Author: Marko

Compiled by: Felix, PANews

On October 11, the cryptocurrency market experienced the largest liquidation event in history. Over $19 billion in positions were liquidated, and many traders saw their assets go to zero. This article aims to review everything that happened that day.

Timeline

Around 9 PM on October 9 (UTC+8), China announced restrictions on rare earth mineral exports—any product containing more than 0.1% Chinese rare earth materials would require approval from Beijing for re-export. This news initially went unnoticed by most, but it caught the attention of the political circle on Twitter.

Around 4:30 AM on October 10 (UTC+8), as Bitcoin dropped from $121,000 to $117,000, a large number of short positions suddenly appeared on Hyperliquid. Half an hour later, at 4:57 AM, President Trump announced via Truth Social a 100% tariff on Chinese goods. Bitcoin plummeted from $117,000 to $104,000 in about 20 minutes, a drop of 15%. Some mysterious traders closed their short positions using brand new accounts, collectively profiting $192 million.

The total open contract volume in the entire market plummeted by over 50%: Bitcoin dropped from $67 billion to $33 billion, Ethereum from $38 billion to $19 billion, and altcoins from $43 billion to $31 billion. Altcoins were severely slaughtered. In one exchange, ATOM fell by as much as 99.99%. Many altcoins, including SUI, saw declines of up to 80% within 5 minutes. Both the magnitude of the drop and the amount of loss were more severe than the flash crash of 2021 or even the FTX collapse.

Why It Went Out of Control

Cryptocurrencies often amplify the volatility of traditional markets, but an over-leveraged environment triggered a "perfect storm." A standard liquidation chain reaction began: long positions were liquidated, which forced selling led to more liquidations, and so on.

But there was a deeper dynamic at play that turned sell-offs into a rout. When the market is functioning normally, aggressive selling should attract speculative buyers who see value. Theoretically, rational participants would step in to stabilize the situation. But that was not the case. When traders, whether manually or through automated trading programs, saw the order book being drastically reduced, survival became the top priority. Everyone rushed to cancel orders. No one wanted to catch a falling knife without knowing why it was falling. This created a vicious cycle: reduced liquidity meant worse execution, which scared off more participants, further reducing liquidity. Orders that should have found counterparties encountered unexpected obstacles. Coupled with stop-loss orders triggering a chain reaction throughout the system, this led to a collapse.

Funding rates (the mechanism that ties perpetual contract prices to spot prices) became insane during extreme market one-sidedness. Traders faced not only losses but also suddenly had to pay hefty funding fees, forcing them to close positions at the worst possible time.

How the Collapse Happened

The main derivative in cryptocurrency is the perpetual contract—a cash-settled futures contract whose price movement is based on the underlying asset. Unlike traditional futures with a settlement date, perpetual contracts remain open indefinitely. They use funding rates (periodic payments between longs and shorts) to keep the perpetual contract price aligned with a reference index tracking the spot market. As prices fluctuate, profits and losses shift between longs and shorts. Falling below the maintenance margin results in forced liquidation. Leverage amplifies both gains and losses. The entire system is, in essence, a zero-sum game. One party's loss funds another's gain, plus transaction fees.

Liquidation Mechanism

Here’s a basic understanding: when you trade Bitcoin perpetual contracts, you are not actually dealing with Bitcoin. It is purely a cash redistribution system. The exchange holds a margin deposit pool and redistributes cash among participants based on price movements. This is a clever simulation of spot trading without the underlying asset.

Key rule: long positions must equal short positions. For every dollar a long makes, a short loses a dollar. This zero-sum game can only operate if both sides remain solvent. When one side runs out of funds, they get liquidated and are kicked out of the game.

What happens during liquidation?

If someone's long position is liquidated, the system needs to maintain balance. There are two possibilities:

- New participants open long positions with new funds

- Short positions are closed to restore balance

Typically, this happens naturally in the order book. Liquidated positions are sold, someone buys in, and they become the new long with new margin.

