Why Is Crypto Market Down Today? Shocks Behind Crash and What Next?

What just pulled the brakes on crypto’s historic Uptober rally? It woke up to a sharp correction. Global market cap slid to $4.3 trillion, marking a 1.7% dip in 24 hours, as traders faced a mix of hacks, macro shocks, and profit-booking after record highs. So, why is crypto market down today, and what’s next for investors?

Why is Crypto Market Dow n Today: 4 Reasons

PancakeSwap Hack Sparks Security Jitters

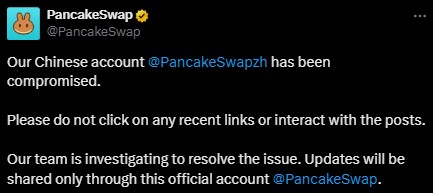

The first shockwave came from the PancakeSwap X account hack on October 8. The popular BNB Chain DEX revealed its Chinese-language X (formerly Twitter) account had been compromised. Hackers used it to promote a fake token called Mr Pancake, which skyrocketed to a $7 million market cap within hours—a 110× pump.

Source: PancakeSwap

Source: PancakeSwap

Although no direct losses were confirmed yet, the incident revived concerns about social media exploits and DEX vulnerabilities. Interestingly, CAKE token held firm, indicating trader confidence—but the broader space reacted cautiously, recalling a similar BNB Chain hack weeks earlier.

Oracle’s $100M Nvidia Loss Hits Broader L andscape

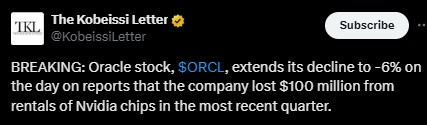

Crypto doesn’t trade in isolation. A $100 million Nvidia chip rental loss by Oracle triggered a $49 billion stock value wipe-out as $ORCL plunged 6% in a single session. This came amid an overheated U.S. equity space, where the market cap-to-GDP ratio has surged to 221%—far above Dot-Com Bubble levels (142%) and nearly 4.6× 2008 lows.

Source: X

Source: X

Macro investors began trimming exposure across risk assets—including crypto—fearing that equity froth could spill into digital assets, especially after Bitcoin’s parabolic run.

US Government Shutdown Adds Macro Uncertainty

The US Government Shutdown 2025 has entered its seventh day, with no funding resolution in sight. Senate bills from both parties failed, leading to federal service disruptions and increasing pressure on the landscape. Historically, prolonged shutdowns dent investor sentiment and liquidity, prompting defensive positioning. This added another layer of risk aversion to the crypto sell-off.

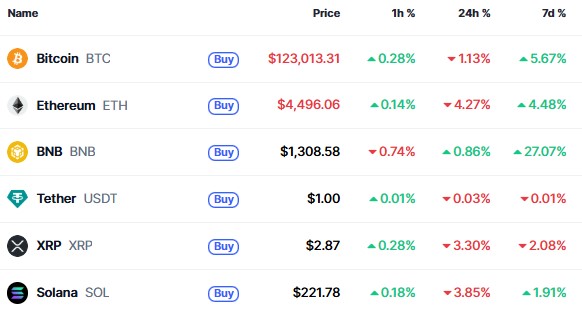

Bitcoin & Altcoins Correct After ATH

On October 7, Bitcoin hit an all-time high of $126,198.07, but quickly corrected 1.11%, trading at $122,954.18 with $2.45T in market cap. Ethereum crashed 4% to $4,502.94, while Solana and XRP lost over 3% each.

Source: CoinMarketCap

Source: CoinMarketCap

The Fear & Greed Index fell from 70 (Greed) to 60, signaling cooling enthusiasm. Historically, high greed levels precede short-term corrections, as traders take profits and leverage unwinds.

What’s Next for Investors?

Corrections after euphoric rallies are healthy. Despite the short-term pullback, the weekly performance remains strong, and institutional inflows via ETFs continue. However, macro risks (US shutdown, equity froth) and security scares (DEX hacks) could keep volatility elevated.

Experts advise watching $120K Bitcoin support, Ethereum ETF flows, and global liquidity trends closely. For long-term investors, this dip may offer strategic entry zones, but caution is key.

Conclusion: Why Is Crypto Market Down Today

The 1.7% dip is the result of layered shocks—PancakeSwap hack, Oracle’s equity stumble, government shutdown uncertainty, and post-ATH profit-taking. While short-term sentiment has cooled, structural drivers remain intact. Seasoned investors treat such pullbacks not as panic signals, but as opportunities to reassess strategy with discipline and data.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。