Come! Let's cultivate immortality together!

Author: Yi He

I generally don't like to be a father to others unless they come to be my father.

Looking back, Bitcoin was born against the backdrop of the 2008 financial crisis. At that time, no one would have thought that a white paper and open-source code would become the best asset of the past 17 years, bar none. Times are changing, the concept of money is changing, the concept of assets is changing, policies are changing, and on a path that no one has walked before, we practitioners have gone from being accused of "pyramid schemes" by others to calling ourselves "noble Wall Street traders." On this path, our community has grown larger and larger, facing one fork after another; every choice is a process of selection, with some getting closer and others drifting further away.

As an entrepreneur who advocates "value investing" and "long-termism," I believe that only businesses that solve users' problems and for which people are willing to pay can be called entrepreneurship and construction. The underlying logic of holding Bitcoin and BNB for many years is my optimism about the entire industry, and within this industry, BTC is the most prominent decentralized asset, while Binance is the project with the most users and the strongest team. If this team is not the world's top team, then I will make it the industry's top team.

Binance has never been a high-end, perfect team. We have stumbled along the way, flying the plane while fixing it. We have paid a huge price, so now we prioritize compliance. Binance has invested enormous resources in compliance, and even third-party audits have rated us as the industry's compliance ceiling, with compliance resources being more than five times that of products, heavier than traditional finance. Many of Binance's businesses were not the first to do so because when you are the first, following is a better strategy. In a sailing race, if you are in the lead position, you just turn when the others turn, and it's a sure win. I am not the first to create a trading platform, we are not the first to do contracts, we are not the first to do C2C, we are not the first to implement on-chain wallets in products, but we are the first to require KYC even for on-chain wallets 😂. Our products started from a point where "not even dogs would use them." We grew up at the village entrance in Africa, walked with users through the Darién Gap in Latin America, enjoyed the cozy coffee in Australian small shops, and experienced typical East Asian competition. We do not have the grand feast of F1; we are with nearly 300 million users, and we are making small, quick strides based on community and user feedback. In other industries, when the times abandon you, they won't even say goodbye. Fortunately, in this industry, if you don't keep up, the community will teach us how to behave, and we "know shame and then have the courage."

I once believed that leveraging contracts would amplify human weaknesses, firmly stating that I wouldn't engage in contracts, until the bear market in 2019 when all coins were plummeting, and all users were crying out in despair. I had to quickly learn financial knowledge, understanding what hedging and risk management were, and later forced two contract teams to compete against each other. However, we also did not forget to have contract users test before trading, nor did we forget to set a cooling-off period for users who continuously gambled. My moments of being slapped in the face were also forged by myself.

I once thought MEME was a conspiracy disguised as subculture, believing that only serious projects that take responsibility for their holders were the right path, until I saw those bright-eyed, well-connected people publicly talking about dreams and sentiments, only to find that they treated Binance as the last stop for liquidity exit, pouring it directly. Faced with professional players, retail investors are defenseless; they either get burned in spot trading or face contract explosions. I understand their anger, but I feel powerless regarding the structural changes in the industry. I once choked up during a 6-hour AMA because I didn't know how to ensure that both retail and professional players could benefit. If we hope our users are the first stop, this is the starting point of Alpha. Until I reconciled with myself, I realized that most users do not expect to earn forever; what they always want is fairness, fairness, and more fairness. Users are not trading "Binance life," nor "Customer Service Xiao He," but rather the little bits of fairness, opportunity, and consensus that accumulate beneath these CAs. At this point, let me remind everyone who is still oblivious: MEME has no one responsible for the project, lacks long-term value support, and is not without conspiracy groups. Be aware of investment risks; the self-proclaimed statements and tweets from Binance and me do not equate to endorsement from Binance or me. For MEME players, Binance, me, and dogs, pigs, frogs, and memes are in the same quadrant, with no difference. Opposing MEME, understanding MEME, and ultimately becoming MEME, the clown is myself.

Compared to the entire financial market, the crypto circle is still a drop in the ocean. The market is large enough to accommodate many giants, so we do not attack competitors; we learn from other entrepreneurs and project parties. If we can't understand, we can still invest and buy because the ultimate goal of plain and simple business competition is to meet user needs, not to pull hair or spit. YZi Labs plans to invest 1 billion USD to support ecosystems and developers, aiming to incubate a batch of top-notch projects; this is true commercial competition. Over the years, we have been thrown countless challenges, and we have used them to grow beautiful flowers. If our wallet isn't good, we will improve it until it is. We have never understood the significance of MEME's existence, and from seeing a CA associated with Binance, we began to spread rumors, guard against it, and draw a line with MEME, returning to what we should be doing, not without having broken our principles a few times.

As a new era entrepreneur and cultivator, I thank everyone for taking the time to read this long article with little information. After thinking it over, I can only force some value, which aligns with our consistent altruistic thinking.

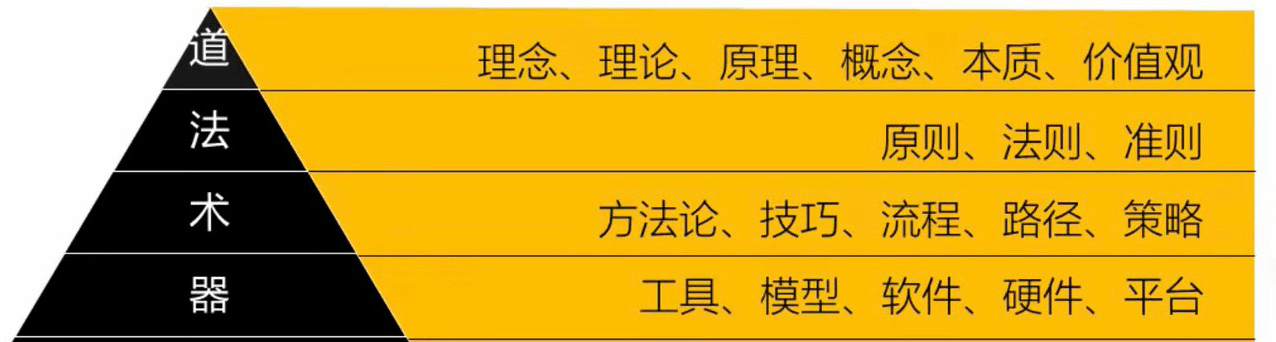

Entrepreneurship, trading, making money, and cultivating immortality are essentially the same thing, emphasizing the Dao, Fa, Shu, and Qi; if you earn money in a muddled way before understanding it clearly, you will also lose it in a muddled way, after all, one can only earn money within their understanding.

Dao is the operating rule of this world; only those who comply with the operating laws can walk far and long. Just like our industry thrives because it aligns with the laws of world development, not because of any one person's brilliance.

Fa is principle; it is the cultural values of each company and organization, the user-centric approach of Binance, freedom, collaboration, hardcore, and humility.

Shu: People are easily enamored with tricks, power plays, and marketing, which are actually minor paths.

Qi: Products and tools; in mobile internet products, the easiest to be replaced are tool-type products.

Everyone, every company, and organization has its strengths; as long as one does well in any aspect, they can achieve great results. Everyone can find their own place. Ultimately, Binance still lacks talent, so this is still a recruitment post. Come join us in cultivating immortality together!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。