Kalshi's trading volume surpassing Polymarket proves that compliance is not a constraint, but a core competitive element.

Written by: c4lvin, Four Pillars

Translated by: Luffy, Foresight News

TL;DR

The development of prediction markets has made compliance a key competitive advantage, as evidenced by Kalshi's rapid rise. Polymarket has been barred from the U.S. market due to sanctions from the Commodity Futures Trading Commission (CFTC), while the licensed Kalshi has taken the lead through aggressive marketing and market expansion.

The fragmented global regulatory environment restricts the expansion of prediction markets, with the conservative attitudes of Asian countries being a major obstacle. Although the Trump administration in the U.S. showed signs of regulatory relaxation, countries like South Korea, Singapore, and Thailand either classify prediction markets as illegal gambling or outright ban access.

Decentralization and demonstrating the social value of prediction markets may be key to addressing regulatory issues in conservative countries. By reducing market manipulation risks through inter-party decision-making protocols like EigenLayer, while emphasizing their practical value as academic research tools and economic hedging instruments, a clear distinction from gambling can be established.

Regulatory Reshaping of the Prediction Market Landscape

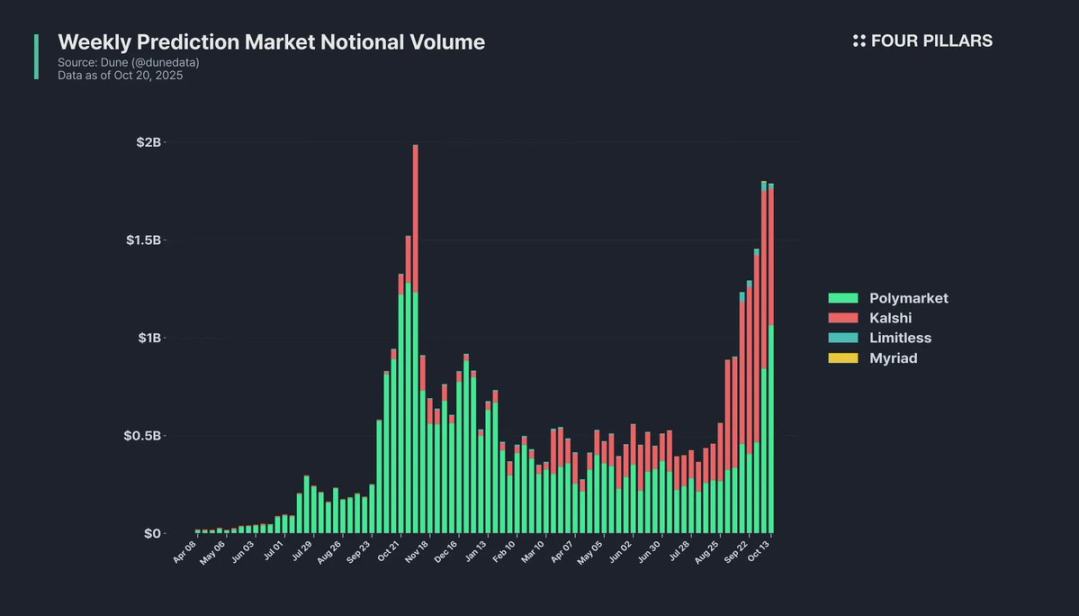

Data Source: Dune

One of the most significant changes in the prediction market ecosystem this year is the rapid rise of Kalshi. As of March this year, Kalshi's trading volume was only about 1/10 of Polymarket's, but after August, its trading volume surpassed Polymarket, becoming the market leader.

