Author: CoinGecko

The cryptocurrency market experienced its third consecutive quarter of growth in Q3 2025.

The total market capitalization rose again by 16.4%, increasing by $563.6 billion, reaching $4.0 trillion, marking the highest level since the end of 2021. This quarter signifies the second phase of the cryptocurrency market recovery, driven by a surge in liquidity, a return of institutional funds, and a strong rebound in trading activity.

The average daily trading volume increased by 43.8% to $155 billion, reversing the downward trend of the previous two quarters.

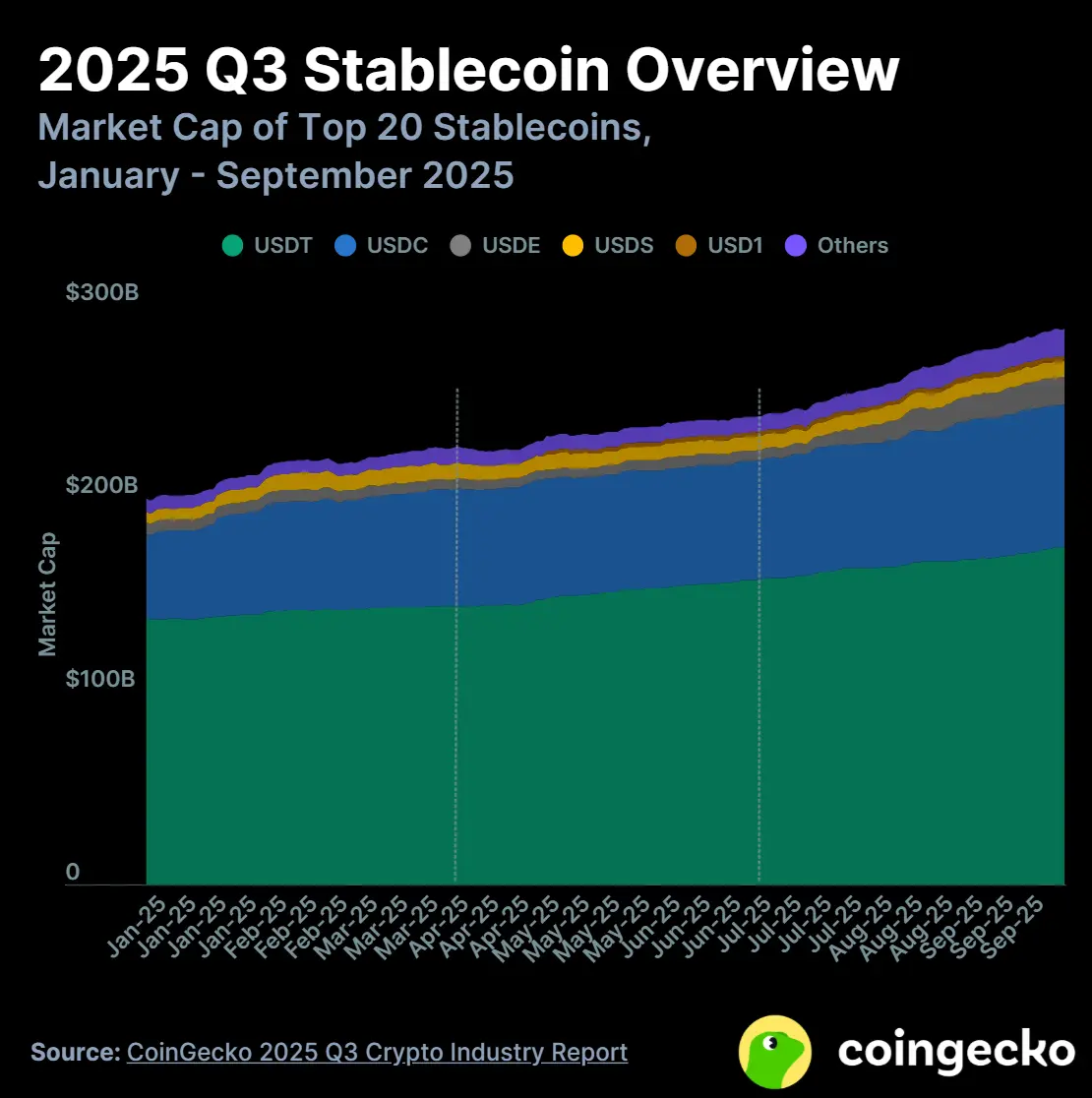

The market capitalization of stablecoins soared to an all-time high, rising 18.3% to $287.6 billion, with the demand for USDe and USDC showing the most significant growth.

