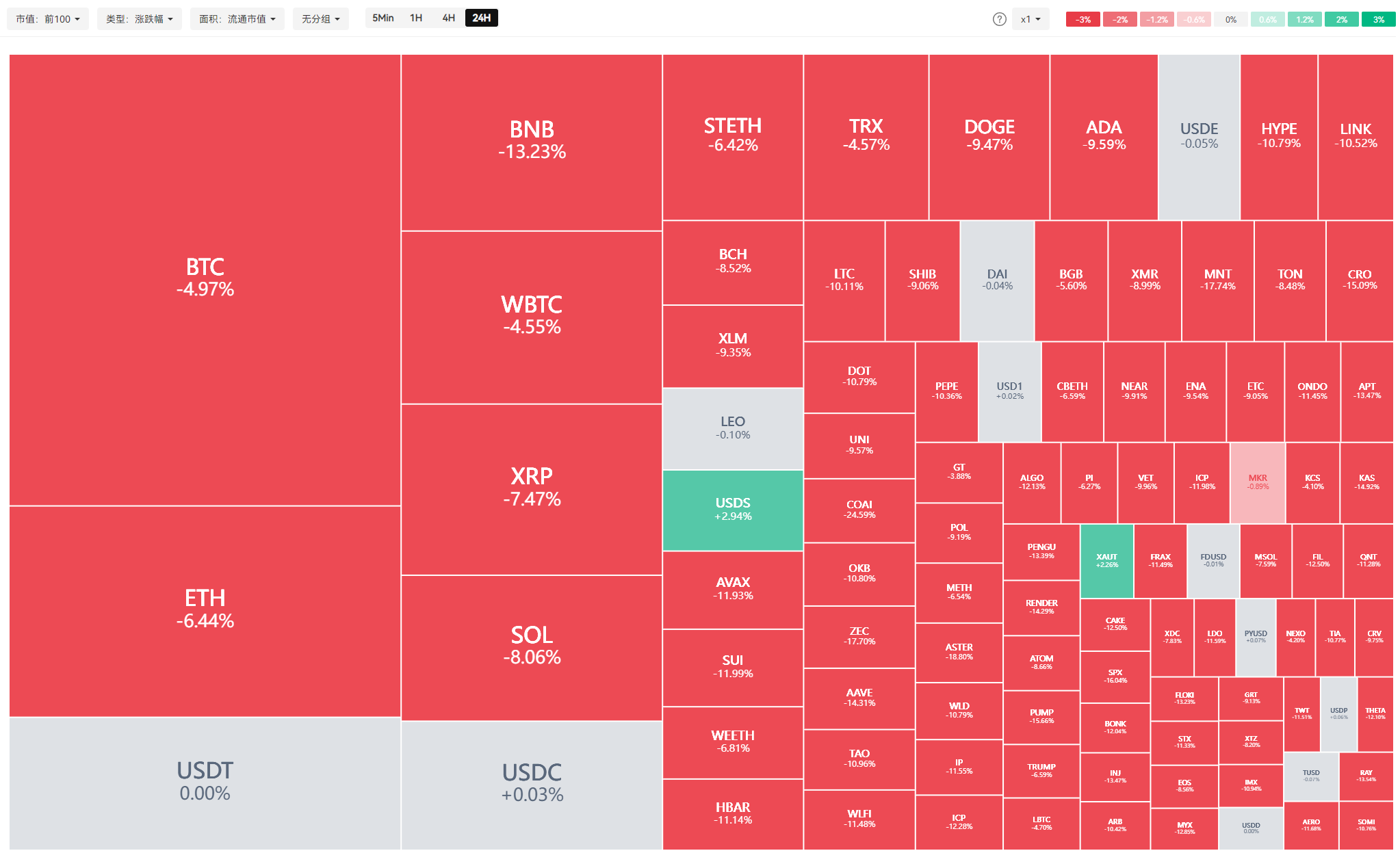

In just 24 hours, the cryptocurrency market once again staged a "mass exodus." From October 16 to 17, Bitcoin plummeted from $111,900 to $104,500, with an intraday drop of over 6.6%; Ethereum also faced a setback, dropping more than 9%. Meanwhile, traditional safe-haven asset gold surged, with spot gold breaking through $4,370 per ounce, setting a new historical high.

This is not merely a technical correction, but an inevitable result of the interplay between the macro environment, regulatory expectations, and market sentiment.

01 Four Factors Behind the Decline

On the surface, this decline appears to be triggered by the collapse of bank stocks leading to risk-averse sentiment, but it is actually the result of multiple factors resonating together.

