Tesla Q3 Profit Rises $80M from Bitcoin Holdings Amid Revenue Growth

Can a cryptocurrency actually contribute to a company's profits? Tesla apparently believes so. Tesla Q3 profit rose by $80 million thanks to its Bitcoin holdings . This illustrates how digital assets are beginning to have a larger place in corporate finances.

Tesla’s Bitcoin Holdings and Q3 Gain

As of September 30, Elon Musk's company held 11,509 BTC worth $1.315 billion. They were worth $1.235 billion three months before. The company did not sell or purchase additional coins during this period; the profit resulted solely from higher BTC prices.

Firm's $80 million profit was also facilitated by new accounting regulations. The Financial Accounting Standards Board (FASB) now permits companies to value digital assets at fair market value quarterly. Companies used to write down crypto to its lowest level, even if later prices rebounded.

This shift allows Tesla to report Bitcoin gains outright on its income. Nevertheless, the firm's overall adjusted profit per share fell short at $0.50, which was less than the $0.55 that analysts predicted. Conversely, the organisation recorded a revenue record of $28.1 billion, surpassing forecasts of $26.36 billion.

Strong Revenue, But Profits Fell

Despite the Bitcoin profit, Tesla's stock fell some 1.5% in after-hours trading. Investors are focused on the larger picture: overall profits, not only crypto profits.

Tesla's profits declined 37% from last year, due in part to increased costs. Tariffs on auto parts and raw materials tacked on some $400 million in cost. Research and development spending particularly in artificial intelligence and robotics also weighed on profits.

Vehicle Sales and Market Challenges

The majority of Tesla's sales came from vehicle sales. In the United States, customers flocked to take advantage of a federal tax credit of as much as $7,500 before it ended. Tesla also introduced a six-seat Model Y, which sold well in China, and sold incentives such as five-year interest-free loans and insurance rebates.

Nevertheless, Tesla is competing fiercely with BYD, Ford, and Hyundai. Car sales might be the future of AI and robotics, but currently, they are Tesla's primary moneymaker.

Bitcoin as Corporate Treasury Asset

Tesla's steady BTC holdings and $80 million gain from it, indicate a larger trend: increasingly, companies are viewing Bitcoin as an asset to be held in the corporate treasury .

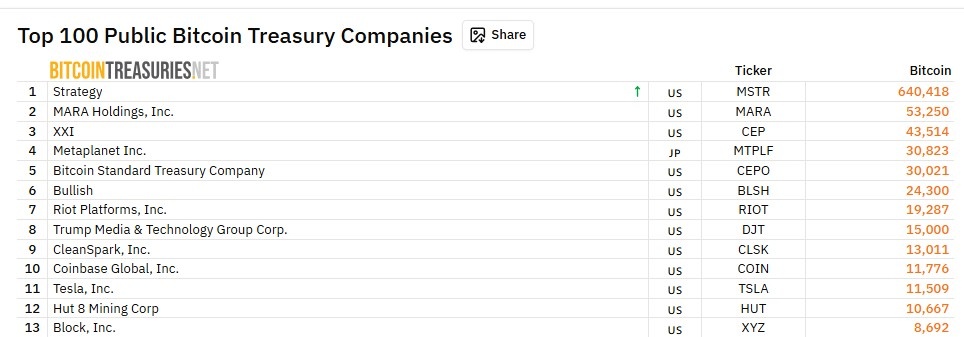

Source: BitcoinTreasuriesNet

Tesla is one of the top public companies holding Bitcoin , with 11,509 BTC in its treasury.

By August 2025, companies collectively held 951,000 BTC, worth over $100 billion. Other big names include MicroStrategy, now called Strategy Inc., which holds 640,418 BTC. This shows that more companies are seeing this digital asset as a way to strengthen their finances.

Regulations such as FASB's fair-value reporting simplify the inclusion of BTC in the balance sheet.

Experts state that Tesla's profit from this crypto indicates that crypto is becoming a normal part of business funding. It may inspire more firms to look towards digital assets for the long run.

Conclusion

Tesla's Q3 profit demonstrates how this digital asset can be used to drive earnings, even when conventional profits are struggling. While auto sales remain the center of the company, crypto provides a new means by which Tesla can increase its financial strength and may prompt others to do the same.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。