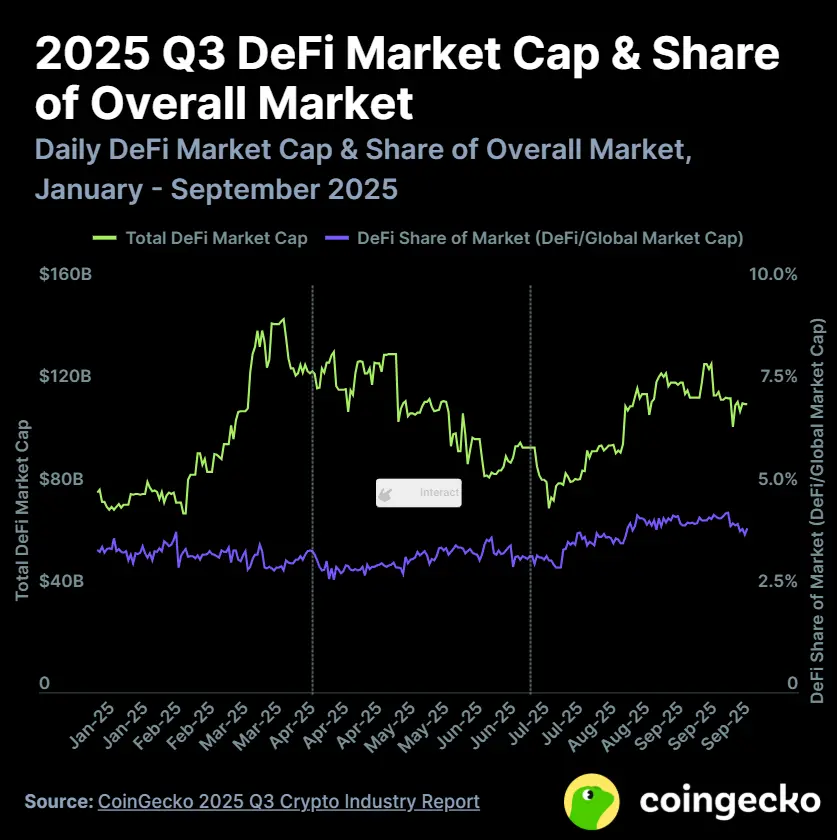

Meanwhile, DeFi made a strong comeback, with the total value locked (TVL) growing by 40.2%, reclaiming its market share in the overall market recovery.

