The biggest enemy of Ethereum is the Ethereum Foundation.

Written by: David, Deep Tide TechFlow

“I feel like I am a somewhat useful fool for the Ethereum Foundation.”

On October 19, a public letter written a year and a half ago was published on Twitter, and this sentence quickly ignited discussions in the crypto community.

The author of the letter is not some fringe Ethereum critic, but Péter Szilágyi:

The former head of the Geth client, which maintained over 60% of Ethereum nodes, and a core developer who has worked in this ecosystem for a full 9 years.

Does this feel familiar?

If you have been following Ethereum long enough, you will notice that this scene plays out every few months:

Criticism of the Foundation (EF) suddenly erupts, the community falls into intense discussions, Vitalik steps in to respond, and then everything returns to calm until the next eruption.

In 2022, it was concerns about centralization after the Merge; in 2023, it was conflicts of interest among researchers; in 2024, it will be the fragmentation issues of L2.

Now, the powder keg has been ignited by an old letter.

The description of "useful fool" is like a knife, piercing through a long-maintained illusion and hurting the hearts of many contributors to the Ethereum ecosystem.

Core contributors, who rarely criticize publicly, including Polygon founder Sandeep and the father of DeFi AC, have stepped forward one after another; the message they convey can be summarized in one sentence:

We have been betrayed.

The specific questions they raised hit the nail on the head: Where did the money go? Why do the most loyal get the least? Who is really controlling the direction of Ethereum?

These questions are actually old clichés, but when they come from the core contributors of Ethereum, the situation and weight may be completely different.

Let’s take a closer look at this letter to see what a technical leader who has worked in Ethereum for 9 years has experienced to describe himself as a fool.

Nine Years of Loyalty, One Letter of Disappointment

On May 22, 2024, when Péter Szilágyi wrote this letter, he was likely in a painful cycle.

The beginning of the letter is very sincere. Péter expresses that he has become increasingly confused and pained about Ethereum and his role in the Foundation over the years. He tried to sort out his thoughts, which led to this letter.

The entire content of the letter reflects the numerous issues a loyal developer has seen regarding Ethereum and the Foundation throughout his career.

- Issue One: Named Leadership, but Actually a Used Fool

Péter bluntly states that he feels he is being used as a "useful fool" by the Foundation.

He explains that whenever there is a controversy within Ethereum, such as a researcher receiving money from an external company leading to a conflict of interest, or a new proposal clearly favoring a specific interest group, the Foundation would have him, the "troublemaker," stand up to oppose it.

Looking back at Péter's previous tweets, there is indeed a flavor of sharp criticism and frankness, as he often discusses various issues within the Ethereum ecosystem; however, the content revealed in this long letter suggests that these statements are more like a performance to cater to the collective interests of the Ethereum Foundation.

This way, the Foundation can publicly claim, “Look, we are so democratic, there are different voices internally.”

But the problem is, every time Péter stands up to challenge those in power or with connections, his credibility diminishes a bit. Supporters of the other side would attack him, saying he hinders progress. Over time, he and the Geth team became seen as troublemakers.

“I could choose to remain silent and watch the values of Ethereum be trampled; or speak out, but gradually ruin my own reputation,” he wrote. “Either choice leads to the same result—Geth will be marginalized, and I will be excluded.”

- Issue Two: 6 Years of Salary Only 600,000, High Effort, Low Return

In the first 6 years (2015-2021) of working at Ethereum, Péter received a total of 625,000 USD. Note that this is the total for 6 years, pre-tax, with no equity or incentives. That averages to about 100,000 USD per year.

During the same period, the market value of ETH rose from 0 to 450 billion USD.

As the person responsible for maintaining the most critical infrastructure of the entire network, Péter's salary might even be lower than that of a freshly graduated programmer in Silicon Valley.

He mentioned that other departments in the Foundation, such as operations, DevOps, and even some researchers, have even lower salaries.

Why is this the case? Péter quoted a saying from Vitalik: “If no one complains about their salary being too low, it means the salary is too high.”

