A person who always talks about failure ultimately secured nearly $400 million in investment.

Written by: David, Deep Tide TechFlow

On October 21, 2025, Coinbase announced the acquisition of the on-chain investment platform Echo for $375 million.

Just a day earlier, Coinbase had spent $25 million to buy an NFT, solely to revive a podcast segment. Two days, two transactions, totaling $400 million, all pointing to the same person:

Jordan "Cobie" Fish.

Who is Cobie?

If you follow the English-speaking crypto community, there are too many labels behind this name. 800,000 Twitter followers, founder of Echo, host of the UpOnly crypto podcast, co-founder of Lido Finance… he is also the whistleblower who exposed insider trading at Coinbase with a single tweet.

In the crypto world, he is one of the few OGs who have survived from 2012 to the present and remain active at the forefront of the market.

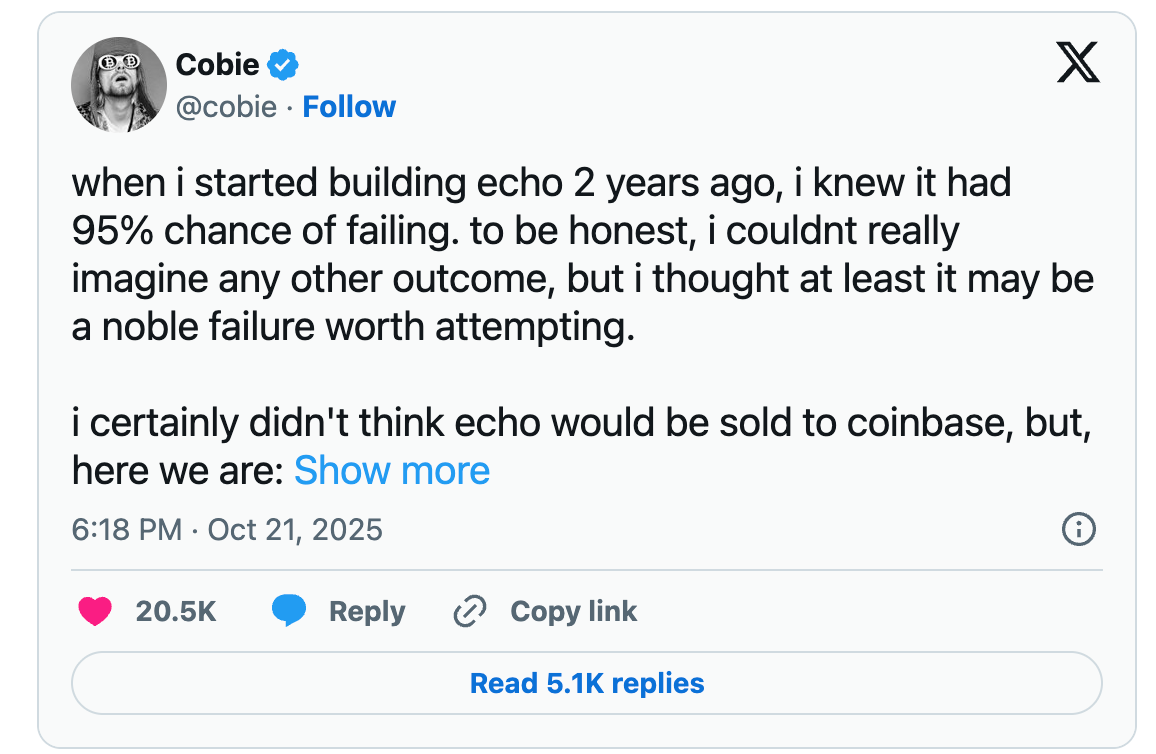

After the acquisition news was announced, Cobie wrote on X: “I really didn’t expect Echo to be sold to Coinbase.”

This sounds like a platitude, but those who frequently follow his social media know that this might be a genuine sentiment. Because when he founded Echo two years ago, he also said:

“I think there’s a 95% chance it will fail.”

A person who always talks about failure ultimately secured nearly $400 million in investment. As a frequent investor in various crypto projects, Cobie doesn’t seem to lack money.

But the story didn’t start this way.

Like every crypto player with dreams of wealth, according to his own account, in 2012, when he first entered the space as a student, he bought some Bitcoin for $200.

