This time, The9 does not want to be an agent anymore, but rather to become a rewriter of the game value distribution rules.

Written by: Deep Tide TechFlow

Is GameFi dead?

Those once-crazy "Play-to-Earn" projects have now become cautionary tales in the crypto circle. Once labeled as Ponzi schemes, that tag is hard to shake off in people's minds.

But is there really no way out for the combination of gaming and Web3?

In this cycle, those projects still striving in this direction have taken another path:

Instead of painstakingly creating rough blockchain games, why not let already successful game economic systems embrace Web3?

Outside the circle, Steam is integrating game distribution, purchasing, management, and community operations. Every year, its parent company Valve takes a 30% cut from every game transaction, while players receive nothing but the game itself.

What if Steam's economic model were tokenized? What if every purchase not only granted access to a game but also a share of ownership in the platform?

The idea of creating a "Web3 Steam" is being put into practice by a company you may have already forgotten.

The9 Limited (NASDAQ: NCTY), a name that once left a significant mark in Chinese gaming history with "World of Warcraft," is back with their 9BIT platform after 15 years of silence.

From 2005 to 2009, The9 was the king of the Chinese gaming industry, with "World of Warcraft" bringing in over 2 billion RMB in annual revenue. After losing "World of Warcraft," The9 experienced ups and downs, trying self-development, agency, and mining, but none could recreate its former glory.

Until 2025, they launched 9BIT. This time, The9 does not want to be an agent anymore, but rather to become a rewriter of the game value distribution rules.

The core logic of 9BIT is to turn real game consumption into investment.

To understand what 9BIT is doing, we first need to look at the current state of the most successful gaming platform outside the circle, Steam.

The problem with Steam is actually quite simple: the one-way nature of value distribution.

Every year, global players spend hundreds of billions of dollars on Steam. They buy games, recharge, and purchase DLC, but once that money is spent, it never comes back.

The reviews contributed by players help games sell better, the mods created extend the lifespan of games, and the communities built maintain the game's popularity, but all this soft value creation is completely unpaid.

What if every expenditure was not just consumption, but investment? This is what 9BIT is doing.

9BIT's answer is "consumption equals mining." This concept sounds very Web3, but the actual experience is very Web2.

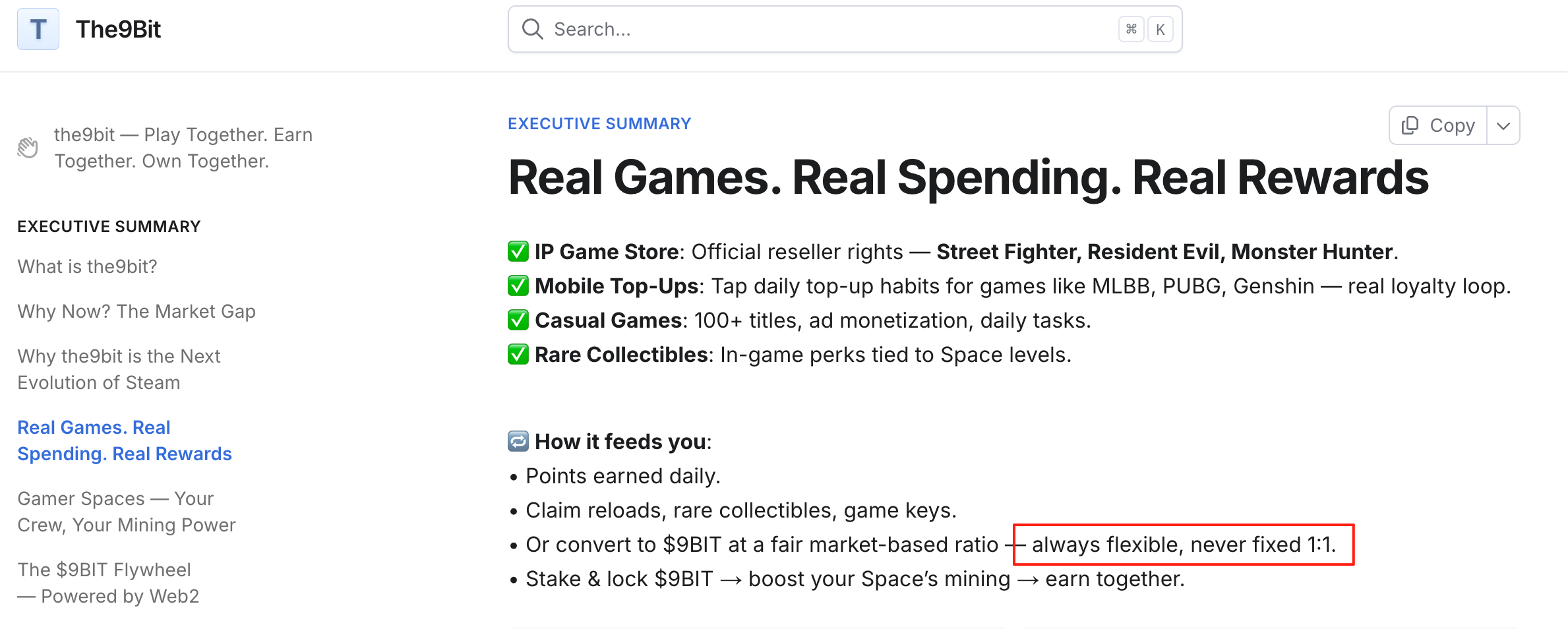

When you open the 9BIT website, the first thing you see is not various blockchain games enticing you to earn, but familiar AAA games, such as Street Fighter 6, Resident Evil, Monster Hunter, and other flagship titles from Capcom.

You can directly purchase these major titles on 9BIT to play. The registration process is surprisingly simple; just enter your email and set a password to complete it.

