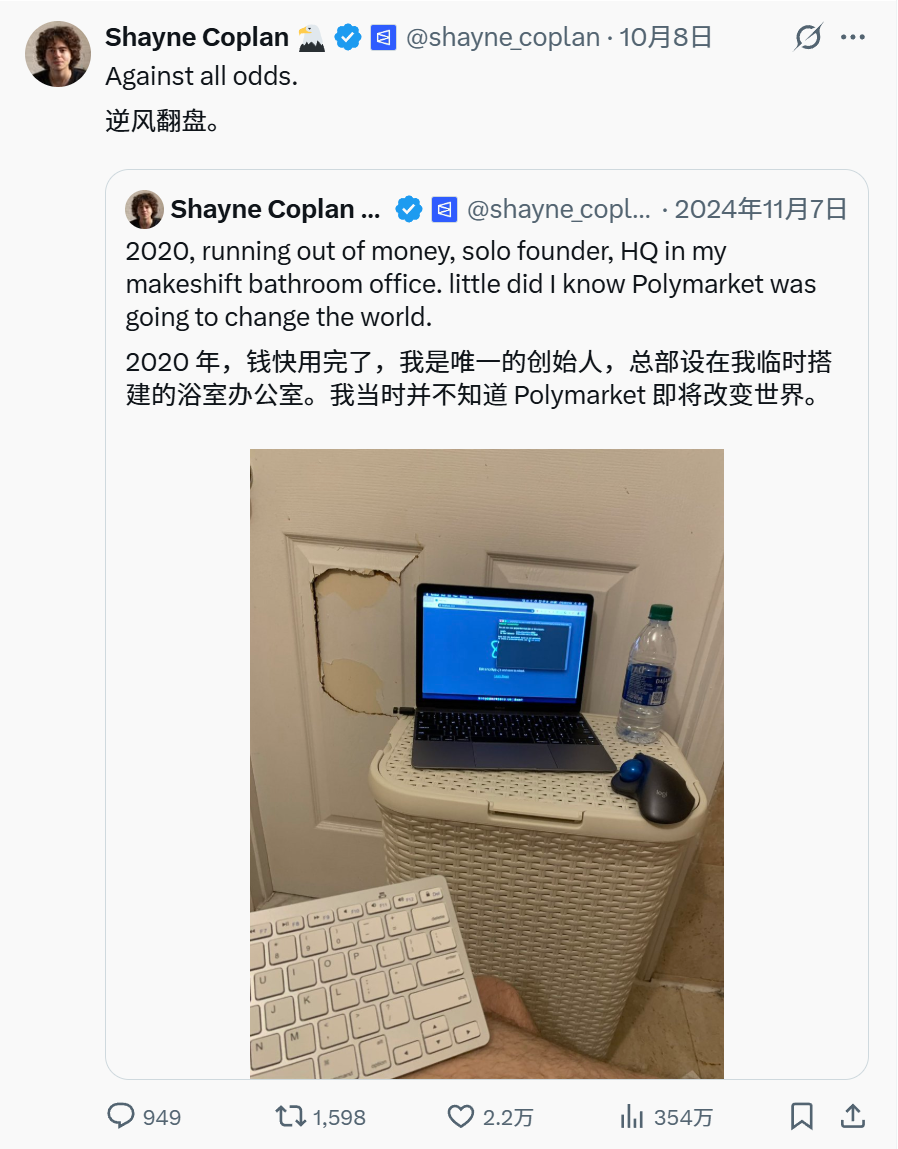

Against all odds, this is a repost by Shayne Coplan, the founder of Polymarket, after receiving a $2 billion investment from the New York Stock Exchange.

At this point, he has become the youngest self-made billionaire in the world, while five years ago, he was a dropout, bankrupt, and betting on an uncertain future while hiding in a bathroom.

The term "odds" first appeared in Shakespeare's "Henry IV," where it was used as a betting term.

Perhaps it is a wonderful coincidence that Polymarket, as the world's largest prediction market, is not only a platform that uses odds to predict the future, but its founder Shayne Coplan's success is also a story about Against all odds.

The Wayward "Bad Student," Determined "E Guardian"

Shayne Coplan was born in 1998 in the Upper West Side of New York (a wealthy area surrounded by attractions like Lincoln Center and Central Park), raised solely by his mother, who taught at NYU's film department. His mother often had young Shayne act in her works, which cultivated his love for art and music.

