Author: Luo Luo

Editor: Wen Dao

In early October, the first batch of Chinese-named Meme coins on the BNB Chain (represented by "Binance Life") suddenly went viral, quickly spreading to the English-speaking community, prompting many overseas players to learn Chinese and trade Chinese Memes.

Unlike the previous Meme craze led by Solana, this time the main stage has completely shifted to the BNB Chain. The creation and trading activity surrounding "Chinese topic coins" surged, driving up interaction and discussion on the BNB Chain, and the price of BNB also rose significantly with market sentiment, becoming one of the most outstanding mainstream assets after BTC.

However, after a short-term volatility event in the industry on October 11, market sentiment tightened for a time. The Chinese Meme market also cooled down, but it was Coinbase that broke the silence. Jesse Pollak, the head of Coinbase's Base chain, had previously expressed dissatisfaction with Binance regarding listing fees but unexpectedly used "Binance Life" as an example in a Base application demonstration. This scene went viral, further promoting the cross-chain narrative of BNB Chain's Chinese Meme and reigniting community discussion enthusiasm.

After the October 11 event, the trading platform Binance invested $400 million to launch the "Same Boat Plan," subsidizing loss-making users and institutions. The entire market gradually entered a self-repair phase, with on-chain activity rebounding and mainstream assets steadily recovering. Despite the turbulence, the structural resilience and intrinsic momentum accumulated in the third quarter of this year have not been broken — the total market capitalization of the crypto asset market exceeded $4.02 trillion by the end of Q3 2025.

In Q3, the trading volumes of both spot and derivatives on the Binance exchange increased compared to Q2, maintaining a total trading volume of $9.93 trillion and holding over 1/3 of the market share, which means strong fee income; the market capitalization of BNB grew to $145.998 billion in Q3, reflecting Binance's valuation to some extent; while BNB Chain generated $357.3 million in fee income by the end of Q3, representing the chain's earning capacity as the underlying layer of Web3.

In the current situation, Binance remains the leader in global trading volume. As the "one strong, many strong" pattern in the exchange industry becomes more solidified, each platform needs "fresh water" for growth, leading to competition on-chain, and "XX Life" is merely a "microcosm" of traffic alignment.

Binance Leads Q3: Trading Volume and Share Rise Together

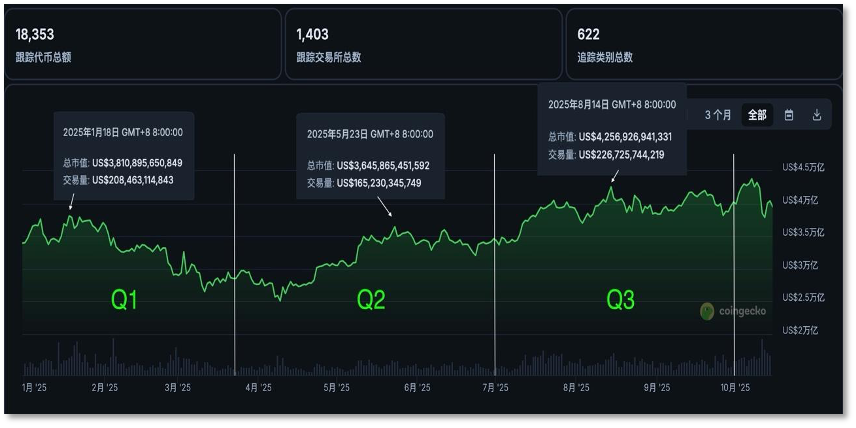

With Bitcoin prices continuously hitting historical highs, the total market capitalization of the crypto asset market exceeded $4.02 trillion by the end of the third quarter of 2025 (Q3), a 16.2% increase from $3.46 trillion at the end of Q2, and a 72.5% increase compared to the same period in 2024 ($2.33 trillion).

