The real watershed is not in the strength of events, but in market position and leverage structure.

Author: NDV

TL;DR

📌 What is TACO?

TACO stands for “Trump Always Chickens Out,” used to describe the typical pattern of U.S. President Trump in trade policy: he first pressures by publicly threatening high tariffs (such as against China or other trade partners), leading to a short-term plunge in global stock and financial markets; subsequently, due to economic pressure or negotiation needs, he often softens his stance, delays, or cancels these tariffs, triggering a rapid market rebound.

📌 What is TACO Trading?

TACO trading is an investment strategy based on the above pattern. Investors buy stocks, cryptocurrencies, or other risk assets (such as U.S. stock index funds, Bitcoin, etc.) at low prices during market panic when Trump announces tariff threats, and then wait to sell for profit when Trump "chickens out" and releases signals of easing. This trading essentially bets that Trump's policies often have "loud thunder but little rain," capturing short-term opportunities from market panic to rebound. However, it is important to note that the essence of TACO trading is not betting on whether someone "will chicken out," but rather betting that "the uncertainty of policy implementation" is initially overestimated by the market, which then returns to a more rational level.

NDV Research Topic

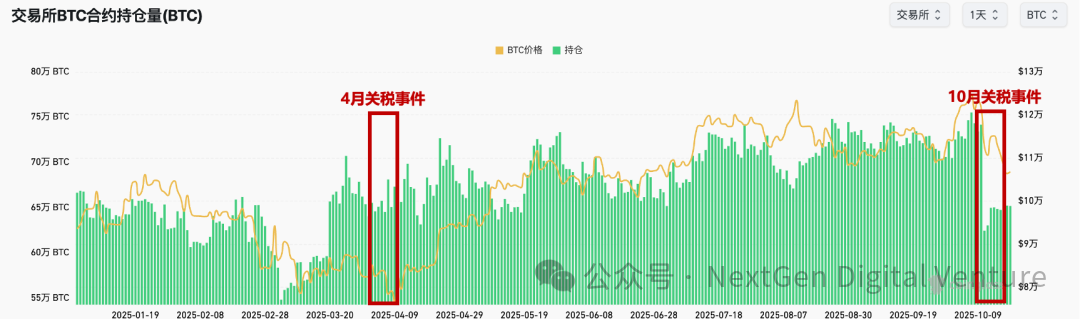

Our research team has conducted a detailed analysis of two typical TACO events (the U.S.-China trade war on April 2 and October 10), attempting to analyze why, even when faced with similar types of events, the market performance can differ under different event evolutions, macro backgrounds, market positions, and market sentiments.

Core Comparison of Two TACO Events

In this tariff event, although both the U.S. and China have released signals of easing, the entire TACO event has not reached a complete conclusion. NDV will continue to closely monitor subsequent dialogues and meetings between the U.S. and China and will keep updating market observations.

TACO Event Timeline

April 2: The U.S. initiates "reciprocal tariffs" against China.

April 2, 2025 (Event Start: Announcement of Reciprocal Tariffs)

Trump announces reciprocal tariffs, imposing a 10% baseline tariff on China and other partners, along with reciprocal adjustments (calculated based on trade deficits). The baseline tariff takes effect on April 5, and the higher "reciprocal tariffs" will take effect on April 9. Treasury Secretary Mnuchin informed Congress on April 1 that the tariffs on April 2 would be the "ceiling," aimed at leaving room for negotiations to lower actual tariff levels.

April 4, 2025 (China's Initial Countermeasures)

The Tariff Commission of the State Council of China announces a 34% tariff on U.S. imports as a response to the U.S. "reciprocal tariffs," covering agricultural products, automobiles, etc.

April 7, 2025 (U.S. Escalation)

Trump announces an additional 50% tariff on China in response to China's 34% countermeasure.

