Preface: Does the choice of exchange really affect the probability of making money?

"Isn't it the same no matter which exchange you buy coins on?" — This is a common thought among many investors, especially beginners. They believe that as long as they choose the right asset, the exchange is merely a trading channel.

But is that really the case? To thoroughly clarify this issue, LUCIDA conducted a systematic data comparison. The focus will be on the following three core dimensions, providing a comprehensive analysis of seven mainstream centralized exchanges (CEX): Binance, OKX, Bitget, Gate, MEXC, Bybit, and Kucoin:

Profitability: At which exchange is it easier to buy the "dark horse" coins that have astonishing price increases?

Risk control capability: At which exchange are you less likely to encounter traps like "breaking the issue price" or "halving"?

New coin listing speed: Which exchanges allow you to get in early on popular coins and capture early profits?

The answers may be more complex than you think.

Disclaimer

All data and analysis involved in this article are based on publicly available market information, independently organized and compiled by LUCIDA, and are intended solely for academic and informational sharing purposes. The rankings, performance differences, and related conclusions regarding the exchanges mentioned do not constitute any investment advice, nor do they represent our endorsement or criticism of any specific exchange. Market conditions are dynamic, and readers should make independent decisions based on their own judgment and risk tolerance. LUCIDA is not responsible for any investment actions or consequences arising from the content of this article.

0. Statistical Methods and Definitions (Must Read)

To ensure a fair and objective comparison, LUCIDA has established unified statistical standards:

