Author: Doug Colkitt

Translation: Deep Tide TechFlow

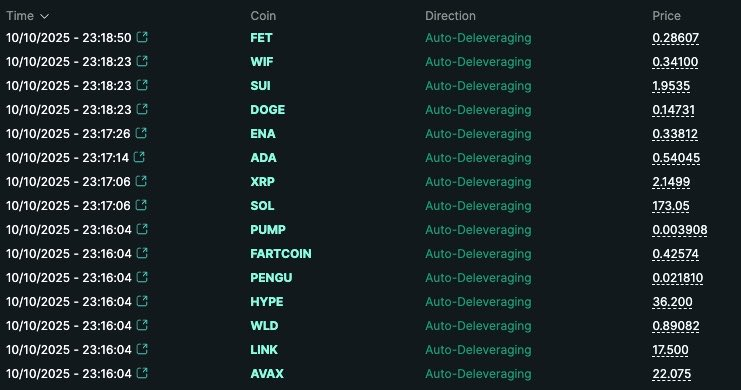

Given that many people wake up to find their perpetual contract (perps) positions liquidated and wonder what "Auto-Deleveraging" (ADL) means, here is a concise introductory guide.

What is ADL? How does it work? Why does it exist?

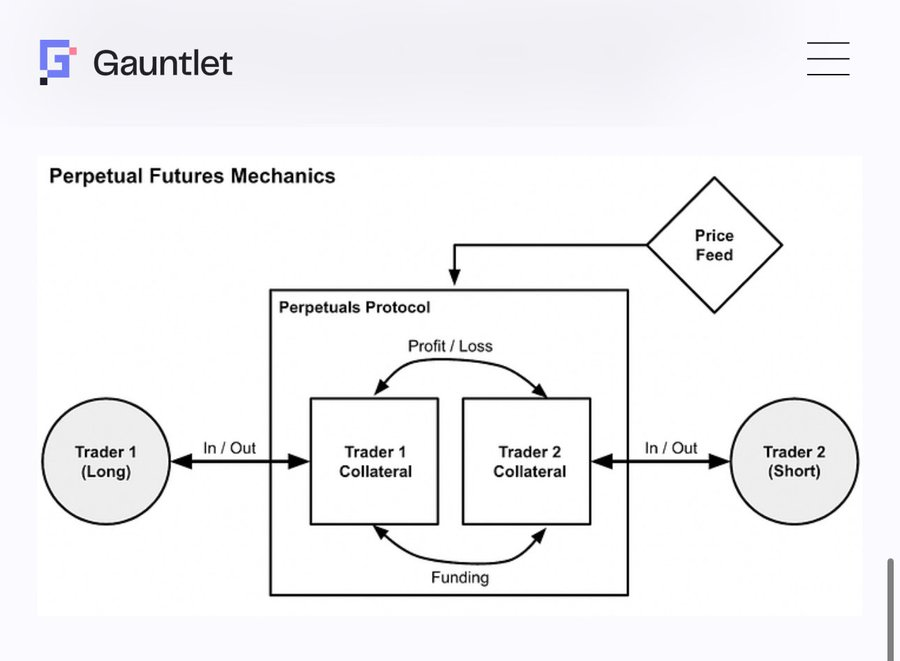

First, we need to understand what the perpetual contract market is and its function from a more macro perspective. Taking the BTC perpetual contract market as an example, interestingly, there is actually no real BTC in this system. There is only a large pile of idle cash.

What the perpetual contract market (or any derivatives market more broadly) does is distribute this pile of cash among participants. It operates through a set of rules designed to create synthetic instruments similar to BTC in a system that does not actually have BTC.

The most important rule is that there are longs and shorts in the market, and the positions of longs and shorts must be perfectly balanced; otherwise, the system cannot function properly. Additionally, both longs and shorts need to contribute cash (in the form of margin) to this pool of funds.

This pool of funds will be redistributed among participants as the price of BTC fluctuates.

In this process, when the price of BTC fluctuates too much, some participants will lose all their funds. At this point, they will be forced out ("liquidated").

Remember, longs can only profit when there are shorts with funds to lose (and vice versa). Therefore, when the funds are exhausted, you can no longer participate in the market.

Moreover, every short must be perfectly matched with a solvent long. If a long in the system has no funds left to lose, this, by definition, means that the corresponding short also has no funds to profit from (and vice versa).

Thus, if a long is liquidated, one of the following two situations must occur in the system:

A) A new long position enters the system, bringing in new funds to replenish the fund pool;

B) The corresponding short position is liquidated, restoring balance to the system.

Ideally, all of this can be achieved through normal market mechanisms. As long as a willing buyer can be found at a fair market price, there is no need to force anyone to take action. In normal liquidation operations, this process is usually completed through the regular order book of the perpetual contract market.

In a healthy and liquid perpetual contract market, this method works perfectly. Liquidated long positions are sold into the order book, and the best buy offer in the order book fills this position, becoming a new long in the system and bringing in new funds to replenish the fund pool. This way, everyone is satisfied.

However, sometimes there is insufficient liquidity in the order book, or at least not enough liquidity to complete the transaction without letting the original position lose more than its remaining funds.

