Written by: Pavel Paramonov, Hazeflow

Translated by: Glendon, Techub News

Editor’s Note: At the end of September, the new crypto project Flying Tulip, founded by DeFi veteran Andre Cronje, completed a $200 million private seed round financing with a token valuation of $1 billion. Investors include Brevan Howard Digital, CoinFund, DWF Labs, FalconX, Hypersphere, Lemniscap, Nascent, Republic Digital, Selini, Sigil Fund, Susquehanna Crypto, Tioga Capital, and Virtuals Protocol. The funds raised will be used to create an on-chain exchange covering the "entire DeFi space," including spot trading, derivatives trading, lending, stablecoins, and insurance services. Additionally, Flying Tulip plans to raise up to $800 million through a public sale of its FT tokens at the same valuation. Andre Cronje stated that this sale will take place on Flying Tulip's own platform rather than using existing ICO platforms.

Using Fundraising for Operating Expenses is Like Slaughtering the "Cash Cow"

Unfortunately, in most projects, tokens are merely used as fundraising tools without practical utility. As a result, project teams often sell tokens to cover operating expenses, incentive programs, liquidity mining activities, and more.

This practice significantly impacts token prices and triggers FUD (fear, uncertainty, and doubt) in the community when teams sell tokens. The Ethereum Foundation is a typical case: when they sell ETH, the community accuses them of dumping.

In contrast, if the raised funds can be reinvested in low-risk strategies, the generated returns should be sufficient to cover operating costs until the product starts generating revenue.

Flying Tulip's Alternative Vision

The core idea of Flying Tulip is to treat fundraising as a "cash cow" rather than simply consuming the principal. The project team does not directly use the raised funds; instead, they deposit them on-chain to earn returns and use these returns to fund the initial protocol operations. (Techub News notes that a "cash cow" refers to a business or enterprise that can continuously generate a large and stable cash inflow.)

The key to this idea is that the team holds no tokens at the initial stage. If they have not started generating revenue, the company should not have any value, and token ownership should be tied to actual income.

Investing, especially venture capital, is an asymmetric game: you might gain 1000 times your investment, but you can only lose your initial investment at most. However, venture capitalists often "cast a wide net" across dozens or even hundreds of transactions and frequently incur losses—that's part of the game.

Flying Tulip's plan also includes a downside protection mechanism, ensuring that even in the worst-case scenario, investors can recover their initial investment.

Thus, the core idea of Flying Tulip is to raise a large amount of funds but not actually spend it, only using the returns from these funds to pay for operating expenses and repurchase its own tokens.