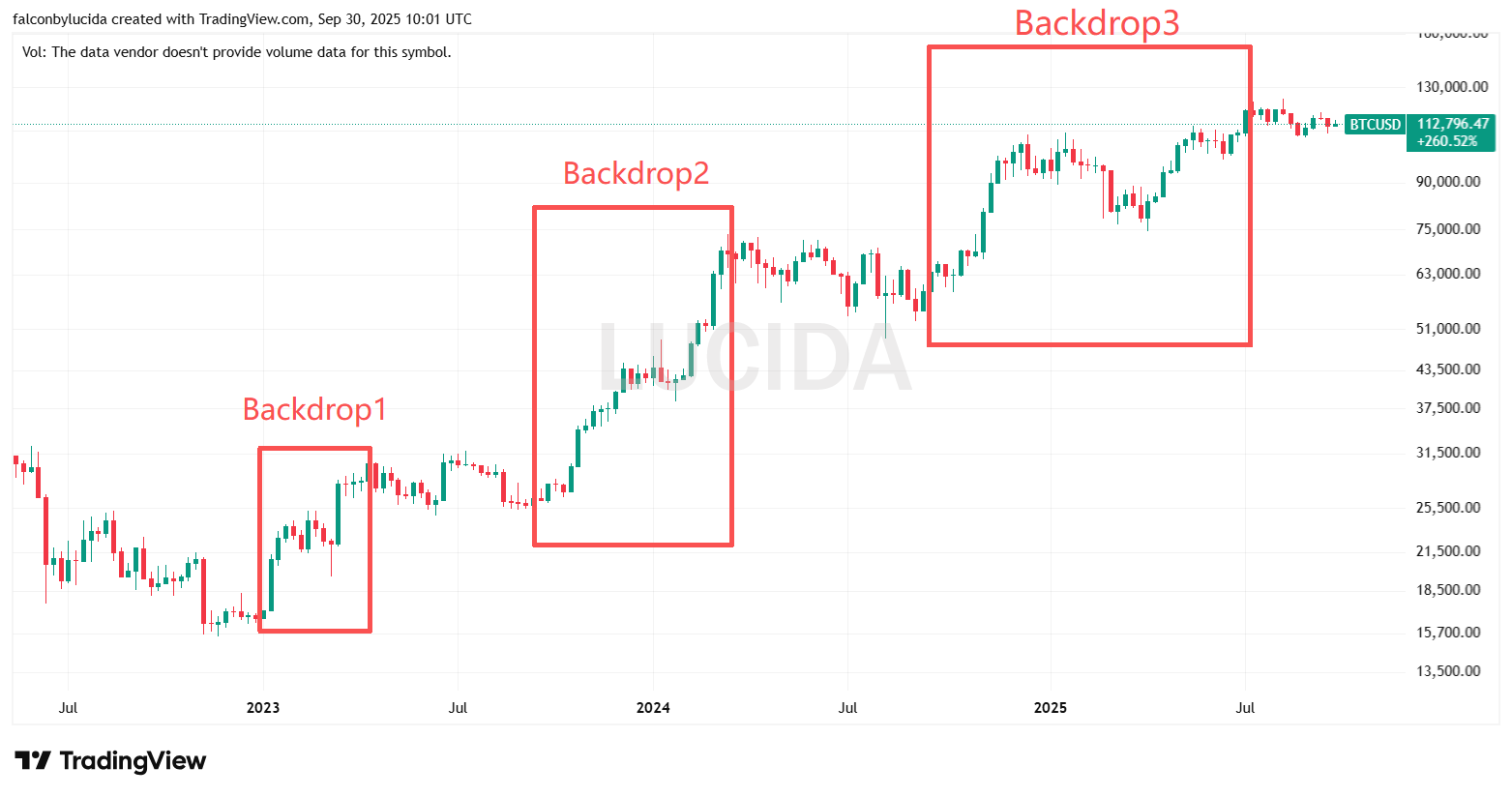

Time slices (Backdrops): To reduce disturbances caused by differences in market phases, LUCIDA divides the core rising segments of the crypto bull market over the past two years into three segments:

Backdrop1: 2023-01-01 ~ 2023-05-06

Backdrop2: 2023-10-01 ~ 2024-04-01

Backdrop3: 2024-09-01 ~ 2025-07-23

The reason for this is: Only when BTC is rising can Altcoins have the opportunity to achieve better excess returns.

The reason for this is: Only when BTC is rising can Altcoins have the opportunity to achieve better excess returns.

I. Profitability

Not only is it important whether a coin can rise, but also how much it can rise. LUCIDA evaluates the "wealth creation" ability of each platform from three levels.

1. Price Increase Range Statistics

Let's start with "how much it rises." To ensure a fair comparison, LUCIDA breaks down the market over the past two years into three phases (referred to as Backdrop1, 2, and 3), with Backdrop1 being from 2023-01-01 to 2023-05-06, Backdrop2 from 2023-10-01 to 2024-04-01, and Backdrop3 from 2024-09-01 to 2025-07-23. Each phase is a core period of BTC's rise, based on the principle that only when BTC is rising can Altcoins have the opportunity to achieve better excess returns.

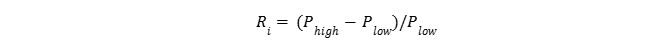

In each phase, LUCIDA calculates the return rates of all coins on each exchange. The return rate for a single coin is calculated using the following formula:

Where Ri represents the return rate of the i-th coin within the interval; Phigh and Plow represent the highest and lowest prices after processing (the time series has chronological issues and needs to be calibrated). Then we compare: which exchanges have coins that rise more? Which exchanges have the most "dark horse coins"? The results are quite intuitive: the differences between exchanges are very large.

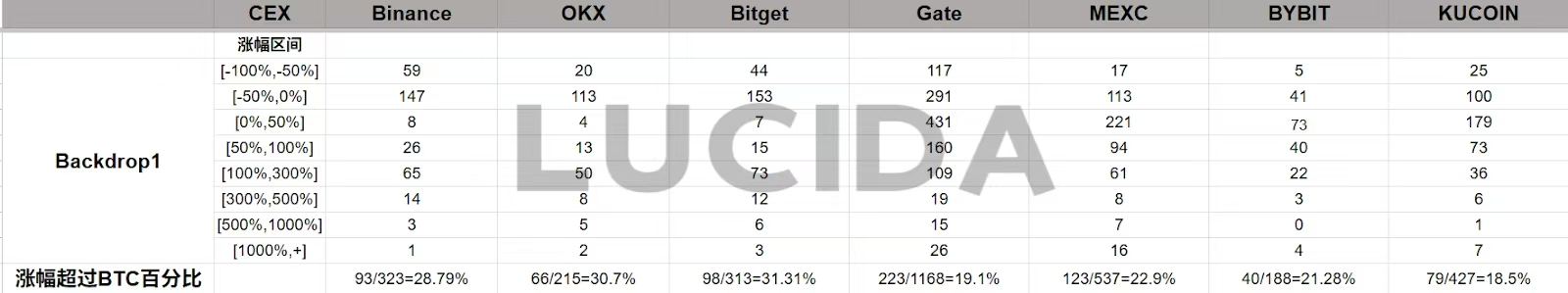

2. Proportion of Coins Exceeding BTC Returns Among Different CEXs

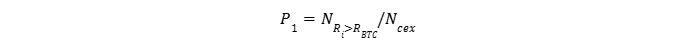

LUCIDA uses the following formula to calculate this evaluation metric:

Where NRi>RBTC indicates the number of coins on that exchange that have risen more than BTC, and Ncex represents the total number of coins listed on that exchange.