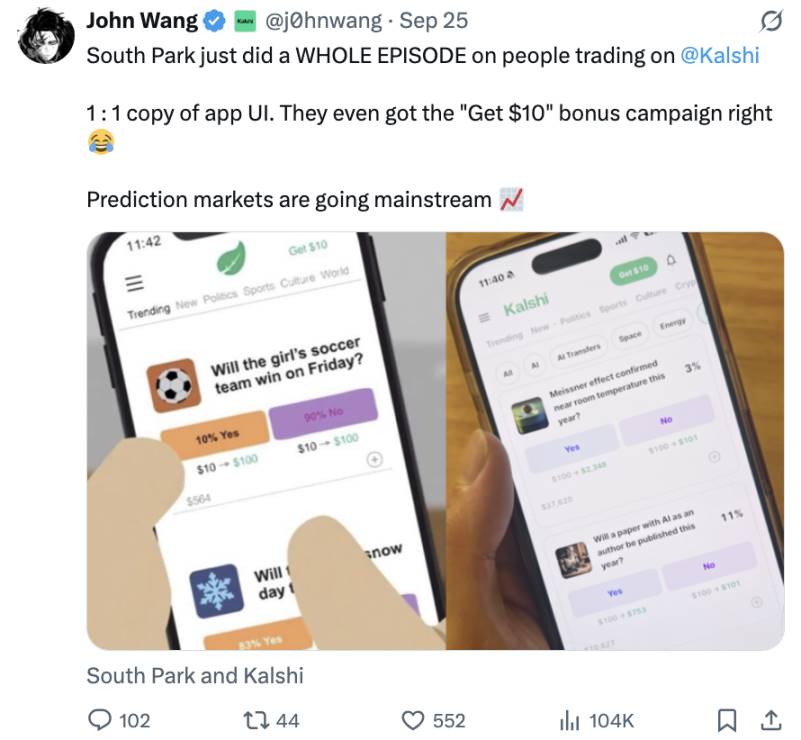

An entire episode of "South Park" revolves around trading on Kalshi.

The direct catalyst for Kalshi's growth was its feature in the popular animated series "South Park." In September this year, the show aired an episode satirizing the prediction market industry, prominently showcasing Kalshi and featuring characters using the Kalshi mobile app. Following the episode's airing, Kalshi's market share surged, confirming that public attention can translate into actual user growth.

However, the fundamental reason for this aggressive marketing is Kalshi's regulatory compliance status. Polymarket is prohibited from serving U.S. users due to CFTC sanctions, while the legally licensed Kalshi can monopolize the U.S. market. At this point, compliance is no longer just a means to avoid legal risks but has become a strategic asset supporting aggressive marketing and partnerships.

Kalshi's case proves that in prediction markets, compliance is not a constraint but a core competitive element. However, discussions within the community regarding the regulation of prediction markets remain quite limited. This article aims to analyze the complex regulatory environment surrounding prediction markets and the efforts required to address regulatory challenges.

Regulation of Prediction Markets and Mainstream Platform Strategies

Current Regulatory Framework for Prediction Markets

In the U.S., prediction markets are regulated by the CFTC and must comply with the Commodity Exchange Act. The services provided by prediction markets are legally classified as event contracts or binary options—essentially derivatives, where returns depend on whether the underlying event occurs, ultimately resulting in either a fixed amount or zero returns.

Current prediction markets must meet multi-dimensional compliance requirements:

Compliance with the Commodity Exchange Act: Must have fair governance mechanisms, oversight systems, and anti-fraud measures; all exchanges must submit detailed rule manuals for approval to ensure core principles are implemented.

Restrictions on event types: Markets involving terrorism, assassination, war, gambling, or illegal activities are prohibited; economic indicators and weather-related contracts are generally allowed.

Regulatory oversight committee: A regulatory oversight committee must be established, with members having no criminal records, responsible for overseeing regulatory procedures, personnel management, and annual report preparation.

Storage of trading data: According to CFTC regulations, all trading data must be stored in an accessible database for no less than 5 years.

Prevention of market manipulation: The Commodity Exchange Act strictly prohibits non-competitive trading, wash trading, spoofing, front-running, and other behaviors; platforms must build sophisticated systems to detect and prevent such operations.

Additionally, all prediction markets must establish a disciplinary committee and an appeals committee to ensure fair processes; a mechanism for determining market outcomes must also be established to clarify how event results are confirmed.

In terms of outcome determination mechanisms, Kalshi and Polymarket have taken different paths:

Kalshi adopts a centralized model: The final determination is made by its own results review committee.

Polymarket adopts a decentralized model: It introduces a system called UMA Oracle, using an optimistic determination mechanism—if there are no disputes within a 2-hour questioning period, the proposed result automatically takes effect; if there is a dispute, it is resolved by a vote of UMA token holders.

Regulatory Gray Areas

Classifying prediction markets as gambling leads to blurred regulatory boundaries. The conflict between the Unlawful Internet Gambling Enforcement Act (UIGEA) and CFTC regulation is particularly prominent: although UIGEA excludes CFTC regulatory activities from sanctions, it also creates space for regulatory arbitrage, allowing platforms to potentially evade state gambling regulations and taxes.