Trend chart of the crypto asset market capitalization in 2025

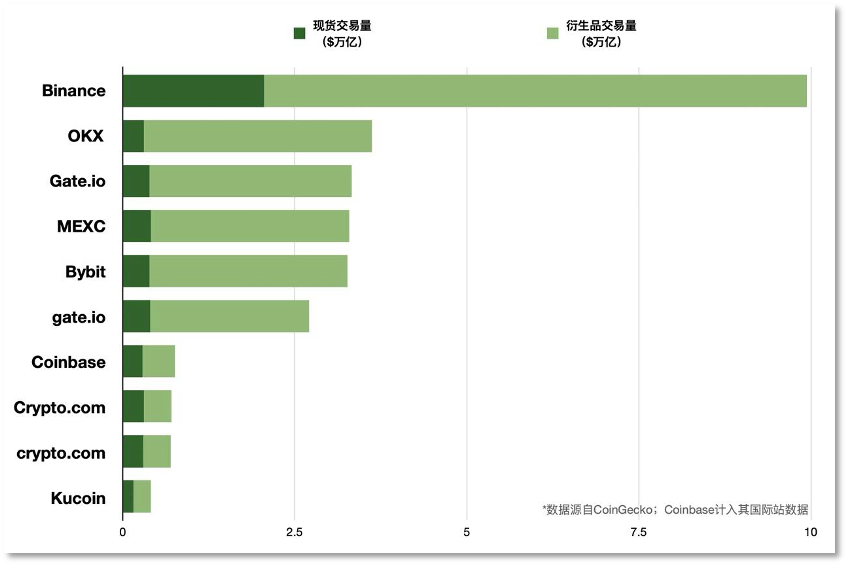

The top 10 exchanges contributed a total trading volume of $28.7 trillion in Q3, a 32.87% increase from Q2 ($21.6 trillion). Among them, the total spot trading volume was $4.9 trillion, a 36.11% increase from Q2 ($3.6 trillion); the total derivatives trading volume was $23.7 trillion, a 17.32% increase from Q2 ($20.2 trillion).

Looking at the performance of the top 10 exchanges, Binance held a total trading volume of over $9.93 trillion (spot + derivatives), accounting for 34.59% of the market share, making it the only crypto asset trading platform to consistently occupy 1/3 of the market share.

In Q3 2025, Binance's trading volume still leads

During the same period, exchanges with over 10% of the total trading volume share included OKX (12.60%), Bitget (11.58%), MEXC (11.45%), and Bybit (11.36%), with the overall market structure of the exchange industry remaining relatively stable in the short term.

Whether in spot or derivatives, Binance's trading volume share in Q3 maintained an absolute leading advantage in the market, and both increased compared to Q2.

According to CoinGecko data, during Q3, among the top 6 platforms by total trading volume market share, Binance's spot trading volume was $2.05 trillion, accounting for 41.26% of the market share, a 3.27% increase from Q2; Bybit and Bitget also saw slight increases in market share, with increases of 0.57% and 0.38%, respectively.

In Q3 2025, Binance's spot/derivatives increased by 3.27% and 1%

In the top 6 of the derivatives market, Binance held a trading volume of $788 million, accounting for 33.20% of the share, still significantly ahead of the other five, with a 1% increase from Q2; Gate.io's share increased by 2.07%, the largest increase; Bitget's share grew by 1.04%, surpassing Binance; MEXC saw a slight increase of 0.8%.

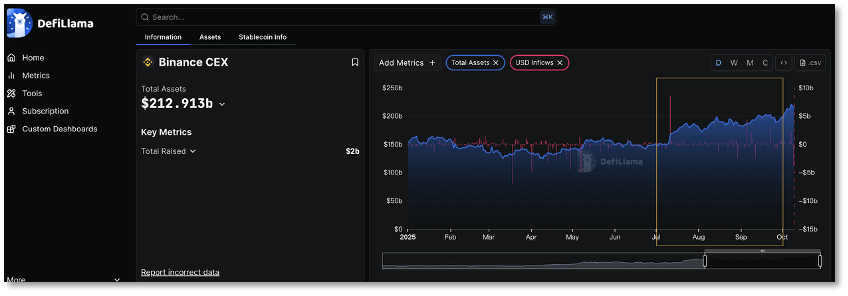

While leading in trading volume market share, Binance also set a record with a net inflow of $14.8 billion in Q3, solidifying its dominant position in the centralized exchange (CEX) field.

In Q3 2025, Binance's net inflow exceeded $14.8 billion

However, it is worth noting that despite the significant market uplift with a 16.2% increase in total crypto asset market capitalization and a 32.87% increase in trading volume, there has not been a substantial shift in market share among trading platforms; the overall structure appears to be solidifying, and both defense and offense among platforms seem challenging, necessitating new breakthroughs.