Example data for Backdrop 1:

Binance: 93/323 (28.79%)

OKX: 66/216 (30.7%)

Bitget: 98/313 (31.31%)

Gate: 223/1163 (19.1%)

MEXC: 123/537 (22.9%)

Bybit: 40/188 (21.28%)

KuCoin: 79/427 (18.5%)

Phase performance ranking:

Backdrop 1: Bitget > OKX > Binance > MEXC > Bybit > Gate > KuCoin

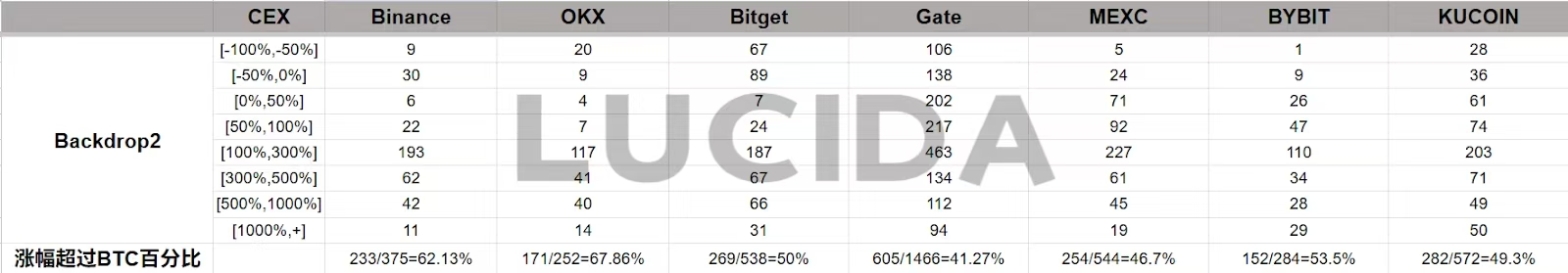

Backdrop 2: OKX > Binance > Bybit > Bitget > KuCoin > MEXC > Gate

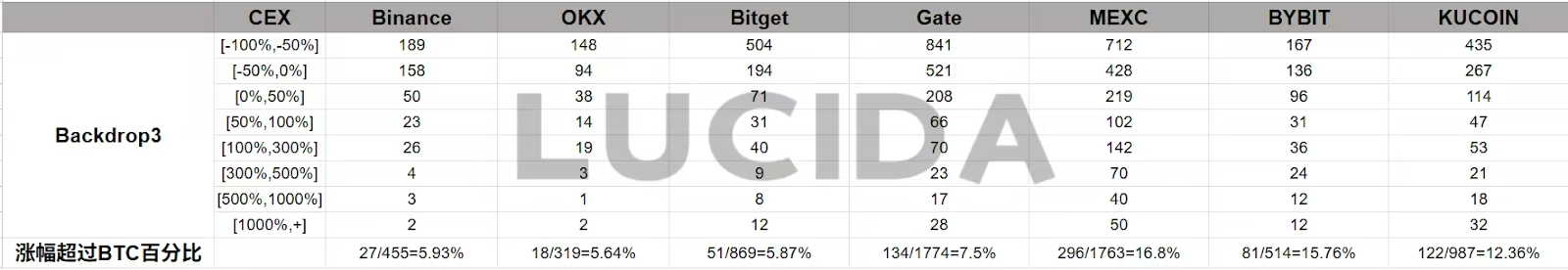

Backdrop 3: MEXC > Bybit > KuCoin > Gate > Binance > Bitget > OKX

Summary:

1. The "Excess Return Ability" of Exchanges is Strongly Linked to Market Background, with No "All-Purpose" Players

The ranking of "excess coin proportions" for exchanges varies significantly across different Backdrops (for example, Bitget ranked first in Backdrop1 but fell to second to last in Backdrop3; MEXC topped Backdrop3 but was not a top performer in the first two phases). This indicates that no exchange can consistently produce a large number of coins that "outperform BTC" in all market environments; the excess return ability of exchanges is highly dependent on market background.

2. Some Exchanges Have Outstanding "Excess Capture Ability" in "Specific Market Conditions"

Bitget led with a 31.31% excess coin proportion in Backdrop1, Bybit ranked high in Backdrop3, and MEXC performed best in Backdrop3 (during a sluggish market). This means that some exchanges have a higher coverage of "outperforming BTC" coins in certain market environments (such as during market initiation or extreme volatility), making them suitable for strategy-oriented investors seeking "market beta + exchange alpha."

3. "Outperforming BTC" is Itself a Low-Probability Event, Highlighting BTC's "Market Anchor Position"

From the numbers, even in the relatively warm Backdrop1, the highest proportion of "coins outperforming BTC" across exchanges is only 31.31% (Bitget), with most exchanges below 30%; this proportion is even lower in other backgrounds. This reflects that in the crypto market, BTC remains a strong "return anchor," and most coins find it difficult to outperform the market in the long term; "outperforming BTC" itself is rare.