April 8, 2025 (Further Escalation)

Trump signs Executive Order 14259, raising the reciprocal tariff on China from 34% to 84% and adjusting low-value import tariffs. The effective date is April 9. On April 9, China simultaneously raises tariffs on U.S. goods to 84% and announces export controls on medium and heavy rare earth items, precisely targeting the U.S. military and semiconductor industries.

April 10, 2025 (Peak Escalation and Partial Easing)

Trump signs Executive Order 14266, further increasing tariffs on China to 125% (a total of about 145%, including original tariffs), effective immediately. At the same time, a 90-day suspension of tariffs on 75 other countries is implemented, reducing tariffs to 10%. On April 11, China announces that tariffs on U.S. goods will also be raised to 125% and states that it will ignore further U.S. tariff increases, marking the peak of the first round of extreme pressure.

May 2, 2025 (Public Negotiation Signals)

China's Ministry of Commerce confirms that the U.S. has made multiple attempts to negotiate, emphasizing that current tariffs are "unsustainable." Both sides agree to hold face-to-face meetings in Geneva. Trump publicly expresses a "hope to reach an agreement with China."

May 12, 2025 (End of Easing: Geneva Talks)

After high-level economic and trade talks in Geneva, the U.S. and China reach a "ceasefire agreement," announcing the cancellation of 91% of previously imposed punitive tariffs, retaining only 10% and suspending 24% of tariffs for 90 days. The trade war temporarily eases.

October sees a resurgence in the U.S.-China trade war.

October 3-9, 2025 (Background Before the Event)

On October 3, the U.S. announces that starting October 14, it will impose high "port maintenance fees" on ships owned, operated, or built by China entering U.S. ports. On October 9, China's Ministry of Commerce issues a series of announcements, implementing export controls on superhard materials, certain rare earth equipment and raw materials, five types of medium and heavy rare earths, lithium batteries, and artificial graphite anode materials, effective November 8. Among these, the controls on overseas rare earth exports and rare earth technology are particularly severe, seen as a "cutting off the enemy's supply."

October 10, 2025 (U.S. Escalation Threat)

On the evening of October 10, Beijing time, Trump expresses dissatisfaction with China's export controls on rare earth products via the social platform Truth Social, stating that he is considering significantly increasing tariffs on Chinese products entering the U.S. Subsequently, Trump continues to announce on Truth Social plans to impose a 100% tariff on Chinese imports and export controls on all critical software made in the U.S., with measures expected to take effect on November 1.

October 12, 2025 (Short-term Easing)

U.S. Vice President Pence releases easing signals, stating in a media interview: "Trump is willing to be a reasonable negotiator with China," implying "everything is negotiable," avoiding immediate full implementation. In response to Trump's latest tariff threats, some easing signals are released. Trump then makes a mild statement on Truth Social: "Don't worry, everything will be fine."

October 17, 2025 (Trump's Statement)

When asked whether he would maintain high tariffs on China, Trump replies, "NO."

October 18, 2025 (Trump's Further Statement)

Trump mentions that if a trade agreement cannot be reached before November 1, China may face a 155% tariff ("China’s paying 55% and a potential 155% come November 1st unless we make a deal.")

Future Key Time Points

Late October: South Korea will hold the APEC summit from October 28 to 31, focusing on interactions and statements between the U.S. and China before the meeting, as well as whether the leaders of the U.S. and China will meet during the summit.

November 1: Whether the U.S. 100% tariff will take effect as scheduled is a "hard indicator" for judging the direction of the trade war.

Mainstream Market Performance During Two TACO Events

Cryptocurrency Market

BTC Price

First, we focus on the performance of BTC during the two events and its market position before the events. Before the April 2 tariff event, BTC had already undergone about two months of corrective consolidation, falling from a high of $109,588 to around $85K on April 1, which was a correction of nearly 30% after Trump's election rally. On the day of the April 2 tariffs, BTC fell about 3%, and as the U.S. and China escalated tariffs, BTC's daily drop exceeded 6% on April 6. It wasn't until both sides eased on April 9 that BTC began to rise steadily, continuing this upward trend until the May 12 Geneva talks.