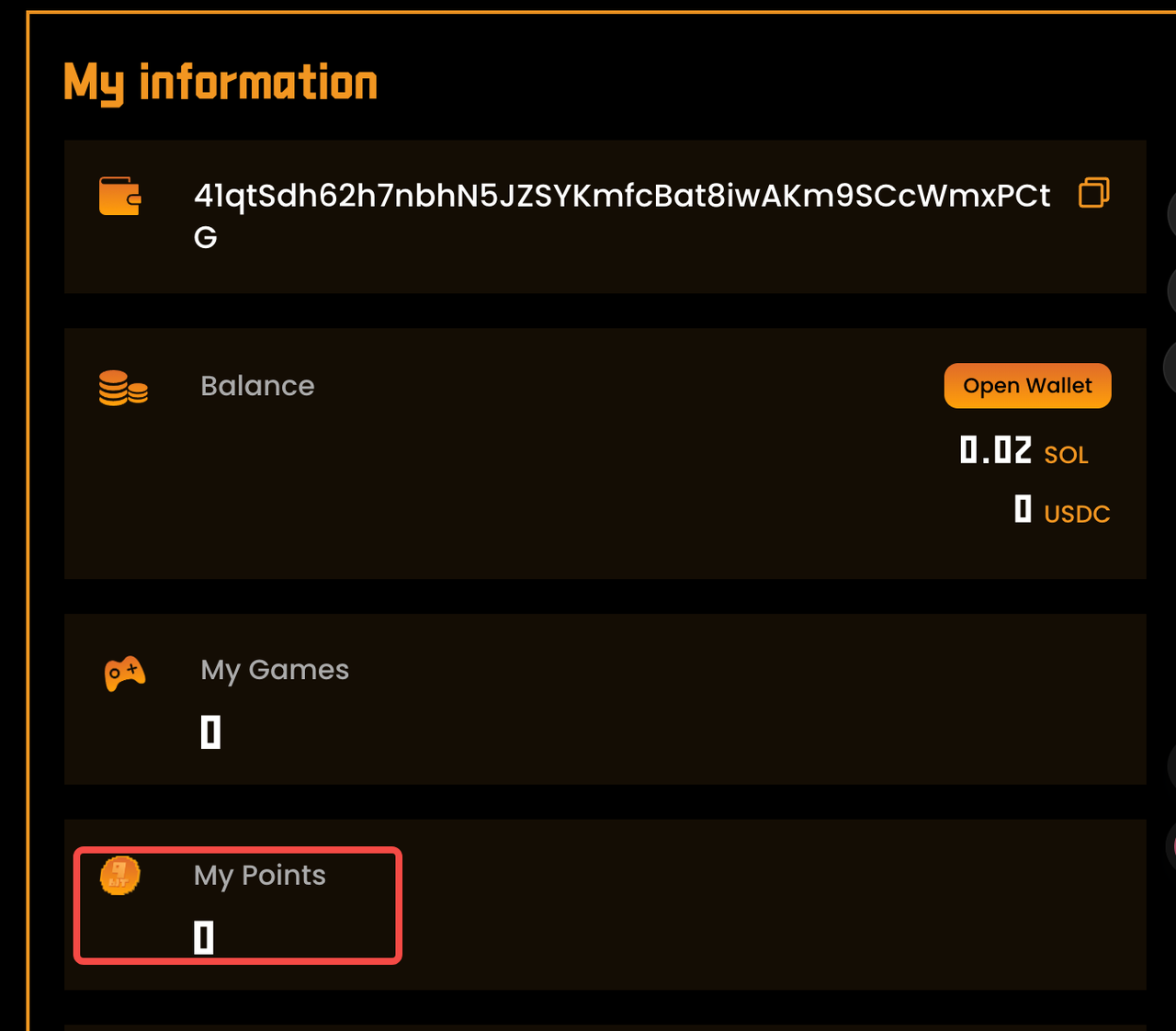

There are no mnemonic phrases or complicated wallet setups. The system automatically generates a wallet in the background through Particle Network, but users are completely unaware of these technical details.

This experience is not much different from registering a Steam account to buy games.

When you choose to purchase a game, the payment options include cryptocurrencies like USDC as well as traditional credit cards.

Choosing to pay with USDC, the entire process is as smooth as shopping on any e-commerce platform. After a successful payment, you will receive a string of game activation codes to activate on Steam or Epic to play.

Here you can see the cleverness of 9BIT; they are not trying to create another Steam, but rather to create a crypto payment layer and incentive layer for Steam:

Players still play games on familiar platforms, and 9BIT simply adds extra value to this payment process. The points added to the account reflect this extra value.

Let’s take a more specific example.

When you recharge 648 RMB for Genshin Impact, in traditional channels, that 648 RMB buys you 6480 Primogems, and the transaction ends there.

But in 9BIT, in addition to Primogems, your account will also gain corresponding points.

When you share a strategy in the community to help other players clear a level, that contribution will also convert into points. These points are a quantifiable reflection of your contribution to the platform.

Naturally, the points correspond to 9BIT's tokens.

From publicly available information, the function to exchange points for 9BIT tokens will be launched in Q4 alongside the token listing. The project's white paper shows that the exchange rate is not fixed but dynamically adjusted based on market conditions to avoid distorting the economic system.

More importantly, points are not limited to just being exchanged for tokens.

You can use them to redeem game items, recharge vouchers, or even limited edition collectibles. Non-speculative players who do not want to deal with cryptocurrencies can also benefit from this system.

