Author: rektdiomedes

Compiled by: Tim, PANews

Has the crypto bull market ended?

In fact, I believe that if we look rationally at the overall market situation, the current state is entirely reasonable.

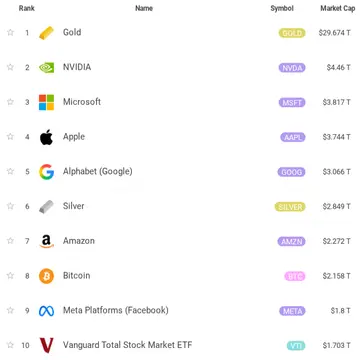

Firstly: Gold prices are skyrocketing, far exceeding stocks and cryptocurrencies.

This is because major sovereign nations (such as China, India, Russia, and to some extent, the United States itself) are driving up gold prices as part of a strategic adjustment away from the era of viewing U.S. Treasury bonds as the "world reserve asset."

This is primarily driven by two major factors: the widespread fiscal extravagance in the U.S. and the actions taken a few years ago when the U.S. froze Russia's foreign exchange and Treasury reserves, which completely exposed the fact that U.S. Treasury bonds can no longer be viewed as a "neutral" reserve asset.

Several macro observers, such as Doomberg, Luke Gromen, and my friend Noah Seidman, have elaborated on this viewpoint: when Russia, and even China and India, witnessed the U.S. implementing freezes in this manner, it can be logically deduced from a game theory perspective that these countries would make the rational choice to increase their gold holdings and reduce their U.S. Treasury bond holdings.

Secondly: U.S. stocks are rising, but have not yet reached a frenzy level.

This is because the U.S. stock market is essentially an automated Ponzi scheme, driven by the automated cash flows of 401k pensions and the passive investment industry complex (as Mike Green has been explaining for years).

Every ordinary nine-to-five worker across the country automatically invests their retirement funds into major indices every month, regardless of price or other variables, so these indices naturally rise over the long term.

Moreover, the U.S. stock market is increasingly becoming the "world stock market," as the global economy is becoming more online. It is reasonable that the largest "global companies," such as Amazon, Nvidia, Apple, and Microsoft, all come from the U.S.

This situation is likely to continue until this trend further develops, and cryptocurrencies themselves will become the dominant stage for global capital formation.

Thirdly: Due to high interest rates, the U.S. real estate market (and the real estate markets of most developed countries with mortgages) remains in a complete "freeze" state.

Currently, the U.S. residential real estate has $37 trillion in asset equity, but the problem is that this equity is almost inaccessible; no one is willing to cash out and refinance at rates higher than their existing mortgages, nor are they willing to sell their current homes and then apply for new mortgages at higher rates, and they certainly do not want to take on home equity lines of credit at exorbitant rates (reaching double digits).

Fourthly: Cryptocurrencies have rebounded from the lows of 2022, when the downturn was due to the interest rate hike cycle and the subsequent collapses of institutions like LUNA and FTX, and have now basically returned to normal.

Our scale has expanded by about 25% compared to the peak period in 2021, but it is still less than Nvidia, only one-tenth of the total market value of gold.

The reason we have not seen any "bull market" like conditions is that the macroeconomic situation has not experienced a large-scale liquidity injection similar to that of 2021.

Most people view stimulus checks and "stay-at-home" measures as the main drivers of the 2021 bull market, but as I mentioned earlier, I believe the real reason was the large amount of extractable home equity at that time.

This is how the legendary "Cardano dad" obtained additional investment funds during the last bull market; they watched Hosk's videos on YouTube and then frantically pressed the buy button on Coinbase.

They either sold their house and reinvested the net equity obtained, refinanced and withdrew cash, or applied for home equity lines of credit.

Conclusion

Given all of the above, the current performance of asset classes is entirely reasonable.

Specifically in the crypto space, we should anticipate that a true "bull market" will start in the second quarter of 2026, when interest rates will eventually drop to a sufficiently low level, beginning to "unfreeze" the U.S. real estate market.

At that point, I believe we will see about six quarters of very positive price movements.

Before the fourth quarter of 2027 or the first quarter of 2028, the aftermath of the market frenzy and the initial emergence of panic ahead of the elections (imagine figures like Mamdani leading in the Democratic primary nationwide) will trigger a wave of selling, leading to another "bear market."

Therefore, I believe the "bull market" in the crypto space has not yet ended, and I do not even think the "bull market" has begun.

I will continue to accumulate coins, take action, and focus on the second quarter of next year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。