In one of her short films, 9-year-old Shayne played the son of a clever single mother, asking her, "Since you broke up with Dad, who have you slept with?" He then mischievously laughed and said, "You have! I know! Who are they? I'll find out!"

Shayne Coplan's investment in an artist

Although he grew up in a wealthy environment, it did not give him a sense of belonging. Coplan admitted in an interview, "Growing up in New York is different, you know, everything is relative." This made him realize his "middle-class" identity early on and sparked a "strong desire" to make money. This desire drove him to indulge in various "gray markets," such as downloading copyright-free music on BitTorrent and trading fingerboards with YouTubers, where sometimes the trading partners would not fulfill their promises. These early experiences gave him a deep understanding of the importance of "trust" in the market.

He attended an elite public high school but was always a misfit "bad student" because he couldn't focus in class. At 14, he began to self-learn programming; at 15, in order to download music not available on iTunes, he discovered cryptocurrency on a forum and quickly became fascinated, mining Litecoin with friends that same year.

Shayne Coplan's high school graduation summary: "I want to thank Sparknotes (a study website), caffeine, and Wikipedia."

In 2014, during Ethereum's first presale, Coplan spent $150 to buy tokens at a cost of $0.30, which are now worth over $1 million, just after he turned 16. After finishing high school, he enrolled in NYU's computer science program but chose to leave after just one semester. Unlike many well-known internet entrepreneurs, he had not yet figured out what he wanted to do; he simply felt that school was not right for him and decided to drop out.

Confusion and Exploration After Dropping Out

In the following years, he lived in isolation, immersing himself in reading and trying new things to find entrepreneurial inspiration.

During his exploration, Coplan quickly became disillusioned with the crypto space at the time, believing that many startups lacked innovation and were involved in disappointing crypto "scams." At that time, ICOs (Initial Coin Offerings) were surging, with project teams raising huge amounts of money, but often pulling the rug halfway.

He mentioned this experience in an interview with New York Magazine: "I realized these were not my role models. These guys are scammers, they do things halfway." In 2017, Coplan founded TokenUnion - his first project aimed at rewarding long-term cryptocurrency holders by offering interest. He then created union.market, aiming to explore whether trust between labor and management in the labor market could be enhanced through POS, but both projects ultimately failed.

