Source: cryptoslate

Translation: Blockchain Knight

Bitcoin is preparing for the release of the U.S. September Consumer Price Index (CPI) on October 24—this is the first significant macroeconomic data since the U.S. federal government shutdown.

Analysts from "The Kobeissi Letter" emphasized the importance of this data update, noting that it is the first time CPI data will be released on a Friday since January 2018, and it comes just five days before the Federal Reserve meeting on October 29.

Additionally, since the U.S. Department of Labor has suspended the release of all other important economic data until the government shutdown ends, this CPI report will become the Fed's only key inflation measure.

This "single indicator reliance" has heightened the importance of the data, as there will be no new employment, non-farm payroll, or producer price data to balance the overall economic picture.

The latest CPI report shows that the U.S. inflation rate for August was 2.9%, a slight increase from the previous month's 2.7%.

Based on this, Wells Fargo economists currently expect the September inflation rate to rise slightly to 3.1%, still within a range consistent with "gradual disinflation."

The core CPI, excluding food and energy prices, is expected to remain stable, indicating that while inflation pressures are easing, they have not completely disappeared.

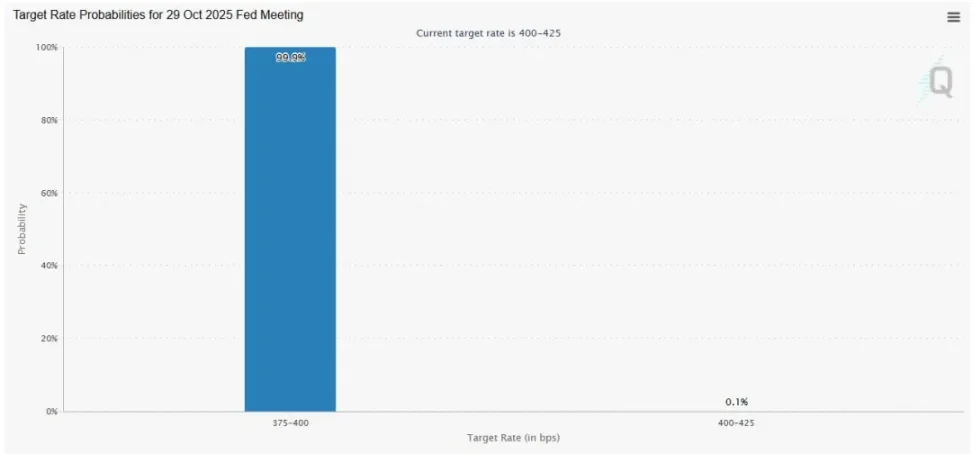

Across the financial markets, traders have begun positioning for potential policy easing. According to the CME FedWatch Tool, futures data shows a 99% probability of a rate cut at the Fed's meeting on October 29, and an 85% probability of another cut in December.

Notably, if the CPI data comes in below expectations (indicating a slowdown in inflation), it could further strengthen this easing expectation and weaken the dollar.

Conversely, if the data exceeds expectations (indicating inflation is hotter than anticipated), it could briefly reignite rate hike speculation.

Analysts from Kautious Data stated that the CPI has a direct impact on Bitcoin, as current "macro signals are relatively scarce, which may provide a short-term bullish basis for cryptocurrency narratives while also increasing tail risks for the broader market."

The agency pointed out that if the month-over-month increase in core CPI is below 0.3% (indicating a slowdown in inflation), it would support dovish policy expectations, put pressure on the dollar, and benefit assets like gold, stocks, and Bitcoin.

However, if inflation data shows "stickiness" (indicating persistently high inflation), especially if service prices and housing prices rise more than 0.4% month-over-month, it could boost the dollar and put pressure on risk assets, including Bitcoin.

The agency also noted that the cryptocurrency market typically reacts with "a rise before data release, followed by a 'buy the rumor, sell the news' response" after the data is announced, a phenomenon often accompanied by a spike in volatility and a reversal in capital flows.

Meanwhile, Dean Chen, an analyst at digital asset company Bitunix, stated that market reactions will depend on how investors reassess risk after the data release.

He noted that if the data meets expectations, the market may maintain the current narrative of "high rates but long-term stability," allowing Bitcoin to continue consolidating near recent highs.

However, if the core CPI data is stronger than expected, it could push up U.S. Treasury yields and the dollar, leading to a short-term pullback in Bitcoin from its recent high range.

Additionally, Dean Chen added that if the CPI data comes in below expectations (indicating cooling inflation), it could restart ETF inflows, pushing Bitcoin towards the $117,000 - $120,000 range.

Conversely, if the data exceeds expectations (indicating rising inflation), it could prompt capital to flow back into safe-haven assets, testing Bitcoin's support level around $100,000.

He further stated: "Traders should pay attention to the real-time movements of U.S. Treasury yields and the dollar after the data release: if both rise simultaneously, it will put pressure on Bitcoin; if both fall, it may reignite risk appetite."

"In this environment, volatility will remain high, and the sustainability of ETF inflows will determine whether Bitcoin can regain upward momentum after the data release."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。