Author: Haotian

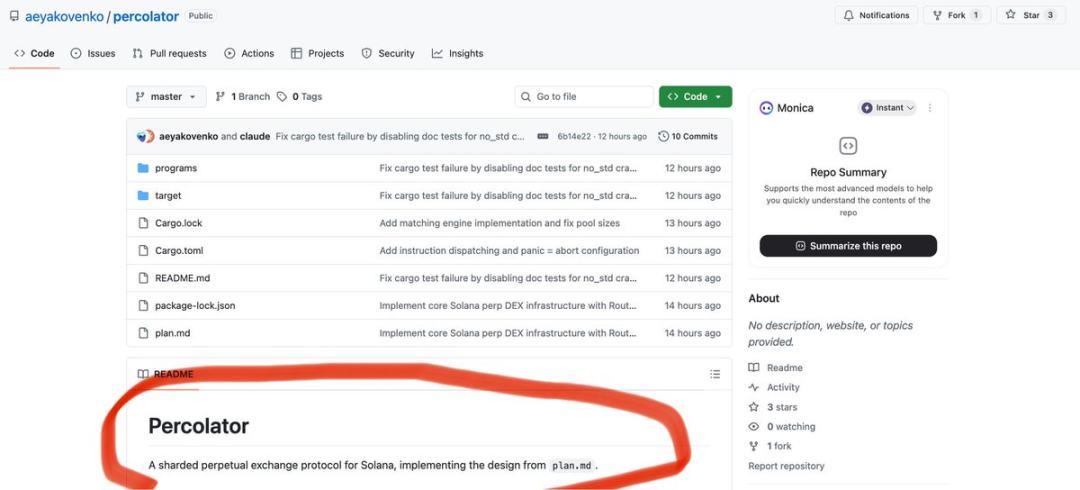

Previously, I wrote an analysis that Perp Dex would definitely explode within the Solana ecosystem. Recently, a GitHub repository unexpectedly exposed by @aeyakovenko, a sharded perpetual contract protocol framework named Percolator, has become the focus of attention:

1) Its architectural innovation roughly involves breaking the order book into multiple shards for parallel processing, including global scheduling and margin management via Router + an independent matching engine via Slab. Additionally, it employs high-frequency trading optimizations and risk control designs, such as a reserve-commit two-phase execution mechanism to prevent MEV attacks.

Interestingly, Toly mentioned in the comments that they might introduce a prop AMM competitive experiment mechanism, allowing LPs to customize matching engines and risk parameters independently.

2) Unexpectedly, it was thought that Solana's approach to entering the Perp Dex competition would be to support emerging Perp Dexs within its ecosystem, such as @DriftProtocol, @pacifica_fi, and @bulktrade, but it has elevated to a strategic level managed by Solana's official lab. This shows how eager Solana is to continue the Perp Dex craze.

3) The logic behind this is clear. In my view, Perp Dex is a track that can simultaneously accommodate high frequency, high leverage, and large volume. Solana has polished performance optimizations like the Alpenglow consensus and Firedancer client for over a year, and it can withstand peak trading volumes during events like Meme Season. Now is the best time to integrate this infrastructure capability into the Perp Dex scenario.

Moreover, the imaginative space for optimizing the validator layer, as well as further optimizations in network bandwidth by @doublezero, are all enhancing Solana's performance ceiling. @jito_sol has already proven that professional optimizations at the validator layer can be effective. From a technical foundation perspective, it is entirely feasible for a Perp Dex of @HyperliquidX's caliber to emerge within the Solana ecosystem.

4) Mentioning this, Toly, @calilyliu, and other core executives must be quite indignant. Given Solana's excellent infrastructure foundation, how can projects like @AsterDEX and @Lighterxyz, which are still unclear about their legitimacy, be allowed to show off excessively?

The key issue is that the Perp Dex driven by the exchange camp is facing many problems, such as false trading volume stimulated by airdrops, the unsustainability of trading-as-mining, and the lack of genuine high-frequency trading demand, which gives Solana a reason to jump in and seize the opportunity.

5) With its basic layout in U.S. stock tokenization and a long-term layout in the ICM internet capital market, Solana has the opportunity to provide a truly capable application scenario for Perp DEX infrastructure that can meet the trading demands of traditional financial assets, rather than just staying at the level of trading crypto-native assets.

Imagine this: After U.S. stock tokenization, users can directly open leveraged long and short positions on Tesla and Nvidia on Solana, settling with $SOL or stablecoins, and trading fees flowing back into the ecosystem. This narrative of "on-chain Nasdaq" is surely much higher than the ceiling of simply speculating on perpetual contracts for BTC, SOL, and ETH assets.

That's all.

Next, let's see how the Perp Dex counterattack on Solana will perform!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。