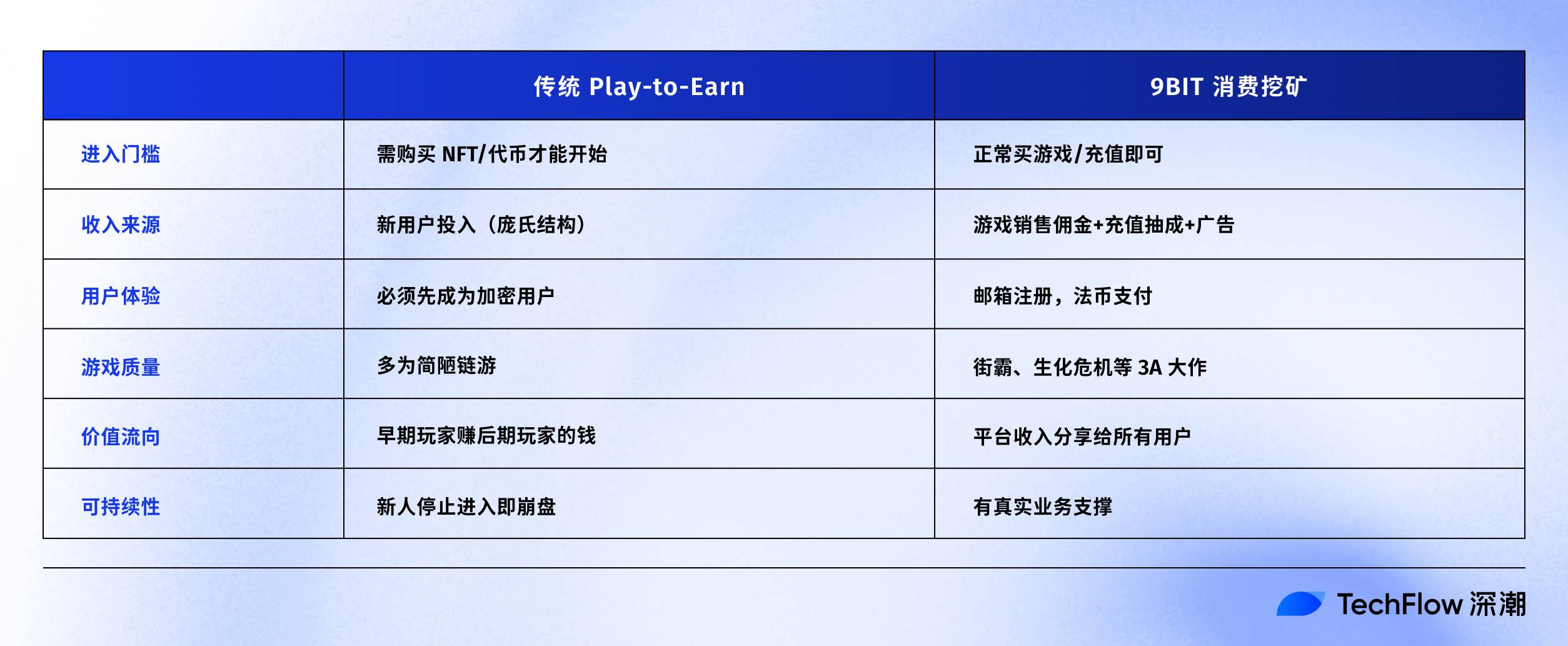

This leads to the essential difference between 9BIT and traditional GameFi.

Traditional Play-to-Earn requires you to first spend money to buy NFTs or stake tokens, essentially making you invest first before recouping your costs;

Whereas 9BIT users are already looking to buy games and recharge, these are essential consumption, and points and tokens are just extra rewards.

The key difference lies in the flow of value.

Traditional P2E is a zero-sum game, where early players earn what later players lose. 9BIT is a positive-sum game, where the money the platform earns from game publishers is shared with contributing users. This is not a transfer from one hand to the other, but a real external value input.

But since we are talking about income, the next question we care about is:

How real are these so-called "real incomes" from 9BIT? Can the scale support a token economy?

In game publishing, seeking a real income moat

To be honest, when GameFi is mentioned now, most people's first reaction is to turn away.

The reflexive rejection is completely understandable, as most blockchain games lack positive externalities and income sources, relying entirely on the funds of new entrants to sustain payments to early players, which is a Ponzi structure.

So when 9BIT claims to be different, skepticism is inevitable. What’s the difference? Where does the money come from?

Let’s do some calculations.

First, there are the commissions from game sales.

On the 9BIT platform, a "Resident Evil Bundle" is priced at $89, which includes remastered versions of Resident Evil 2 to 4.

According to the distribution rules of the gaming industry, platform providers typically receive a 10-15% commission. A simple calculation shows that for each bundle sold, 9BIT can earn $8 to $13.