Core Value Flow

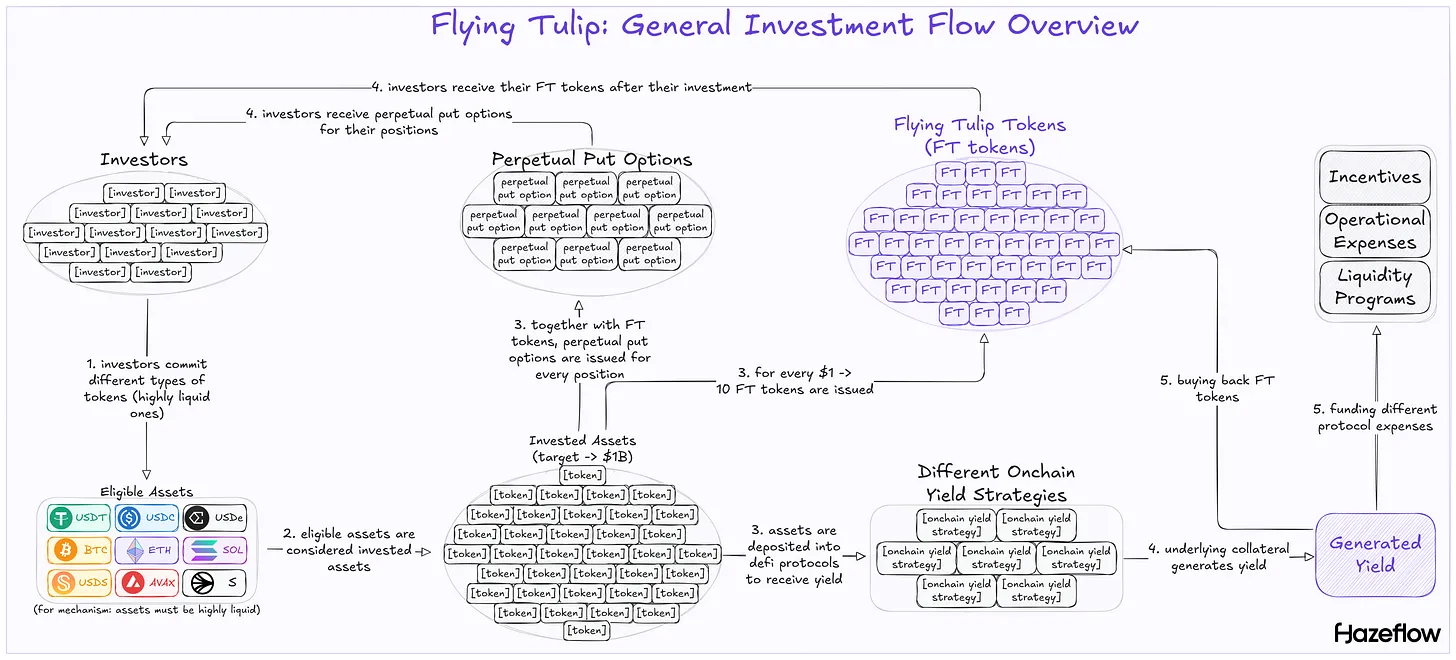

Investors commit different types of high liquidity tokens;

These tokens serve as supporting capital for FT tokens;

FT tokens are issued simultaneously with a permanent put option for each investor's position;

Investors receive FT tokens and permanent put options;

Invested capital is deployed across multiple DeFi protocols to earn returns;

The generated returns are used to repurchase and burn FT tokens, thereby increasing token scarcity;

The generated returns are also used to pay various protocol fees.

What are Permanent Put Options?

First, perpetual futures (perps) and perpetual options are not the same thing.

Perpetual futures are ongoing contracts that allow traders to bet on asset price movements without an expiration date. Profits or losses steadily increase or decrease with price fluctuations, and small fees are paid periodically to ensure the contract price aligns with the actual market price.

Permanent options give traders the right (but not the obligation) to buy or sell an asset at a fixed price indefinitely. The profits from such options are not uniform and can limit the buyer's losses, including upfront fees and potential changes in the fixed price over time.

Options are divided into two types: put options (sell rights) and call options (buy rights). In the context of Flying Tulip, permanent put options are issued simultaneously with FT tokens, meaning investors can sell their tokens at the initial investment price at any time.

For example, if an investor buys 1000 FT tokens at a price of $10 each, they can sell these 1000 FT tokens at $10 each at any time, even if the value of FT tokens has fallen below that price. It is important to note that put options can be traded independently, so there will be a public market where the price is likely to be highly correlated with the price of FT tokens.

Therefore, holding a permanent put option equates to having a guarantee that the asset's value will not be lost.

How Will the Team Obtain Tokens if They Do Not Hold Any at TGE?

In the initial phase, investors hold 100% of the token supply, and the team holds no tokens. In fact, before the protocol starts generating profits, the team can be said to have "nothing," which incentivizes them to work hard to make their protocol profitable.