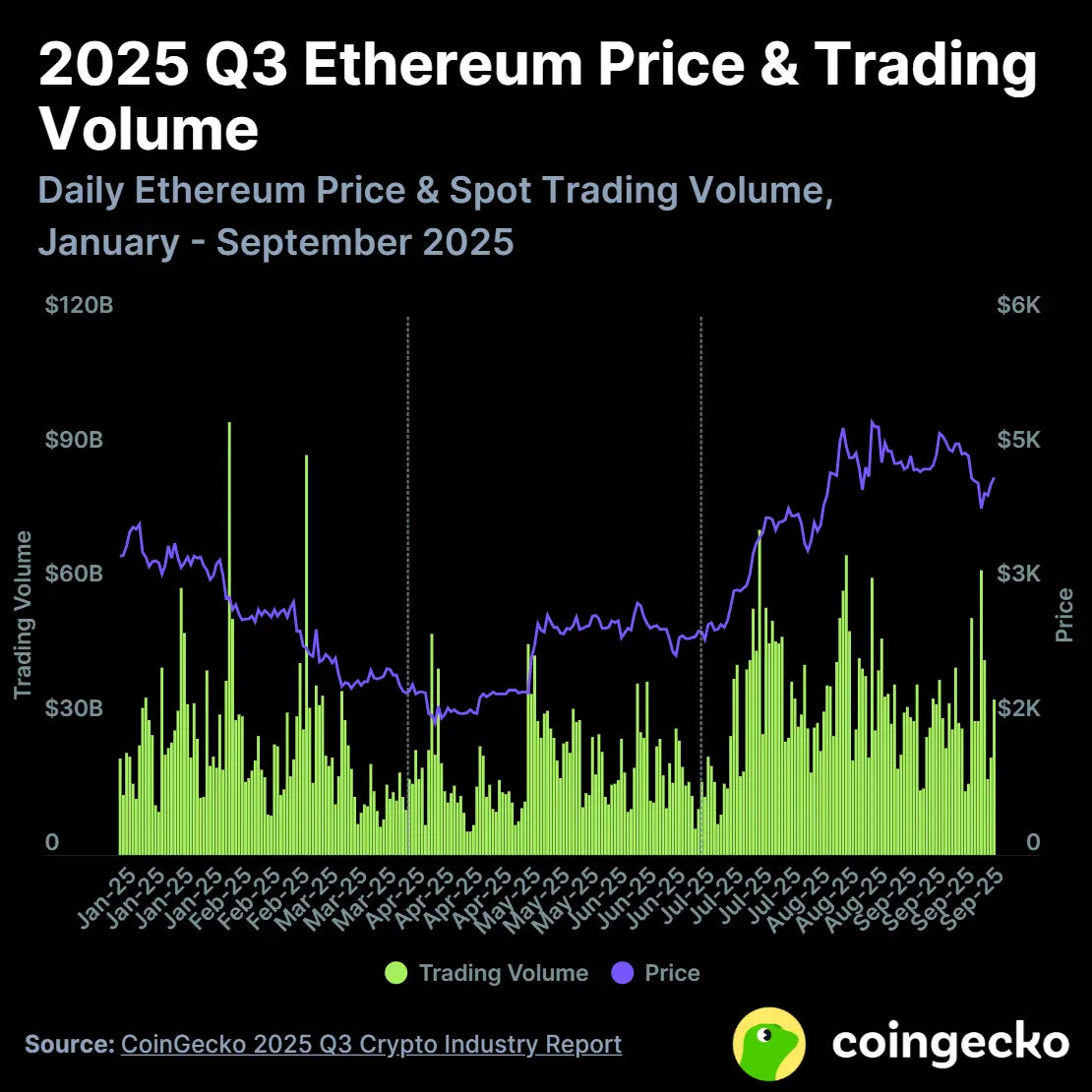

Among mainstream assets, Ethereum (ETH) and BNB performed the best, both reaching all-time highs.

ETH rose +68.5%, closing the quarter at $4,215;

BNB surged +57.3%, closing the quarter at $1,030.

The spot trading volume on centralized exchanges (CEX) increased by +31.6%, reaching $5.1 trillion, with Binance and Bybit leading the market.

CoinGecko's "2025 Q3 Crypto Industry Report" systematically outlines the market landscape, the trends of Bitcoin and Ethereum, the dynamic performance of DeFi and NFT ecosystems, as well as a comparative analysis of centralized and decentralized exchanges.

Here are the seven key highlights from this quarter's report (the full report is 51 pages long and can be accessed at the end):

🌐 Seven Key Highlights of Q3 2025

The total market capitalization of cryptocurrencies continues to rise by +16.4%, reaching $4 trillion.

The market capitalization of stablecoins grew by +$44.5 billion this quarter, reaching an all-time high of $287.6 billion. USDe and USDC became the fastest-growing mainstays.

The price of Ethereum (ETH) skyrocketed from $2,502 to $4,946, setting a new all-time high.

BNB surged +57.3%, breaking through $1,048 at the end of the quarter to reach a new high.

The total value of the DeFi market grew by +40.2%, reclaiming market dominance.

Spot trading volume on centralized exchanges grew by +31.6%, reaching $5.1 trillion.

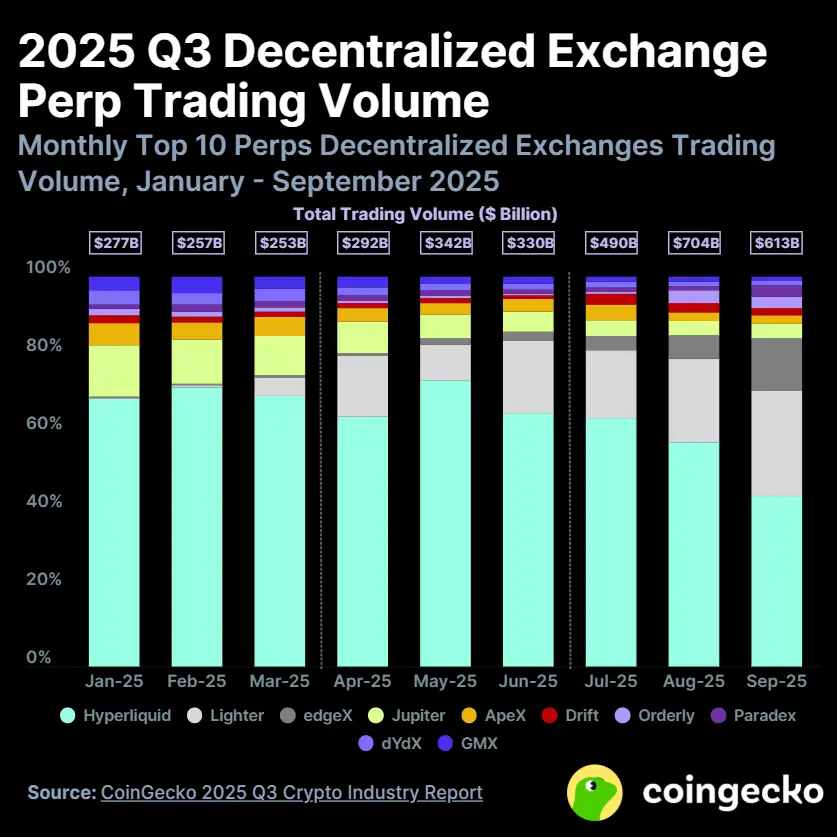

Decentralized perpetual contract DEX trading volume hit a new high, with Aster, Lighter, and edgeX emerging as new challengers.