The market situation on October 10 was quite different from that on April 2; BTC had experienced a strong breakout and just reached a historical high on October 8, breaking through the $126,000 mark. After the announcement of the tariff increase on October 10, BTC closed down more than 7% that day, with a significant liquidation causing it to drop to a low of $102,000, a drop of over 20% from the opening price. Subsequently, due to a relatively easing attitude from both sides, especially from the U.S., BTC slightly rebounded to around $115,000, but then tested the support level of $107,000 again and fell below it.

Sentiment Index

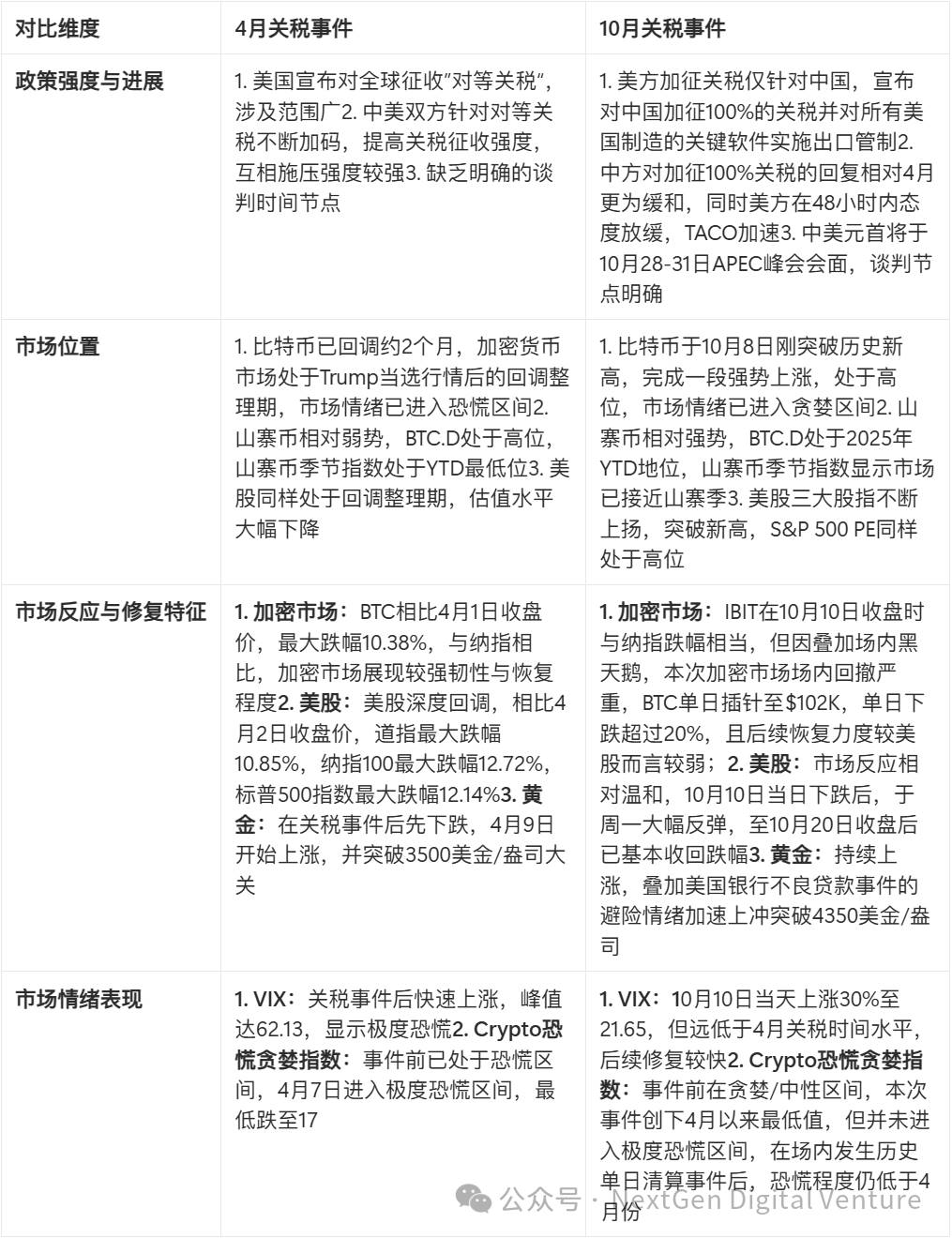

The Crypto Fear and Greed Index also reflects the differences in market positions during the two events. During the April 2 tariff event, the market had already entered the fear zone due to previous corrections, and the drop on April 6 brought the market into extreme fear. Before this tariff event, the market was hovering in the greed and neutral zones due to the breakthrough of new highs, and after the tariff event and the outbreak of a black swan in the market, the sentiment index plummeted. As of October 18, the Fear and Greed Index had dropped to 25, marking a new low in market sentiment since the April tariff event, but still higher than during the April tariff event, not entering the extreme fear zone.

Altcoin Index and BTC.D

The altcoin index and BTC.D reflect the performance of altcoins, excluding BTC, during the two TACO events. Before the April 2 tariff event, both the altcoin index and BTC.D showed a relatively weak position for altcoins. After the significant drop on April 2, BTC.D continued to rise rapidly until just before May, indicating the market's risk-averse sentiment towards altcoins at that time. Before this tariff event, BTC.D had fallen to a relatively low level since 2025, with the market experiencing an overall rise in altcoins driven by ETH's increase, while several large projects' TGE also raised the market cap share of altcoins. However, we saw that due to the significant drop in altcoins, BTC.D briefly spiked to 63% on October 10, an increase of over 4% compared to the previous day. During the market recovery process, on October 11 and 12, the market cap recovery of altcoins outperformed BTC, mainly due to the oversold recovery from significant liquidations in altcoins. Additionally, from the altcoin index perspective, due to the excessive liquidation of altcoins, the altcoin season index quickly fell from around 65, and as of October 18, the altcoin season index had dropped to 41.