From an unknown student to a crypto OG, Cobie’s journey is almost a microcosm of the 13-year history of the crypto industry: early idealism, the madness of ICOs, the rise of DeFi, the collapse of FTX… he was present for it all.

The key is, he wasn’t just present; he survived through the ups and downs to this day.

In an industry where everyone yearns for quick wealth, surviving for a long time is a kind of luck that most people cannot attain, and an adherence that is extremely difficult to maintain.

Entering the space with $200, developing a zero-value celebrity coin (2012-2014)

In 2012, Jordan Fish was studying at the University of Bristol in the UK.

As a computer science major, he bought his first batch of Bitcoin for less than $10 each. According to his later account on Twitter, he entered the crypto industry with only $200 in capital.

At $10 each, that was roughly equivalent to 20 Bitcoins at the time. He also gave himself a nickname: CryptoCobain, which he later changed to Cobie.

In 2013, Bitcoin rose from $13 to $1,000. In January of that year, Cobie found a job at a UK startup called CYOA, where he served as the technical director.

Until a chance opportunity arose, Cobie developed a “celebrity coin,” which changed the trajectory of his career.

In 2011-2012, there was almost no coverage of Bitcoin in mainstream Western media. The "Keiser Report" was one of the few media programs that continuously discussed cryptocurrencies in its early years, playing an important role in shaping the early community's understanding.

The host of this program was Max Keiser, who later became an advisor on Bitcoin to the President of El Salvador.

Keiser had accurately predicted that Bitcoin would rise above $1,000, and his exaggerated performance style, such as tearing up dollar bills on the show, made him a “mad evangelist” in the crypto world.

At that time, Keiser jokingly tweeted that if a coin called Max Keiser could reach a market cap of $1 billion, he would appear naked on the show.

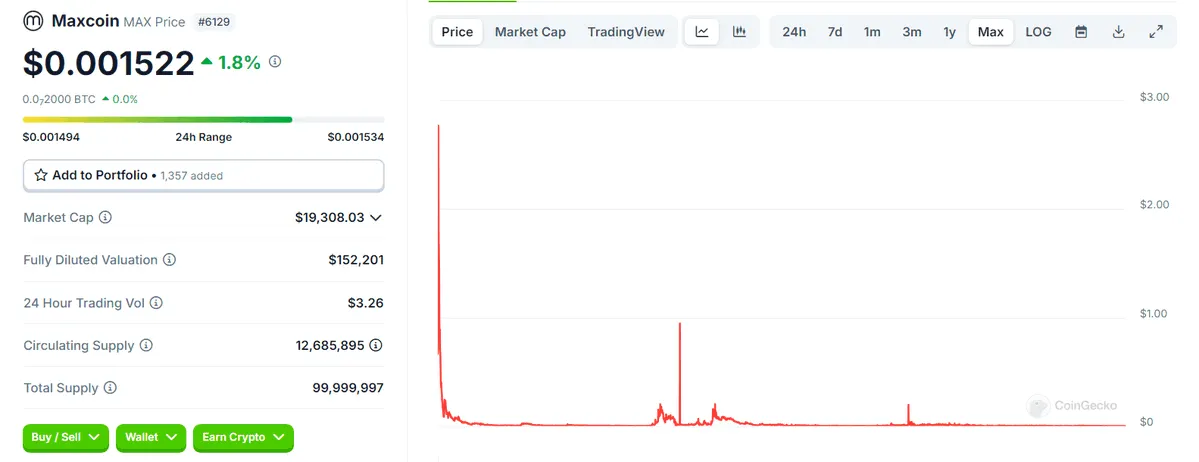

Cobie and another partner, Luke Mitchell, took him seriously and created a coin called MAX (Maxcoin), forking it from Bitcoin at the time. This might be the first celebrity coin to appear on television, predating the current wave of presidential and celebrity coins by more than a decade.

On January 28, 2014, the 555th episode of the Keiser Report was titled "Launch of Maxcoin." Keiser mined the genesis block of MAX in front of a global audience.

On February 14, Valentine’s Day, Maxcoin rose to $3.11, with a market cap of $8.5 million. Cobie and Luke were invited onto Keiser’s show to discuss technical details.