Market leader Binance seems to have already recognized the limitations of the exchange's market share competition and has early on shifted its strategic focus to on-chain activities. The phenomenon-level product Alpha in the second quarter was a "key move," and investments were increased in the third quarter.

BNBChain Active Addresses Increased by 57%

"Chain Version of Binance" Releases DEX Potential

The on-chain integration of Alpha into the Binance main site acted like kindling, and the Alpha airdrop was the spark that ignited the BNBChain, maintaining its heat from the beginning of the year to the present.

A recent report from CryptoRank shows that BNBChain, alongside Solana and Avalanche, ranks as "the best-performing blockchain in Q3 2025." BNBChain's DEX trading volume reached $225 billion, the highest level since Q4 2021, second only to Solana ($365 billion) and Ethereum ($337 billion).

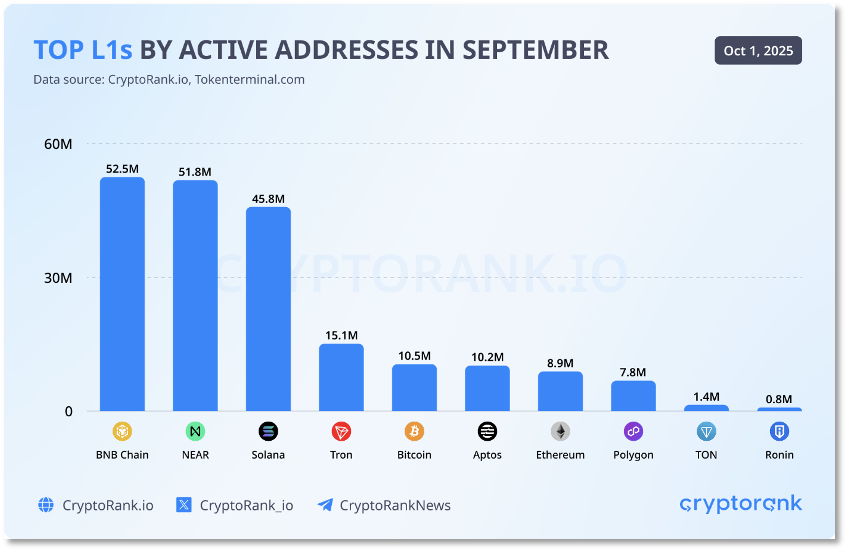

However, in terms of active addresses, BNBChain began to surpass other chains in September, reaching a new high of 52.5 million, a 57% increase; during the same period, Solana and Ethereum had 45.8 million and 8.9 million, respectively. The number of transactions on BNBChain also saw significant growth, increasing from 892 million in Q2 to 1.22 billion in Q3.

In September, BNBChain's active addresses exceeded 52.5 million, ranking first among mainstream chains

The substantial increase in activity allowed BNBChain to generate $357.3 million in fee income before the end of Q3. The CryptoRank report stated that in September alone, BNBChain's revenue reached $2.2 million, the highest level since March.

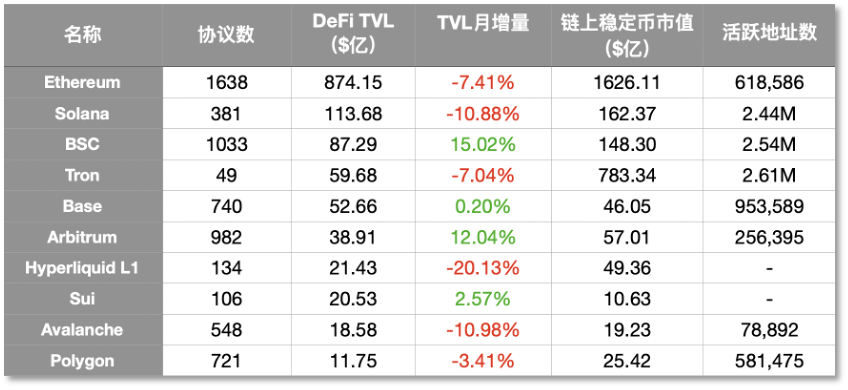

Additionally, data from DefiLlama shows that the number of protocols on BNB Smart Chain (BSC) reached 1,033 by the end of Q3, 2.7 times that of Solana (381), gradually approaching Ethereum's 1,638; the TVL on BSC reached $8.729 billion, although still far from Ethereum ($87.415 billion), it is just $2.6 billion short of catching up with Solana ($11.368 billion), but BSC's TVL recorded a monthly increase of 15.02%, becoming the strongest growing layer among the top 10 public chains by TVL.