Diving deep into technology and not caring much about returns is indeed the ideal image of some tech geeks and cypherpunks. But the problem is that a long-term low-salary culture can have negative consequences.

Those who genuinely care about the protocol's development are forced to seek compensation outside of Ethereum due to inadequate salaries within.

This leads to various conflicts of interest: researchers act as consultants for external projects, core developers privately accept sponsorships.

Péter bluntly stated: “Almost all of the Foundation's early employees have long since left because that was the only reasonable way to obtain compensation commensurate with the value created.”

- Issue Three: Vitalik and His Circle

The sharpest part of the letter is the analysis of the power structure within Ethereum.

Péter admits that he has great respect for Vitalik himself but points out a fact:

Whether Vitalik is willing or not, he unilaterally decides the direction of Ethereum. Wherever Vitalik's attention goes, resources flow there;

Whatever projects he invests in, those projects succeed;

Whatever technical routes he endorses, those routes become mainstream.

Worse still, a “ruling elite of 5-10 people” has formed around Vitalik. These individuals invest in each other, act as consultants for one another, and control the distribution of resources within the ecosystem.

New projects no longer conduct public fundraising but directly approach these 5-10 individuals. Securing their investment is equivalent to obtaining a ticket to success.

“If you can get Bankless (a well-known podcast) to invest, they will promote you on the show. If you can get a researcher from the Foundation to act as a consultant, you can reduce technical resistance.”

This has a familiar flavor of upward management in domestic workplace environments, where the key to success is not technology or innovation, but rather getting in good with those few people around Vitalik.

- Issue Four: Idealism is the Most Heartbreaking

At the end of the letter, Péter's tone shifts from anger to desolation. He states that he has turned down countless high-paying offers over the years because he believed in the ideals of Ethereum.

But now the entire ecosystem is saying, “It’s just business.” He cannot accept this mindset but sees no way out.

“I feel that in the grand blueprint of Ethereum, Geth is seen as a problem, and I am at the center of that problem.”

This letter was written in May 2024. A year later, in June 2025, Péter left the Ethereum Foundation. Reports indicate that he rejected a 5 million USD proposal from the Foundation and chose to make Geth an independent private company.

He chose to leave completely rather than turn ideals into business.

Chain Reaction, Big Names Speak Out

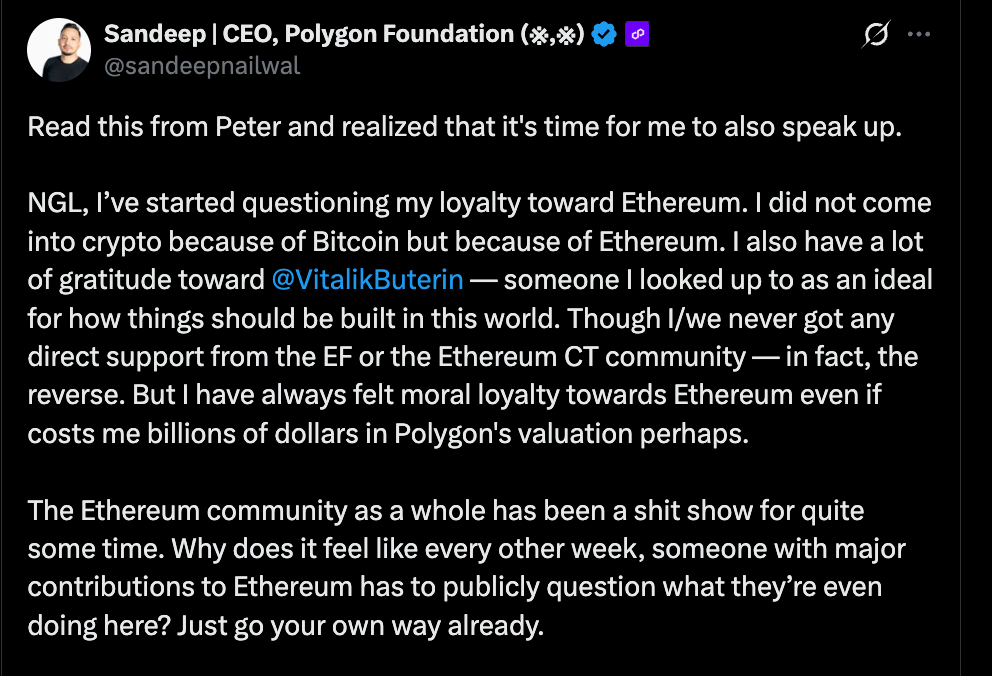

Less than 24 hours after Péter's letter was made public, Polygon founder Sandeep Nailwal could no longer sit still and expressed his feelings by quoting Péter's post.

