Lighter - Don’t trust—verify

This generation of Perp DEX has fundamentally differentiated itself from the previous generation represented by “GMX, DYDX.” Since it is still a Perp DEX, the title will continue to discuss it as a Perp DEX.

Lighter is a Perp DEX invested by the well-known American venture capital firm a16z, based on Ethereum's ZK Rollup, and follows an order book (CLOB) model.

In an AMA at the end of August this year, the team mentioned some future plans for Lighter. For example, it will launch RWA derivatives and Pre-launch perps (these two developments have lower volumes than spot trading and are planned to be launched almost simultaneously). Season One (private testing phase) is about to end, and the distribution rules for points during this phase are intentionally not fully disclosed to prevent score manipulation. Season Two (after public testing) will provide clearer guidelines. Additionally, as it enters the next phase, there will be a scheduled disclosure of some well-known investors and their contributions. Most importantly, the TGE is still progressing normally, with an expected timeline in Q4 of this year.

Today (2025.10.3), after 8 months of private testing, the Lighter public mainnet has officially launched. However, RWA perps, Pre-launch perps, and Spot have not been seen, and it is unclear whether the TGE will be delayed. A wild guess is that Spot and TGE will launch simultaneously, while RWA perps and Pre-launch perps will be introduced during the public testing period.