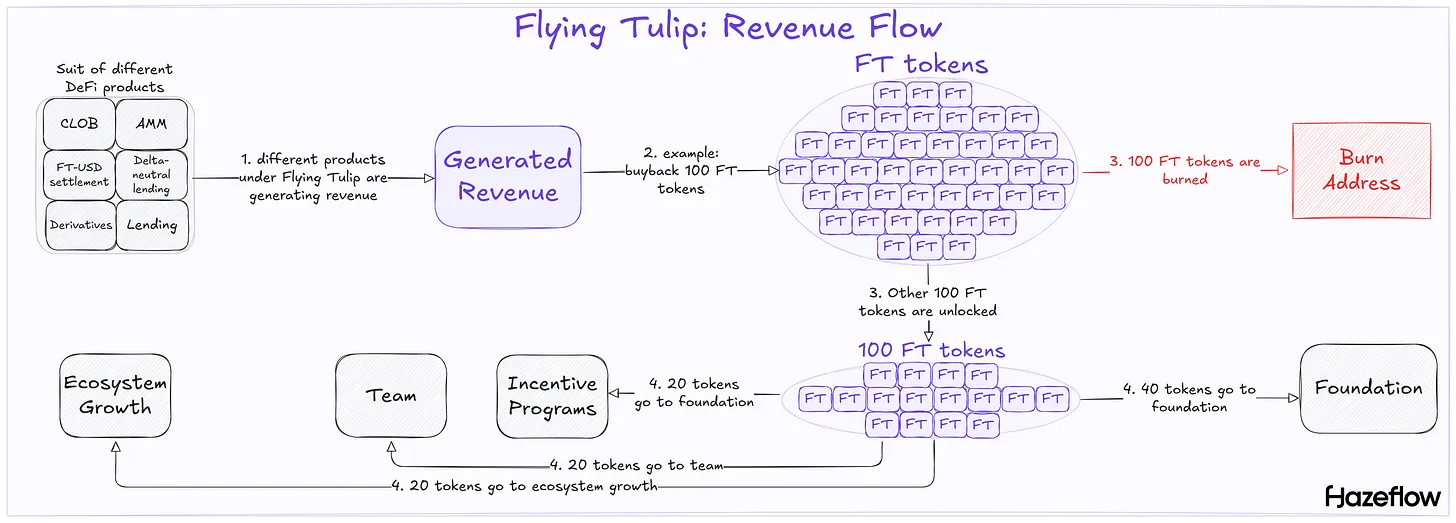

Once the team's entire DeFi product suite starts generating revenue, 100% of the profits will be used to repurchase and burn FT tokens. At the same time, an equivalent amount of tokens will be unlocked and allocated to the foundation, incentive programs, ecosystem development, and the team itself (specific ratios can be seen in the diagram below). The profits and fees will ultimately provide buying pressure for FT tokens.

Why Are Only Stablecoins, BTC, ETH, SOL, and AVAX Allowed as Backing Assets?

Put options are a core function of the protocol. If assets are locked in positions with low liquidity, the protocol may not be able to meet redemption demands, especially under stress scenarios, facing the following risks. Put options are asset-specific; for example, if an investor invests USDC, they must also receive USDC upon redemption rather than other assets. Therefore, each asset must maintain high liquidity. Funds cannot be reallocated to higher-yielding investment opportunities because the returns generated may be from other types of assets.

First, this is why only high liquidity assets can serve as backing assets. Second, this is also why high liquidity assets must be deployed in high liquidity strategies (e.g., stablecoins deposited in Aave, ETH converted to stETH, SOL deposited in jupSOL, etc.).

What Happens When FT Tokens Are Sold or Transferred?