Polygon is one of the largest Layer 2 projects on Ethereum, handling a large number of transactions and hosting numerous applications, including the prediction market Polymarket.

It can be said that Polygon has made a significant contribution to the scalability of Ethereum.

But Sandeep stated, the Ethereum community has never truly accepted Polygon.

There is a strange double standard in the market, he wrote. “When Polymarket succeeds, the media says it’s an 'Ethereum victory.' But Polygon itself? Not considered Ethereum.”

This is not just a matter of reputation but a real loss of money.

Sandeep pointed out even more bluntly that if Polygon announced itself as an independent L1 rather than Ethereum's L2, its valuation could immediately double or even quintuple.

For example, the relatively niche L1 project Hedera Hashgraph has a market value that exceeds the combined total of Polygon, Arbitrum, Optimism, and Scroll, the four major L2s.

As for why not shift to L1, Sandeep said it is out of moral loyalty to Ethereum, even if this loyalty may cost him tens of billions in valuation.

But what has this loyalty brought in return?

There are always voices in the community saying Polygon is not a true L2. The growth statistics website GrowthPie refuses to include Polygon's data. Investors do not consider Polygon part of the “Ethereum ecosystem” in their portfolios.

In Sandeep's original post, there is a particularly heart-wrenching rhetorical question:

“Why is it that every week, Ethereum contributors are questioning themselves?”

He mentioned the story of his friend Akshay. Akshay was initially inclined to support Polygon but was disgusted by the Ethereum community's criticism of successful projects and its promotion of "politically correct" practices. In the end, he took his talents to Solana, helping the latter build the empire it has today.

Even Polygon's shareholders are questioning his decisions, arguing that he has a fiduciary duty to Polygon, why sacrifice the company's value for so-called loyalty?

