The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and I refuse any market smoke screens!

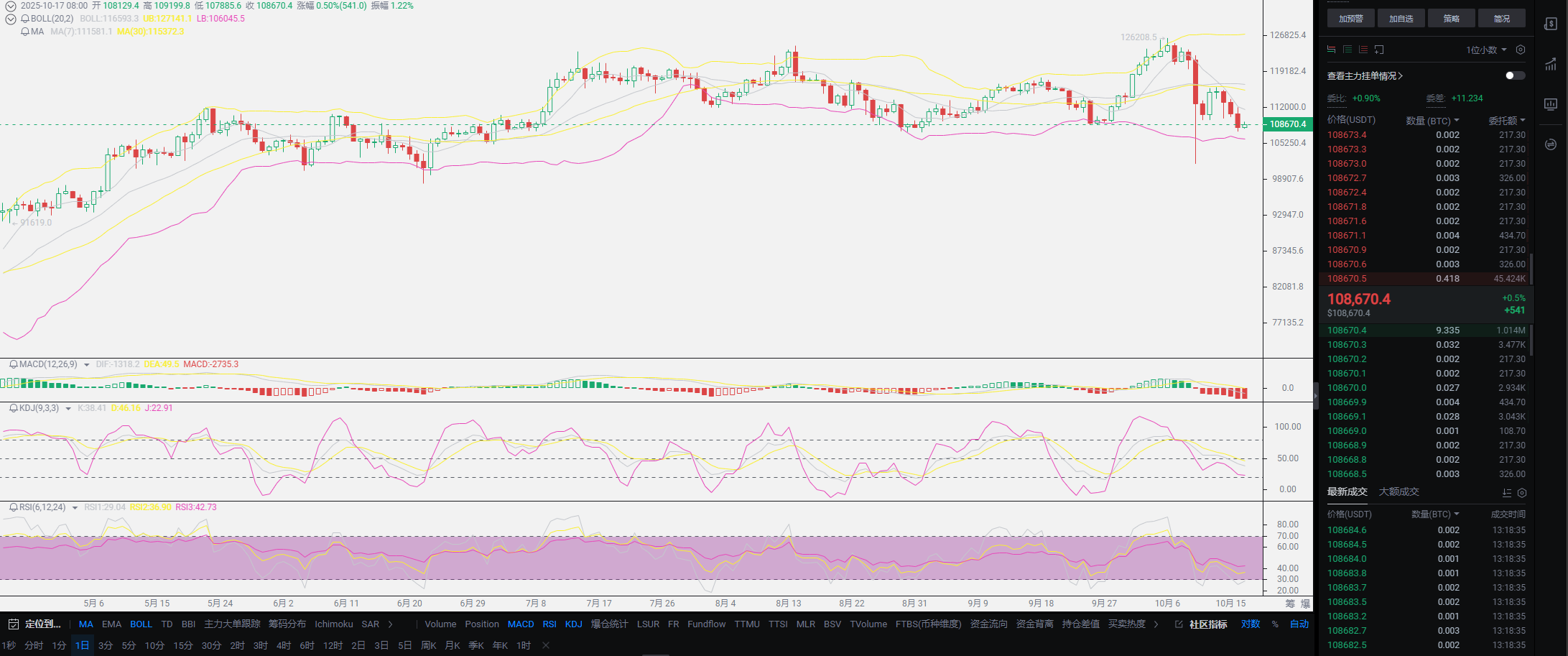

The short-term market trend is once again making a push towards new lows, and more and more users are beginning to doubt the changes in the trend. Many believe that the bull market has reached its peak and is starting to reverse. Even though Lao Cui emphasizes this, there is inevitably some lack of confidence. Why does Lao Cui continue to buy the dip in the downtrend? And why does he encourage short-term contract users to feel at ease about shorting? Many feel that these two viewpoints are contradictory and lack coherence. In fact, after experiencing the sharp drop on October 10, Lao Cui also had some concerns and doubts about the market trend. However, after watching Powell's speech, Lao Cui's belief in the bull market became even stronger. A few days ago, he simply mentioned the interpretation of Powell's speech, but it seemed that everyone did not take Lao Cui's points to heart. Today, I want to emphasize the impact of ending the balance sheet reduction.

