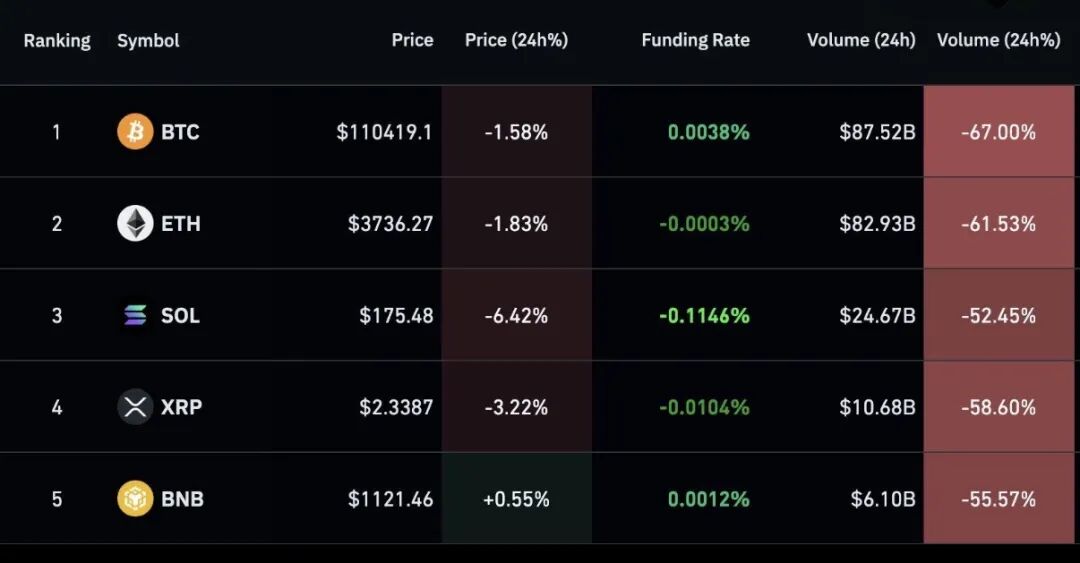

What exactly happened this weekend? A threat from Trump on social media (imposing a 100% tariff on Chinese goods and an export ban on all key software) acted like a financial nuclear bomb, triggering market panic. In just 24 hours, crypto assets suffered a heavy evaporation: approximately $19.1 billion in positions were liquidated, with long positions making up the vast majority. High-leverage longs turned the market into dry tinder, and any slight disturbance led to a stampede out; market quotes became chaotic, and DeFi liquidity dried up, adding fuel to the fire. Even the world's third-largest USDe instantly de-pegged to $0.65 (not due to USDe itself, but a pricing mechanism error at Binance), with mainstream coins like ETH and SOL also suffering, plummeting more than 20% during trading. Consequently, this Saturday, October 11, 2025, many friends in the crypto industry went bankrupt overnight, and some were even found dead from gunshot wounds in their Lamborghinis over the weekend.

Our industry truly seeks fortune in danger.

Here are some of my personal thoughts:

Tail, Tail, Tail! "The Black Swan" and Taleb have become global phenomena because, in a digital, intelligent, and interconnected end-of-the-world era, the resonance of global greed, anger, and ignorance generates karma that makes low-probability events no longer low-probability, and tail events no longer tail events. Even in the past five years, we have experienced COVID, FTX, UST, Binance's lawsuit in the U.S., and now this flash crash; it seems that without a major stimulus each year, it feels like the year hasn't been completed. Therefore, always be prepared for that major stimulus to arrive.

Does your investment portfolio affect your sleep? "The Psychology of Money" shares an interesting point: whether you can sleep at night is a crucial indicator of your investment portfolio. After all, making money is meant to bring happiness, not to crazily increase cortisol levels and then lose everything in liquidation and pain.

The crypto market is an offshore small-cap stock market: Previously, practitioners studied halving events for four years, but now the crypto market has grown up, leaving the laboratory environment and entering the global macro market. Everyone should become a macro student and learn more from Druckenmiller and Soros.

Survivorship bias: As of 8 AM on October 11, the total amount of liquidations across the network was approximately $19.134 billion, with long liquidations amounting to about $16.679 billion, marking the most brutal slaughter in crypto history. However, on social media, you mostly see people sharing how they made money from this crisis. If you don't look at other news, you might think we just experienced a major surge. It reminds me of World War II when engineers discovered many bullet holes in the wings of returning bombers and fighters, and then held a meeting to discuss reinforcing wing armor; later, they realized that planes with fuel tank breaches couldn't return. What you should do is reinforce the armor of the fuel tanks.

Centralized exchanges find it hard to achieve transparency in rules: Until this incident, users could see that the price of USDe used by Binance was its own, rather than a weighted price obtained from various market prices. However, this time Binance plans to take responsibility for its mistake and compensate users, which is a step forward for the industry.

The House Always Wins:

a. A certain Bitcoin whale closed 90% of its BTC short positions and fully closed its ETH short positions on Hyperliquid, making a profit of about $190 to $200 million in just one day. Notably, this whale established a nine-figure BTC and ETH short position just minutes before the market dropped. This is only its publicly disclosed position on Hyperliquid; its operations on centralized exchanges or other platforms remain unknown, and this account may have played a key role in that day's market. This whale's family name might be Trump. In this world, wealth is obtained not only through value creation like Tesla and Alibaba but also through value transfer and value plunder. This is unfair, but it is the truth.

b. The world increasingly needs Open Finance/DeFi: The common people need it for convenience and permissionless access; the big players need it for permissionless, anonymity, and tax evasion; policymakers need it for convenience, anonymity, and the ability to open long and short positions at any time. Therefore, DeFi will only continue to prosper.

Recently, I came across a story about a man named Rick Guerin. He was the third early partner of Buffett and Munger, and like them, he believed in value investing, but he was more aggressive—preferring to use leverage to amplify returns. During the stock market crash of 1973-1974, he was forced to liquidate due to high leverage, suffering heavy losses, and had to sell a large amount of Berkshire stock to repay margin calls. After that, he gradually faded from public view and missed out on the subsequent decades of Berkshire's remarkable growth. Buffett later mentioned him, saying, "The three of us were actually on the same path; Charlie and I wanted to get rich slowly, while Rick wanted to get rich quickly."

I hope we can all become like Buffett and Munger, and not like Rick.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。