First, regional banks in the U.S. are facing issues. Stocks of regional banks like Zion Bank and Western Union Bank suddenly plummeted due to allegations of credit fraud. This directly sparked concerns about the stability of the financial system. Although these banks are not very large, the market is currently like a startled bird; any slight disturbance can trigger panic.

Second, the U.S. government is still in a shutdown. It has now been 17 days, and key economic data has yet to be released. Without data, the market is like a blind person trying to touch an elephant; no one dares to act rashly. Particularly, the delay in the release of September's non-farm payroll and CPI data has left investors feeling even more uncertain.

Third, concerns over U.S.-China trade frictions are intensifying. Trump has threatened to impose a 100% tariff on China, which may just be a negotiation tactic, but it is enough to make the market nervous. As soon as the news broke, the cryptocurrency market reacted immediately, indicating that the market is currently extremely sensitive.

Most importantly, the leverage within the cryptocurrency market is indeed too high. The recent surge led to excessive long leverage, and any negative news could trigger a chain reaction of deleveraging.

02 Subtle Changes in Capital Flow

To understand the situation of cryptocurrencies, it is essential to place them within the broader context of global finance. In this crash, the performance of gold and U.S. stocks serves as the most vivid "reference point" for cryptocurrencies.

1. The Frenzy of Gold

A very obvious phenomenon has emerged in the past few days: gold is hitting new highs while cryptocurrencies are declining. This stark contrast of "one falling, one rising" reveals a harsh reality:

• The true safe-haven asset remains gold. Amid geopolitical tensions, strong central bank demand for gold, and global concerns over the trend of "de-dollarization," gold is viewed as the last safe haven by institutions and nations.

• The boost from interest rate cut expectations. The market's strong expectation that the Federal Reserve will initiate a rate-cutting cycle has lowered the opportunity cost of holding non-yielding assets (gold), fundamentally supporting gold prices.

Many once believed Bitcoin was "digital gold," but when a real crisis strikes, the muscle memory of traditional finance remains: sell risk, buy gold. Bitcoin ultimately did not pass this "safe-haven test."

2. The Resilience and Differentiation of U.S. Stocks

Compared to the bloodbath in cryptocurrencies, U.S. stocks, while down, have shown significant resilience. There was no panic-driven systemic sell-off.

• The "moat" of quality assets: Wall Street has stratified risk assets. Tech giants (AI, cloud computing, etc.) are viewed as "quality growth assets" due to their strong cash flow and performance certainty, still attracting capital.

• The "spillover effect" of risk: In comparison, cryptocurrencies are the least liquid and most unstable in consensus, so they bear most of the selling pressure. Capital has not fled all risk assets en masse but has shifted from the "highest risk" cryptocurrency sector to the "relatively safe" traditional stock market and "absolutely safe" gold.

The resilience of U.S. stocks indicates that global market liquidity has not completely dried up, but investors' risk appetite is sharply contracting. They prefer to hold tech stocks supported by performance rather than purely speculative cryptocurrencies.

This shift in capital flow reveals the current market's segmentation logic regarding risk assets: cryptocurrencies remain at the highest end of the risk spectrum and are the first to be impacted when liquidity tightens.

03 Future Market Judgments and Operational Suggestions

To be honest, the current position is quite awkward. There is support below, but a lack of momentum above. The market needs to consolidate here for a while to clean out the weak hands.

For traders, the most important thing now is to control positions. In this high-volatility environment, position management is more crucial than directional judgment. It is advisable to lower leverage and leave enough buffer space for oneself.

In terms of sector selection, Bitcoin remains the most resilient. If the market continues to adjust, Bitcoin's decline is likely to be smaller than that of other altcoins. Consider reallocating funds from weaker coins to Bitcoin, and then think about adjusting positions once the market stabilizes.

Additionally, several indicators need to be closely monitored:

First, when will the U.S. government shutdown end? Until this is resolved, the market will struggle to find a clear direction.

Second, the progress of U.S.-China trade frictions. Vance mentioned that Trump is willing to negotiate, which is a good sign, but we need to see actual actions.

Third, the trend of gold. If gold continues to hit new highs, it indicates that risk-averse sentiment is still rising, which may put further pressure on cryptocurrencies.

Lastly, a reminder: the market is always right, and one must acknowledge when they are wrong. Although this round of adjustment has been brutal, it is also a necessary process for the market to self-correct. Deleveraging and clearing bubbles lay the foundation for the next round of increases. The key is to survive until that time.

Remember, in this market, surviving longer is more important than making quick profits. Control risks, maintain patience, and wait for the market to provide clear signals before taking action.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。