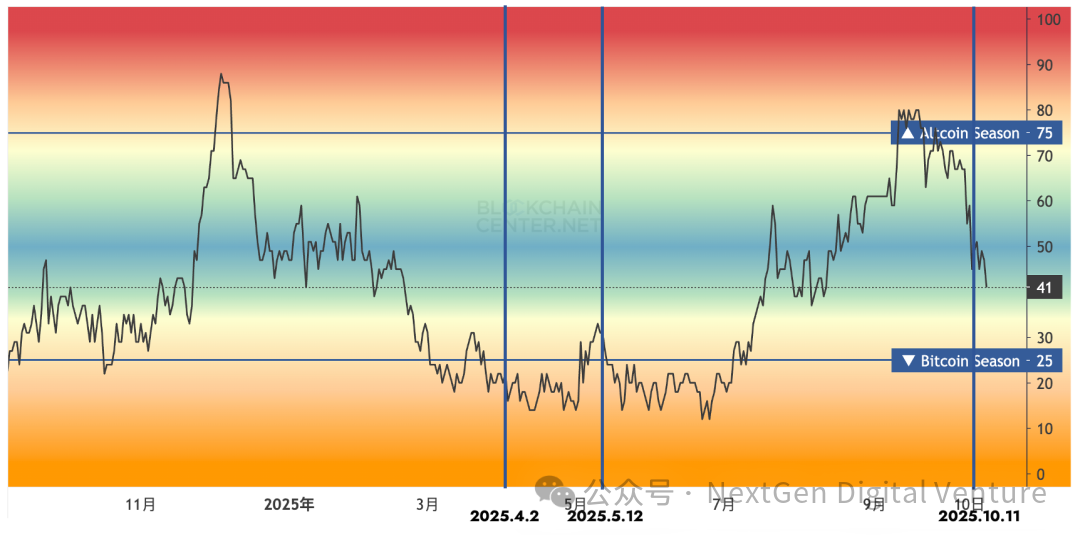

On-Site Leverage Situation

Comparing the tariff events in April and this time, the current event has seen a more thorough cleaning of leverage. On one hand, altcoins experienced widespread flash crashes, leading to a significant reduction in altcoin leverage. On the other hand, even looking at BTC, the degree of leverage cleaning is much more pronounced than in April. The preliminary decline before the April 2 tariff event did not lead to a significant decrease in BTC's open interest (OI), while after this event, OI plummeted from 741,500 BTC on October 10 to 624,400 BTC on October 11, a decrease of about 18%, returning to levels seen in March 2025.

U.S. Stock Market

Performance of the Three Major U.S. Indices and IBIT

The table and chart below reflect the price changes of the three major U.S. indices and IBIT during the two TACO events. In the table, we selected the price changes for six trading days after each event. In this event, the current decline in U.S. stocks is less than that of the April tariff event, but IBIT has seen a deeper decline and weaker recovery. Although on October 10, IBIT's decline was close to that of the Nasdaq, it continued to fall in the following trading days without achieving a satisfactory recovery.

S&P 500

Nasdaq 100

Dow Jones

IBIT

Before reviewing the price changes of IBIT, let's briefly discuss the different perspectives reflected by BTC and IBIT, and why it is necessary to discuss IBIT separately while focusing on BTC prices. IBIT trades during U.S. stock market hours, and its investor base overlaps more with institutional investors and U.S. stock investors. Additionally, it isolates the excessive declines caused by black swan events in the crypto market, making IBIT a point of observation for the trends in both the crypto and U.S. stock markets. After the April 2 tariff announcement, IBIT fell about 5.75% on April 3, and then dropped another 7.21% on April 7, before rebounding by 7.43% on April 9.

In this tariff event, on October 10, IBIT fell 3.70%, and did not achieve effective recovery afterward. As of October 17, it remained in a downward trend and had fallen below the key support level of around $61, down 12% from the closing price on October 9.

Valuation Level: S&P 500 PE