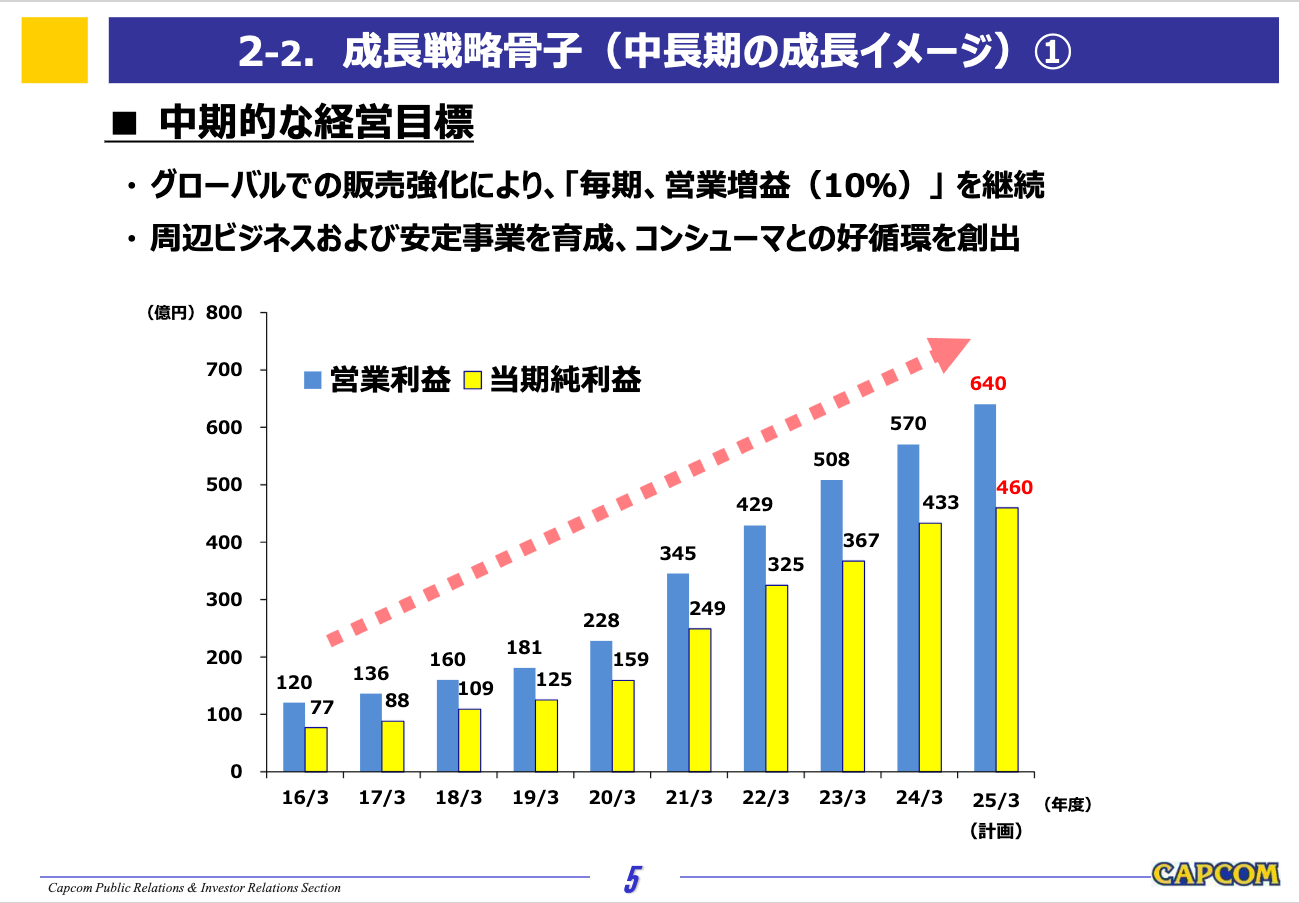

This may not sound like much, but considering that Capcom's game sales for the 2024 fiscal year are expected to exceed $360 million, if 9BIT can capture just 1% of those sales, which is not a high target in distribution channels, then theoretically, annual revenue could reach $3.6 million.

And Capcom is just one game publisher; if more publishers and major IPs can be onboarded, this number may increase.

The second source of income is even more interesting: mobile game recharge commissions.

The Southeast Asian market leads the world in mobile game recharge activity. For example, Genshin Impact has a stable monthly revenue of over $20 million in Southeast Asia. The recharge scale of national-level mobile games like Mobile Legends and PUBG Mobile is even more astonishing.

As a recharge channel provider, 9BIT typically earns a 5-10% channel fee.

A key detail is that 9BIT's partner, Vocagame, is one of the largest game recharge platforms in Southeast Asia. This means that 9BIT is not starting from scratch to establish recharge channels but is adding a Web3 incentive layer to a mature traditional business.

In a community of 1,000 active users, if each spends an average of $20 per month on recharges, the monthly channel income could reach $1,000 to $2,000. Expanding to dozens or hundreds of such communities, the income scale becomes quite considerable.

The third source is advertising revenue.