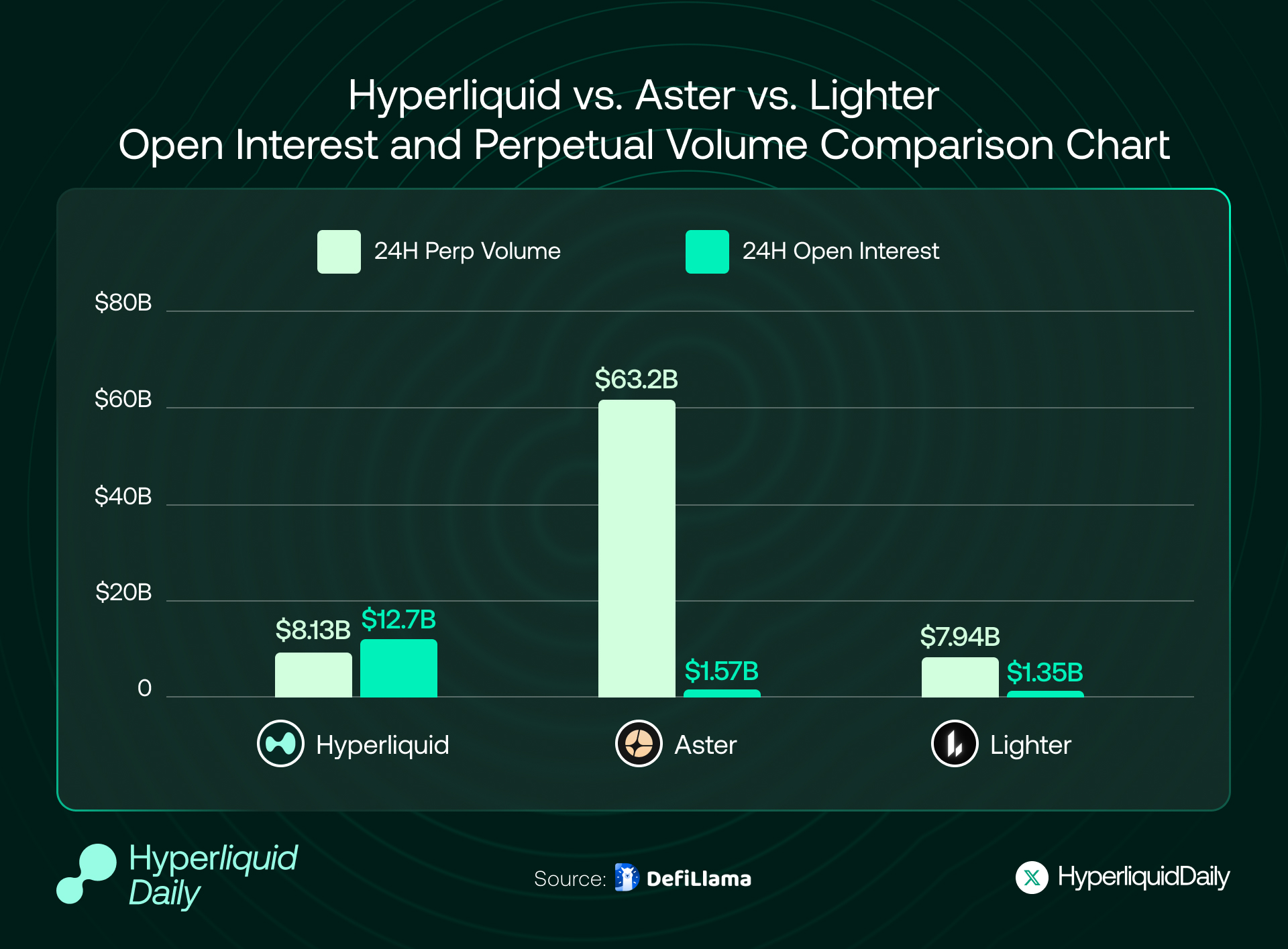

The image above shows the 24-hour data for Perp DEX on October 1, 2025, with Hyperliquid, Aster, and Lighter occupying the top three positions in terms of trading volume and open interest (OI) data. From the Volume/OI ratio, Hyperliquid is less than 1 (indicating that many users hold positions overnight, making the market healthier) with a significant real trading volume and user proportion; Lighter is around 6, which is at a medium level; Aster is about 40 at the highest, indicating that Aster is currently experiencing severe volume manipulation as the new season begins.

The first two TGE launches were very successful, whether Lighter will be the next “epic big shot” after Hyperliquid and Aster remains uncertain, but community expectations are very high.

Lighter User Growth Flywheel and Points Incentive Mechanism Design

Lighter's growth logic revolves around the two core concepts of “invitation-based cold start + points-driven fission.”

During the cold start phase (lasting 8 months), Lighter used a closed testing strategy, allowing only users with invitation codes to register (public testing just opened today, and additionally, users with weekly points exceeding 50 can receive 3 invitation codes). The difficulty of obtaining invitation codes is relatively high, and existing users need to accumulate a certain trading volume or points to unlock a small number of invitation codes. For each successful invitation of a new user, the inviter receives an additional 10% points reward from the invited user. This design increases the cost of “batch registering small accounts,” effectively suppressing witch attacks, and creates a market scarcity effect through the rarity of invitation codes. There has even been off-market trading of invitation codes and points within the community, further reinforcing users' FOMO psychology. A fixed weekly distribution of 250,000 points is made, with limited points and no inflation.

The combination of cold start, fission, prevention of witch attacks, and airdrop incentives creates a self-reinforcing growth flywheel: expected airdrop → trade to accumulate points → unlock invitation codes → fission spread → community expansion → points value increase → attract users again.

Some Scoring Strategies Based on Official Hints

- Small Capital ($10k) Scoring Strategy

- Target Selection: Choose trades with low OI and low trading volume (as reminded by the official), making it easier for the trading volume/position to be “seen” by the points model without pushing up slippage.

- Order Method: Focus on small, multiple limit orders to reduce impact costs; avoid “strategy-less order waterfalls.”

- Risk: Low liquidity means higher slippage and liquidation risks—preferably leverage ≤ 5x, maintain a margin reserve of about 2 times as a buffer, strictly set take-profit and stop-loss, and tightly control liquidation (1% nominal principal liquidation fee is very “painful”).

- Sub-accounts: Used to isolate strategies/risk control (not to replicate multiple account behavior). The official states that sub-accounts are included in statistics, but witch detection will reset to zero, so do not abuse multiple accounts.

- Target Selection: Choose trades with low OI and low trading volume (as reminded by the official), making it easier for the trading volume/position to be “seen” by the points model without pushing up slippage.

- Medium/Large Capital (≥ $10k–$1m) with Semi-Automatic/Quantitative

- API Trading: Generate a key, receive the API role in Discord, and use TWAP/VWAP for low-impact execution; • Control the order-fill ratio and cancellation rate (e.g., cancellation rate ≤ 70% as an internal red line) to avoid being flagged as volume manipulation/HFT abuse.

- Costs and Identity: If the trading style is close to market making/HFT, calculate the marginal returns of the strategy based on 0.02%/0.002% costs; accounts leaning towards mid-line/trend should maintain retail characteristics (0% fee) (low frequency, low cancellation, high fill ratio, long holding time).

- Hedging and Risk: Can perform directional hedging/basis trading on other exchanges to achieve “normal trading” rather than self-trading; any wash trading or counterparties within the same account may be viewed as wash trading.