The S&P 500 PE Ratio also shows the differences in market positions. Before the April 2 tariff event, the U.S. stock market had undergone a period of correction, with valuation levels at a relatively low stage. In this tariff event, the PE ratio had reached its highest point since 2022, indicating that U.S. stocks were not only at high prices but also at high valuations.

VIX

VIX reflects the panic situation in the U.S. stock market; the higher the VIX value, the greater the market's fear sentiment. From the VIX index, the correction before the April tariff event had already intensified the panic sentiment in the U.S. stock market, with the VIX index approaching 30 in March. After the April tariff event, the VIX index skyrocketed to 60. Although this tariff event caused the VIX index to rise rapidly to its highest level since April, it remains far lower than in April. This is partly because the progress of this tariff event has been relatively mild, and partly because after the "market education" in April, the market has higher expectations for TACO trading and reduced sensitivity to tariff events.

Gold

In both events, the market position of gold was very similar, reaching new highs after a rapid rise. After the April tariff event, gold experienced declines over the next three trading days due to global sell-offs, before continuing its upward trend. In this event, gold continued its upward trend, and combined with the bad debt events of two regional banks in the U.S., gold strongly broke through $4,300.

Summary

Finally, let's summarize the comparison of the two U.S.-China tariff TACO events:

The Events Themselves

This tariff event has progressed more gently compared to April. In April, the announcement of reciprocal tariffs on April 2 led the U.S. to initiate comprehensive tariff increases against its main trading partners, with both the U.S. and China continuously escalating tariffs, creating a tense atmosphere for a week, which caused the market to gradually decline as tariffs increased. This time, the tariff event is only directed at China, and both sides have relatively mild attitudes. After Trump proposed tariff increases, China did not propose corresponding tariff increases as a countermeasure, and the U.S. quickly eased its stance, with both sides believing there is room for further negotiations. However, it should be noted that although both sides' attitudes have softened, we do not believe that a complete TACO has been achieved; we need to continue monitoring the subsequent statements and progress from both sides, as well as the specifics of the meeting in South Korea.