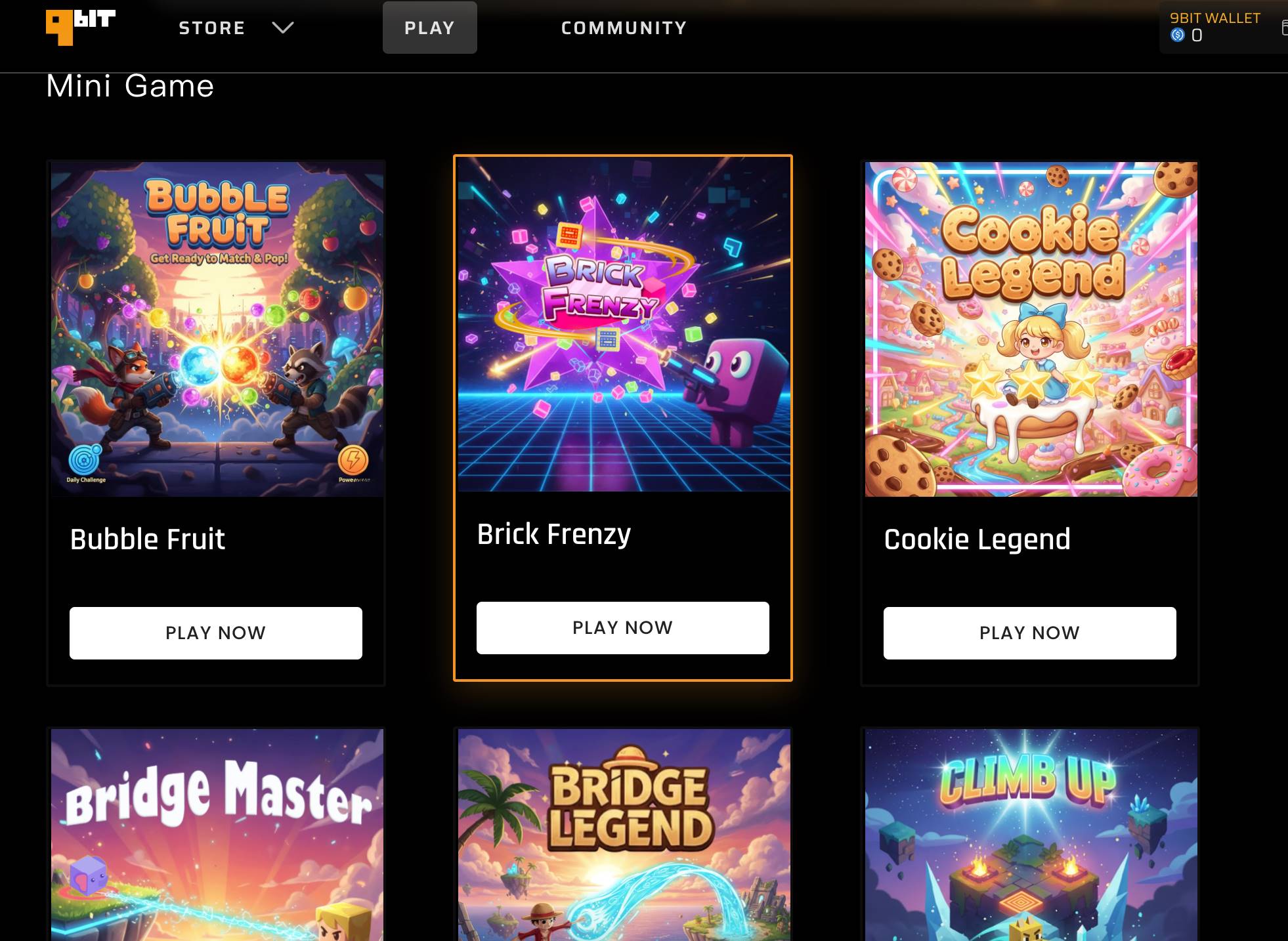

The platform has already launched over 50 casual games, which are simple and easy-to-play mini-games. These games can adopt the classic incentivized video ad model, where players watch ads to earn in-game rewards.

These are the known business aspects of 9BIT. According to plans, the upcoming P2P game item trading market in Q4, referencing OpenSea's 2.5% fee standard, will be another source of income. Management fees for token staking pools, sponsorship fees for esports events, etc., are also in the planning stages.

According to the latest publicly available data from the team, the platform launched on August 1 of this year and has already registered over 5 million users, generating over $1.8 million in revenue.

This number is not astonishing, but the key lies in the source of this money:

It is not from token presales, nor from NFT issuances, but from real game purchases and recharges. In contrast, the vast majority of GameFi projects have zero income before their tokens launch, relying entirely on VC funds to burn.

It is worth mentioning that The9, as a NASDAQ-listed company, will have 9BIT's financial data reflected in The9's quarterly reports; this level of transparency is not common in the Web3 world.

More importantly, the sustainability of income. Even if the price of 9BIT tokens plummets, players will still need to buy games and recharge; these businesses will not disappear.

Players come to the platform for games, not for "mining and selling," which determines that the user lifecycle will be longer.

Ideally, as the platform's game library expands and the user base grows, the network effect will make 9BIT increasingly attractive to game publishers, forming a positive cycle.

Spaces: Community as "Mining Pools"

With real income as a foundation, the next question naturally arises: how to allow contributing users to fairly share this income?

Behind every successful game, there is an active Discord server. Hundreds of thousands gather to discuss strategies, share insights, and organize events.

However, apart from occasional thanks and the rare "community contributor" title that a few may receive, enthusiastic players in the community often get nothing in return.

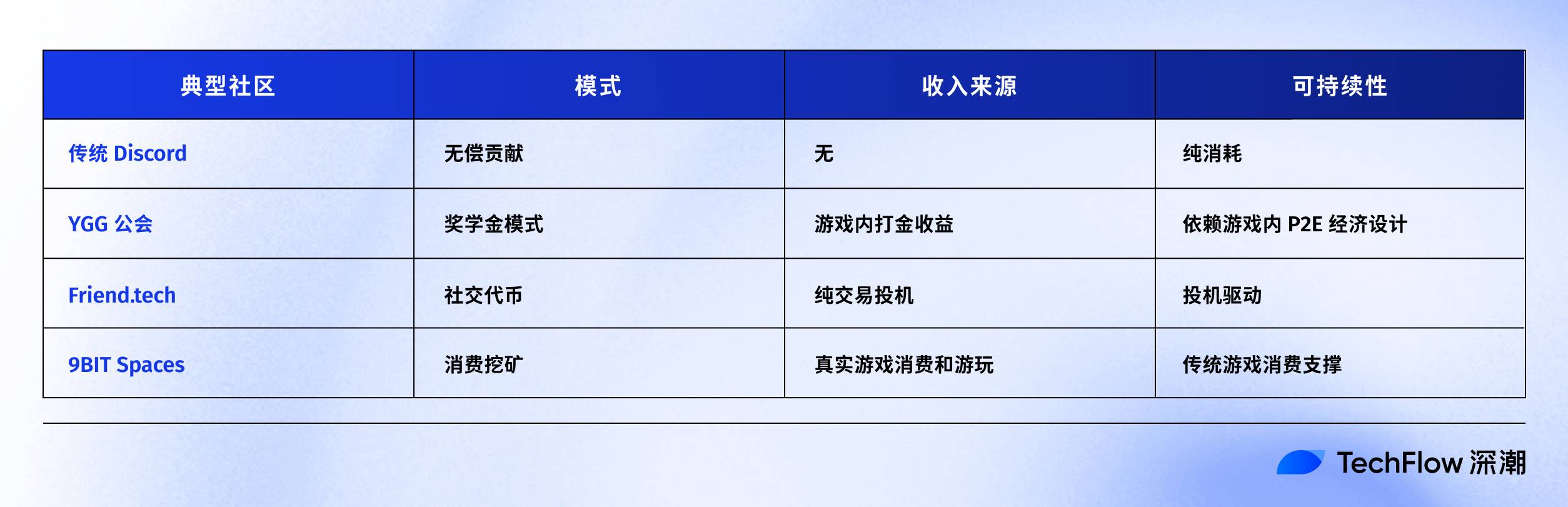

This is the norm in the entire gaming industry: the community creates value, while the platform enjoys the profits. The 9BIT's Spaces feature seems to aim to change this logic.