In October 2025, the Pennsylvania Gaming Control Board issued a warning to Congress regarding the conflict between federal derivatives laws and state-level gambling regulatory authority, highlighting the potential risks of federal-state regulatory conflicts.

The regulatory conflicts surrounding sports and entertainment-related markets are even sharper. In January 2025, after Kalshi launched sports prediction markets, six states, including Nevada, New Jersey, and Maryland, immediately issued cease-and-desist orders, claiming that Kalshi's services constituted unlicensed gambling, violating state gambling laws; Kalshi responded by citing federal preemption principles, asserting that federal regulatory authority takes precedence over state regulation.

Regulatory Challenges Faced by Prediction Market Platforms

Polymarket

Source: Cointelegraph

Polymarket experienced rapid growth after its launch in June 2020, but in January 2022, it received severe penalties from the CFTC: it was fined $1.4 million for not registering as an exchange and was prohibited from serving U.S. users. For the next two years, Polymarket was only open to non-U.S. regions.

The CFTC determined that Polymarket's services fall under the definition of swap contracts in the Commodity Exchange Act and can only be traded on registered exchanges in designated contract markets (DCM).

In November 2024, the FBI raided CEO Shayne Coplan's residence, suspecting that Polymarket was still serving U.S. users. However, in July 2025, the situation reversed when Polymarket acquired QCX LLC, a derivatives exchange holding a CFTC license, thereby obtaining DCM and derivatives clearing organization (DCO) licenses. In September of the same year, Polymarket received a no-action letter from the CFTC regarding "swap data reporting and recordkeeping requirements," officially returning to the U.S. market.

Kalshi

In contrast to Polymarket, Kalshi chose a fully compliant path from the outset. On November 5, 2020, Kalshi became the first platform in U.S. history to focus solely on event contract trading and receive CFTC approval for DCM qualification.

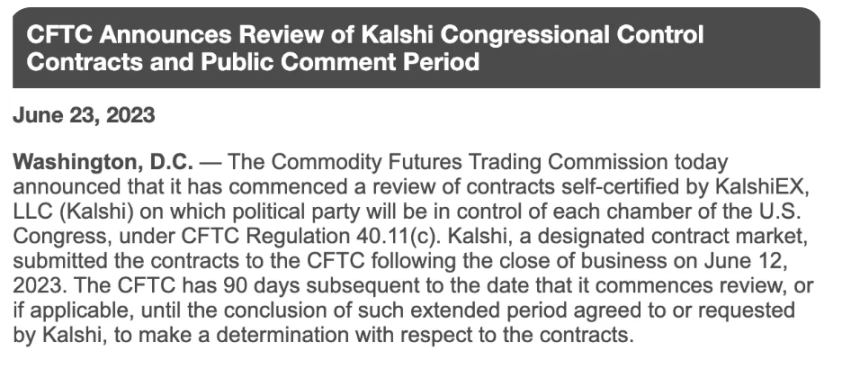

Source: CFTC

However, in June 2023, after Kalshi self-certified and launched markets related to "Congressional Control," the CFTC raised objections, arguing that such markets constituted betting on events, violating state laws and not serving the public interest. Kalshi filed a lawsuit in federal court in November of the same year and won in September 2024; after the CFTC withdrew its appeal, Kalshi completely overcame this regulatory obstacle.

After winning the lawsuit, Kalshi aggressively expanded into the sports prediction market: in January 2025, it launched markets related to the National Football League (NFL), National Hockey League (NHL), National Basketball Association (NBA), and National Collegiate Athletic Association (NCAA) across all 50 states. During the "March Madness" (NCAA basketball tournament), trading volume exceeded $500 million. However, six states, including Nevada and New Jersey, issued cease-and-desist orders again, and Kalshi responded with federal preemption principles, gaining support from a federal court in New Jersey in May 2025.

Other Platform Cases

In addition to Polymarket and Kalshi, several other prediction market exchanges are also subject to U.S. government regulation:

PredictIt: Originating from a research project at Victoria University in Wellington, New Zealand, in 2014, it once received a no-action letter from the CFTC but was subject to strict limitations (maximum bet of $850 per contract, with a maximum of 5,000 traders per contract). In August 2022, the CFTC withdrew the no-action letter, requiring it to shut down; after a long legal battle, PredictIt won in July 2025 and received a DCM license in September of the same year, officially becoming a compliant derivatives exchange.