Then reality hit. Aside from Keiser promoting it on the show, Maxcoin had no actual use. No merchants accepted it, and there were no application scenarios. Worse still, in February 2014, Mt. Gox went bankrupt, and the entire crypto market collapsed.

By December 31, 2014, Maxcoin closed at $0.00666, a drop of 99.8%. The code stopped updating, and even Keiser himself no longer mentioned the coin.

Cobie continued to work at the tech company in the UK until April 2015. As a developer, he stated on Twitter that he had never held Maxcoin.

At this point, Bitcoin had fallen from $1,000 to $200, and most people who entered the market in 2013 may have left the crypto space forever, but Cobie chose to stay in a different way.

Growing in Web2, becoming a KOL on Twitter (2015-2020)

In April 2015, Cobie left his position as technical director at CYOA and joined a programming education startup called Enki as the head of growth.

At this time, the crypto market was dead silent. Bitcoin was trading between $200 and $400, and most altcoins were either worthless or close to worthless. Maxcoin had been completely forgotten.

Cobie could have, like most people, treated the previous few years of coin issuance as a youthful adventure and returned to a normal life. In fact, on the surface, it seemed he did just that.

In August 2017, he jumped to Monzo, then the hottest fintech unicorn in the UK. This digital bank was promoting a purely mobile banking experience, attempting to disrupt traditional banking.

That summer, Bitcoin had just broken through $2,000, and the ICO boom was brewing; by December 2017, Bitcoin would rise to nearly $20,000, and the entire crypto world would go crazy.

But Cobie was still in the Monzo office.

Outside the office, from 2017 to 2020, the crypto market experienced a complete bull-bear cycle. The madness at the end of 2017, the crash of 2018, the stagnation of 2019, and the COVID crash in March 2020.

During these three years, public reports indicated that he “earned enough money while working at Monzo to fully commit to cryptocurrency.”

At the same time, he never stopped speaking on Twitter, commenting on Bitcoin prices, mocking ICO projects, analyzing DeFi protocols… He became a fixture in Crypto Twitter, a voice that was always online and always had an opinion.

By March 2020, in an interview, he revealed his asset allocation: only 5% in cryptocurrencies, 95% in cash and other traditional assets.

This figure surprised many; as a well-known KOL in the crypto space, he hardly held any cryptocurrencies.

This perhaps explains why he was able to stay at Monzo for three years. He didn’t need to rely on trading coins for a living; he had a stable income and career development.

In the summer of 2020, everything changed. DeFi exploded. Compound issued the COMP token, initiating liquidity mining. Uniswap airdropped UNI, making early users overnight millionaires. Suddenly, those who had persisted until now found that new opportunities had arrived.

In September 2020, Cobie left Monzo. He had been lurking in traditional tech companies for over five years.

However, this time, he was no longer just a rookie programmer; his work in product and growth positions provided both income and experience, and, more importantly, knowledge of the financial industry.

The developer of the once worthless Maxcoin was about to become one of the most successful early investors of the DeFi era.

Betting on Lido, starting a podcast (2020-2022)

In October 2020, just a month after returning full-time to the crypto space, Cobie made a life-changing investment.

At that time, two Russian programmers were developing a project called Lido, which provided a solution for liquid staking: users could stake any amount of ETH and receive stETH as a certificate, which could be freely traded.

Most people might not have understood the utility of this. But Cobie clearly did. He not only invested but also helped the project find audits, wrote tweets, and introduced it to other investors. He became one of Lido's earliest and most active supporters.

By the end of 2021, Lido had become the largest staking service provider on Ethereum. By 2024, Lido managed assets exceeding $30 billion, and the market cap of the LDO token surpassed $2 billion.

Cobie's early investment yielded over 1,000 times returns. According to multiple overseas media reports, this single investment earned him “millions of dollars.”

But what truly transformed Cobie from a Twitter KOL into an influential figure in the industry was a podcast.

In April 2021, Cobie co-founded the UpOnly podcast with another crypto KOL, Ledger.

The timing was also clever. It was the peak of the bull market, and everyone wanted to learn about cryptocurrencies, but most podcasts were either too technical or too superficial. UpOnly found a balance:

Discussing deep topics in a relaxed manner.