4. The "Stability" of OKX and Binance is More Aligned with "Broad Market Conditions," Weakening Advantages in Extreme Markets

OKX and Binance performed top-notch in Backdrop2 (neutral to warm market), but in Backdrop3 (sluggish market), OKX fell to last place, and Binance ranked only fifth. This indicates that their "stability" is better suited to neutral, broad market environments, while in extreme market conditions (such as deep corrections or strong one-sided trends), the "stability of excess returns" is significantly weakened, and some smaller exchanges are more likely to "break through" in extreme markets.

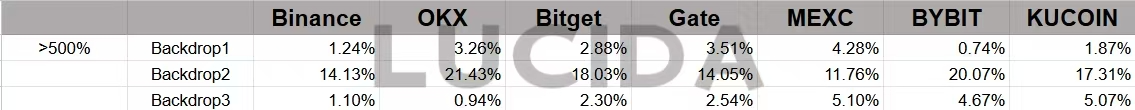

3. Proportion of Coins with Increases Exceeding 500% Among Total Coins Listed on Different CEXs

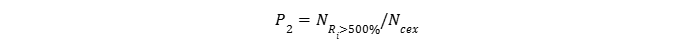

In addition to outperforming the market, investors are more eager to find "mythical coins" that can bring huge returns. LUCIDA calculates this using the following formula:

Where NRi>500% indicates the number of coins listed on that exchange that have risen more than 500%, and Ncex represents the total number of coins listed on that exchange. The results are shown in the table below:

Phase performance ranking:

Backdrop 1: MEXC > Gate > OKX > Bitget > KuCoin > Binance > Bybit

Backdrop 2: OKX > Bybit > Bitget > KuCoin > Binance > Gate > MEXC

Backdrop 3: MEXC > KuCoin > Bybit > Gate > Bitget > Binance > OKX

Summary: If you are an adventurer seeking extreme returns and are not afraid of high risks, exchanges like MEXC, Gate, and KuCoin, which employ a "sea of coins" strategy (i.e., listing a large number of high-return, high-risk coins), may provide more opportunities for significant asset gains.

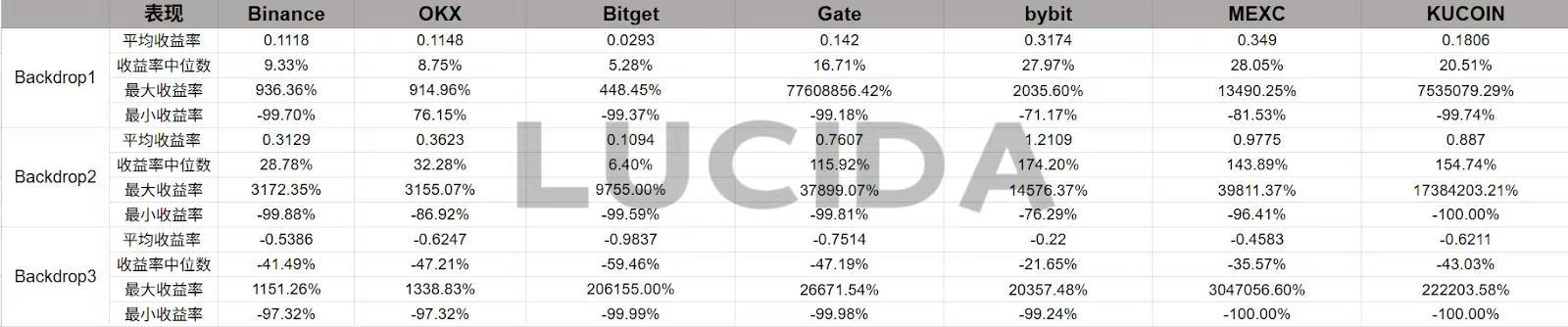

4. Logarithmic Average Returns and Descriptive Statistics of All Listed Coins on Different CEXs

Average returns can effectively evaluate the performance of coins within an exchange from a macro perspective. To avoid the asymmetry of ordinary returns (where price increases theoretically have no upper limit, while decreases have a lower limit), LUCIDA uses logarithmic returns to describe the distribution of coins. The specific calculation formula is as follows:

ln(Ri) represents the logarithmic return of a single coin on that exchange during a certain backdrop, and Ncex represents the total number of coins listed on that exchange. The results of the statistics are shown in the following chart:

From the perspective of logarithmic average returns, the performance differences between exchanges become clearer:

"High Upper Limit Potential": The distribution of logarithmic returns for coins on KUCOIN, Gate, and MEXC shows significant "upper limit potential," indicating that coins on these exchanges are more likely to experience "breakthrough increases."