Crypto.com: After obtaining a margin derivatives license in September 2025, it launched sports prediction markets in 16 states through a partnership with Underdog, but faced state-level challenges (such as losing in court in Nevada).

Railbird: An emerging prediction market platform that received a no-action letter in August 2025, allowing it to operate within a narrow scope of B2B risk hedging.

Atmosphere of Regulatory Relaxation for U.S. Prediction Markets

Although the U.S. government has previously regulated prediction market platforms with extremely strict standards, a fundamental shift in the regulatory environment occurred during the Trump administration:

Trump himself posted Polymarket odds on Truth Social, showing personal interest;

Donald Trump Jr. serves as a paid advisor to Kalshi while also being a board member and investor in Polymarket, with his company 1789 Capital investing tens of millions of dollars in Polymarket;

On September 29, 2025, SEC Chairman Paul Atkins and CFTC Acting Chair Caroline Pham announced a "comprehensive coordination plan," stating that they would review the development opportunities for event contracts across jurisdictions and prevent regulatory loopholes.

Fragmented Global Regulatory Environment

Although prediction markets are gradually becoming legalized in the U.S., other regions are moving in the opposite direction. This regulatory fragmentation poses severe challenges for global platforms, with the conservative attitudes of Asian markets particularly restricting the global expansion of prediction markets.

Attitudes of Asian Countries Toward Prediction Markets

South Korea: Strictly prohibited, viewed as illegal gambling

South Korean regulators take an extremely conservative stance toward prediction market platforms: all gambling markets are regulated under the National Sports Promotion Act, with only Sports Toto, operated by the Korea Sports Promotion Corporation, being a legal gambling platform; all other gambling websites are considered illegal, and both users and operators may face penalties.

The legal Sports Toto only allows betting on a very limited number of sports events and is strictly regulated by the government, with a maximum bet amount of only 100,000 won (approximately $70).

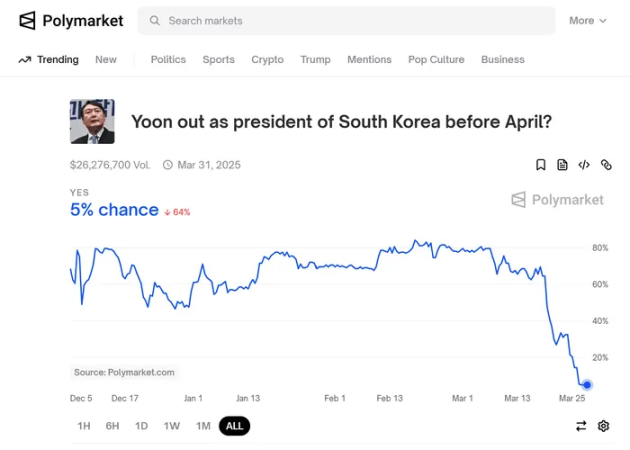

Source: South Korean media "Daily Economic News"

In early 2025, during the impeachment crisis of former President Yoon Suk-yeol, a large number of contracts related to South Korean political events appeared on Polymarket, sparking widespread public and media attention on prediction markets in South Korea. South Korean media uniformly defined Polymarket as an illegal private Toto and emphasized that, under current South Korean law, participation by South Korean citizens in prediction market betting could be considered a gambling offense punishable by law.

Singapore: Banning platforms and heavily penalizing users

Singapore also classifies prediction markets as gambling. In January 2025, the Singapore government took a hardline approach, completely banning Polymarket, classifying it as an unlicensed online gambling operator under the Gambling Control Act. Under this law, users of unlicensed gambling platforms can be fined up to 10,000 Singapore dollars (approximately $7,200) and face up to six months in prison.

Thailand: Banning due to cryptocurrency use

In January 2025, the Thai Technology Crime Suppression Division announced at a press conference that it was preparing to ban Polymarket, citing the platform's use of cryptocurrency as a violation of gambling laws.

It is evident that Asian countries maintain an extremely conservative attitude toward prediction markets. Given Asia's share in the cryptocurrency market, this will become a key constraint for the future expansion of prediction market platforms.