- User Public Pools Points and Capital Efficiency

- Passive Participants: DeFi farmers who wish to “invest to earn points” (the latest policy requires first obtaining 50 points to have a 25% quota) should prioritize user-created pools (as the protocol-operated pools do not count for points). Selection criteria: historical drawdown, net value curve, maximum position, past 30-day win rate, and average holding duration.

- Active Operators: Creating user pools can simultaneously expand capital scale and points sources, but must ensure personal capital co-investment, public strategy rules, and risk control lines to establish credibility; avoid excessive risk-taking for “point chasing.”

Based on my experience from a few weeks of trading, here are some speculations about real trading points (anti-volume manipulation). There are three points (not necessarily correct, welcome to discuss):

- Formula: f=(real transaction amount × maker quality × OI‑hours × price impact negative reward), if any item is 0, all are 0.

- Multiplier: Market making in key depth areas (e.g., within 1bp) has weight; the longer the net holding period, the higher the weight (encouraging real risk tolerance).

- Exclusion: Short-cycle wash trading within the same account/same IP/same device, extremely high cancellation ratios, and net OI≈0 “self-trading” rings.

Try to avoid two extremes: one is high trading volume X OI‑hours with instant opening and closing, and the other is low trading volume X high OI‑hours hedging positions; the final multiplied result is not very large (just a guess).

Public Capital Pools

Public capital pools include protocol public capital pools and user protocol public capital pools, which are not particularly different from Hyperliquid.

In the LLP part, Lighter implements a 0 fee policy for ordinary traders (both Maker and Taker fees are 0), aiming to profit through high-frequency traders. As of today, with public testing starting, ordinary user trading remains completely free, with only funding rates settled between long and short, and the platform does not charge additional fees.

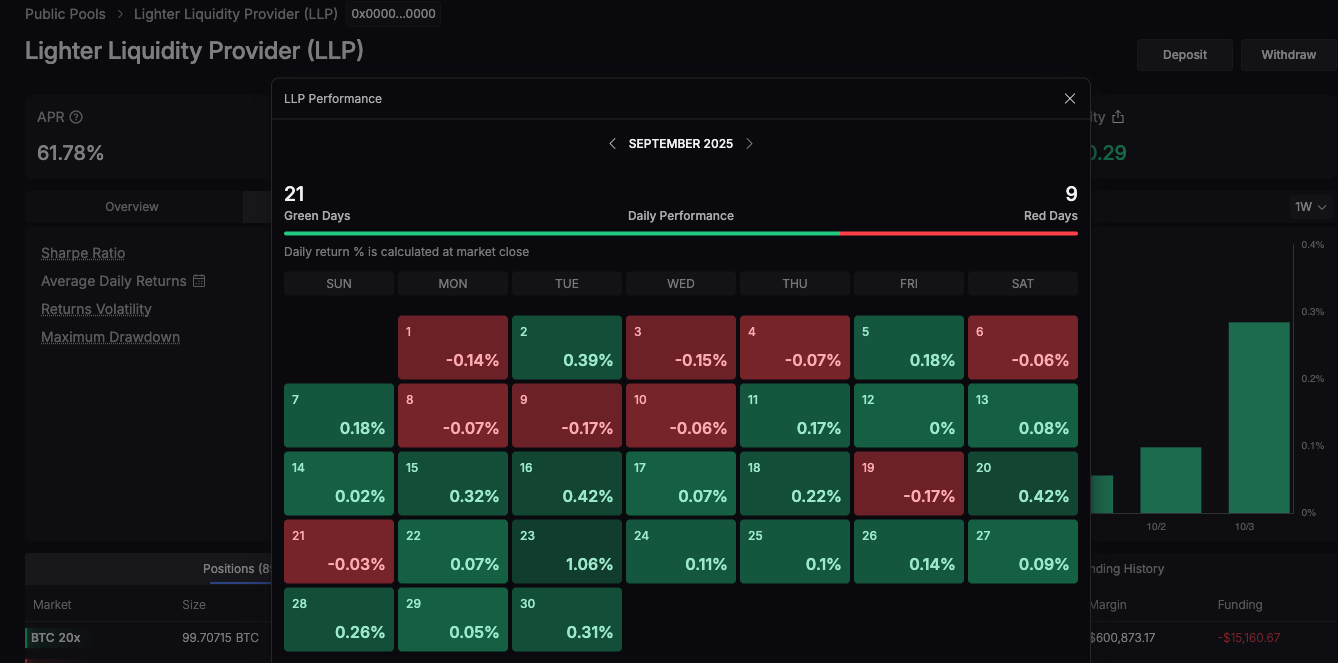

In this model, the revenue of LLP mainly comes from market making profits and liquidation profits: when the LP capital pool acts as a counterparty, if most traders incur losses, the corresponding profits and losses enter LLP. The current LLP APR is about 60% (for example, in September, there were 21 days of positive returns and 9 days of negative returns).