Inspiration for Polymarket

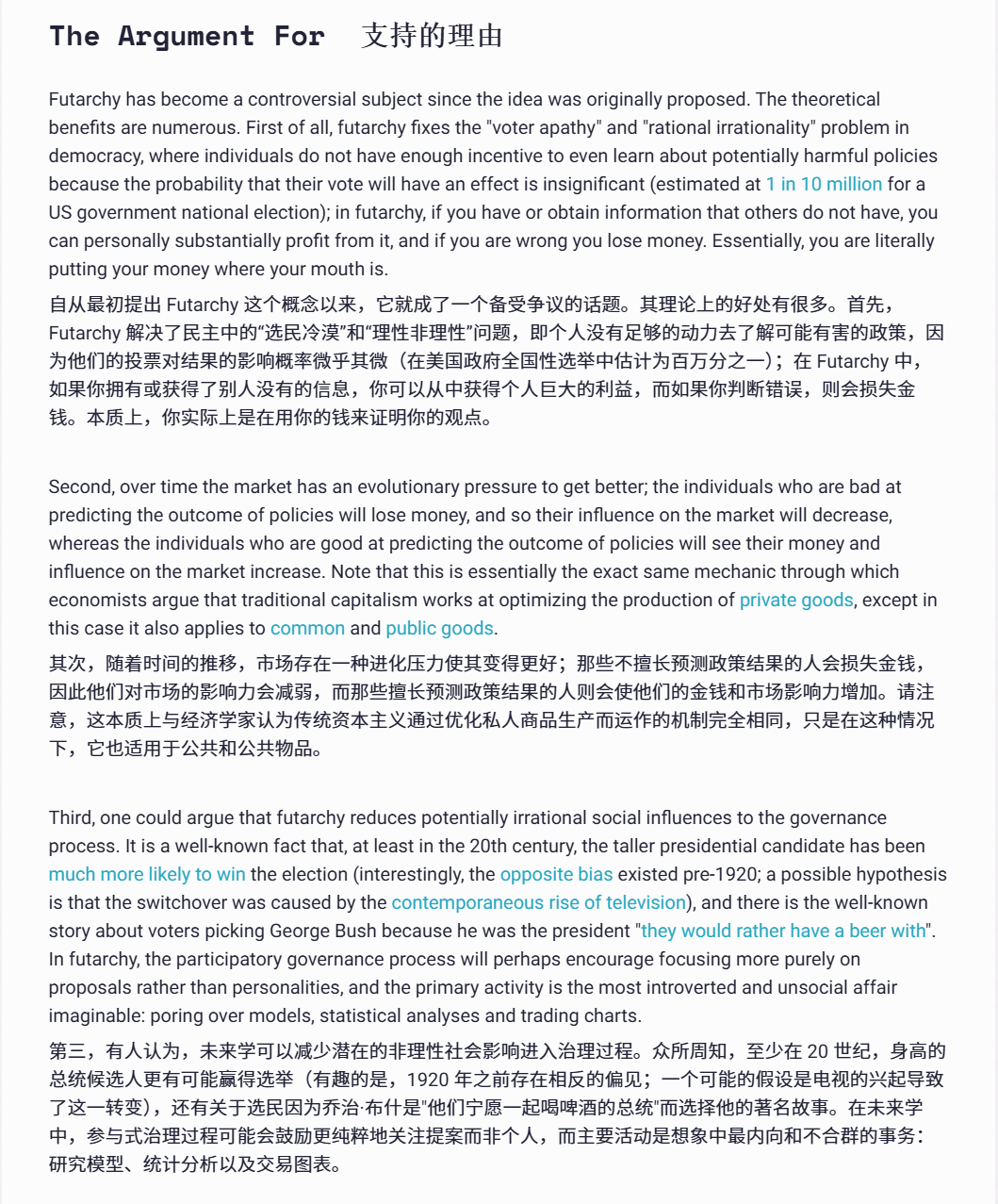

Economist Robin Hanson described a market governance form called "Futarchy" in his paper "We Will Vote on Values, But Bet on Beliefs," where the core idea can be summarized as follows: democratic voting expresses the political will of the people, but betting markets indicate how to achieve it; when a betting market clearly estimates that a proposed policy will increase expected national welfare, that proposal should become law.

This paper inspired Coplan to create Polymarket. If everything has a price, should "truth" also be priced?

In early 2019, Coplan wrote to Hanson, claiming in multiple emails that he wanted to "be the person who brings prediction markets to reality," but Hanson ignored him, as too many had already failed, and he was not optimistic about this unknown young man.

However, this incident did not dampen Coplan's confidence. "In my view, who would want to work with me? I had nothing." So he launched the website alone and, like a persistent salesperson, personally managed social media, messaging every investor he knew to ask them to like or place bets.

Vitalik's introduction to Futarchy blog

From Wild Growth to Wall Street Platform

In 2020, when the pandemic broke out, the world was speculating whether the pandemic would be declared and when lockdowns, mask mandates, and vaccines would be implemented. Coplan seized the opportunity decisively, hiding in a bathroom to build a real-time "prediction market" website where people could buy shares in what they thought were the most likely outcomes. In June, Polymarket was born and accurately predicted Biden's victory in that year's presidential election.

In 2021, Coplan entered a frenzied fundraising period. In an interview, Coplan said the best feedback was when someone told him he was "overselling himself," "I would come on very enthusiastically." Krug, the founder of Augur (the first prediction market, which Coplan had criticized for its overly complex product), initially rejected Coplan's repeated investment pitches. Krug set a weekly trading volume target of $5 million and told Coplan he would invest if it was reached.

In 2022, the Commodity Futures Trading Commission (CFTC) came down hard, requiring Polymarket to pay a $1.4 million fine and promising to completely ban U.S. users.

By the end of 2023, Coplan called Krug to say he had done it. The firing of Sam Altman by OpenAI sparked bets on whether he would return to Polymarket, with funds pouring in.

In 2024, due to the presidential election, Polymarket attracted nearly $3 billion in bets, and while traditional polls indicated a tight race, the platform had already announced Trump's victory.