This becomes a problem because it means there is not enough cash in the fund pool to meet the needs of other participants.

Typically, the next step in the "rescue mechanism" involves an "insurance fund" or "insurance pool." The insurance pool is a special fund pool supported by the exchange that intervenes during extreme liquidity events and absorbs the liquidated counterpart.

The insurance pool tends to be quite profitable in the long run because it has the opportunity to buy at a significant discount and sell at high prices during price volatility. For example, Hyperliquid's insurance pool earned about $40 million in one hour tonight.

But the insurance pool is not magic; it is just another participant in the entire system. Like others, it needs to inject funds into the fund pool, adhere to the same rules, and its ability to take on risk and contribute capital is also limited.

Therefore, the system must have a final "rescue step."

This is what we call "Auto-Deleveraging" (ADL). It is a last resort and a situation that (hopefully) occurs rarely, as it involves forcibly exiting someone's position rather than paying them. This situation happens so infrequently that even experienced perpetual contract traders often hardly notice its existence.

You can think of it like an overbooked flight. First, the airline will use market mechanisms to resolve the overbooking issue, such as continuously increasing compensation amounts to entice passengers to switch to a later flight. But if ultimately no one accepts, some passengers must be forcibly removed from the plane.

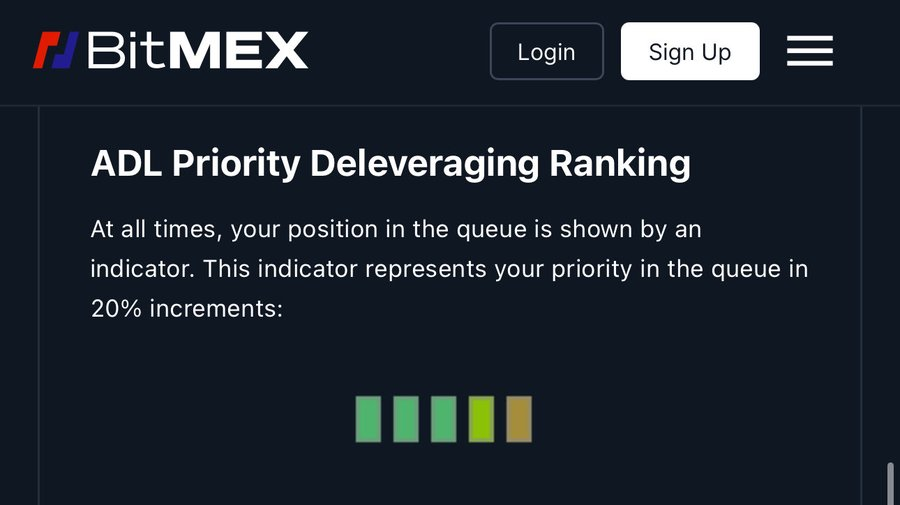

If the long's funds are exhausted and no one is willing to step in to take their place, the system has no choice but to force at least some shorts to exit and close their positions. Different exchanges have vastly different processes for selecting which positions to liquidate and at what price.

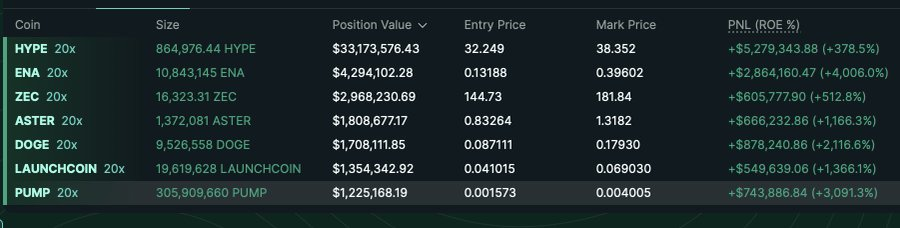

Typically, the ADL system selects which profitable positions need to be liquidated through a ranking system based on criteria such as: 1) most profit; 2) leverage ratio; 3) position size. In other words, the largest and most profitable "whales" will be sent home first.

People naturally feel dissatisfied with ADL because it seems unfair. You are at the peak of profitability, yet you are forcibly exited from your position. But to some extent, its existence is necessary. Even the best exchanges cannot guarantee that there will be an infinite number of losers on the other side to fill the fund pool.

You can think of it as a winning streak in a game of Texas Hold'em. You enter the casino and defeat everyone at the table; then you switch to the next table and defeat everyone again; then you switch to the next table. Eventually, everyone else in the casino runs out of chips. This is the essence of ADL.

The beauty of the perpetual contract market is that it is always a zero-sum game, so the entire system will never be insolvent overall.

There is not even real BTC that can depreciate. There is only a large pile of uninteresting cash. Just like the laws of thermodynamics, value is neither created nor destroyed throughout the system.

ADL is somewhat like the ending of the movie "The Truman Show." The perpetual contract market constructs a very elaborate simulation, as if it is a real world linked to the spot market.

But ultimately, all of this is virtual. Most of the time, we do not need to think about this issue… but sometimes, we touch the boundaries of this simulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。