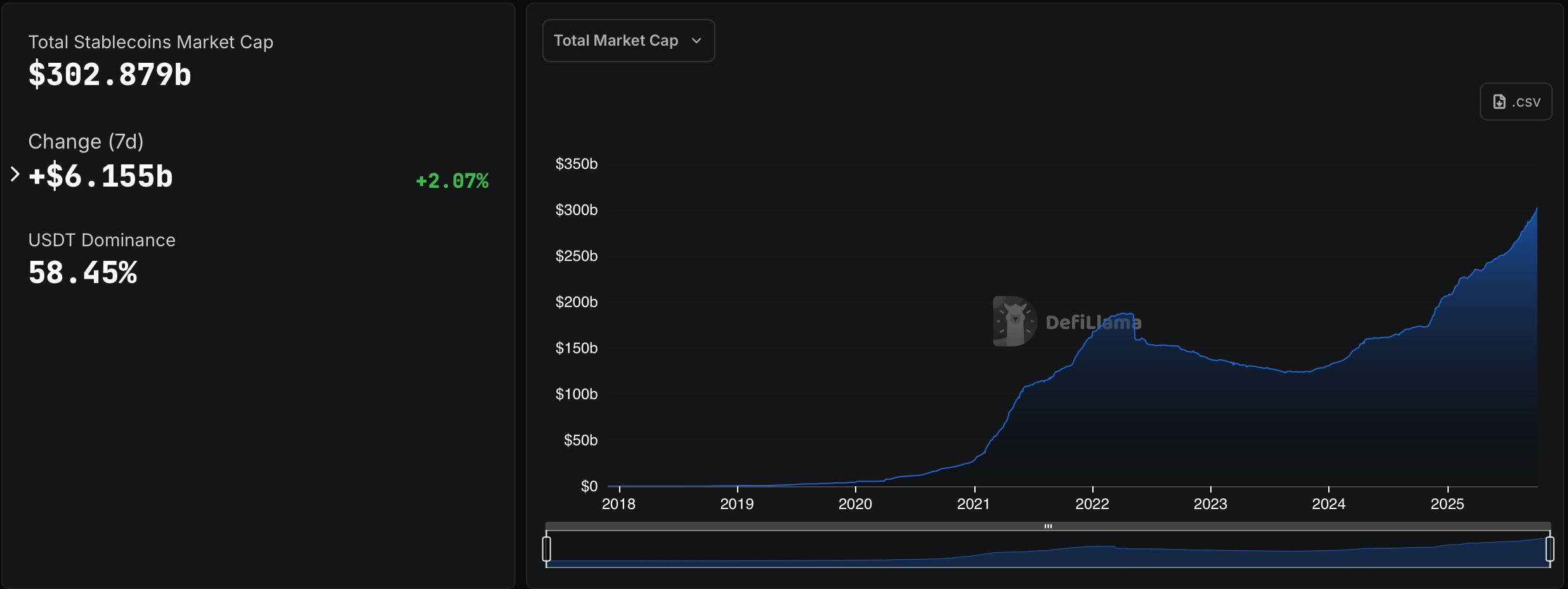

Between Sept. 28 and Oct. 5, 2025, the fiat-pegged token economy fattened up by more than 2%, with another $6.155 billion worth of stablecoins entering circulation. As of Sunday, the sector’s total value hovered at $302.879 billion, according to defillama.com’s stablecoin stats.

Tether’s USDT remains the heavyweight champ, claiming more than 58% of that pie with a hefty $177.018 billion market cap. USDT padded its lead this week, climbing 3.77% ($2.641B) and accounting for 42.91% of the stablecoin sector’s overall growth thanks to Tether’s fresh minting spree.

Source: Defillama.com metrics on Oct. 5, 2025.

Circle’s USDC added $1.676 billion to its stash, now sitting pretty at $75.084 billion after a tidy 2.28% lift. Ethena’s USDe kept the momentum going, welcoming $491 million in new inflows and lifting its market cap to $14.815 billion.

Sky’s DAI, however, drifted slightly off course—its $5.037 billion market cap slipped 1.70% this week. Sky Dollar (USDS) didn’t exactly defy gravity either, dropping 5.85% to $4.311 billion. Over in World Liberty Financial’s corner, the project’s USD1 token showed a hint of pep, nudging up 0.54% to $2.682 billion.

But the show-stealer was Blackrock’s BUIDL, the gym rat of the bunch, pumping up 19.36% to $2.665 billion—clearly skipping rest days. Paypal’s PYUSD followed suit, flexing its minting muscles with a massive 116% gain to $2.542 billion.

Meanwhile, Ethena’s USDtb cruised higher at $1.827 billion, up 14.29%, and Falcon USD (USDf) managed a graceful 5.83% climb to $1.62 billion, wings steady in the stablecoin breeze. As the stablecoin sector swells to new highs, the market’s pecking order looks anything but static.

Heavyweights keep flexing while upstarts muscle in with ambitious growth. If this rhythm keeps up, the next leg of expansion could reshape how liquidity flows—and who ultimately dominates crypto’s U.S. dollar-denominated stage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。