Subsequently, the high-stakes betting during the election drew regulatory attention, and the FBI raided Shayne Coplan's apartment and confiscated his phone. Later that day, a freed Coplan posted on X, joking in a signature Gen Z tone, "New phone, who dis?"

Now, Polymarket has caught the attention of Wall Street, and the platform, once seen as a prohibited product, has returned to the U.S. As of now, according to its platform display, Polymarket's prediction success rate has reached 95.2% within 4 hours, and the success rate for predictions made in the past month is 91.1%.

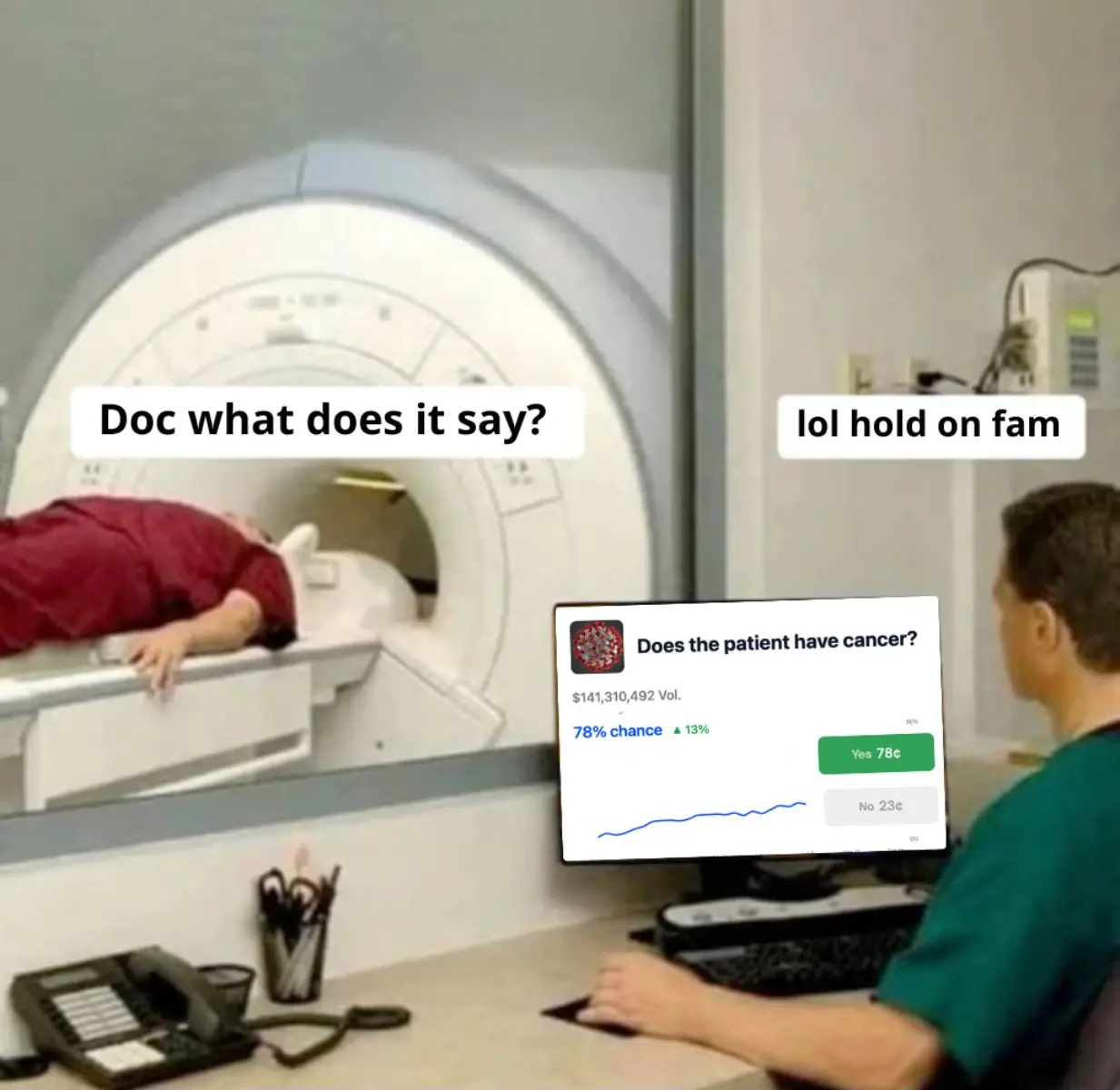

A meme created by a user, indicating that doctors use Polymarket to determine whether a patient has cancer

Whose Facts, Whose Casino?