When the Market Collapses

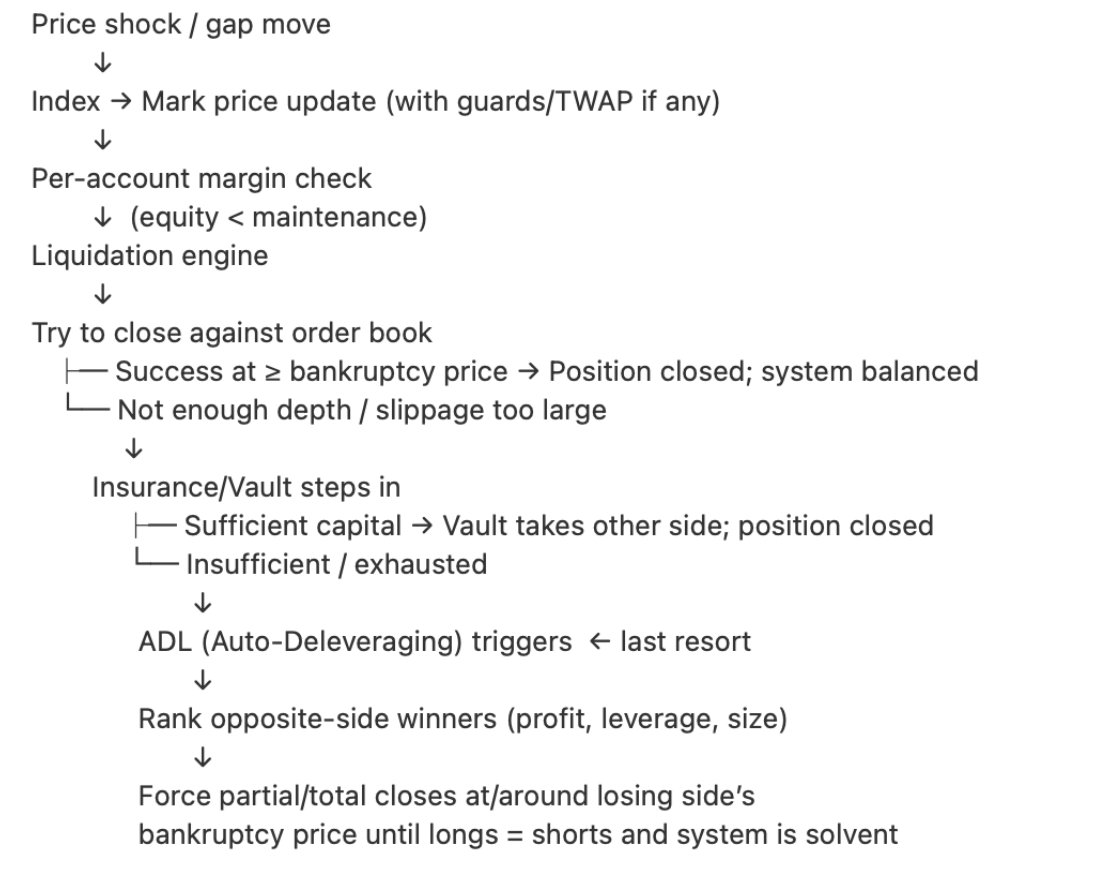

Sometimes, the order book cannot absorb liquidations because the losses on positions exceed their margin (bankruptcy price). At this point, the insurance fund intervenes—this is a fund pool maintained by the exchange to absorb liquidations during market turmoil. These insurance funds typically profit long-term by buying during crashes and selling during rallies. In this market collapse event, Hyperliquid's insurance fund made a profit of $40 million within an hour.

However, insurance funds also have their limitations. They are finite pools of capital and cannot absorb all positions.

Automatic Deleveraging (ADL)

When the insurance fund cannot cover, the exchange activates ADL: forcibly liquidating the positions of the profitable side to offset losses. This is akin to an airline kicking passengers off an overbooked flight after failing to provide incentives. If long funds run out and no one voluntarily takes over, some short positions must be liquidated.

Exchanges typically rank positions based on profitability, leverage, and size, with the most profitable positions being liquidated first. Most major trading platforms (Binance, Bybit, BitMEX, Aevo) employ similar automatic deleveraging (ADL) ranking systems, usually executing at the bankruptcy price of the liquidated positions. The feeling of being forced out of a profitable trade is very unfair, but the alternative is system bankruptcy. You can dominate every table in a casino, but eventually, you will encounter opponents with no chips. This is the ADL moment: when you hit the simulated boundary and realize that this beautiful spot market replica is ultimately just a bounded cash transfer game.

Source: Doug Colkitt

Design Choices of Trading Platforms: Hyperliquid vs. Lighter

This liquidation exposed the ideological differences between platforms. Almost every major exchange and Hyperliquid triggered ADL, with Lighter being a notable exception.

In zero-sum perpetual contracts, the exchange's risk waterfall determines who bears tail risk. This is a fundamental choice about who to prioritize.

Hyperliquid's Approach

Their HLP treasury is designed to absorb liquidation flow and fees, meaning that during times of stress, liquidation profits go to depositors—this is good for LPs but painful for traders. HLP has the privilege of priority access to liquidation flow, with fees plus liquidation penalties redistributed to HLP depositors. In this event, this design was reflected in HLP's profits, clearly prioritizing depositors over traders during market turmoil. If you held the same short position on both platforms, the payout amount from Lighter would be significantly higher. This comes at the expense of traders. Due to extreme declines, even with moderate leverage, longs were liquidated while profitable shorts were automatically closed (ADL).

