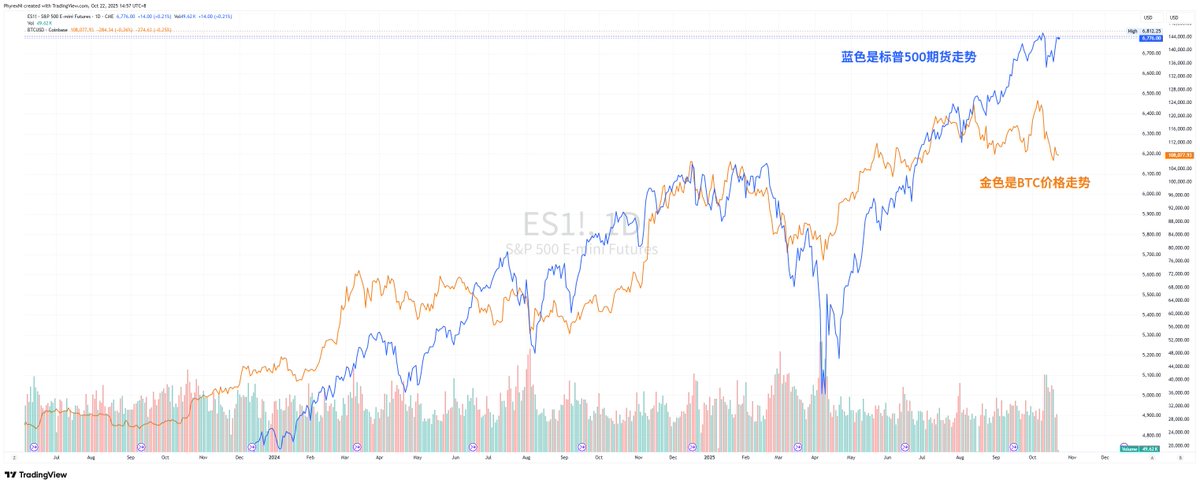

I have been discussing the U.S. stock market, especially the tech stocks and their strong correlation with $BTC. However, whether the U.S. stock market can continue to rise is still uncertain. Recently, I came across three pieces of data that are quite promising. Although I have included them in my daily assignments, I would like to share them in a more focused manner.

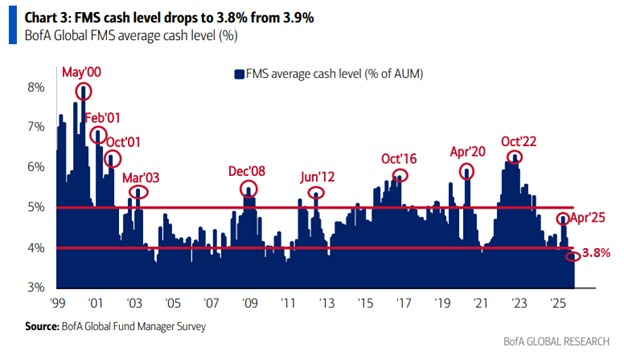

First, regarding the cash allocation of global fund managers, the latest data shows that this figure has dropped to 3.8%. The historical low for this data is 3.5%, indicating that global fund managers have limited capital available. This is both good and bad news. The good news is that the funds being spent are increasingly flowing into U.S. stocks, particularly tech stocks led by AI. The bad news is that these funds are limited, and there may not be enough capacity to continue pushing stock prices higher in the market.

This also suggests that it is quite possible these fund managers may sell off some of their holdings in the short term. For some investors, this could be a frightening prospect, raising concerns about the onset of a bear market. However, historically, fund managers are not long-term holders. Even in 2025, there were two significant reductions in holdings: the first from January to February, where cash allocation dropped from 4.2% to 4%, and the second in April, where it fell from 4% to 3.8%. Currently, it remains at 3.8%, although it did rise back to 4.1% between June and July.

In other words, even if fund managers reduce their holdings, it does not necessarily mean the market will enter a bear phase. A short-term pullback is possible, but in the long run, it may simply reflect a turnover among fund managers. The last time cash allocation went from 3.8% in April to 4.1% in June, this current 3.8% could represent a similar operational pattern, as the core focus this week remains on the Federal Reserve's monetary policy rather than a misguided approach.

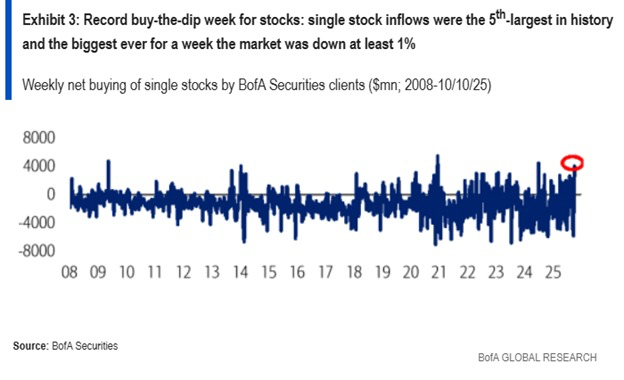

Additionally, since last week, investors have purchased over $3.9 billion in U.S. stocks. The net inflow into individual stocks reached $4.1 billion, marking the fifth highest point since 2008, and setting a historical record for the S&P 500 during a week when it fell by at least 1%. This indicates that current investors are buying the dip, and this buying activity is driven by institutions, with institutional inflows amounting to $4.4 billion, the highest since November 2022.

Retail investors bought over $1.1 billion, marking the second weekly net purchase in the last six weeks. Hedge funds sold off $1.6 billion, marking the fifth consecutive week of selling. It is worth noting that the statistics for 'hedge funds' likely overlap with the sample of global fund managers, so their selling behavior can represent a certain degree of global capital position adjustment. Moreover, this is just regarding the U.S. stock market; there is also a set of data specific to tech stocks.

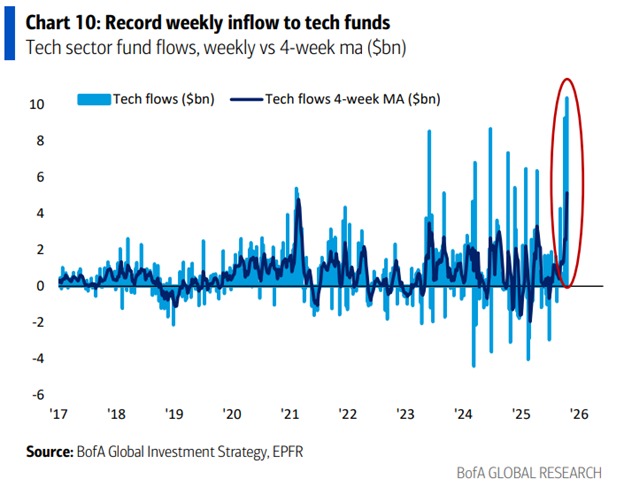

This week, investors net bought $10.4 billion in tech stocks, compared to $9.2 billion last week, resulting in nearly $20 billion in net inflows over two consecutive weeks, the largest two-week net inflow ever recorded. This also marks the fourth consecutive week of significant capital inflow into tech stocks.

Therefore, even from these three pieces of data alone, we can see that the market does carry some risks. The risk lies in the fact that fund managers, with insufficient capital, may reduce some of their positions, and they may have already begun doing so.

However, institutions and retail investors continue to buy during declines in the U.S. stock market, especially in tech stocks. The reduction in holdings by fund managers is likely being offset by purchases from these investors. Next week, the earnings reports from the "Seven Sisters" will be released one after another. If there are no significant issues with the earnings reports, it should provide a positive stimulus for the market.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。