Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)

RWA Market Performance

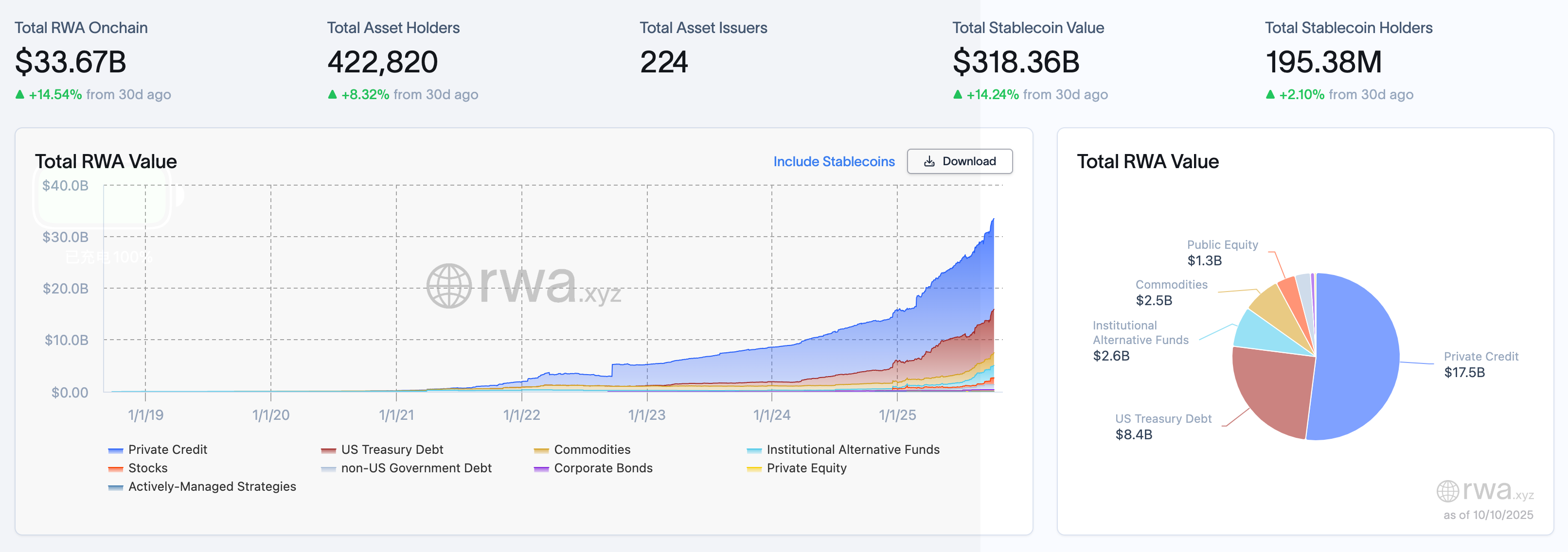

As of October 10, 2025, the total on-chain value of RWA is $33.67 billion, an increase of $2.4 billion from $31.27 billion on September 30, representing a growth rate of 7.67%. This marks another significant rise following a period of double-digit growth, with the scale of on-chain assets continuing to reach new historical highs. The total number of asset holders increased from 407,788 to 422,820, adding 15,032 new holders, a growth rate of 3.69%, the largest single-week net increase in nearly a month. The number of asset issuers rose from 221 to 224, with 3 new issuers, maintaining a moderate upward trend. In the stablecoin market, the total market capitalization increased from $289.06 billion to $318.36 billion, a growth of $29.3 billion, with a growth rate of 10.13%; the number of stablecoin holders increased from 193.52 million to 195.38 million, an increase of approximately 1.87 million, a growth rate of 0.97%.

From the asset structure perspective, private credit remains the absolute mainstay of the RWA market, currently valued at $17.5 billion, up $2 billion from last week's $17.3 billion, with a growth rate of 1.16%, slightly declining in proportion but still exceeding fifty percent; U.S. Treasury bonds further rebounded, rising from $7.7 billion to $8.4 billion, an increase of $700 million, with a growth rate of 9.09%, marking a strong rebound for two consecutive weeks, possibly reflecting a return of risk appetite and a strengthening signal of interest rate expectation turning points. The scale of commodity assets increased from $2.1 billion to $2.5 billion, a growth of $400 million, with a growth rate of 19.05%, showing the most remarkable performance, indicating a rapid increase in market attention to inflation hedging and bulk allocation. Institutional alternative funds continued to grow, rising from $2.3 billion to $2.6 billion, a growth rate of 13.04%, continuing last week's momentum, reflecting an increasingly diversified institutional allocation tendency. The newly added public equity reached $1.3 billion, marking its first explicit notation, indicating that the structure of on-chain assets has gradually expanded from "debt-credit" to the "equity-rights" domain; other categories such as non-U.S. government debt, active management strategies, stocks, corporate bonds, etc., are relatively small in scale, but the overall structure is richer, with market depth and breadth growing simultaneously.