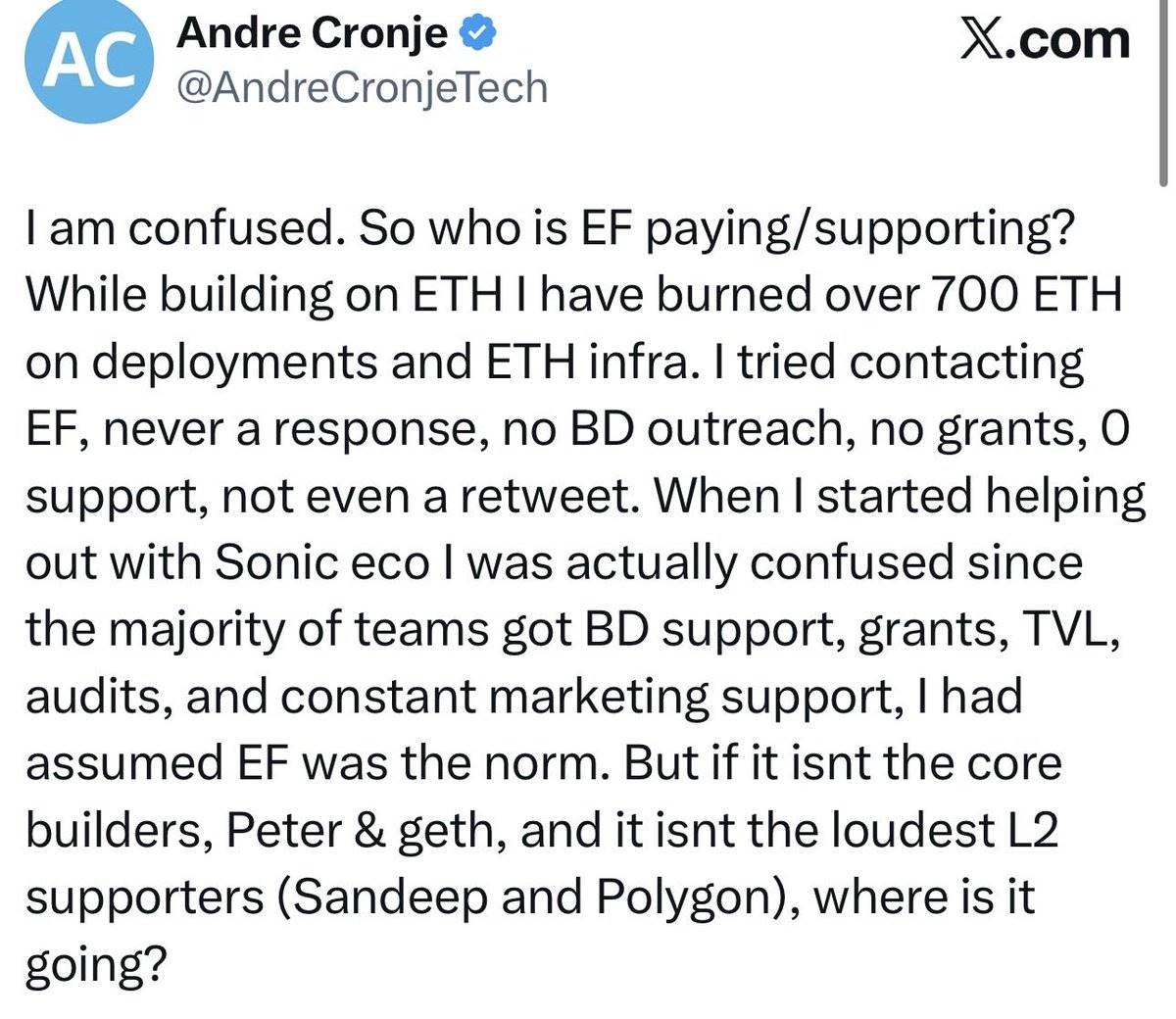

Also speaking out is the legendary figure of DeFi, Andre Cronje.

Andre's post is relatively short but sharp:

“I am confused. Who is EF actually paying/supporting? When I was building on ETH, I burned over 700 ETH just deploying contracts and infrastructure. I tried to contact EF, never got a response, no BD reached out to me, no funding, zero support, not even a retweet.”

700 ETH is approximately 2.66 million USD at current prices. These are all costs that Andre paid out of his own pocket.

Ironically, when AC started helping the Sonic ecosystem, he was surprised to find that most teams received ongoing BD support, funding, liquidity, and auditing support.

Then, this soul-searching question became even more poignant:

“If the money didn’t go to core builders Peter and Geth, and it didn’t go to the loudest L2 supporter Sandeep and Polygon, where did the money go?”