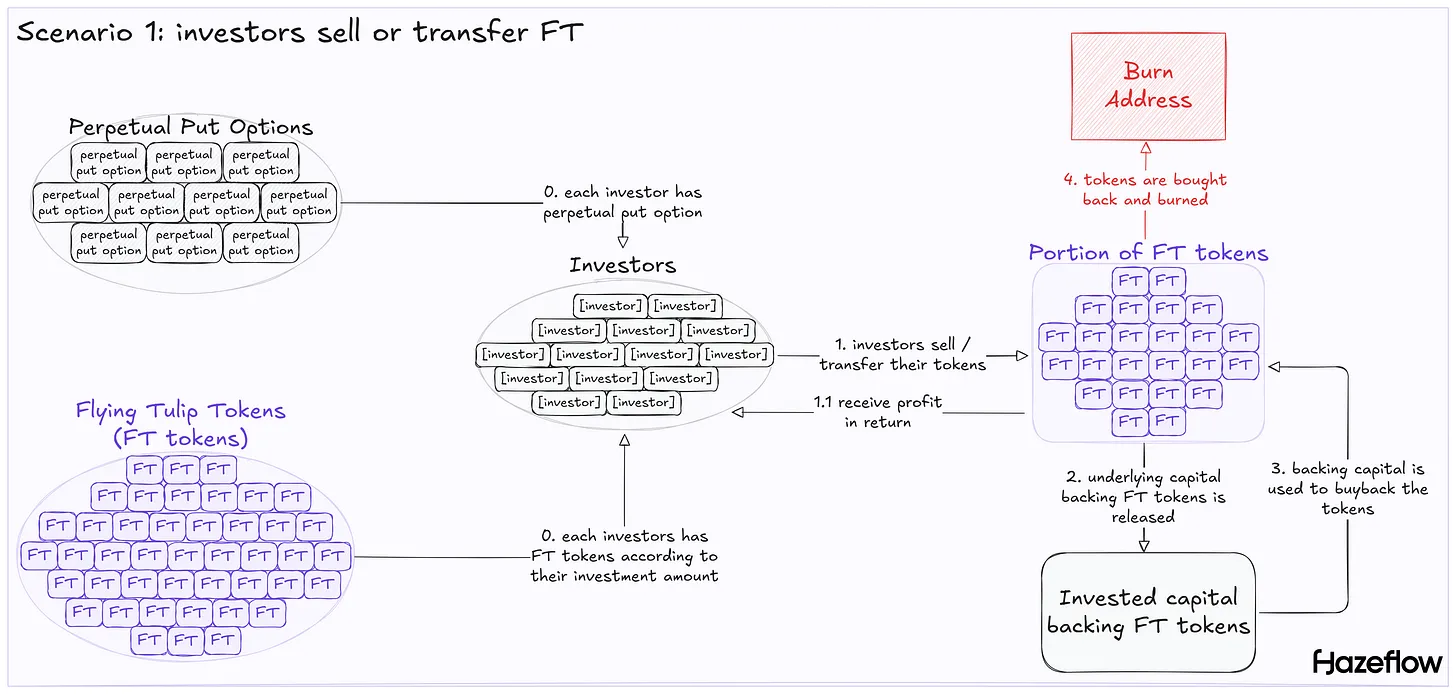

If investors transfer or sell their tokens, their put options will become invalid.

For example, if an investor uses 100 USDT to purchase 1000 FT tokens. When they sell the tokens (or part of the tokens), they will receive 100 + USDT (assuming the investor has selling incentives rather than exercising the option). The initial 100 USDT (the supporting capital for 1000 FT) will be released for repurchasing FT tokens and burning them, thereby reducing the total supply of tokens.

An investor pays 100 USDT (1 FT = 0.1 USDT) to purchase 1000 FT tokens;

The investor selling 1000 FT tokens will receive 110 USDT (1 FT = 0.11 USDT);

The initial supporting capital of 100 USDT has been released;

100 USDT is used to repurchase 909 FT (1 FT = 0.11 USDT);

These 909 FT are burned, reducing supply and increasing token scarcity.

In summary, when investors sell tokens, they can always obtain some profit; otherwise, there would be no reason to sell (they can always recover their investment without any loss). Token sales will affect prices, depending on the quantity sold. Repurchasing and burning tokens is intended to offset price declines and reduce volatility caused by sell-offs by lowering the supply of tokens.

What Happens When Exercising Put Options?

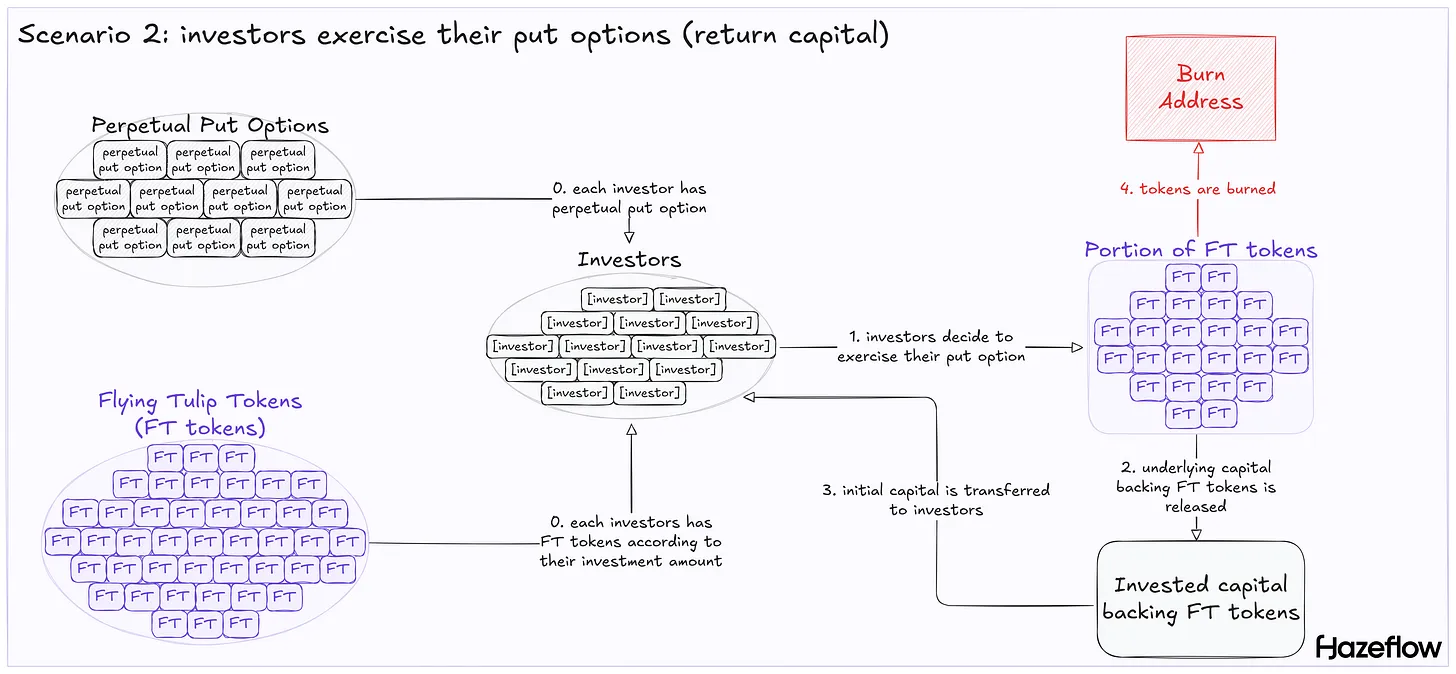

Investors can exercise their options at any time since they are permanent. However, investors are only motivated to exercise their options when the current cost of the tokens is less than or equal to their initial investment amount.

