Introduction

In the past few weeks, the perpetual contract DEX market has undergone dramatic changes. Hyperliquid, which had long held the top position, saw its market share plummet from 45% to as low as 8%; meanwhile, new platforms like Aster, Lighter, and edgeX experienced explosive trading volumes, with Aster's weekly transaction volume even surpassing $300 billion. This has led to questions about whether this DeFi platform, once regarded as the "ultimate form of on-chain derivatives," is losing its competitive edge. However, focusing solely on the changes in trading volume may underestimate Hyperliquid's true strength.

1. Behind the Sudden Drop in Market Share, Hyperliquid Remains the Most Profitable Perp DEX

Although Hyperliquid's market share has declined in the short term, it remains the most profitable perpetual contract DEX currently.

From a revenue perspective, Hyperliquid's annualized revenue is stable and shows significant growth. Unlike most similar projects that rely solely on incentives to maintain trading volume, it has genuinely built a DEX with a sustainable business model.

Currently, Hyperliquid's market cap to revenue ratio (P/S multiple) is approximately 12.6 times, which is still within a reasonable range in the rapidly growing DeFi sector. It is important to note that the circulating HYPE only accounts for about 27% of the total supply, and the fully diluted valuation (FDV) is higher, reflecting market confidence.

More critically, the entire Perp DEX market is in a structural upcycle. Since 2022, the share of decentralized perpetual contract trading volume in the overall derivatives market has increased from less than 2% to over 20%, growing nearly tenfold in three years.

Whether as a driver or a beneficiary, Hyperliquid is a central participant in this trend.

2. The Surge of Aster and Market "Fever" — The Stability and Instability of Hyperliquid

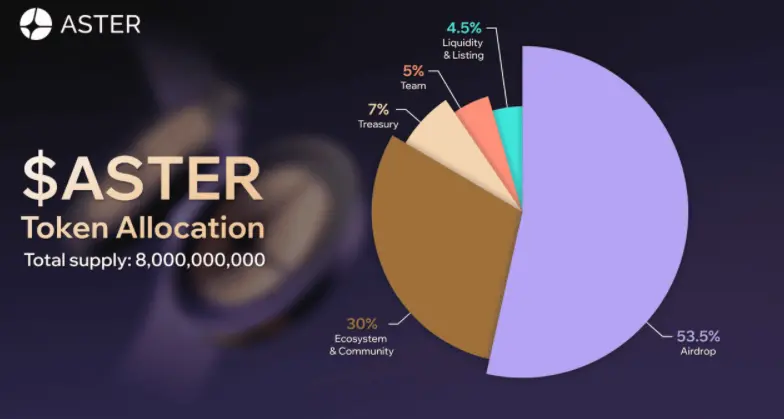

The recent market turbulence stems from the Aster platform, a Perp DEX associated with Binance. Within just one week, Aster's trading volume skyrocketed from $11 billion to $270 billion, capturing over half of the market share. Such explosive growth is almost impossible to explain through natural trading behavior. Unless future data validates this, it is more likely a "short-term fever" driven by incentives.

Aster is not an isolated case. Several platforms, including Lighter and edgeX, have also doubled their trading volumes in a short time, but the core logic remains the same: attract high-frequency trading through expectations of future airdrops → hope that some users will stay.

The problem is that a short-term surge in trading volume does not equate to product competitiveness. Whether users can truly be retained depends on trading stickiness and open interest. On these two core metrics, Hyperliquid still ranks first — with an open interest market share as high as 62%, and it has continued to grow over the past year.

This indicates that users are not passively retained but are actively choosing to stay due to product experience and trust. This long-term retention relies not on subsidies but on the product itself.

3. From Perp DEX to DeFi Ecosystem, Hyperliquid's Growth Engine

Hyperliquid is not solely betting on the perpetual contract business.

It is building a second growth curve through a Layer 1 + stablecoin + open protocol system to reduce the risks of a single business and enhance the intrinsic demand for the HYPE token.

(1) HyperEVM:

Currently, Hyperliquid's Layer 1 network has deployed over 100 protocols, with a TVL exceeding $2 billion and daily application revenue exceeding $3 million.

The ecosystem includes native projects (such as Kinetiq and HyperLend) and has attracted leading multi-chain protocols like Pendle, Morpho, and Phantom.

This makes it one of the few DeFi platforms that "has successful applications and general public chain capabilities."

(2) USDH Stablecoin:

Issued by Native Markets, with reserves managed by BlackRock and Superstate.

Currently, its circulating market cap is about $25 million, and it has become the base asset for pricing in Hyperliquid's spot market.

Stablecoins themselves are one of the most stable profit models in the crypto space, with their earnings feeding back into ecosystem liquidity, creating additional value support for HYPE.

(3) HIP-3 Proposal:

The upcoming proposal will allow developers to create custom perpetual markets on Hyperliquid, but they must collateralize 500,000 HYPE.

This mechanism not only expands the range of trading assets but also adds new consumption scenarios for HYPE, making Hyperliquid a "derivatives infrastructure layer."

4. Risks and Turning Points — Three Things Hyperliquid Needs to Prove

Despite Hyperliquid's solid fundamentals, the validity of the investment logic still depends on three key assumptions:

- Trading volume and market share continue to grow.

If total trading volume declines and market share is further compressed, it indicates that competitors are eating into the market rather than expanding it together.

- Open interest remains ahead.

If open interest significantly declines or competitors approach, it will signal a decrease in product stickiness.

- USDH achieves robust liquidity.

If USDH remains unpegged for an extended period or fails to form an effective ecosystem within 12 months, Hyperliquid's diversified expansion will be hindered, affecting the value support for HYPE.

These variables determine whether Hyperliquid can upgrade from a "high-profit DEX" to a "self-circulating financial ecosystem."

Conclusion

From a plummeting market share to ecosystem expansion, Hyperliquid is in a phase that is being "misread." In the short term, it does face pressure from incentive-driven competition; but in the long term, it possesses the industry's most solid revenue model, the strongest user stickiness, and an emerging second growth curve. What truly determines the outcome is not the temporary highs and lows of trading volume, but whether it can build a decentralized financial system with cash flow and network effects. For Hyperliquid, this "defensive battle" may very well be the starting point for the next round of expansion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。