Crypto Market Update Today: MON Airdrop Live, Coinbase Coindcx News

Crypto Market Update: The global Cryptocurrency market cap has surged to $3.92 trillion, decreasing by 0.8% in the last 24 hours. Daily trading volume reached $272 billion.

Bitcoin leads with 57% dominance, while Ethereum holds 12.6%.

With 19217 tracked cryptocurrencies, ecosystems like AI Applications and XRP Ledger are currently among the largest gainers.

Major Crypto Events Today

Source: Forex Factory

24 Hour Crypto Market Update

Bitcoin (BTC) and Ethereum (ETH) Price:

-

Bitcoin is currently priced at $112,844, representing a 1.7% decrease in the past 24 hours. With $91.94 billion in trading volume and a $2.2 trillion market cap, BTC continues to dominate as the top cryptocurrency globally.

-

Ethereum trades at $4,102.27, dips 2.8% in the last 24 hours. With a $495 billion market cap and $63.48 billion trading volume, ETH strengthens its dominance as the leading smart contract platform.

Top 5 Trending Coins

-

MANTRA (OM) at $0.1309, down 2.9% with trading volume $218 million.

-

Yei Finance (CLO) at $0.6049, skyrocketed 342% with TV $76 million.

-

Enso (ENSO) at $2.69, decreased 36% with TV $383 million

-

Zcash (ZEC) at $250.19, up 1.9% with TV $876 billion.

-

Synthetix (SNX) at $2.19, down 2.3% with TV $485 billion.

Top 3 Gainers:

-

Yei Finance (CLO) jumps 339%, with a price reaching $0.6037 and a TV of $76M.

-

BNB Attestation Service (BAS) rises 97.2%, now priced at $0.1023 with TV $39M.

-

Nockchain (NOCK) surges 99%, trading at $0.1209 with a TVL of $4.3M.

Top 3 Losers:

-

Enso (ENSO) drops 36%, trading at $2.67 today with volume $384M.

-

DORA (DORA) down 32.9%, priced at $0.08348 with TV $5.9M.

-

Portal to Bitcoin (PTB) falls 25.2% at the current price $0.04999 with TV $34M.

Stablecoins and Defi Update:

-

Stablecoins hold a market cap of $305 billion with $205 billion in trading volume, representing 0.5% growth.

-

The DeFi market cap stands at $149 billion, down 2.6% in the last 24 hours, with a trading volume of $12.2 billion. DeFi dominance remains at 3.8%.

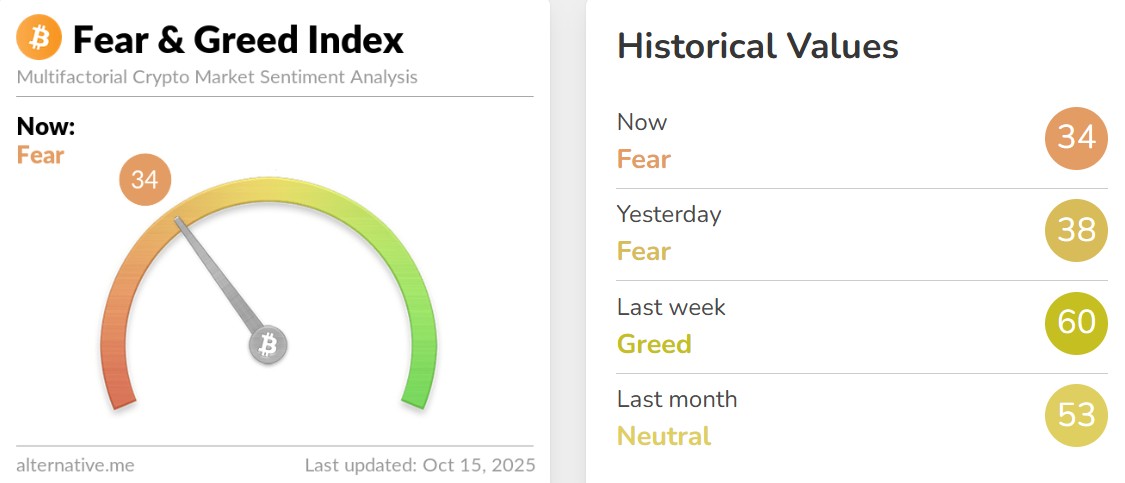

Fear and Greed Index Today

Source: Alternative Me

The Crypto fear and greed index stands at Fear (34), degraded then yesterday’s fear (38). However, Last week, market sentiment was strong with Greed at 60, and last month it was Neutral at 53.