The literal meaning of balance sheet reduction is to reduce the total assets and liabilities of the central bank, usually achieved by selling bonds and not renewing them after they mature, along with lowering the required reserve ratio. It is important to emphasize that it is the deposit reserve ratio that is lowered, not the lending rate, so please do not confuse the two, as they usually refer to lending rates. The ultimate goal of balance sheet reduction is to curb inflation or prevent risks, allowing the economy to slow down. To illustrate with actual data, how has the Federal Reserve completed balance sheet reduction in recent years? The specific operation is to sell off $95 billion in assets each month, consisting of $60 billion in Treasury bonds and $35 billion in mortgage-backed securities; this roughly translates to taking $1.14 trillion in cash out of the market each year. Such a massive figure reflects in the market as a devaluation of the real economy, which means the appreciation of the dollar. Last year to this year, the dollar to RMB exchange rate reached a high of 1:7.5, while dollar assets would depreciate under normal financial conditions.

At this point, users who pay attention to the US stock market might feel that Lao Cui's statements are problematic, as the US stock market is soaring, with major indices reaching new highs, including companies like Nvidia and Apple, which have all set historical highs. The dollar assets have not depreciated. This is why Lao Cui emphasizes that this result occurs under normal financial conditions. Taking the S&P 500 as an example, these seven tech companies account for 32% of the entire index's weight, meaning that the US economy has already shown signs of polarization. Essentially, balance sheet reduction and expansion, as well as interest rate cuts, are closely related; these two usually appear together in the financial landscape. During the balance sheet reduction period, the goal of the US is, to put it simply, to encourage companies to borrow to buy Treasury bonds and dollar assets, and during Trump's term, Treasury bonds have already been sold off quite a bit. Again, it is important to remind that the power of stopping balance sheet reduction far exceeds that of interest rate cuts, which is a significant positive message. Looking at the data, a 25 basis point rate cut brings only $50 billion to the market, while stopping balance sheet reduction can bring over a trillion dollars in liquidity; this is not the same concept.

This is why Lao Cui mentioned the importance of stopping balance sheet reduction the very next day. The data shows that only 11% of analysts have paid attention to what Powell said. Of course, he did not directly state that the balance sheet reduction would stop, but Lao Cui provided the original quote: "Normalization of the balance sheet may be completed earlier than expected." This means that the Federal Reserve is already considering stopping the balance sheet reduction. Why does Lao Cui feel that this probability is high? First, the weak dollar at the beginning of the year, combined with interest rate cuts, is preparing for the return of manufacturing. Although it seems that this can be declared a temporary failure now. Stopping the balance sheet reduction will undoubtedly lead to the appreciation of dollar assets, which is beyond doubt; this is a series of measures to stimulate the real economy. Historical examples show that before the collapse of Lehman Brothers, interest rates had already been cut to 0, yet it still could not avert the financial crisis, and the ultimate solution was reverse balance sheet reduction, which stopped the financial crisis.

The economic issues in the US are quite acute. Looking at the US stock market, it is primarily led by the tech virtual economy. Simply put, everyone knows that companies like Apple and Nvidia primarily survive on patent monopolies; however, the creation of patents does not drive much employment. The manufacturing lines of Apple and Nvidia are not located in the US, and creating a patent often requires a team of fewer than a hundred people. This means that US tech companies are quite unique; even though their market value is high, they do not contribute to market liquidity. These companies hold $800 billion in cash but do not circulate, which leads to financial circulation issues and naturally triggers a financial crisis. So, following this logic, looking back, Trump was indeed skilled at managing the economy. He promoted the linkage of the cryptocurrency market with the dollar and US debt, which at least alleviated the purchasing rate of Treasury bonds. Understanding this point, one can comprehend why Trump promoted the cryptocurrency market.

If you can think through this logic, you will understand that there is indeed a high probability of stopping the balance sheet reduction this year. However, do not be overly optimistic; a true bull market often occurs during balance sheet expansion. Stopping the balance sheet reduction merely means halting the withdrawal of liquidity from the market. But at this stage of the financial market, as long as the balance sheet reduction stops, it can maximize the effect of interest rate cuts. Once stopped, a 25 basis point rate cut may lead to the circulation of hundreds of billions of dollars. Small and medium-sized enterprises will no longer need to worry about corporate debt issues, allowing them to invest more boldly in the market. That concludes the discussion on stopping the balance sheet reduction; the remaining space will address your questions. Many friends are puzzled as to why, despite such terrifying positive news and significant growth in the US stock market, the cryptocurrency market continues to decline. The logic is simple: funds need to be released. You can pay attention to the giants in the cryptocurrency market, which are basically the same as the giants in the US stock market. The decline in the cryptocurrency market while funds flow into the US stock market only indicates that funds in the cryptocurrency market are moving towards the US stock market.

