BNB All Time High: Record Network Activity, Institutional Buying Boost

Ever seen a crypto rally with strong price action, rising demand, and through-the-roof network utilization all at the same time?

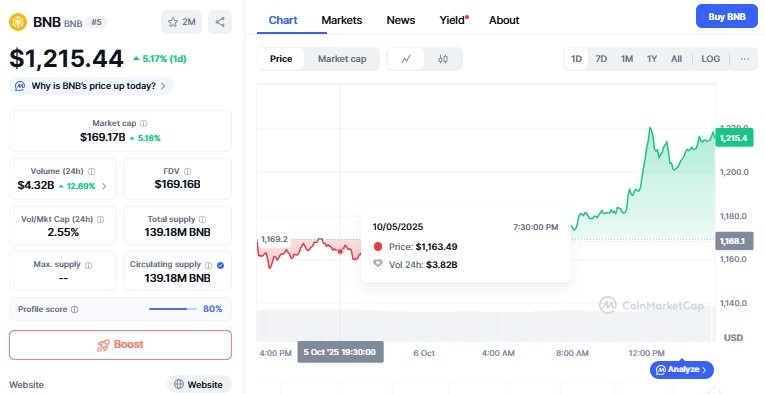

That's exactly what we're seeing on Binance Coin today. The token has set a BNB All Time High of $1,215.42, its highest since launch.

Source: CoinMarketCap

The 5.17% climb in just 24 hours shows how investors and institutions are fuelling the coin's momentum growth.

Network Activity Hits Record Heights

Apart from price charts, the BNB Chain itself is more active than ever. With an estimated 60 million monthly consumers and 4.3 million daily transactions, the activity of the network has increased by 22% in only a month.

The fees on transactions have fallen to 0.05 Gwei, which makes the network cheaper for developers and traders alike.

This increased usage fuels actual demand for it because it must be used to pay fees as well as to stake tokens.

The combination of greater usage and reduced fees is one explanation why the token has increased more than 40% this month alone, driving it to this BNB All Time High.

Institutional Investors Fuel BNB's Rise

Large funds are now flowing into this digital currency.

-

Electric vehicle company Jiuzi Holdings just announced a $1 billion crypto treasury strategy that features Binance Coin as a top asset.

-

Kazakhstan's Alem Crypto Fund also included BNB in its portfolio.

-

Also VanEck's pending ETF filing indicates that large institutions are beginning to take this cryptocurrency seriously.

-

Analysts say that Jiuzi’s investment alone could absorb nearly 1% of it’s total supply, a massive show of confidence.

These large allocations create steady buying pressure, which plays a big part in keeping prices above the $1,200 mark.

Technical Momentum and Price Signals

Technically, Binance Coin is strong.

-

The price has crossed above the key $1,109 resistance and is now trading well above it.

-

The MACD is still in positive territory, indicating that momentum is still with the bulls.

-

But the RSI is 73, which implies that the coin is a bit overbought. This could create a short-term correction prior to the next move upwards.

BNB Price Prediction and Future Outlook

Short-Term Price Target: $1,283 if it stays above $1,200, with possible small dips along the way.

A temporary dip would not be out of the question following the $256 million in liquidations over the last day, both long and short positions, according to coinglass liquidation data .

Long-Term Price Target: While no exact figure was given, sustained growth, institutional demand, and network adoption indicate BNB could trend higher beyond $1,300–$1,400 in the coming months.

Analysts predict that BNB All Time High might not be the last time this year. As utilization on the network grows and institutions keep on purchasing, BNB's long-term direction seems to be robust.

Its deflationary design, consistent adoption, and growing treasury demand more than qualify it as a mere trading token.

For the time being, traders must observe Bitcoin's action and the $1,109 support area for further cues.

The net worth of Binance founder Changpeng Zhao has risen to $87.3 billion , ranking him as the 21st wealthiest person globally, as per Forbes, evidence of how crypto's success is transforming the crypto industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。