Will $45M BlackRock Ethereum Purchase Reverse ETH Crash or Bad Timing?

ETH is going through a wild ride as almost $1 billion tokens got wiped out in just 24 hours as traders with leveraged positions panicked. But in the middle of this chaos, one of the largest asset management firms buyed the dip. Yes they made a big move and executed a $45.48 million BlackRock Ethereum Purchase.

While regular traders were scared, the BlackRock Ethereum news is coming as a strong backup and support for the asset, as it rotated money from Bitcoin and Solana into $ETH, showing confidence even during a crash.

Why Does the BlackRock Ethereum Purchase During Crash Matters?

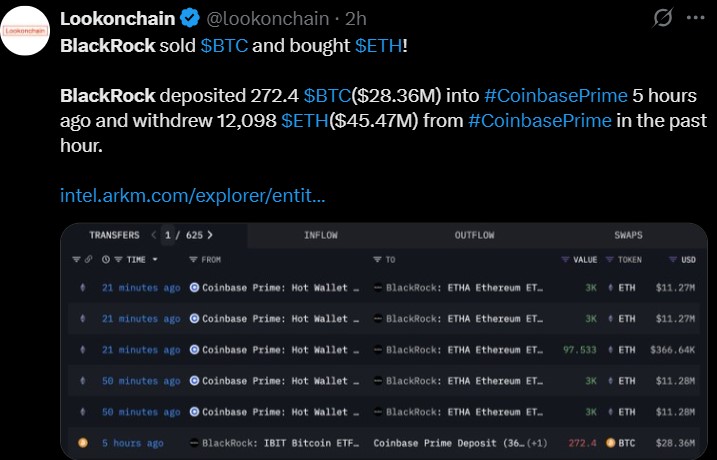

Data from Lookonchain shows that the BlackRock purchase was significant at this volatile moment: they deposited 272.4 BTC (~$28.36M) into Coinbase Prime and withdrew 12,098 tokens (~$45.48M) right after.

This shows that big industry whales are preferring altcoin over world's largest cryptocurrency. Massive whale accumulation might flip the price crash and bring a new hope in the crypto market’s trend reversal.

Traders Note: When the market shows weak momentum, people often panic and sell, but smart firms see a chance to buy the dip, which shows long term belief in the asset.

The Liquidation Storm That Set the Stage for BlackRock ETH Buy

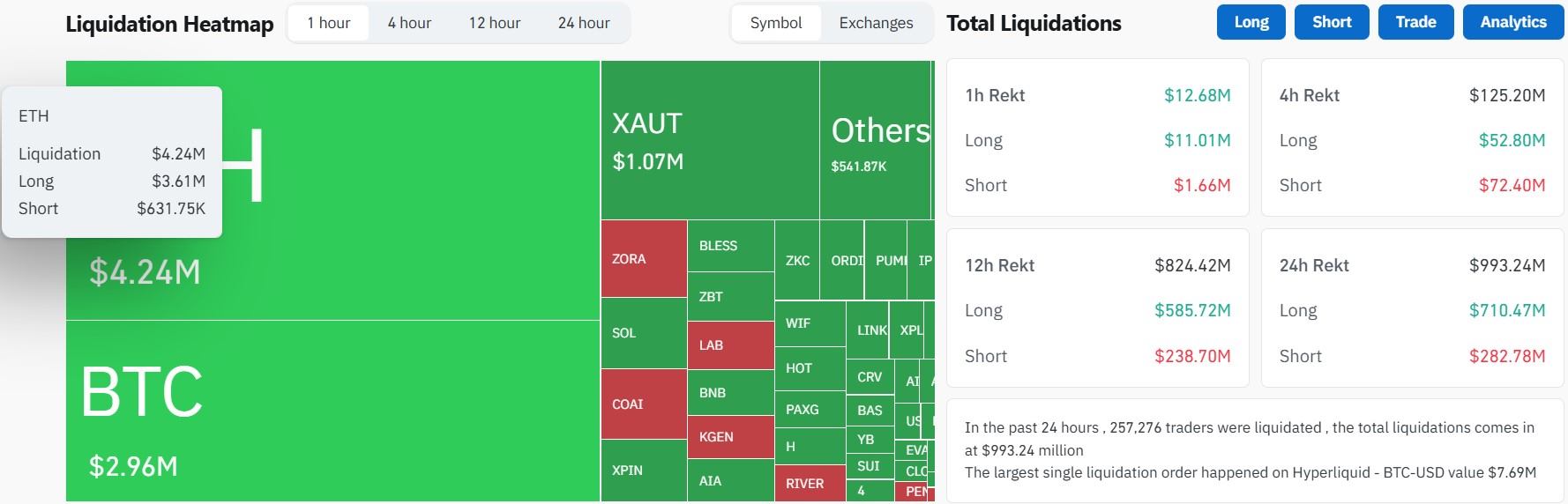

In the last 24 hours 257,318 traders were liquidated, which brings the title liquidation to $993.23M.

Source: Coinglass

-

Biggest single liquidation: $7.69M on Hyperliquid (BTC-USD)

-

ETH liquidations: $4.24M, with $3.61M from long positions

Most traders were betting that token will soon show positive momentum, but they got wiped out. This made the price drop a perfect chance for BlackRock Ethereum Purchase.

Buying now helps the firm to absorb some selling pressure and positions them for future gains.

Why Is Ethereum Falling Today: ETF Outflows and Macro Pressure

There are 4 other Ethereum price crash reasons excluding price that might affect this instituional buy for a while. Let’s uncover them:

-

ETH ETF Outflows : The asset has seen $56.88M coins being exited as of October 16, which added pressure.

-

Crypto Options Expiry: $5.7B in options expired today.

-

Technical Breakdown: Price crashed below $3,850, which is a weak point.

-

Macro BTC Weakness: Bitcoin bloodbath often pulls other coins with it.

All of this explains why altcoin is falling today, but the BlackRock Ethereum Purchase shows that big investors see a chance in the panic.

Did Big Fund Pick the Perfect Time to Buy? Chart Analysis

At the time of writing the token is trading at $3,802.33, forming a short-term base around $3,700, the same level where the asset management company bought. Technical indicators show:

-

RSI at 52.86, slightly bullish

-

MACD slightly positive, hinting at a small reversal

-

Resistance zone: $3,850–$3,900, where price may face challenges

These indicators show that it is the perfect entry point for anyone looking for long term profit booking.

Top experts expect bullish ETH price prediction :

-

Short Term: $3,850–$4,100 if momentum continues

-

Mid Term: $4,250–$4,500, helped by institutional buying and ETF inflows

-

Long Term: $5,000+, if adoption grows and smart investors keep rotating money into altcoins

Conclusion

The $45.48M BlackRock Ethereum Purchase is a big vote of confidence during a market crash. After rotating from Bitcoin and Solana, the company is not just buying the dip but helping create medium-term bullish momentum.

Technical support, liquidations, and smart money activity all suggest that ETH crash could soon turn into recovery and push past key resistance levels, so traders should keep a close watch on this asset.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。