Macroeconomic Environment

Compared to April, it is important to note the following macro events that need attention during this event: (1) Interest Rate Cut Cycle: After a 25 basis point cut in September, the market has fully priced in subsequent rate cuts, and we have entered a relatively certain rate cut cycle; (2) U.S. Government Shutdown: The U.S. government has been shut down since October 1, and as of October 18, it has been shut down for 18 days, with no signs of termination in the short term, adding significant uncertainty to the macro environment; (3) U.S. Small and Medium Bank Loan Crisis: The loan crisis at Zions Bancorporation and Western Alliance Bancorp has triggered panic in the U.S. stock market regarding regional banks, raising concerns that this could be the beginning of a crisis for the entire banking sector, leading to a decline in U.S. stocks on October 16, especially a 6.31% drop in the KRX (Nasdaq Regional Banking Index).

Market Position

The market positions and states of U.S. stocks and cryptocurrencies show significant differences during the two events. In simple terms, in April, both the U.S. stock and cryptocurrency markets had undergone relatively sufficient corrections and adjustments, while in this event, both were at high levels. Whether in terms of price, valuation, or leverage levels, the market is relatively fragile. After the market has relatively fully priced in subsequent rate cuts, both lack catalysts for further upward movement after breaking new highs, making the tariff event a trigger for a pullback.

Market Sentiment Reflection

In terms of market sentiment, this event triggered the highest level of panic in the U.S. stock and crypto markets since the April tariff event, but the panic sentiment is not as severe as during the April tariff event. This is partly because the attitudes of both the U.S. and China in this event were relatively mild, without too many actual measures taken in direct opposition, and partly because the market's sensitivity to similar events has decreased after the April tariff event.

NDV's Viewpoint

The real watershed is not in the strength of events, but in market position and leverage structure.

Looking back at the two TACO events, the biggest difference between April and October is not "how serious the news is," but the market state at the time of the trigger.

In April, the market had undergone a round of adjustment, with low leverage and cool sentiment; while in October, the market was at new price highs, high valuations, and full leverage, making it more fragile and more susceptible to "chain liquidations" during shocks.

Therefore, this round of TACO resembles a structural clearing rather than a simple panic sell-off. In the short term, the deleveraging process in the crypto market is still not fully over, and the recovery curve will be flatter and longer; however, the positive aspect is that signals of policy easing have appeared earlier, and the stability of U.S. stocks and gold is providing external conditions for the bottoming of risk assets.

Core Judgment: The essence of TACO is "the mean reversion of risk premium."

The repeatable logic of such events lies in the fact that the market often overestimates risk premiums during the policy threat phase, and then gradually repairs itself after easing signals appear. In other words, TACO is not betting on whether an individual "will chicken out," but rather observing how the market first overreacts and then self-corrects. Therefore, rhythm and structural judgment are more critical than short-term sentiment.

Key Points for Future Observation:

Policy Statements — Whether easing expressions continue to translate into concrete actions, especially before and after the APEC summit;

Funding Aspects — Whether ETF fund flows and trading activity can recover, and whether institutional funds will re-enter the market;

Market Structure — Whether open interest (OI) and liquidation scales continue to decline, and whether BTC can stabilize above key support levels.

These factors will determine the market's transition from "short-term fluctuations" to "trend recovery."

NDV's Viewpoint

For the market, TACO is not a black swan, but a type of identifiable and quantifiable policy rhythm risk. It tests not the speed of reaction to news, but the depth of understanding of market structure. When panic leads to pricing deviations, calmness and patience become the most scarce assets.

NDV will continue to track the subsequent dialogues and meetings between the U.S. and China, and will update our judgments on the progress of this "panic-recovery" cycle in future market observations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。