In key indicators among chains, BSC's TVL monthly growth is significant

If Alpha was the key to Binance's growth in the chain ecosystem in Q2, then the emergence of the perpetual DEX "Aster" on BNBChain is the successor. This perpetual contract DEX saw multiple indicators of growth in September, with daily revenue reaching $7.2 million, even surpassing the derivatives industry's "king bomb" Hyperliquid ($2.79 million). Its growth also propelled BNBChain's perpetual contract trading volume to soar by 55% in Q3, reaching $36 billion.

The continuous growth of trading and TVL on the BNBChain has contributed to cost reduction and increased efficiency.

As trading becomes the main use case on-chain, on September 24, BNBChain's validators proposed to lower the minimum gas price from 0.1 Gwei to 0.05 Gwei and to shorten the block generation interval from 750 milliseconds to 450 milliseconds. This proposal marks the third major fee reduction in the past 18 months, with a long-term goal of reducing the cost of a single transaction to about $0.001.

In fact, BNBChain has previously reduced transaction fees multiple times: from 3 Gwei to 1 Gwei in April 2024, and then from 1 Gwei to 0.1 Gwei in May 2025, totaling a reduction of 75%.

The fee reduction in May had a significant effect: the median transaction fee dropped by 75% (from $0.04 to $0.01), and the daily transaction volume surged by 140%, exceeding 12 million transactions. It has been proven that there is a strong correlation between fee reductions and increased network usage.

The recent fee reduction in September paved the way for BNBChain to upgrade from a general-purpose public chain to the underlying financial system.

In the past, BNBChain has already gathered established DEXs and DeFi platforms, including PancakeSwap, Venus, Uniswap, Solv Protocol, and Aave. The emergence of Aster filled the gap in the derivatives sector on the BSC chain and created immediate value for itself and BNBChain.

The flourishing ecosystem on BNBChain also validates the judgment made by Binance founder Changpeng Zhao (CZ) three years ago: DEXs have enormous potential. Alpha and Aster have become the best answers three years later, and this "double A" DEX has also tested BNBChain's ability to handle high-frequency trading on-chain.

As described in a media headline, Binance has created two "mini Binances" — Alpha focuses on "on-chain spot," while Aster takes on "on-chain contracts." In the fierce market competition, it seems that the only entity capable of disrupting Binance is Binance itself.

But the question is, despite the unlimited potential on-chain, how can more vehicles be driven on the highway? This not only relates to the incremental sources of the Binance ecosystem but also determines how much value "on-chain income" BNB can still create.

BNB Hits a New Record of $1,376 — Where is the Next Growth Point?

If we follow the logic of traditional capital markets, when the Binance ecosystem not only possesses super products that can support its value but also has strong profitability, the capital market will estimate its value. Currently, the $150 billion market capitalization of BNB can be seen as the market's strong expectations for Binance, allowing it to return to the top 3 of crypto assets. Can it continue to grow?

BNB's market capitalization performance this year

Part of the driving force behind this round of growth comes from capital's optimism about BNB's potential, especially as institutions have been rapidly creating various financial reserves for Bitcoin (BTC) and Ethereum (ETH).

As noted in a recent client Q&A report by the American investment bank Jefferies aimed at large institutional investors, crypto assets are still in the "1996 stage," similar to the early internet boom, with greater growth potential. "Many companies are actively formulating investment strategies and determining how to allocate funds between tokens, ETFs, digital asset treasury companies (DAT), and publicly listed companies with risk exposure."

"Focusing too much on Bitcoin prices distracts attention from the disruptive potential of blockchain technology across various industries," the Jefferies analyst's advice echoes the investment strategies of the 1996 internet era: be selective and focus on lasting utility. Jefferies suggests that tokens should be analyzed like early-stage tech startups, prioritizing "adoption, development, usage, and use cases."

BNB is one of the assets that fits this advice.