What are the Trends (Compared to Last Week)

Overall, the RWA market this period exhibits a dual characteristic of "volume increase and structural expansion." On one hand, the total market capitalization has significantly surged, coupled with stablecoins simultaneously skyrocketing by nearly $30 billion, indicating a notable increase in new liquidity; on the other hand, user activity and the number of asset issuers have both achieved synchronized growth, continuously enhancing the vitality of the platform ecosystem. In terms of asset structure, U.S. Treasury bonds and commodity assets have become the main engines of this round of increase, with the proportion of credit slightly declining but still the largest in absolute terms, indicating that under the backdrop of increased risk appetite, the market is undergoing "reallocation" and "rebalancing." The market style is transitioning from a "credit-dominated high safety margin" to a phase of "debt + commodities + alternative assets" running in parallel, especially with the emergence of public equity, which may signal an enhanced ability of on-chain RWA to gradually adopt the logic of the secondary capital market, evolving towards more complex structured finance.

In summary, attention should be focused on: first, the ongoing support capacity of stablecoin supply changes for RWA assets; second, whether commodity assets can establish long-term allocation value after a short-term strengthening; third, whether there are expansion nodes for asset issuers in public equity and active management strategies. Overall, the RWA market has entered a new platform phase, breaking through $30 billion and entering a critical stage of "accelerated stratification + institutional layout."

Key Events Review

U.S. SEC Chairman: SEC Plans to Officially Launch "Innovation Exemption" by Year-End or Q1 2026

U.S. SEC Chairman Paul Atkins stated at an event in Manhattan that the agency still hopes to establish an "innovation exemption" policy for companies conducting business based on digital assets and other innovative technologies in the U.S. as soon as possible (possibly by the end of this quarter). Although the current government shutdown has hindered the SEC's ability to advance rule-making, establishing this policy remains a top priority for the end of this year or Q1 2026. He indicated that the agency intends to start rule-making work by the end of 2025 or Q1 2026 and is confident in achieving this; implementing formal rule-making in the cryptocurrency field could free it from previous regulatory models. During the Q&A session, he mentioned that the exemption policy being promoted is one of the matters he hopes to finalize soon, aiming to welcome innovators to conduct business in the U.S. Additionally, he pointed out that the government shutdown is obstructing work, rule-making has been paused, and praised Congress's efforts to pass cryptocurrency legislation, mentioning the "GENIUS Act," but stated that the SEC did not play a major role in it.

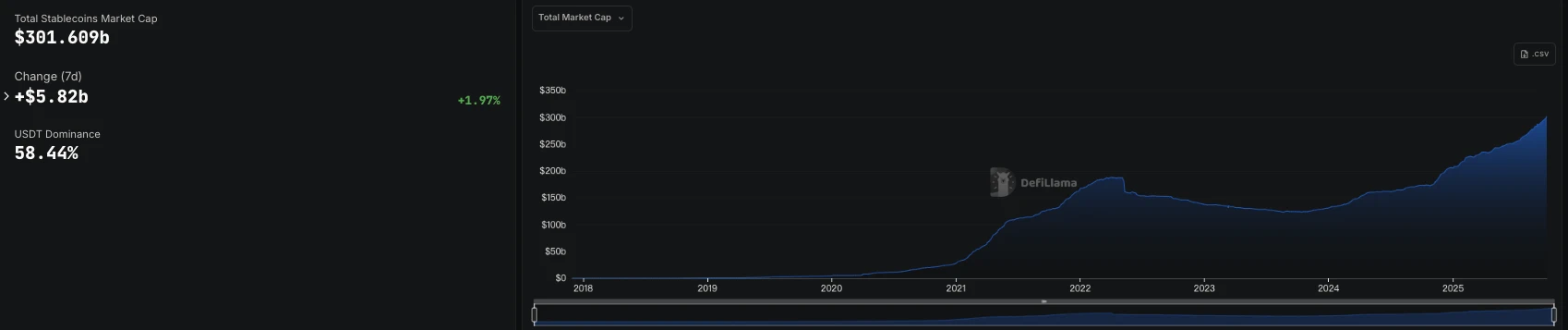

Total Market Capitalization of Stablecoins Exceeds $300 Billion, Setting a New High

According to DeFiLlama data, the total market capitalization of stablecoins has exceeded $300 billion, setting a new high.

Goldman Sachs, Barclays, and Other Major Global Banks Plan to Jointly Launch Stablecoin Project

According to market news, major global banks are planning to jointly launch a stablecoin project, with alliance members including Santander, Bank of America, Barclays, BNP Paribas, Citi, Deutsche Bank, Goldman Sachs, MUFG, TD Bank, and UBS.

The U.S. Securities and Exchange Commission is formulating a plan to allow stocks to be traded on blockchain technology similar to cryptocurrencies. This initiative is a key focus of the Trump administration's regulatory agenda supporting cryptocurrencies, which may eventually allow investors to purchase tokens representing shares of companies like Tesla and Nvidia on cryptocurrency exchanges. Currently, SEC staff are discussing the proposal with industry representatives. Companies within Coinbase (COIN.O) and Robinhood (HOOD.O) are actively pushing regulators for prompt approval to conduct stock trading on blockchain platforms. However, the plan has encountered strong opposition from traditional financial institutions that have established profitable models within the existing market structure.