Regulatory Cases in Western Countries

France: Banned Polymarket in November 2024. The French National Gambling Authority determined that Polymarket provided online gambling services without obtaining a French license and made it clear that "even with the use of cryptocurrency, gambling activities remain illegal in France."

Canada: Based on the 2017 regulation prohibiting retail investors from trading binary options with a maturity of 30 days or less, prediction markets are banned. In April 2025, the Ontario Securities Commission reached a settlement with Polymarket-related companies, with Polymarket admitting to violations in Canada and required to pay a fine of 200,000 Canadian dollars (approximately $150,000).

United Kingdom: The attitude is relatively open. The UK's Financial Conduct Authority is in discussions with Robinhood about introducing prediction markets to the UK, with Robinhood stating that the demand for prediction market products is strongest in the UK and Europe.

Conclusion: The Future of Prediction Markets Lies in Decentralization to Break Regulatory Barriers

In summary, the global regulatory environment for prediction markets is highly complex due to regional policy differences and legal interpretation discrepancies. This fragmentation not only restricts the global user expansion of prediction market platforms but also affects their stable operation.

Although decentralized prediction market protocols attempt to achieve borderless trading through blockchain technology, regulatory agencies in various countries still prioritize domestic laws, restricting platform operations and user access through measures such as "domain bans" and "direct sanctions against operators."

Currently, platforms like Polymarket and Kalshi have successfully developed the U.S. market, but the potential of global markets like Asia cannot be overlooked. If the Asian market, which accounts for a significant proportion of cryptocurrency trading volume, cannot be covered, the true globalization of prediction markets will remain out of reach.

To achieve global expansion of prediction markets, it is essential to address the root causes of strict regulation, and even consider pilot promotions within regulatory sandboxes.

The main reasons for the strict regulation faced by prediction markets are:

Market manipulation risks: Most prediction markets currently face this issue—real-time disclosure of voting results may trigger herd behavior, allowing large fund holders to dominate initial trends; furthermore, if outcome determinations are controlled by a few individuals or lack transparency, the risk of manipulation cannot be eliminated.

Potential distortion of public opinion: If large amounts of capital can manipulate probabilities, prediction markets may distort public opinion, indirectly affecting actual event outcomes, which is particularly sensitive in political and social events.

Blurred boundaries with gambling: Due to the nature of prediction markets being bets on event probabilities, many regulatory agencies directly classify them as gambling.

It is worth noting that, aside from the blurred boundaries with gambling, the first two issues can be partially addressed through decentralization. For example, decentralized oracle systems using inter-party decision-making protocols like EigenLayer can significantly enhance the transparency and anti-manipulation capabilities of outcome determinations. By incentivizing multiple validators to report results truthfully through economic incentives, while employing punitive measures against malicious behavior, the risk of market manipulation can be significantly reduced. Although the fairness of existing governance-based determination mechanisms like the UMA protocol is still questioned, EigenLayer offers a fairer solution to the "suspected manipulation" issue through measures such as "questioning and punishment mechanisms" and "forkable token systems."

The boundary issue with gambling, however, requires a long-term strategic response; relying solely on technical solutions is insufficient. It is necessary to demonstrate the social value of prediction markets. For instance, academic prediction markets like the Iowa Electronic Markets and the Good Judgment Project have shown higher accuracy than traditional polls in political and economic predictions. Based on these successful cases, it is essential to continuously convey the core message: prediction markets are not merely gambling but a mechanism for aggregating information through collective intelligence.

Since the birth of Chicago's grain futures in 1848, the derivatives market has steadily expanded from agricultural products to financial assets. In the age of social media, categorizing personal opinions and predictions as a new asset class and launching event contracts based on this may be a natural evolution of the market. As Kalshi co-founder Mansour stated, prediction markets are the democratization of hedging—providing individual investors or small and medium-sized enterprises with accessible and low-cost risk hedging tools.

The future of prediction markets depends on constructive dialogue and cooperation among regulatory agencies, platform operators, and technology developers. What we need is not an unconditional ban but a balanced regulatory framework—one that embraces innovation while protecting consumers. In the long run, countries that completely ban prediction markets will show significant competitive differences in information efficiency and financial innovation compared to those that cultivate prediction markets within a compliant framework.

We look forward to prediction markets shedding the label of mere speculative tools and becoming a core infrastructure for managing uncertainty and leveraging collective intelligence in the modern economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。