Industry giants like Vitalik, Michael Saylor, Do Kwon, SBF, and CZ have all appeared on his podcast. These individuals are willing to chat with the two hosts for an hour or two.

Cobie and Ledger don’t hold back on the show; they ask silly questions, make jokes, and admit when they don’t understand something. This relaxed atmosphere allows those who are used to serious interviews to open up and share things they wouldn’t say in other settings.

At the same time, the podcast's business model is quite interesting. They issued NFTs (UpOnly NFTs), which serve as membership cards, allowing holders to participate in recordings, ask questions, and access exclusive content.

These NFTs later exceeded a price of 10 ETH on the secondary market. A few days ago, Coinbase spent $25 million to acquire this NFT series.

It’s worth mentioning that the most ironic sponsor of UpOnly was actually FTX. SBF’s exchange sponsored UpOnly for a long time until it suddenly collapsed in November 2022.

On the day of the collapse, Cobie was live-streaming, tracking $400 million in suspicious fund flows in real-time. He was watching on-chain data while explaining what was happening. This live stream later became an important record of the FTX collapse.

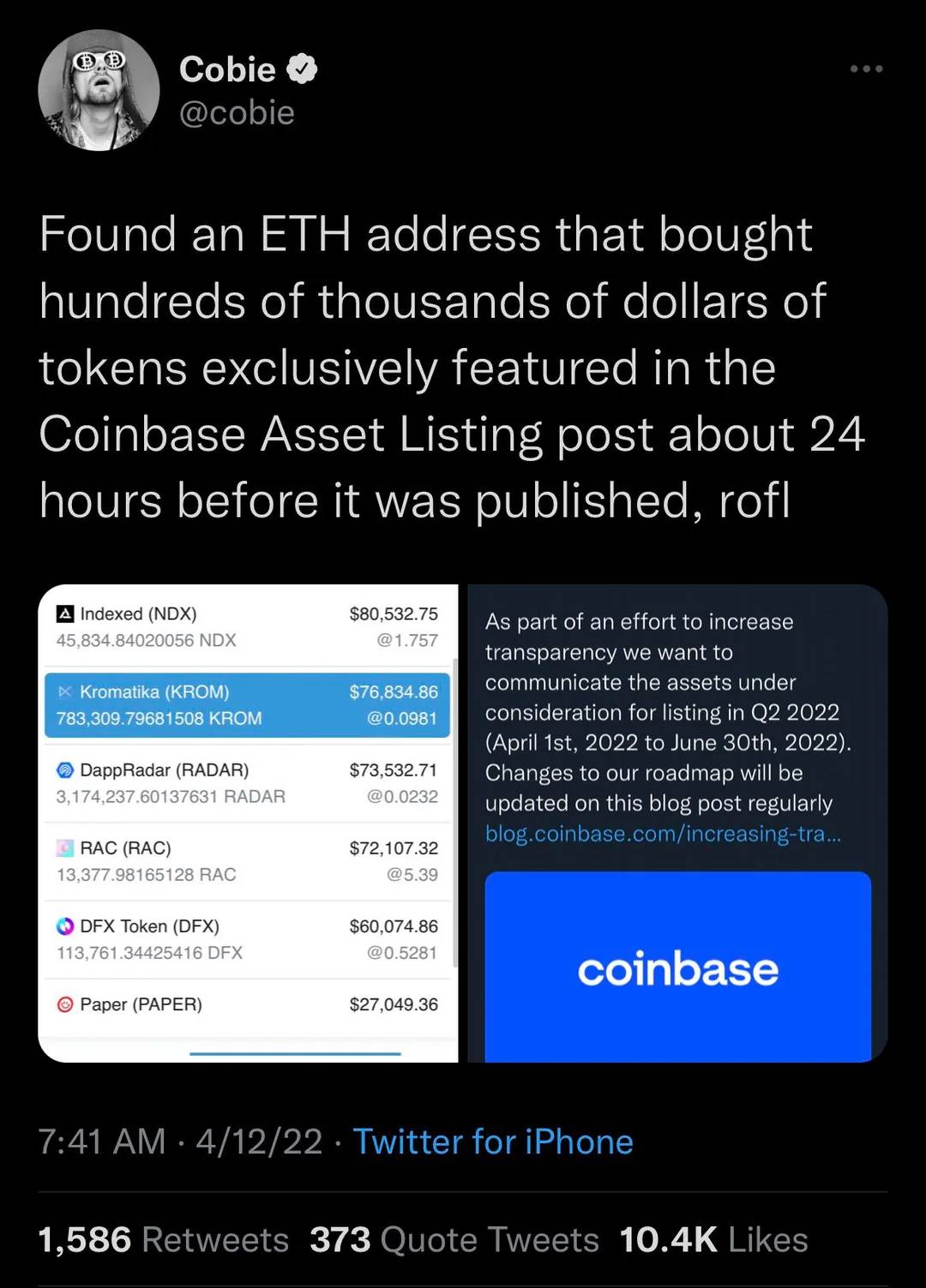

Another ironic event was that Cobie became the whistleblower for insider trading at Coinbase.

In December 2022, Cobie tweeted about a wallet address that had been buying related tokens in large quantities before they were listed on Coinbase. This wasn’t a coincidence happening once or twice; it was a continuous pattern.

Within hours, this tweet was shared tens of thousands of times. Media outlets began reporting on it. Regulatory agencies intervened to investigate.

Ultimately, the U.S. Department of Justice charged former Coinbase product manager Ishan Wahi, marking the first insider trading case in cryptocurrency history.

Coinbase had to publicly respond and improve its listing process. The entire industry began discussing transparency issues. And Cobie, the developer of a once worthless celebrity coin, had now become a supervisor of the industry.

By the end of 2022, his influence peaked. He now has over 800,000 Twitter followers, making him one of the most influential voices in the English-speaking crypto community; UpOnly is also one of the most popular crypto podcasts.

More importantly, he has established a unique persona:

He is both an insider with early player status, a technical background, and a successful investment history, while also mocking hype and exposing dark corners, maintaining a sense of distance. In his own words:

“I’m still a cynic (Cobain), just now I have money.”

But Cobie himself may also know that the lifecycle of a KOL is short, and podcasts can go out of style. He needs to build something more lasting.

Echo, possibly the last startup (2023-2025)

At the beginning of 2023, the crypto market was still at the bottom of a bear market. The aftershocks of FTX’s bankruptcy were still felt, and Cobie posted a meaningful tweet on Twitter:

“The best time to build is when everyone feels hopeless.”