Clearly, investors will not exercise their options when they wish to sell for a profit (as this would be pointless). Therefore, put options are only exercised when investors wish to sell tokens at their initial investment amount without loss.

In this case, the initial capital is returned to the investor, and the tokens are burned. In terms of value flow, exercising options is similar to selling for profit: in the first case, the tokens are burned; in the second case, the tokens are repurchased and burned. In fact, regardless of the actions taken by investors, their behavior helps reduce the token supply.

What Risks Does This Model Have?

I categorize risk types into two categories: general risks and model-specific risks.

General risks refer to the risks present in most DeFi products. The stability of stablecoins and anchor assets used as backing assets must be considered, as most assets will earn returns through staking. Assuming USDe is one of the core backing assets, staking it as sUSDe would further amplify the risks, as these assets are sensitive to market financing rates. Returns could turn negative, or may not even be sufficient to cover the redemption of permanent put options.

In this case, the protocol will bear the losses, and the downside protection promised by the put option mechanism may fail. Clearly, since most backing assets are stablecoins (primarily USDT and USDC), there are regulatory and legal risks. However, to be fair, if such risks occur, they will affect the entire industry, not just Flying Tulip.

Additionally, model-specific risks are more concerning, especially considering Flying Tulip's demand for "instant liquidity" and the delays in the trading supply chain. The issue lies in the unbinding period or withdrawal queue of staked positions. On Ethereum, delays may occur due to network validators exiting the stETH queue. The withdrawal queue is more dangerous than the ETH unstaking queue because the funds involve potential risks from multiple underlying protocols.

If there are a large number of related put options being exercised, delays will become a problem when redemptions require same-day liquidity. This could lead to investor panic and the exercise of options to cover potential losses, further exacerbating system instability.

Opportunity Cost

If the price of FT remains around the initial $0.1 for an extended period, the value of FT will stagnate. Holders will be unable to realize capital gains, and their investments will be locked in a low-volatility, momentum-lacking asset, rendering their participation meaningless. They could easily deposit their money elsewhere, as depositing USDC on Aave would yield similar returns.

In Flying Tulip, the supporting assets themselves can also earn similar returns. These returns indirectly support FT holders through repurchases, stabilizing or moderately increasing the token's value, but the process is not straightforward.

However, if the price remains unchanged, the returns for holders will be the same as those from directly holding stablecoins and earning returns, without the additional benefit of significant appreciation. This is because, at this level of repurchase, the primary goal is to maintain the floor price rather than generate excess returns.

What is the Essence of This Product? Is It Just a Fundraising Mechanism?

This part is particularly interesting. You might wonder why the entire text focuses on the fundraising mechanism, but what is the actual product? This model seems applicable everywhere, but aside from the fundraising mechanism, how is the specific product designed? How are returns generated?

Currently, there are no clear details about the specific product, but the team hopes to build a complete DeFi super application based on this, covering its own stablecoin (ftUSD), delta-neutral lending markets, delta-neutral derivatives, insurance, on-chain CLOB (Central Limit Order Book), permissionless AMM (Automated Market Maker), lending, and permissionless derivatives. FT tokens will be natively integrated, and the revenues from these products will be used for repurchases and to distribute returns to users (of course, also to support its own operations).

Origin of the Name "Flying Tulip"

I am personally very interested in this question because "Flying Tulip" itself has no inherent meaning, so I sought confirmation from the team.

Flying refers to "The Flying Dutchman"

Tulip refers to "Tulip Mania"

The Flying Dutchman (a ship destined to sail forever) symbolizes the volatile yet open and permissionless cryptocurrency market (much like the sea). Additionally, Andre Cronje himself is of Dutch descent.

"Tulip Mania" represents the history of the Dutch Republic, where speculative trading led to a surge in the prices of rare tulip bulbs, followed by a crash—one of the greatest financial lessons and a part of the world's financial heritage. In other words, flying tulips = Andre's legacy + world financial heritage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。