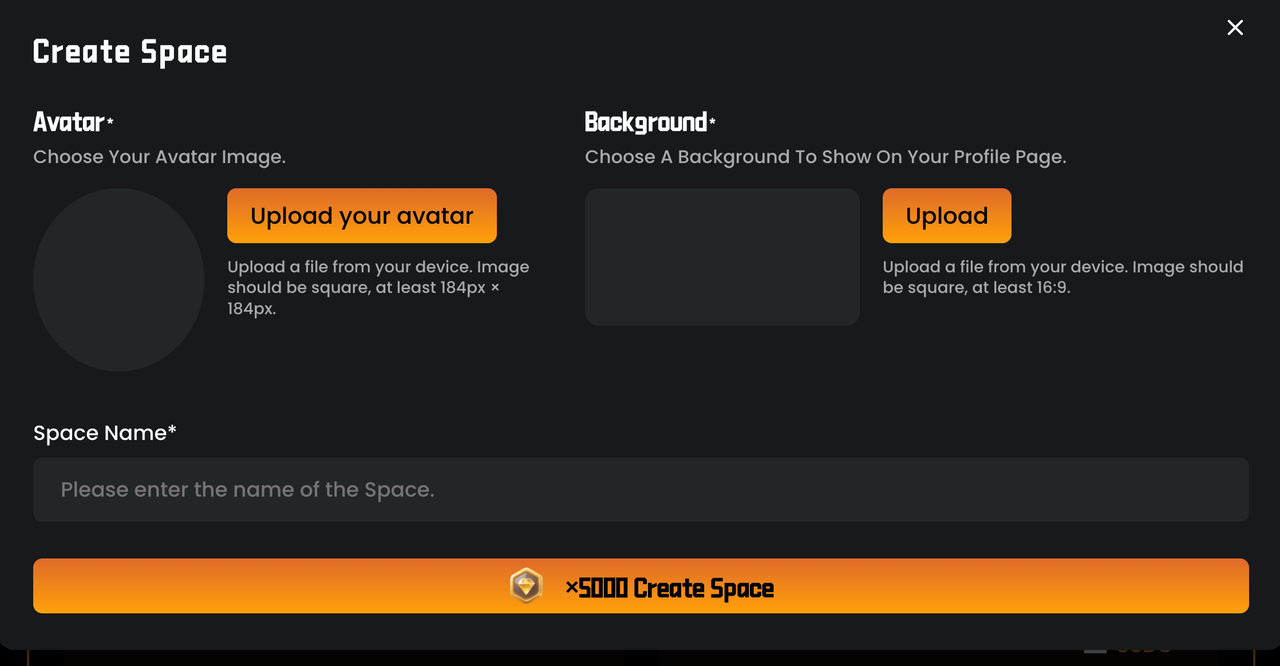

Spaces looks like Discord, but it is not entirely the same. Each Space functions like a small economy, where members are not just chatting but working together towards a quantifiable goal: mining rewards.

The mechanism is not complicated. A fixed number of 9BIT tokens, say 100,000, is released daily across the network; all Spaces distribute the tokens from this pool based on performance.

According to the design in the white paper, 50% of the mined tokens can be withdrawn immediately, while 50% is locked for 12 months. This provides immediate incentives, allowing contributors to see returns right away, while also preventing excessive sell pressure.

You can easily see how this approach differs from traditional blockchain game guilds and Web2 gaming communities:

This design addresses two of the most troublesome issues for Web3 projects.

The first is customer acquisition cost. Traditional projects spend a lot of money to acquire users, with various airdrops and subsidies; once the money runs out, users leave. 9BIT does not need this, as each Space will spontaneously attract new users, because the more users there are and the more active they are, the higher the mining rewards, creating a self-growth mechanism.

The second is user stickiness. Players join a Space not just to find gaming partners but also for shared economic benefits.

Over time, top Spaces may generate a premium like a brand; for instance, being a member of XX Space could become a form of identity recognition, and there is also room for the operation of assets like NFTs.

Of course, the author believes this system also faces challenges.

Preventing bot activity, balancing the interests of large and small Spaces, and ensuring the long-term effectiveness of incentives are all practical issues that 9BIT must address.

But at least, 9BIT has proposed a feasible direction that makes community contributions quantifiable, incentivized, and sustainable.

$9BIT Token Economy

Whether the token distribution is reasonable, whether the unlocking is restrained, and whether the value capture is real—these details hide the true intentions of the project team.

9BIT has a total supply of 10 billion tokens, deployed on the Solana chain, using the SPL-20 standard.

Choosing Solana over Ethereum clearly considers transaction costs and speed.