At the same time, during liquidation, LLP can charge certain fees or retain margin. Lighter's liquidation mechanism stipulates that some forced liquidations will be matched at “0 price,” and if executed at a better price, no more than 1% liquidation fee will be extracted and injected into LLP. Therefore, whenever forced liquidation or shutdown occurs, LLP acts as an insurance fund, earning liquidation fee income. Additionally, LLP, as a counterparty, also earns funding fees (the funding fees paid by the counterparty flow to LP) and spread profits. Due to the zero trading fee in the early stages, Lighter's stable income sources are limited, and LLP revenue largely depends on market volatility and traders' profit and loss situations. Overall, Lighter LLP currently creates revenue for LP through counterparty profits and losses, funding fees, and liquidation fees, and will later introduce some fee-sharing.

Moreover, after the start of public testing today, the threshold for public capital pools LLP has increased from “0 points can deposit 25%” to “must first obtain 50 points to deposit 25%,” which maintains a high APR to some extent and protects the interests of early users from being diluted.

The user public capital pool part is similar to Hyperliquid's, akin to a secondary fund and copy trading system, where fund managers/traders take a 20-30% commission. The difference is that participants in the user public capital pool can earn points, while LLP cannot, but the risks are also higher than LLP, requiring caution.

Since no tokens have been issued yet, Lighter's current user retention mainly relies on points incentives and community operations, with “zero fee trading” still being one of Lighter's biggest selling points. For those who are optimistic about Lighter in the long term and plan to hold Lighter tokens, here are some suggestions for the post-TGE era. First, referencing Aster, after the first round of airdrop hype, immediately start the second phase of activities, issuing a second airdrop, successfully retaining some users into the second phase. Lighter could also consider reserving a portion of tokens for rewarding users who continue to trade after the token issuance (for example, distributing based on monthly or quarterly trading volume, active days) to smooth the transition during the airdrop's activity gap. Second, at the same time as the TGE, launch a VIP level and fee discount system. Drawing from Hyperliquid (which launched a bit late), establish user tiers based on token holdings or trading volume. For example, holding a certain amount of platform tokens or reaching a trading volume threshold in the past 30 days could upgrade VIP levels, enjoying benefits like fee discounts, priority customer service, and testing qualifications. This approach encourages users to hold tokens (not sell them) and prompts high-end users to continue trading to maintain discounts, forming a retention loop.

Overall, Lighter technically introduces ZK to ensure fairness, offers 0 fees to be user-friendly, and is poised for growth through its points mechanism. It will undoubtedly secure a place in the Perp DEX space. Additionally, as mentioned in the AMA at the end of August, Lighter will rhythmically disclose some well-known investors in the next phase, and today the public testing officially begins, with the official Twitter receiving endorsements from several Ethereum ecosystem founders like EigenLayer. Other news indicates that Founders Fund, Arthur Hayes, etc., have also participated in the investment.

Finally, Discussing Lighter and the “Ethereum Endgame”

Lighter does not build its own L1 and full protocol like HyperLiquid; instead, it will serve as a natively composable Ethereum L2—such as tokenizing LLP to the mainnet and collaborating with protocols like Aave, enjoying a low-cost, low-latency, verifiable execution environment. The ecosystem follows the “Ethereum composability” route, allowing for faster integration into mainstream DeFi rather than a closed-loop self-build.

Lighter = “Verifiable Exchange” on the Ethereum Endgame. It incorporates the two most sensitive aspects of exchanges—price-time priority matching and liquidation—into ZK proofs and entrusts asset custody, state, and data availability to Ethereum; as 4844→Danksharding, (e)PBS, and (potential) native Rollups gradually land, Lighter's advantages in cost, censorship resistance, and trust minimization will increasingly resemble “protocol-level features.” This is its structurally aligned relationship with the Ethereum endgame.

If Aster is backed by Binance, then Lighter is backed by Ethereum.

For a detailed analysis of Perp DEX: Hyperliquid, Aster, Lighter, edgeX, see the next article.

The above is just personal opinion and not investment advice; please point out any errors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。