Will $5B Grayscale Ethereum Staking Turn ETH Crash Into Uptober Rally?

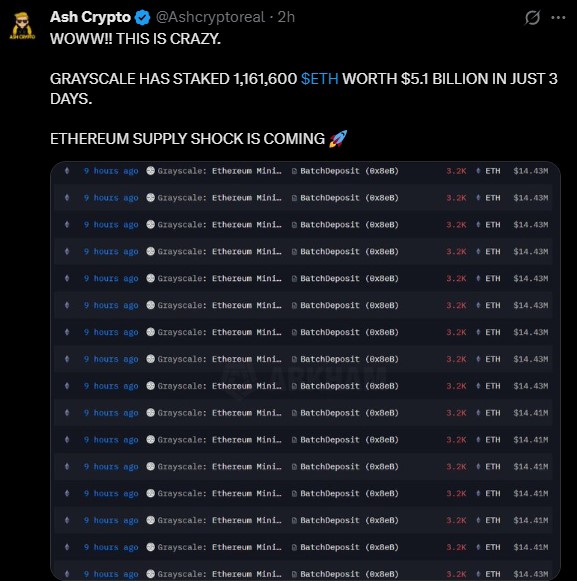

In a surprise move that has shocked the crypto market is the massive Grayscale Ethereum Staking. Yes, the firm has staked 1,161,600 ETH worth $5.1 billion in just three days, signaling powerful institutional conviction in the assets long-term vision.

Source: Ash Crypto X Account

This news came when the $ETH crashed in early “Pumptober.” But seasoned traders suggest this flush may be setting the stage for a parabolic rally later this month. Let’s uncover the truth

$5B Grayscale Ethereum Staking Signal Institutional Buying Surge

This altcoin accumulation has suddenly jumped in the last three days. This asset management firm has staked 1,161,600 ETH worth $5.1 billion, making it one of the biggest staking events of 2025.

As per Lookonchain , they also sent 3,701 ETH (around $16.3 million) to Coinbase Prime recently. This shows that big investors are buying and selling on a large scale.

“This ETH Uptober rally isn’t canceled, it’s being quietly loaded by institutions,” said one analyst on X.

Uptober Begins With Fear: Why Is Ethereum Falling?

Even though big players are buying, the token's price has dropped. In the last 24 hours, it fell by about 4%, and is now trading near $4,299.74, after it could not cross $4,600 earlier this month.

This drop during Uptober trend, which is usually a strong month, has confused many people. Traders are asking, “What will be Ethereum October price target now”

Coingabbar Experts say this is a planned market flush:

“This is happening to liquidate all the bulls and mainly the retail because market makers always flush longs before sending the market.”

Technical Signals Show Market Could Turn

TradingView technical chart suggests some simple clues that every trader should know:

-

RSI is 30.25. This means the asset is oversold, and a bounce can happen if buyers step in.

-

MACD shows sellers are strong, but the pressure is slowing down.

-

Important price levels:

-

Resistance: $4,400

-

Major Support: $4,000

This Ethereum price drop technical analysis suggests the token has moved sideways since late September. If it stays above $4,250, it may move up toward $4,400 again. But if it falls below $4,250, it can dip closer to $4,000.

Key Things Happening Now

-

Retail investors are scared because of the $ETH crash.

-

Grayscale news is buzzing as institutional buying surge.

-

Technical signals are showing the market is near a turning point.

-

Past cycles show the same setup before big rallies.

2020 Deja Vu? Price Pattern Mirrors Its Last Parabolic Run

Many traders say today’s $ETH chart looks just like 2020. Back then, it dropped in early October, scared people, then shot up fast by the end of the year.

This year looks the same:

-

September low

-

Early October dip

-

Grayscale Ethereum Staking and institutional buying surge

Experts believe the real Uptober rally might begin between October 15–20, once weak positions are cleared. If these things happen together, Ethereum price prediction could reach $5,000–$8,000 in Q4, with altcoins possibly jumping 10×–50× in the next few months

Conclusion: Timing Is Everything and Grayscale Picked Uptober

The timing of Grayscale Ethereum Staking looks smart. While small investors panic about the drop, they staked $5 billion in just 3 days— a strong sign that they are planning for the long term.

This is a classic setup in crypto markets. It may be getting ready for a big rally in late October. While some traders focus on the short-term fall, institutions are already building positions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。