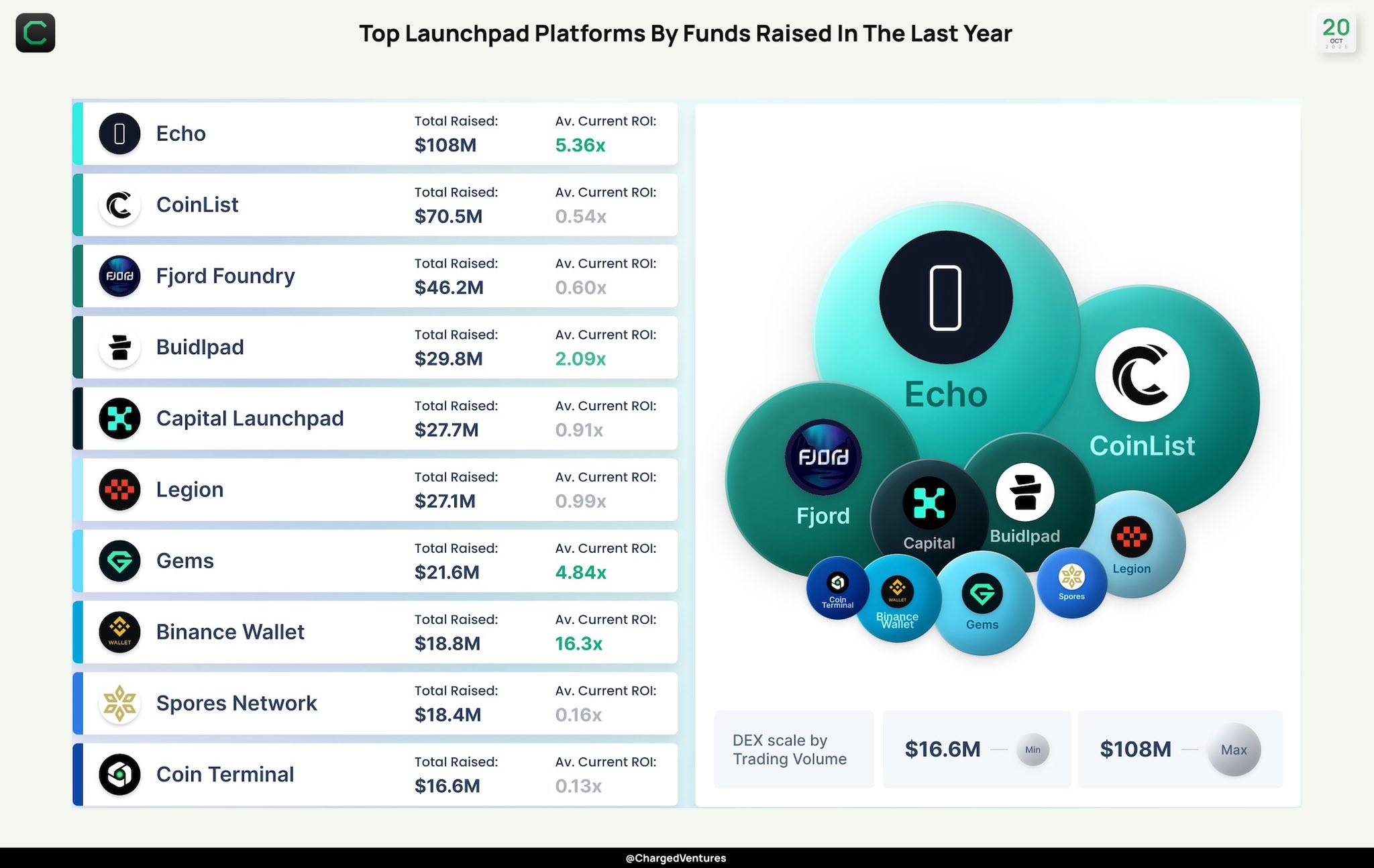

A few months later, Echo quietly launched.

Unlike the high-profile launch of the celebrity coin Maxcoin in earlier years, Echo had no press conference, no white paper, and not even a formal announcement. It was just a simple website with a simpler function: helping projects raise funds from early investors.

Specifically, Echo does two things.

First, it allows crypto projects to sell tokens to qualified investors through private placements. Second, it enables ordinary users to participate in certain public sales through a tool called Sonar. The entire process is conducted on-chain, non-custodial, and transparent.

Initially, it hardly resembled a product. The interface and functionality were basic; it was merely a tool for project teams and investors to sign SAFT (Simple Agreement for Future Tokens). But the first project soon arrived: Ethena.

Why did Ethena choose a newly launched, unknown platform? The answer is simple: because of Cobie.

Guy Young, the founder of Ethena, is a regular guest on the UpOnly podcast and has a good personal relationship with Cobie. More importantly, Cobie didn’t just provide the platform; he also invested in Ethena and publicly supported it on Twitter. For a new project, Cobie’s endorsement is invaluable.

Ethena completed its seed round financing through Echo. A few months later, when Ethena became one of the hottest DeFi protocols of 2024, Echo’s credibility was instantly established.

Subsequently, major projects like MegaETH, Initia, and Plasma began raising funds on Echo; by mid-2024, Echo’s operational model had matured. A typical process looks like this:

The project team approaches Echo, the Echo team conducts basic due diligence, the project team sets financing terms, and tokens are issued through Echo’s smart contracts.

Investors (both institutional and individual) invest through the platform, with funds and tokens transparently circulating on-chain.

The key is that Echo itself does not hold funds, does not provide investment advice, and merely offers tools and connections.

Cobie’s role goes far beyond being the founder of this financing platform. He is actually Echo’s biggest business developer (BD). Every time he interviews a founder on the podcast, it could turn into a potential client for Echo. Every time he comments on a project on Twitter, he is indirectly advertising for Echo.

He doesn’t even need to actively promote. When you are one of the most influential voices in the crypto space, people naturally come to you. By the time of its acquisition in October 2025, Echo had processed over $200 million in transactions, involving about 300 investments.