Due to the recent crypto market crash , price drop, and high volatility, cryptocurrency sentiments are moving toward high fear shows investors cautiousness and a risk-averse approach.

Latest Market News Today

U.S. Rep. Troy Downing will introduce the Retirement Investment Choice Act , aiming to make permanent Trump’s executive order allowing 401(k) plans to invest in cryptocurrencies and private equity. Supported by four GOP lawmakers, the bill seeks to “democratize finance” by expanding retirement investment options, though no Senate version exists yet.

VanEck has updated its Solana ETF filing, cutting fees to 0.30% and allowing up to 50% staking through SOL Strategies. Rewards come after a 0.28% fee. Gemini and Coinbase ensure custody. The move, amid a U.S. shutdown , mirrors Ethereum staking ETFs and growing institutional interest in Solana.

Coinbase has invested in CoinDCX, a leading crypto exchange in India and the Middle East. With over 20 million users and strong revenues, CoinDCX is growing fast. This move shows Coinbase’s commitment to expanding in India and the region, supporting crypto adoption and building the future onchain economy.

Japan plans to ban insider trading in cryptocurrency for the first time, Nikkei reported. The Securities and Exchange Surveillance Commission will investigate and penalize violations, while the Financial Services Agency aims to pass new laws by 2026. Previously, insider trading rules did not apply to crypto assets in Japan.

The Blockchain Recovery Investment Consortium (BRIC), formed by GXD Labs and VanEck, settled a lawsuit with Tether, securing $299.5 million for Celsius Network’s bankruptcy estate. The case, filed in 2024, claimed Tether improperly handled collateral before Celsius’s 2022 bankruptcy. BRIC continues managing recoveries for creditors.

Federal Reserve Chair Jerome Powell signaled another rate cut later this month, citing job market weakness despite sticky inflation. He said the Fed may soon end its balance sheet reduction and warned that removing its interest-on-reserves tool could threaten control of short-term rates and risk market instability.

The U.S. indicted Chinese businessman Chen Zhi, accusing him of running crypto scams via Cambodia’s Prince Group, defrauding billions. Authorities aim to seize 127,000 BTC and luxury assets. Treasury sanctioned Prince Group, while FinCEN cut Huione Group off for laundering $4B, including DPRK funds. ZachXBT flagged the wallet earlier.

Binance has launched the $400M “Together Initiative” to support users and institutions hit by volatility. It includes $300M in USDC vouchers ($4–6,000 each) for eligible users facing liquidation losses, and a $100M low-interest loan fund to help institutional players recover and rebuild confidence in the industry.

The Monad Foundation has opened claims for the MON airdrop, rewarding 5,500 community members and 225,000 users. Eligible groups include active on-chain traders, Monad Cards holders, builders, Farcaster users, and contributors like ZachXBT. The claim portal runs until November 3, ensuring real crypto users become Monad stakeholders.

CoinGabbar Opinion

The trends show mixed signals with a $3.92T cap and high volatility. While Bitcoin and Ethereum maintain dominance, altcoins like Yei Finance surge sharply. Regulatory developments, airdrops like MON, and institutional moves suggest cautious optimism, but investors should remain vigilant and risk-aware amid swings.

Disclaimer: Coingabbar provides informational content on cryptocurrencies, NFTs, and other decentralised assets. This is not financial advice. Users, please DYOR, understand the risks, and consult financial professionals before investing. CoinGabbar is not responsible for any financial losses. Crypto and NFTs are highly volatile—invest wisely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。