1. The total market capitalization of cryptocurrencies continues to rise by +16.4%, reaching $4 trillion

In Q3 2025, the total market capitalization of cryptocurrencies increased by $563.6 billion (+16.4%), reaching $4.0 trillion at the end of the quarter, achieving significant capital growth for the second consecutive quarter.

At the same time, market trading activity fully recovered, with the average daily trading volume rising to $155 billion (+43.8%), reversing the downward trend of Q1 and Q2 (Q2 was $107.8 billion), indicating a significant increase in market participation during the price rebound.

2. The market capitalization of stablecoins soared by +$44.5 billion, reaching an all-time high of $287.6 billion

In Q3 2025, the total market capitalization of the top 20 stablecoins grew by +18.3% (+$44.5 billion), reaching $287.6 billion, and continued to rise in early Q4, surpassing $300 billion.

Among them:

USDe saw its market capitalization skyrocket by +177.8% (+$9.4 billion), with its market share increasing from 2% to 5%, surpassing USDS to become the third-largest stablecoin.

USDT's market capitalization increased by +$17 billion, but its market share fell from 65% to 61%, reflecting the rapid rise of other stablecoins.

3. The price of Ethereum (ETH) skyrocketed from $2,502 to $4,946, setting a new all-time high

ETH reached an all-time high of $4,946 in August, before retreating to around $4,000.

It closed the quarter at $4,215 (+68.5%), outperforming BTC, SOL, and XRP among mainstream assets.

The average daily trading volume of ETH rose from $19.5 billion in Q2 to $33.4 billion in Q3.

The increase in trading activity was primarily due to buying pressure from institutional funds, with companies like Bitmine Immersion (Tom Lee) and SharpLink (Joe Lubin) increasing their ETH holdings; at the same time, strong capital inflows into the U.S. spot Ethereum ETF also boosted the upward trend.

4. BNB surged +57.3%, reaching a new all-time high of $1,048

BNB closed Q3 at $1,030 (+57.3%), and continued to rise to a new high of $1,369 entering Q4.

Quarterly trading volume doubled, increasing from $800 million/day in Q2 to $1.7 billion/day.

Driving factors include:

The newly launched perpetual contract DEX "Aster" introduced BNB trading pairs;

PancakeSwap deeply integrated through the Binance Alpha program, activating DeFi activity on BSC and boosting BNB demand.

5. The total value of the DeFi market grew by +40.2%, reclaiming market dominance

In Q3 2025, the total value locked (TVL) in DeFi rose from $115 billion to $161 billion (+40.2%).

Benefiting from the rise in ETH prices and the expansion of stablecoins, the total market value of DeFi also increased from $115 billion to $181 billion, peaking at the end of September.

Emerging projects like Avantis (AVNT) and Aster (ASTER) contributed to the overall rebound of the DeFi sector, with market share increasing from 3.3% in Q2 to 4.0%.

6. Spot trading volume on centralized exchanges (CEX) grew by +31.6%, reaching $5.1 trillion

In Q3 2025, the total spot trading volume of major centralized exchanges worldwide reached $5.1 trillion (+31.6% QoQ).

Binance's market share rose to 40%, with quarterly trading volume increasing by +40.2%, setting a new high.

Bybit grew by +38.4%, rising from 6th to 3rd place globally.

Upbit grew by +40.5%, entering the global top ten.

Coinbase saw a +23.4% increase in trading volume, but its global ranking fell to 10th place.

7. Decentralized perpetual contract trading volume hit a new high of $1.8 trillion, with Aster, Lighter, and edgeX rising

In Q3 2025, the total trading volume of the top ten decentralized perpetual contract exchanges (Perp DEX, excluding Aster) grew by +87.0%, from $964.5 billion to $1.81 trillion.

Among them:

Hyperliquid maintained its lead with a 54.6% market share;

Aster, Lighter, and edgeX emerged as new challengers, with daily trading volume peaking at $84.8 billion (Aster, September);

However, some of the traffic comes from incentive programs, and the stability of capital flow remains to be verified.

From the perspective of open interest (OI), Hyperliquid still holds 75% market share, with other platforms each below 10%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。