Coinbase and Mastercard in Talks to Acquire Stablecoin Startup BVNK for $2 Billion

Cointelegraph, citing Wealth Magazine, reported that Coinbase and Mastercard are negotiating to acquire stablecoin startup BVNK for approximately $2 billion, with Coinbase reportedly in a dominant position in the negotiations.

Ondo Finance announced on the X platform that it has completed the acquisition of Oasis Pro, which includes its SEC-registered digital asset brokerage, alternative trading system (ATS), and transfer agent (TA) licenses.

This acquisition enables Ondo Finance to develop a regulated market for tokenized securities and provides infrastructure for tokenized real-world assets (RWA), digital asset transfer agents, primary issuance markets, and secondary trading systems.

At the Token 2049 event in Singapore, Robinhood CEO Vlad Tenev stated in an interview with Bloomberg, "Asset tokenization is like a train of the times, inevitable, and will ultimately engulf the entire financial system. But the reality is that many people talk about RWA, but few take action. Compared to stablecoins, those holding RWA assets are still a minority. Since the stock token launch event held in France this summer, we have now launched about 200 company stock (equity) tokenized products, and we are continuously expanding."

Hot Project Updates

Plume Network (PLUME)

One-Sentence Introduction:

Plume Network is a modular Layer 1 blockchain platform focused on the tokenization of real-world assets (RWA). It aims to transform traditional assets (such as real estate, artworks, equities, etc.) into digital assets through blockchain technology, lowering investment thresholds and increasing asset liquidity. Plume provides a customizable framework that supports developers in building decentralized applications (dApps) related to RWA and integrates DeFi and traditional finance through its ecosystem. Plume Network emphasizes compliance and security, committed to providing solutions that bridge traditional finance and the crypto economy for institutional and retail investors.

Recent Updates:

On October 6, Plume Network was approved by the U.S. Securities and Exchange Commission to become a registered transfer agent. As a registered transfer agent, Plume will now directly manage digital securities and shareholder records on-chain, supporting interoperability with the U.S. Depository Trust & Clearing Corporation (DTCC) settlement network. Additionally, it will facilitate a range of use cases, including on-chain IPOs, small-cap financing, and registered funds. Following the news of "Plume Network's SEC Approval as a Registered Transfer Agent" impact, PLUME broke through 0.13 USDT, with a 24-hour increase of 35%.

On October 8, Plume announced the acquisition of the institutional-grade staking protocol Dinero on Ethereum. This acquisition will integrate staking functionalities for ETH, SOL, and BTC into the Plume ecosystem, enabling institutions and DeFi users to earn yields and manage tokenized assets on the same platform.

MyStonks (STONKS)

One-Sentence Introduction:

MyStonks is a community-driven DeFi platform focused on tokenizing U.S. stocks and facilitating on-chain trading. The platform partners with Fidelity to achieve 1:1 physical custody and token issuance, allowing users to mint stock tokens like AAPL.M and MSFT.M using stablecoins such as USDC, USDT, and USD 1, and trade them on the Base blockchain around the clock. All transactions, minting, and redemption processes are executed by smart contracts, ensuring transparency, security, and auditability. MyStonks is dedicated to bridging the gap between TradFi and DeFi, providing users with a high liquidity, low-threshold entry for U.S. stock investments on-chain, building the "NASDAQ of the crypto world."

Previous Updates:

On September 16, MyStonks platform officially launched Hong Kong stock contract trading, allowing users to participate in trading directly using wallets with USDT/USDC, supporting up to 20x leverage. The launched contracts cover several high-quality Hong Kong stocks, including Guotai Junan International (1788.HK), BYD Company (1211.HK), Xiaomi Group (1810.HK), Moutai Group (2097.HK), Meituan (3690.HK), Tencent Holdings (700.HK), Pop Mart (9992.HK), JD Group (9618.HK), and SMIC (981.HK), spanning multiple industries such as technology, automotive, retail, internet, and semiconductors, meeting users' diverse asset allocation needs.

On September 25, MyStonks announced a brand upgrade, officially changing its domain to msx.com, stepping into a new era of global fintech. According to the announcement, this upgrade not only simplifies access but also reflects a transition from meme culture to a professional international financial brand, showcasing its determination in digital financial innovation and global expansion. The msx.com team stated that they will continue to focus on users, drive technological innovation, and enhance the security and efficiency of digital financial services.

Related Links

Summarizing the latest insights and market data in the RWA sector.

《Crazy Rush to Hong Kong RWA: Financing or "Financing Trend"?》

According to incomplete data compiled by First Financial reporters, from 2024 to the present, there have been successful RWA cases involving 13 institutions or enterprises, including Langxin Group, Xunying Group, Huaxia Fund, and Pacific Insurance, with underlying assets including funds, bonds, physical gold, mortgage loans, agricultural products, etc., and technical partners including Ant Group, OSL, and HashKey.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。