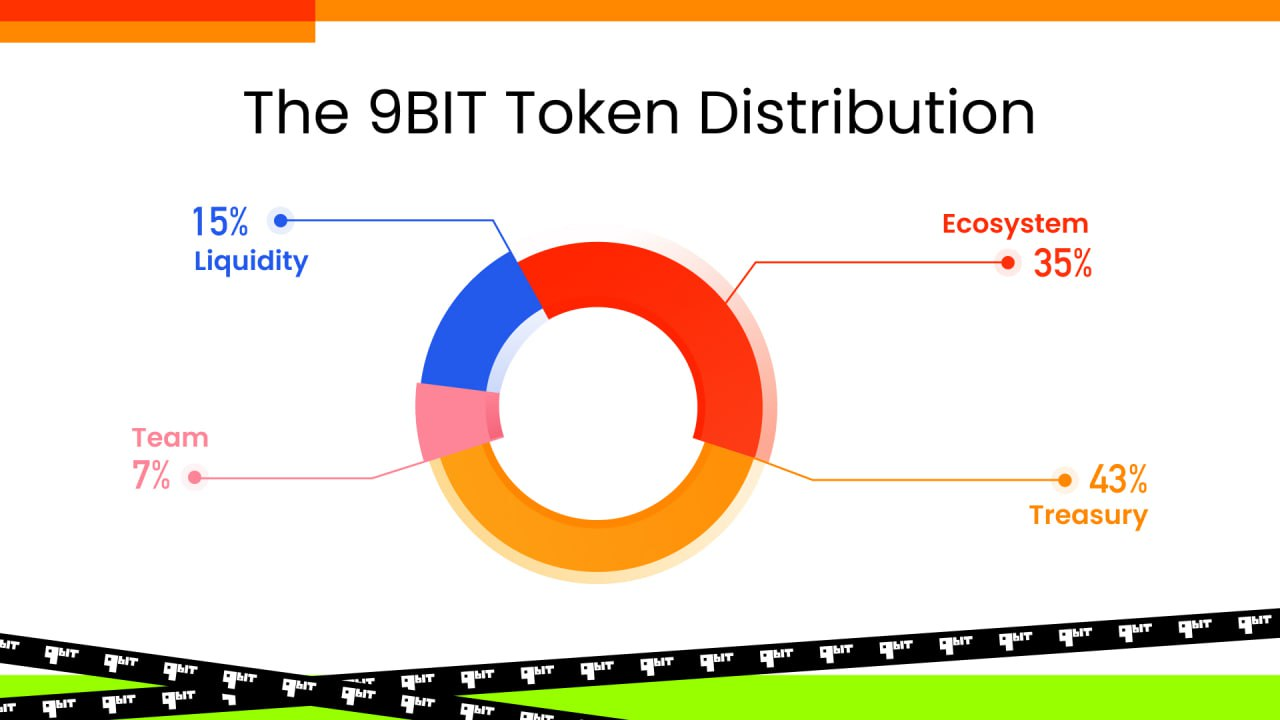

In terms of distribution structure, 35% is allocated for ecological incentives, which is the source of all mining rewards. 43% goes to the treasury, 15% for liquidity, and 7% for the team and advisors.

This distribution has several highlights. First, the portion that the community can obtain, combining the 35% ecological incentives and 15% liquidity, reaches a total of 50%.

In GameFi projects, this ratio is considered generous. Many projects allocate most tokens to VCs and teams, leaving less than 30% for the community.

The 43% allocated to the treasury deserves careful analysis. Of this, 19% belongs to The9, another 19% is distributed to major cryptocurrency investment institutions, and the remaining 5% is reserved for future partner expansions and strategic acquisitions.

The 19% held by The9 is particularly special.

As a NASDAQ-listed company, this portion of tokens will be reflected as assets in financial reports. This means that any large-scale sell-off must be disclosed in advance, subject to SEC and investor oversight. To some extent, this 19% may be the most stable part of the circulating supply.

Although this is not a DAT (decentralized asset treasury) model, it provides a ballast for a Web3 gaming project.

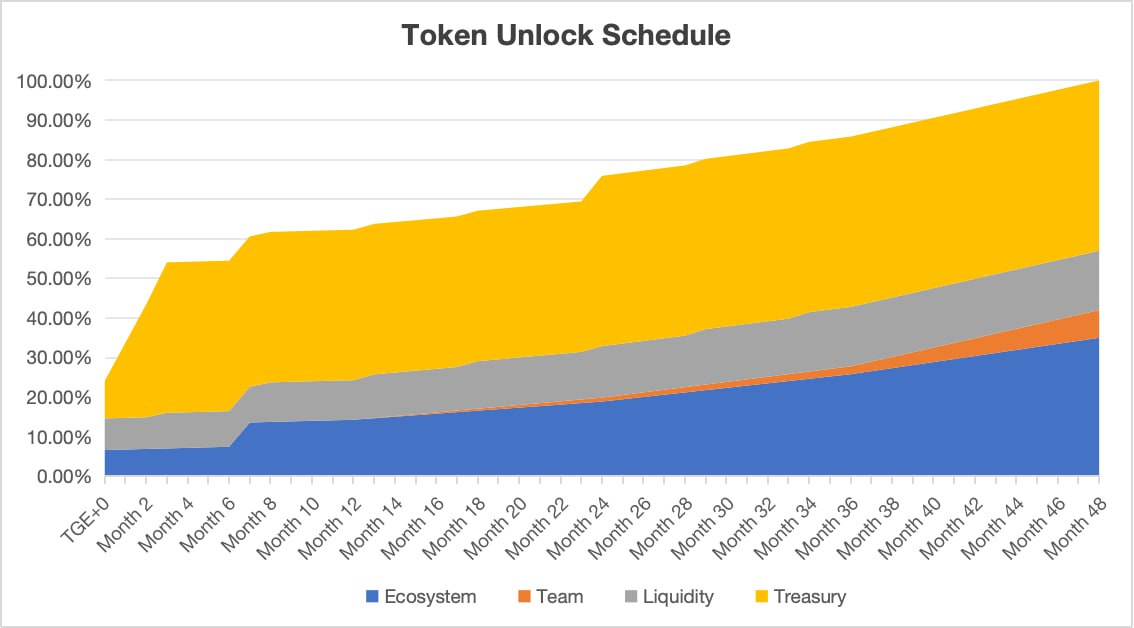

Looking further into the unlocking mechanism, the ecological incentive portion is theoretically released over 4 years, but the daily release amount has an upper limit, making it difficult to reach this limit every day.

This means that the 35% ecological incentive may take 6 to 8 years to be fully released, which appears much healthier than projects that release large amounts of tokens all at once.

Additionally, the tokens for the team and investors have a lock-up period of 12 to 24 months. This is quite restrained in the current market environment.

Many projects have significant unlocks on the day of TGE (Token Generation Event), resulting in peaks at launch followed by a downward trend. At least in this regard, 9BIT has demonstrated a long-term perspective.

Finally, let’s look at the value capture of the tokens.

According to the disclosures in the white paper, the platform promises to use a portion of its annual net profit to repurchase 9BIT tokens.

Note that it is net profit, not revenue. This means that repurchases will only occur when the platform is genuinely profitable.