In a sense, Coinbase acquired not just the Echo platform, but the entire ecosystem that Cobie built. This also explains why Coinbase was willing to pay $375 million; they were buying the key to enter this network.

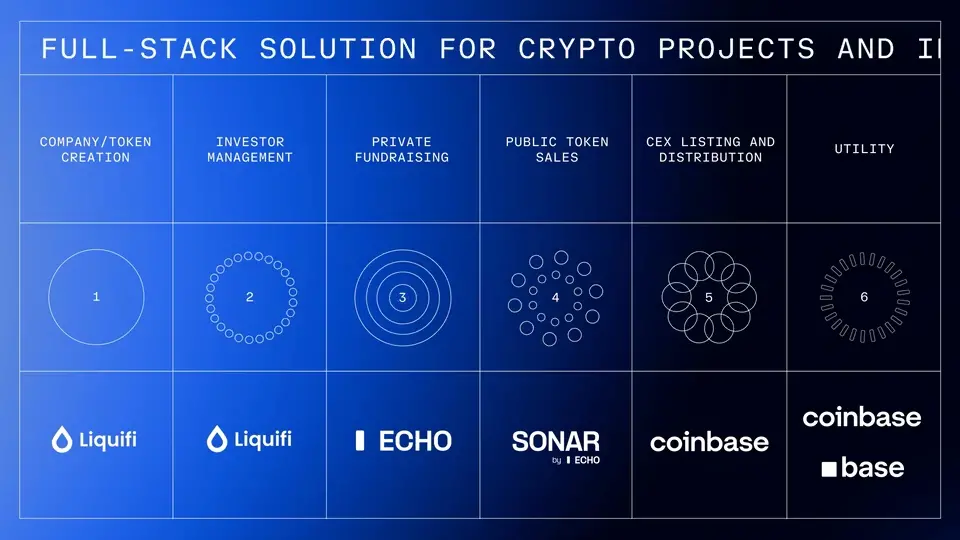

The transaction structure indicates that this was not an all-cash acquisition; it included Coinbase stock, meaning Cobie is now also a shareholder of Coinbase. The Echo team will join Coinbase, but the brand will temporarily remain independently operated. The Sonar tool will be integrated into Coinbase’s product system.

From Coinbase’s perspective, the logic behind this acquisition is very clear.

In July 2025, they had just acquired the token management platform LiquiFi. Now they have acquired Echo. LiquiFi manages post-token issuance affairs, Echo handles the financing phase, and combined with Coinbase’s own exchange business, this forms a complete chain from the primary market to the secondary market.

After the acquisition news was announced, the community's reaction was interesting.

Some said Cobie sold too early, and Echo could have become an independent unicorn. Others said this proves the feasibility of KOL entrepreneurship. Some even dug up old posts from 2014, comparing the collapse of Maxcoin with Echo’s exit, reflecting on the saying “a sword is sharpened over ten years,” suggesting that you always have a chance at the table.

And Cobie himself seems to have not stopped to rest. He immediately announced that he would join Paradigm as an advisor, “focusing on liquid markets, trading, and DeFi trends.”

The last OG

In the crypto world, 13 years is an incredibly long time.

Most early participants from 2012 have either retired or disappeared after some cycle collapsed. Exchanges have changed several generations, public chains have changed several generations, and even the definition of decentralization has changed multiple times.

But Cobie is still here.

He has witnessed every cycle, participated in every bubble, and survived every collapse.

He is not the one who made the most money, certainly not the most famous, and not even the most successful entrepreneur in the crypto space; but he might be the most complete crypto practitioner:

He has traded coins, lost money; started businesses, failed; invested, succeeded; been a KOL, influenced the market, built products, and completed exits.

From Jordan Fish to CryptoCobain, from a college student who bought $10 worth of Bitcoin to an entrepreneur acquired by Coinbase, this story took a long 13 years.

What has allowed him to survive until now? In his own words, perhaps it is knowing the difference between luck and skill, and having the ability to navigate between the two:

“I was very lucky early on, making some good altcoin trades that kept me in profit. I thought I was really good at this thing called cryptocurrency trading.

But anyone who starts out thinking they are really good is wrong. If you are fortunate enough to join a* bull market* and successfully trade altcoins, that doesn’t mean you are good at it.”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。