Lighter's Approach

LLP serves as an insurance fund and liquidity backstop. This design absorbs losses during extreme events and distributes them to depositors—more trader-friendly, allowing them to retain more advantages and making them less likely to be automatically liquidated (ADL), but LPs bear the downside losses. However, this angered depositors, and the platform experienced hours of downtime due to unprecedented trading volume. They promised to conduct a post-mortem analysis and compensate affected users.

This trade-off is real: prioritizing traders over depositors may jeopardize liquidity in the long run (fewer depositors → worse execution → fewer traders). Prioritizing depositors over traders risks losing the initial user base that attracted depositors.

Clearly, there is no absolute right answer, and Hyperliquid's choice seems reasonable. Similar behaviors exist in swap contracts in traditional finance. Many traders do not fully understand the risk conditions of leveraged perpetual contracts and what happens during extreme tail events.

Ethena (ENA)

As mentioned in Aslan's speech, Ethena's USDE stablecoin engages in basis trading—holding spot ETH while shorting perpetual futures to maintain delta neutrality. In principle, the core hedge is 1x short against 1x spot (no leverage), so this portfolio should withstand directional volatility. Given the disastrous ADL situation, even without leverage, problems are still expected.

Automatic Deleveraging Risk

A key tail risk that many are concerned about: ADL may disrupt hedging during times of stress. According to shoku, Ethena has negotiated with major CEXs regarding ADL on its hedging inventory.

This explains why when ADL affected retail and institutional accounts elsewhere, their hedges remained effective. This exemption reduced the model's risk and provided an interesting case study. Each time an agreement is reached with entities like CEX, can similar protective measures be negotiated?

Ethena also published proof of reserves during market turmoil, maintaining user confidence in the protocol.

Redemption and Secondary Market Prices

However, USDE decoupled to $0.62 (a 38% discount) in certain trading venues, including Binance's newly launched USDE market. As others pointed out, USDE acted as collateral in the same exchange where Ethena was shorting, which is also quite absurd.

However, Ethena's primary market minting/redemption process remained operational throughout. This highlights the classic oracle vs. redemption issue: how much "price" is there when secondary market liquidity is insufficient and chaotic? This affects any project built on USDE. Using stable-priced assets for margin trading is already risky. What happens when your underlying asset drops 80% and your "stable" priced asset drops 60%?

This leads to the next big question: the oracle.

Oracles

Oracles connect off-chain data (like prices from CEXs) to on-chain smart contracts, supporting lending, perpetual contracts, and most DeFi operations. They aggregate market prices from major exchanges to determine the "real price." In calm markets, this works well; but during chaotic times—when there are significant price discrepancies reported by different exchanges and liquidity is drained—it becomes difficult to define an asset's "fair price" with a single number.

When Sui is trading at $2 on Bybit, $0.5 on Binance, and $0.14 on Kraken, and liquidity disappears everywhere, what is the fair price?

USDE perfectly illustrates this issue. If an oracle reads the price from Binance, it would report a decoupling of 38%. However, Ethena's primary redemption mechanism maintained full value throughout the process. The chaos in the secondary market does not necessarily reflect the reality of the primary market.

Case Study

Aave switched the data source for USDe to Ethena's proof of reserves (redeemability) instead of directly using CEX prices. This decision protected a position worth $4.5 billion from improper liquidation. Subsequently, they executed approximately $180 million in liquidations cleanly within a system valued at over $75 billion, without any manual intervention and without generating bad debt, making the execution exemplary. This was thanks to careful governance work with Chaos Labs and LlamaRisk, a company focused on pegged assets.

Design Points

For pegged assets with reliable primary market redemption mechanisms, consider using oracles that combine secondary market prices with proof of reserves or redemption signals at the issuer level. Time-weighted averages (TWAPs/VWAPs) can reduce "scam-like" liquidations, although they sacrifice responsiveness—longer windows can slow down "scam-like" liquidations but may lag behind actual crashes. Circuit breakers, grace periods, and cross-platform reasonableness checks are standard mitigation measures.

This raises a design question for Sui DeFi protocols: should users be liquidated based on price changes over one minute? AlphaLend (supporting lending for Bluefin) controversially uses moving averages to filter extreme spikes before triggering liquidations. Critics argue this is poor design. I believe the IKA incident from a few weeks ago and this liquidation event demonstrate that the threat posed to users by flash crashes and scam-like candlesticks is greater than that of slow, sustained declines, as moving averages will trigger during slow, sustained declines regardless.

There is no absolute right answer—it depends on your risk tolerance and threat model. You rarely encounter such severe stress tests.