This is much more substantial than projects that rely on printing money for buybacks. A portion of the repurchased tokens will be burned, directly reducing circulation; another portion will enter the ecological fund for future development. In the long run, this creates a deflationary mechanism.

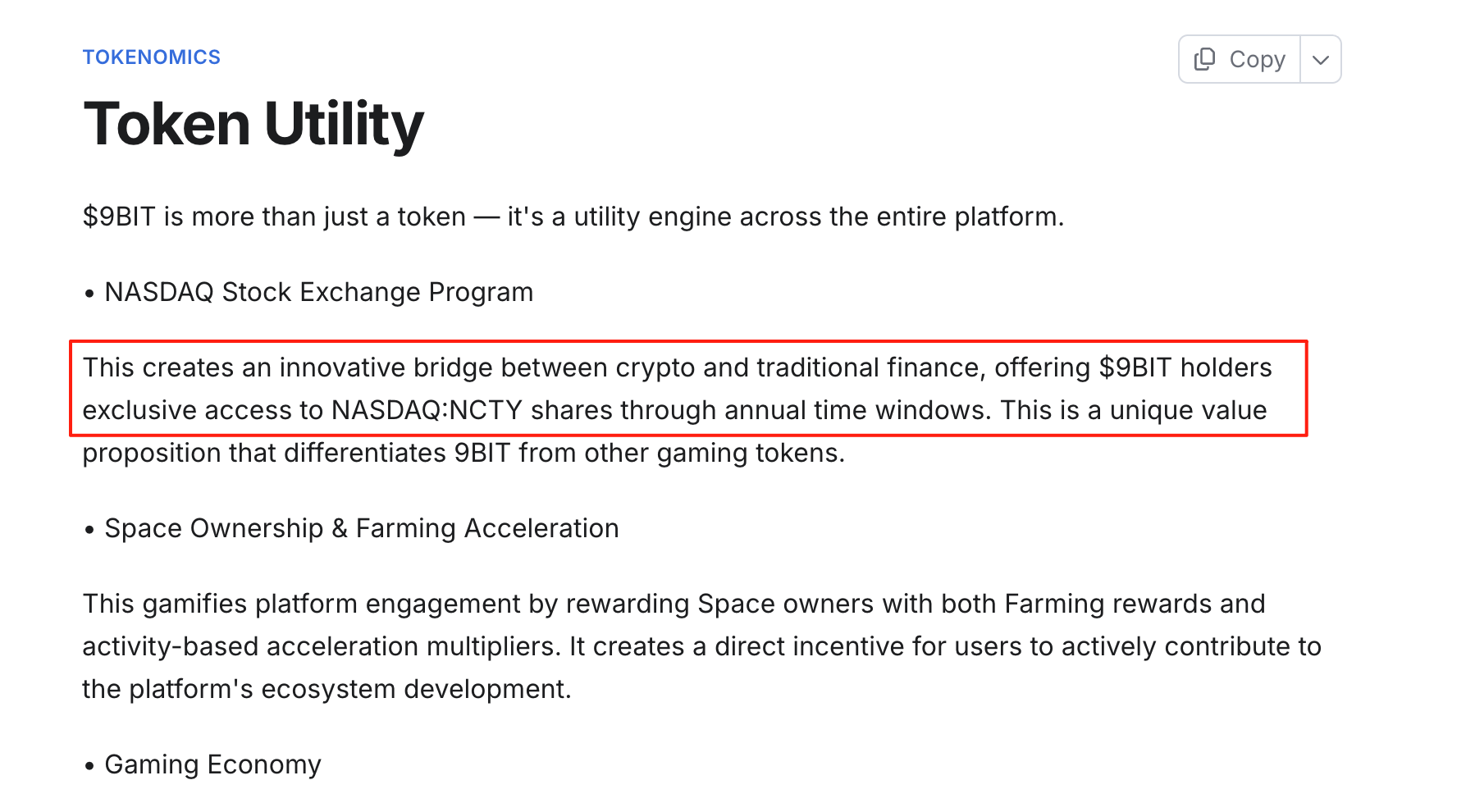

In terms of use cases, 9BIT is not just a governance token that can only be used for voting.

You can use it to purchase games, receive discounts; staking it can increase your Space's mining efficiency; holding a certain amount allows participation in exclusive platform events, and even the opportunity to purchase The9's stock.

At least from a design perspective, 9BIT demonstrates the thinking of a mature team.

There are no extravagant promises, no obvious Ponzi characteristics, but rather a value support based on real business and a relatively reasonable distribution mechanism.

Returning to the Essence of Gaming

After going around in circles, we still need to return to the initial question: who should benefit from the value created by the gaming industry?

Steam has proven, through the most traditional centralized method, that a game distribution platform can become a billion-dollar business.

9BIT does not aim to replace Steam but to add a Web3 distribution mechanism to the model already validated by Steam. Players still play games on familiar platforms, but now every expenditure grants them a share of ownership in the platform.

They seem to be doing traditional business: selling real games, serving real players, and making real money.

In a time when GameFi projects are struggling to survive, this business model based on real operations stands out.

The market environment is indeed full of uncertainties, but this is precisely 9BIT's opportunity. As the entire GameFi sector reflects and adjusts, truly valuable projects are more likely to emerge. The model based on real income gives 9BIT the ability to navigate through cycles.

What is the essence of gaming? It is joy, social interaction, and a sense of achievement. But in the Web3 era, gaming can also be an investment, a right, and an opportunity for collective growth.

What 9BIT aims to do is to make players the true beneficiaries without changing the essence of gaming.

From being an agent for "World of Warcraft" to becoming a pioneer of Web3 gaming platforms, The9 has gone through a full circle in 20 years.

This time, as more and more people realize that the value they create should be rewarded, 9BIT has already prepared a new answer for them.

This is a new chapter for the gaming industry and the beginning of 3 billion players becoming "shareholders."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。