The initial goal of Polymarket was to create a platform for people to predict the future or the outcomes of events, thereby ensuring the factuality of information. But can it really achieve that?

In early July this year, a bet on Polymarket drew attention regarding whether Zelensky would wear a suit before July. At a meeting, Zelensky appeared in a black jacket. The designer of the clothing, Zelensky himself, and major media outlets like BBC and Reuters all agreed that the outfit was a suit. However, UMA (UMA is Polymarket's official dispute resolution mechanism, which makes judgments through staking, usually in USDC) ruled that it was not a suit.

Similarly, on October 10, the day the Nobel Peace Prize was announced, the victory of Ukrainian opposition leader María Corina Machado became an upset. About 11 hours before the results were announced, her Polymarket odds surged from 3.7% to 73.5%, with trading volume skyrocketing, leading many to believe there was insider trading.

In addition to insider trading and manipulation by large players, the platform's political bias often leads to controversial rulings on certain topics.

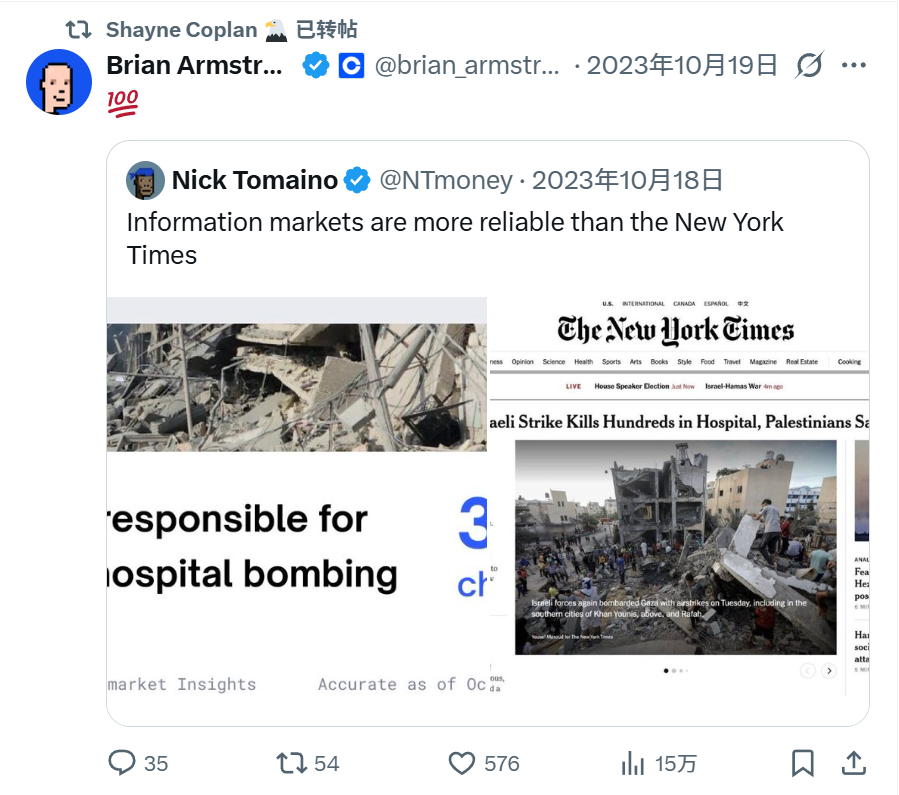

On October 19, 2023, Shayne Coplan retweeted a post about whether Israel should be held responsible for the attack on a Palestinian hospital. The New York Times' answer was yes, while Polymarket's ruling was no. The original poster later deleted the post, and no related records could be found on Polymarket.

Moreover, there are issues such as regulation, English dominance, and the potential for encouraging wrongdoing (such as assassination markets possibly incentivizing malicious actions). However, regardless of how people judge it, the switch for this experiment has been pressed and cannot be reversed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。