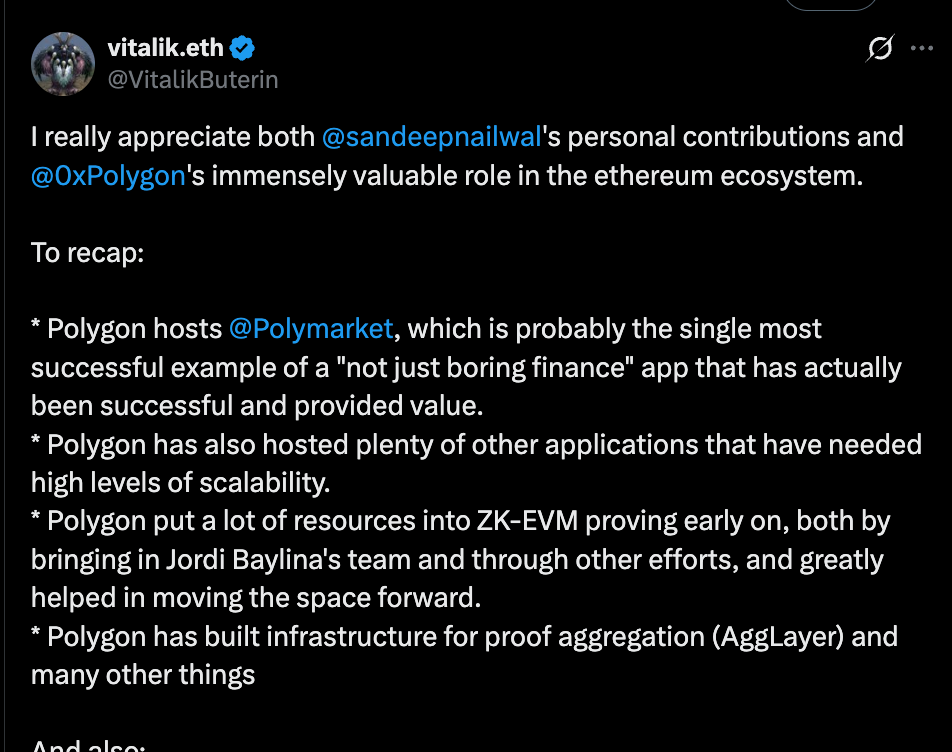

Vitalik Responds, Avoiding the Issues

In response to these doubts, Vitalik made a response to Sandeep's comments on October 21. His reply was lengthy and mainly included:

A detailed enumeration of Polygon's contributions (hosting Polymarket, advancing ZK technology, etc.)

Extensive praise for Sandeep's charitable work (donating medical resources to India)

Thanks to Sandeep for returning 190 million USD in SHIB token profits

Suggesting that Polygon adopt the latest ZK technology upgrades

But upon careful reading, you will find that Vitalik did not mention a word about the three core issues: low salaries, lack of funding transparency, and the small circle of power.

This non-answer may itself be an answer.

These responses collectively point to a truth that everyone can see but no one is willing to speak out about: there are serious problems with the resource allocation within Ethereum.

The most loyal contributors do not receive support, while those who are good at "playing the game" can obtain substantial resources. The Foundation sold over 200 million USD worth of ETH in 2025, but this money clearly did not flow to those who are truly building the protocol.

The biggest enemy of Ethereum is the Ethereum Foundation

The uproar triggered by Péter's letter will likely be overshadowed by new hot topics in two weeks, but the issues it reveals will not disappear.

In fact, this collective outcry against the Ethereum Foundation occurs every few months.

For Ethereum today, its biggest enemy is not other chains like Solana, but the Ethereum Foundation.

Ethereum has grown from a geek project to an ecosystem worth hundreds of billions of dollars, but its governance structure and culture remain in an early stage.

In Péter's words, the Foundation is still managing a large system that requires "additive thinking" with a "subtractive mindset."

The deeper reason may be that Ethereum has fallen into the typical problems of large companies.

Startups face issues when they grow larger, such as bureaucratization, factional struggles, and stagnation of innovation, all of which are present in Ethereum.

The difference is that traditional companies can respond through equity incentives and management reforms, but Ethereum, as a decentralized project, cannot admit to being centralized nor can it truly decentralize.

Thus, the core contradiction we see is: it must maintain the appearance of decentralization, but its actual operation heavily relies on centralized decision-making.

Vitalik's existence is a concentrated embodiment of this contradiction.

On one hand, the community needs his vision and leadership; on the other hand, his very existence negates decentralization.

This creates a peculiar "decentralized theater," where everyone is performing decentralization, but everyone knows where the real power lies.

The cost of this performance is enormous.

As Sandeep pointed out, the Ethereum community superficially promotes egalitarianism, but the actual control of small circles is more hypocritical than pure capitalism.

At least on Solana or other centralized chains, the rules of the game are clear.

Now, the ball is in the hands of Vitalik and the Foundation. Their choices will not only affect Ethereum but also the direction of the entire crypto movement. Will they continue to maintain the decentralized theater, or will they bravely face reality?

Time will provide the answer. But it is certain that those "useful fools" like Peter will not remain silent forever.

The next eruption may not be as simple as just one letter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。