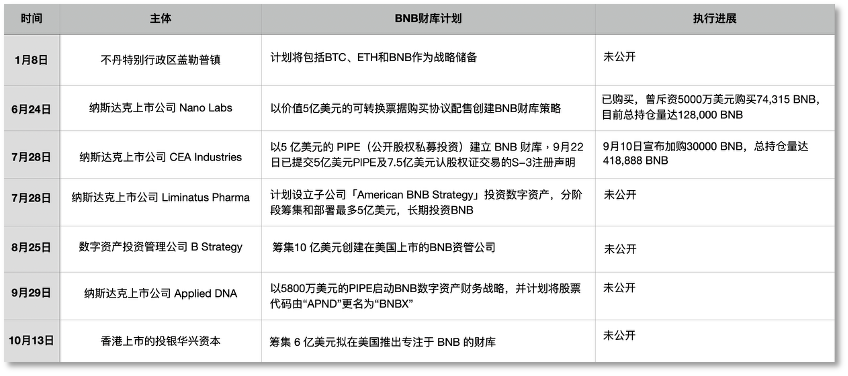

In June and July of this year, several publicly listed companies from traditional industries announced that they would include BNB on their balance sheets. When CZ revealed that over 30 teams were preparing projects involving BNB reserves for publicly listed companies, this momentum further grew in Q3.

By August 25, the Web3 veteran B Strategy announced it would raise $1 billion with the support of YZi Labs to establish a publicly listed company in the U.S. that would hold BNB as a financial asset and invest in the BNB ecosystem. YZi Labs is viewed as the "strongest family office" in the crypto circle, having begun independent operations after being spun off from Binance in January this year, managing funds for Binance founder CZ and a few early executives.

Multiple institutions have included BNB in their reserve/treasury plans

On October 13, Bloomberg reported that Hong Kong-listed investment bank Huaxing Capital plans to raise $600 million to launch a BNB-focused treasury in the U.S. Once completed, this project will become the largest single investment in BNB by a publicly listed company. Additionally, on October 9, news of SoftBank's (9984.T) payment application operator PayPay Corp acquiring a 40% stake in Binance Japan also reached the market.

The news of institutional investment and acquisitions, combined with the growth of on-chain activities, further boosted market confidence, providing support for BNB's subsequent rise.

Although investing in BNB still means investing in the future of Binance, BNB has long since transcended the narrative of being merely an exchange platform token. It has become a comprehensive crypto asset that integrates trading, payment, public chain fuel, and investment tools, catering to different groups of people.

As Binance users put it, "For trading users, BNB can offset transaction fees to save on trading costs; for investors, it serves as a pass to participate in early projects and earn returns in Launchpool and TGE; for developers, it is the gas for building decentralized applications on BNBChain."

By September, institutions prioritizing "adoption, development, usage, and use cases" arrived. Compared to the Meme craze, such participation can become the hardcore driving force for the incremental growth of the BNB ecosystem.

On September 24, global investment giant Franklin Templeton, managing $16 trillion in assets, announced that it is expanding its proprietary Benji technology platform to the BNBChain ecosystem, looking to leverage BNBChain's technological advantages, including its scalable low-cost infrastructure and high transaction throughput, to further enhance Benji's expertise in institutional-level tokenization and create on-chain financial assets.

On October 15, CMB International Asset Management Limited, a wholly-owned subsidiary of China Merchants Bank, put a money market fund with an asset management scale of over $3.8 billion on-chain with BNBChain. By deploying CMBMINT and CMBIMINT Tokens on the chain, investors can subscribe using fiat currency or stablecoins and redeem their held assets in real-time through DigiFT's proprietary liquidity management smart contracts.

Indeed, RWA (Real World Assets) is a channel that has already connected traditional financial assets with Web3 technology and the crypto world in practice. For on-chain infrastructures like BNBChain, large-scale adoption is the only way to validate its value. Compared to Meme, this represents a new world with more transformative significance.

As more entities like Franklin Templeton and CMB International adopt BNBChain, the continuously expanding, upgrading, fee-reducing, and efficiency-increasing BNBChain can achieve its long-term goal — to become the cornerstone of the financial system. This is the true starry sea that BNB aims to reach after crossing the noise of Meme speculation and setting a new high of $1,376.

(Disclaimer: Readers are advised to strictly comply with local laws and regulations; this article does not constitute any investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。