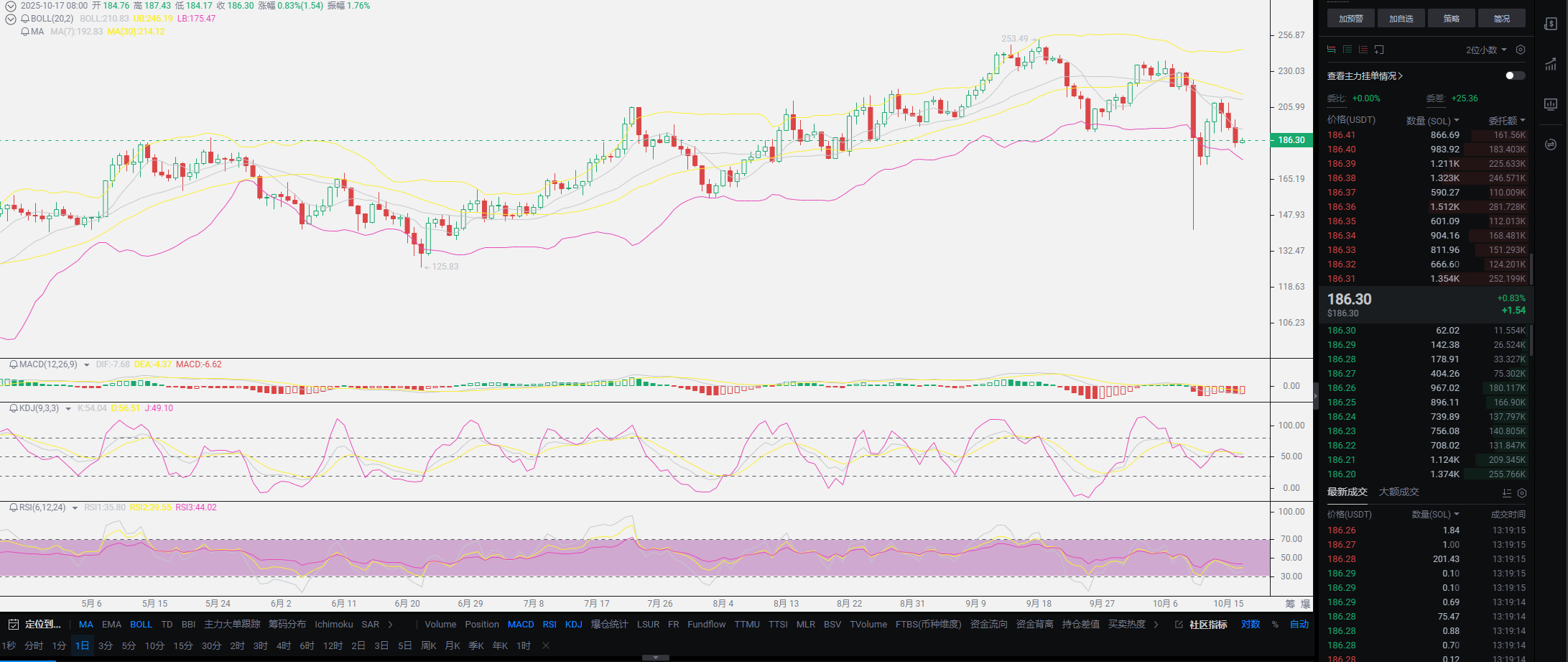

Lao Cui summarizes: Whether it is balance sheet reduction, interest rate cuts, or cryptocurrencies preparing for listing, they all belong to expected news that has not yet officially arrived. Therefore, I hope everyone can be a bit more patient. The delay in the listing of SOL is not due to the cryptocurrency itself, but rather the US government shutdown, which has led to delays in reviews. The latest fee submitted on the 14th has already reached 0.30%, currently the lowest fee in the cryptocurrency market, and it is estimated that after listing, it will bring at least $1.5 billion into the SOL market. In the third quarter, the SOL chain created $223 million in real economic value, higher than both Tron and Ethereum. In the past 30 days, DEX trading volume reached $138 billion, directly surpassing Ethereum. Key indicators such as stablecoin inflow and MEV income are all on the rise. The SOL cryptocurrency itself has not encountered significant issues, and the probability of approval in 2025 is as high as 90%. Everyone should be more patient. Finally, regarding contract users, Lao Cui also emphasizes that if you are primarily trading contracts, the current focus should definitely be on shorting. However, as long as there is spot trading in the market, do not short, as you will miss the opportunity for a rebound. You can only choose to buy at low points; once the market starts, historical highs will be reached within half a month, so do not focus on short-term gains.

Original article created by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on individual pieces or territories, aiming for the final victory. The novice, on the other hand, fights for every inch of ground, frequently switching between long and short positions, only seeking short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries risks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。