Other DeFi Protocols

Morpho handled approximately $100 million in liquidations without any apparent bad debt. USDT briefly traded at a premium of 60 basis points ($1.006) as traders were willing to pay a premium for stability. On-chain infrastructure collapsed—Rabby and DeBank stopped serving tens of thousands of users. Some traders obtained extremely favorable prices (SOL experienced positive slippage, while BNB and wETH were heavily discounted), but these trades did not reflect CEX prices at all.

Impact on Sui DeFi

Yesterday's stress test provided important lessons:

Liquidation Policy: Clearly define whether to prioritize protecting depositors (insurance funds first, faster automatic debt liquidation) or traders (allowing LPs/treasuries to bear more losses in extreme cases). Users should clearly understand the risk profile they are choosing.

Oracle Policy: For pegged assets, assess the perceived sources of proof of reserves and time-smoothing mechanisms (bounded weighted average prices or circuit breaker mechanisms) as liquidation trigger conditions. Consider setting grace periods and cross-platform reasonableness checks to avoid bad trades due to price fluctuations. Parameters must be reasonable when questioned.

Liquidity Resilience: Incentivize the continuity of orders and quotes during periods of stress to mitigate the impact of market makers withdrawing liquidity.

"Winners" and "Losers"

"Winners"

Aave: Executed approximately $180 million in liquidations within an hour, with no bad debt. This is a model of scalable DeFi risk management. Governance choices made months ago played a crucial role at this critical moment.

Hyperliquid (infrastructure): Maintained operation without downtime under unprecedented pressure. Most CEXs and other DEX competitors could not achieve this.

Ethena: If they can withstand events like this, my confidence in the protocol will greatly increase. Others will feel the same. However, collateral risk should still be emphasized, especially risks associated with Deepbook.

Sui (technology): Despite the significant drop in token prices, the network performed remarkably well, and the ecosystem team praised its performance. This proves the excellent work done by the engineering team here, which is why Sui stands out.

Open Source: This event also prompted people to read project documentation, participate in governance discussions, and review actual code. Auditable and explainable protocols will outperform "black box" protocols in the next wave. Since most of Sui's TVL is open source, it is in a favorable position to stand out. Hyperliquid performed well, but it may not be so lucky next time as it has not yet open-sourced.

Insider Traders: Accounts that opened large short positions 30 minutes before the president's announcement made $192 million. This severely undermined retail confidence.

"Losers"

CEX: Many exchanges could not handle such high loads and faced criticism from traders and market makers for poor performance and lack of transparency. Even within 24 hours, you could see CEX CEOs starting to attack DEXs and even each other:

- Crypto.com CEO called for regulators to investigate the largest exchanges by liquidation scale in the past 24 hours;

- OKX CEO: USDe should not be considered a stablecoin; it is a tokenized hedge fund;

- CZ has been discussing Hyperliquid founder Jeff on X for several days.

Market Makers: Many market makers withdrew quotes when the market needed depth the most. This is a rational self-protective behavior but undermines the value of market makers. It is unclear which market makers went bankrupt and which made profits, although some may have profited from the volatility. There are rumors that some third-tier exchanges and smaller market makers went bankrupt.

Retail Traders: With positions halved and ADL triggered, many saw eight-figure profit and loss fluctuations on Hyperliquid's leaderboard and other platforms. The blows retail can withstand are limited. Since 2022, the stock market has performed strongly, making cryptocurrencies appear less valuable to retail buyers in comparison. Each crash permanently loses some retail participants. For newcomers, leveraged gambling is unsustainable, especially without investor protection measures like those in traditional finance.

Frequently Asked Questions

Did market makers like Wintermute collapse?

Unlikely, but it is too early to draw conclusions. It took a while for the full impact of FTX's collapse to manifest. It is more likely that major market makers simply triggered circuit breakers and temporarily withdrew all liquidity.

Will cryptocurrencies continue to decline?

No one knows. This event clearly shows that the influx of new funds into the crypto space is far less than what recent price movements suggest.

What broader impact will this have on Sui DeFi?

It is too early to draw conclusions; we look forward to summary reports from various teams. It is clear that directly relying on oracles is dangerous, and even market makers who dislike Deepbook may face issues.

This also reveals the reflexivity of DeFi yields—so-called "organic" yields largely come from activities driven by price increases, which generate income. When the casino shuts down, the yields stop. Whether you like it or not, trading drives all on-chain activity. A lack of liquidity means that even for non-DeFi projects, the token flywheel cannot successfully operate.

The situation is rapidly changing, making it difficult to predict what will happen next.

Related Reading: The Revelation of the Crypto Avalanche Day: The Triple Contagion Chain of Market Crash and How the Industry Can Rebuild More Robust Foundations

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。