"Dual Excellence in Mean and Median": Bybit and MEXC perform relatively better in terms of both the mean and median of logarithmic returns, suggesting that the overall return level of coins on their platforms is more prominent and the distribution is more balanced.

Summary: Overall, the returns and risks of cryptocurrency trading are highly intertwined, with market conditions being a key variable; from more scientific indicators like logarithmic returns, the ability to make money varies significantly across different exchanges, and investors should carefully choose based on their own risk preferences and market judgments.

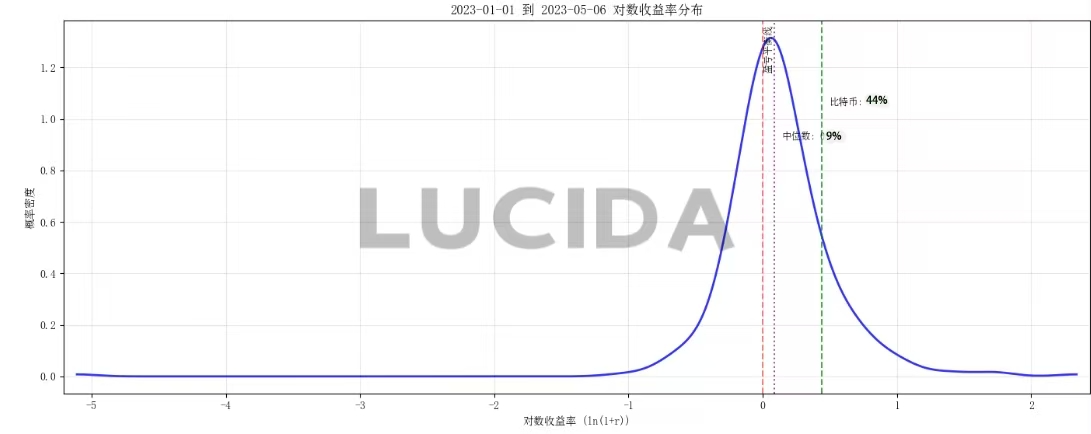

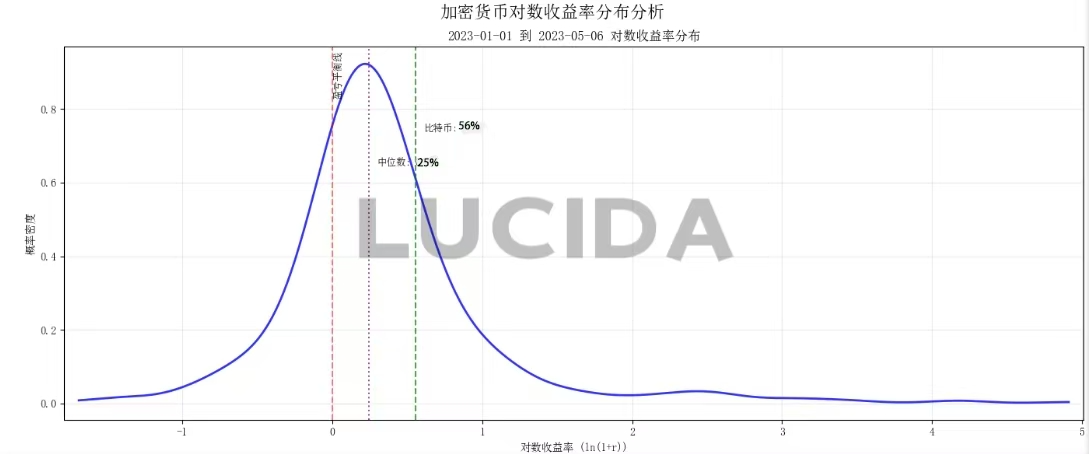

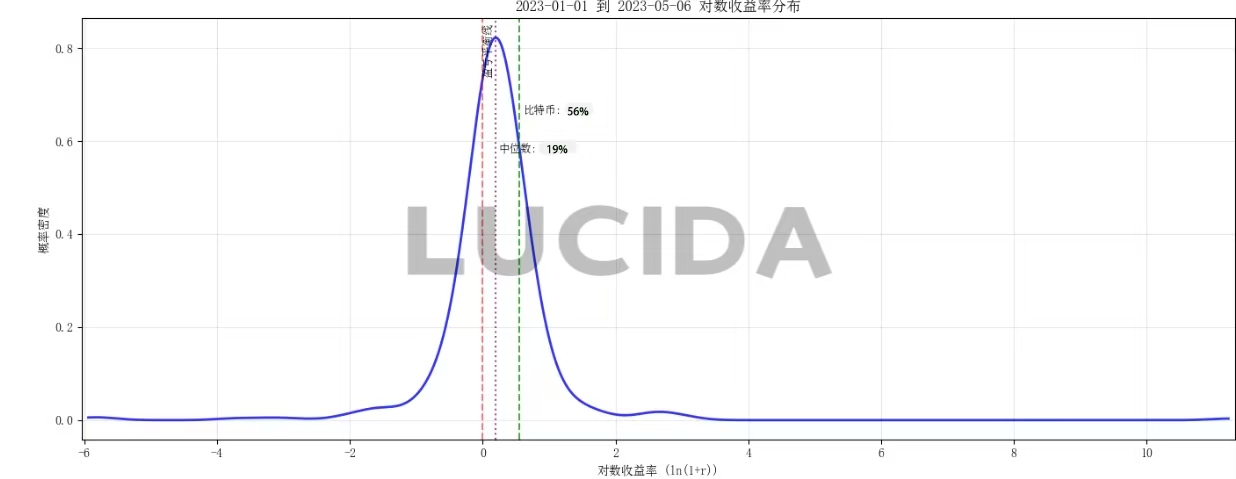

5. Probability Density of All Listed Coins on Different CEXs

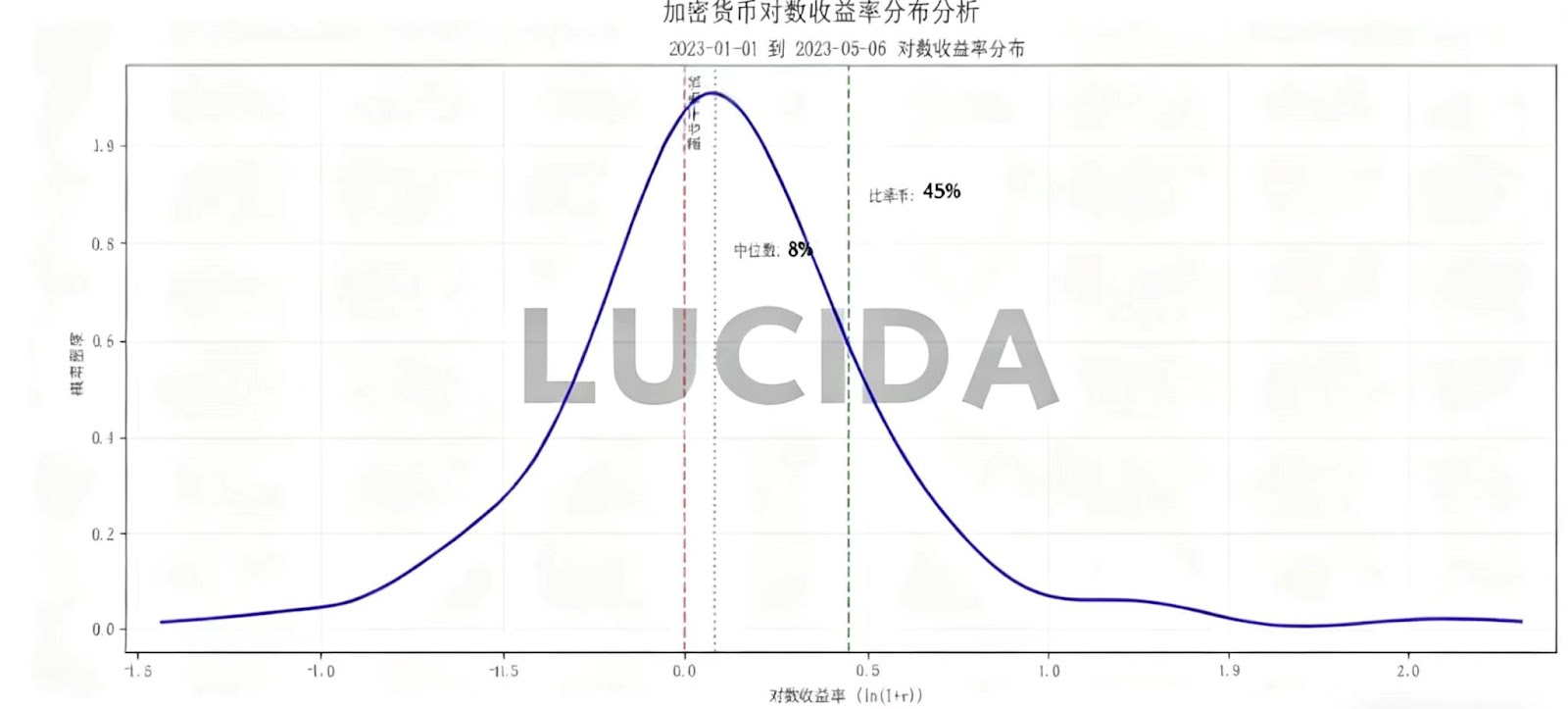

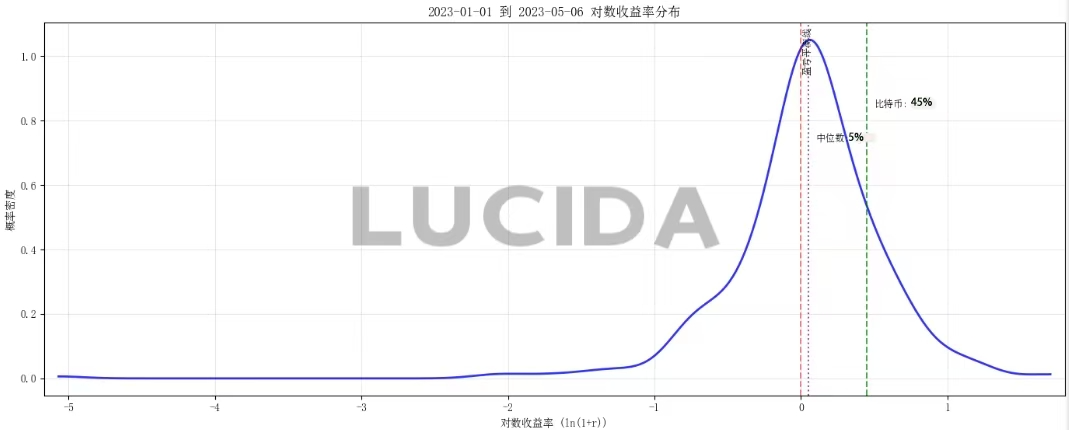

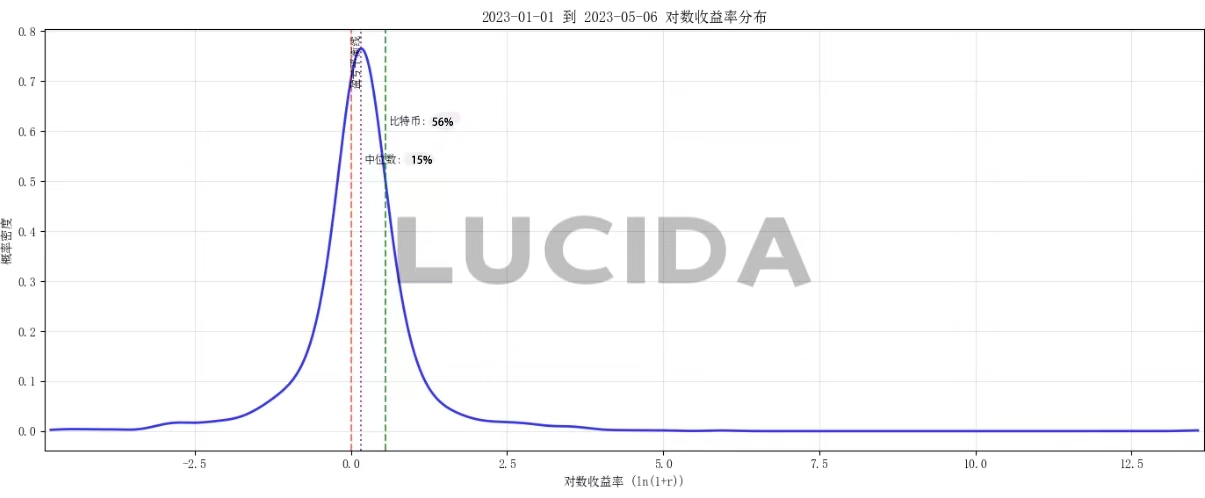

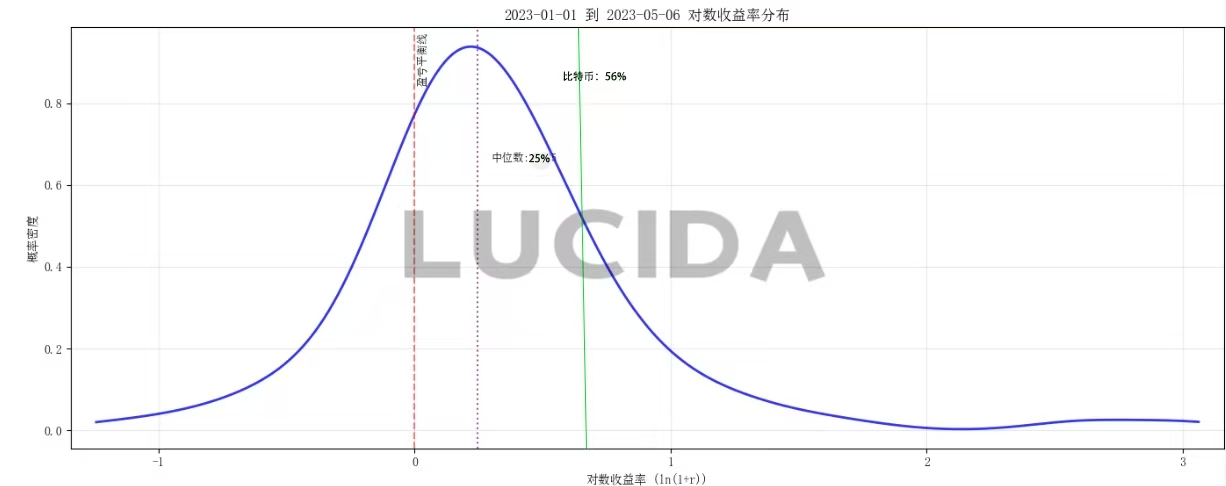

To assess return levels more macroscopically, LUCIDA adopted logarithmic average returns. To reveal more microscopic distribution characteristics, LUCIDA plotted the probability density distribution of coin returns on each exchange (using Backdrop 1 as an example).

Binance

OKX

Bitget

Gate

BYBIT

MEXC

KUCOIN

As shown in the figures, the returns of coins on different exchanges exhibit the following characteristics:

Distribution Characteristics: The return distributions of each exchange are approximately normally distributed and exhibit long-tail characteristics.

Platform Differences:

Binance: The peak is the highest, indicating that more coins' returns are concentrated around the mean, making it easier to achieve market average returns, providing a relatively "stable" experience.

Gate: The distribution is uniform, making it more challenging to obtain a stable mean, with greater uncertainty.

Tail Characteristics: MEXC, KuCoin, Bybit, and OKX have abnormal peaks on the positive return side, indicating that on these platforms, the probability of capturing extremely high-return "dark horse" coins is relatively higher. In contrast, Gate's tail is more concentrated in the negative return range, meaning investors face a correspondingly higher risk of significant losses.

Profitability: This is not about choosing a platform, but about choosing a battlefield

The data clearly reveals a core fact: there is no absolute "better" among exchanges, but rather a fundamental "strategic differentiation." Choosing an exchange is essentially choosing your profit model and risk exposure.

- Binance & OKX: Mainstream "Beta" and Selected "Alpha"

Core Value: Stable excess returns. They are a microcosm of the mainstream market, providing the highest quality "Beta" (market average returns). Here, you have the highest probability of selecting coins that outperform Bitcoin.

Strategic Positioning: The "core holdings" and "main battlefield" of wealth. Suitable for allocating most funds here for medium to long-term investments. Their new listing strategies tend to be conservative, but the project quality screening is stricter, effectively providing you with the first round of risk control. Earning money here relies more on your judgment of project fundamentals and market trends rather than luck.

Summary: If you want to steadily outperform the market, this is the best starting point. They are the battlefield prepared for "investors."

- MEXC, Gate, KuCoin: Hunting Grounds for High-Risk "Alpha"

Core Value: Extreme return potential. They are practitioners of the "sea of coins" strategy, maximizing the soil for nurturing "hundredfold mythical coins" by listing a large number of various projects (especially early-stage and niche projects).

Strategic Positioning: The "satellite positions" and "opportunity windows" of wealth. Suitable for using a small portion of funds for high-risk, high-reward speculation. Their advantage lies not in win rates but in odds. Data shows they have the most significant "positive return long tail," meaning the probability of capturing assets with extreme price increases is the highest.

Insight: However, you must accept the cost: extremely high volatility and deeper "traps" (Gate's negative return long tail is a clear example). Earning money here is more like panning for gold in the sand, requiring strong information filtering abilities and disciplined quick loss-cutting. They are the battlefield prepared for "adventurers" and "hunters."

- Strategic Insights: Balanced Account Allocation

Do not choose one over the other; instead, combine allocations. A savvy investor should not stick to just one exchange.

Main Account (Binance/OKX): Used to deploy your core positions, capturing mainstream market trends and stable growth.

Scout Account (MEXC/KuCoin/Gate): Used to scan the market's cutting-edge hotspots and meme coins with small funds, seeking extremely high returns while isolating risks from the main account.

Exchange performance will rotate: Data indicates that no exchange maintains a leading position in all phases. The rise of MEXC and KuCoin in Backdrop 3 suggests that market hotspots and capital preferences will change at different stages of a bull market; a smart approach is to dynamically adjust your troop deployment across different battlefields based on market atmosphere.

Conclusion

The answer to the question is no longer "which exchange is more profitable," but rather "what role should each exchange play in your investment portfolio." Use Binance/OKX to safeguard your lower limit and MEXC/KuCoin to push your upper limit; this is the most profound profit strategy derived from the data.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。