Organized by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Inflow of $446 Million

Last week, the U.S. Bitcoin spot ETFs saw a net inflow over three days, totaling $446 million.

Nine ETFs were in a net inflow state last week, with inflows mainly from IBIT, ARKB, and FBTC, which saw inflows of $324 million, $54 million, and $52.3 million, respectively.

Data Source: Farside Investors

U.S. Ethereum Spot ETF Net Outflow of $243 Million

Last week, the U.S. Ethereum spot ETFs experienced a net outflow over four days, totaling $243 million.

The outflow was mainly from BlackRock's ETHA, with a net outflow of $95.2 million. Six Ethereum spot ETFs were in a net outflow state.

Data Source: Farside Investors

Overview of Crypto ETF Dynamics Last Week

Caixin: Hong Kong's First Solana Spot ETF Does Not Include Staking

According to Caixin, the Hong Kong Securities and Futures Commission has approved the "Huaxia Solana ETF" for listing on the Hong Kong Stock Exchange. Although Hong Kong's regulations allow virtual currency spot ETFs to offer staking services, the issuance of the Huaxia Solana ETF does not include staking. Industry insiders suggest this may be due to concerns following a suspected hacking incident involving a staking service provider, Klin, which led to a theft event at the Switzerland-based cryptocurrency platform SwissBorg, prompting Hong Kong regulators to believe that the staking function requires more cautious evaluation.

155 Crypto ETF Applications Awaiting Approval in the U.S., Led by Bitcoin and Solana

According to Bloomberg, there are currently 155 applications for cryptocurrency-based exchange-traded products (ETPs) in the U.S., covering 35 digital assets, with Bitcoin and Solana each having 23 applications, XRP with 20, and ETH with 16.

Despite the U.S. government shutdown delaying the approval process, industry experts remain optimistic that approvals are forthcoming. Recently, issuers have actively submitted applications for 2x and 3x leveraged ETFs and products that include staking mechanisms, reflecting a "land grab" mentality in the market for crypto ETFs. Analysts point out that investors prefer to diversify their investments in emerging digital assets through index and actively managed ETFs rather than single tokens. Since the launch of spot Bitcoin and Ethereum ETFs in January and July 2024, the BTC ETF has managed nearly $150 billion in assets, while the ETH ETF has about $24 billion.

U.S. Asset Management Firm T. Rowe Submits Cryptocurrency ETF Application

U.S. asset management firm T. Rowe has submitted an application for a cryptocurrency ETF.

The ETF is named "T. ROWE PRICE ACTIVE CRYPTO ETF," aiming to outperform the FTSE U.S. Listed Cryptocurrency Index, which consists of the top 10 cryptocurrencies by market capitalization that meet the U.S. Securities and Exchange Commission (SEC) general listing standards.

Hong Kong's First Solana Exchange-Traded Fund "Huaxia Solana ETF" Approved

According to the Hong Kong Economic Journal, the Hong Kong Securities and Futures Commission has officially approved the first Solana (SOL) spot ETF, issued by Huaxia Fund (Hong Kong), making it the third approved cryptocurrency spot ETF after Bitcoin and Ethereum, and the first of its kind in Asia.

The ETF (code: 03460) is expected to be listed on the Hong Kong Stock Exchange on October 27, with a Renminbi counter (83460) and a U.S. dollar counter (9460). The trading unit is 100 units, with a minimum investment amount of approximately $100. Its virtual asset trading platform is OSL Exchange, with a management fee rate of 0.99% and an annual recurring expense ratio of about 1.99%.

Standard Chartered Hong Kong to Launch Virtual Asset ETF Trading Services in November

According to local media Ming Pao, Standard Chartered Hong Kong recently conducted a survey under the Hong Kong Monetary Authority's "Digital Hong Kong Dollar+" project, finding that three-quarters of high-end clients are interested in digital assets, and nearly 80% of respondents intend to participate in digital asset investment activities in the next 12 months.

Standard Chartered Hong Kong's Head of Wealth Solutions, Ho Man Chun, stated that the bank will launch virtual asset ETF trading services in November, allowing clients to participate in related emerging investments through the Standard Chartered platform, providing more diversified asset allocation and financial options.

VanEck Submits Application for Lido Staked Ethereum ETF

According to official news, ETF issuer VanEck has submitted an S-1 registration application for the "VanEck Lido Staked ETH ETF" to the U.S. Securities and Exchange Commission (SEC). This fund aims to allow investors to earn Ethereum staking rewards through Lido protocol-staked ETH tokens (stETH).

Kean Gilbert, Head of Institutional Relations at the Lido Ecosystem Foundation, stated, "This application marks the growing recognition of liquid staking as a core component of Ethereum infrastructure. The stETH of the Lido protocol demonstrates that decentralization and institutional standards can coexist, laying the foundation for broader market development."

The ETF will hold stETH, benefiting from its fully audited smart contracts, deep secondary market liquidity, and integration with leading custodians and exchanges. If approved, this ETF will provide institutional investors with a compliant and tax-efficient way to participate in Ethereum staking within a regulated investment framework.

Osprey Submits S-1 Application for Solana Spot ETF to the U.S. SEC

21Shares Has Submitted a New INJ ETF Application

Views and Analysis on Crypto ETFs

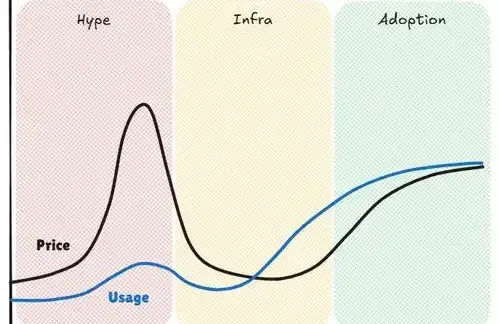

Glassnode released data on social media indicating that the net outflow of funds from spot Bitcoin ETFs often occurs near local market lows, accompanied by a decline in market sentiment. When fund flows stabilize or turn positive, historical patterns suggest that this typically indicates the early stages of demand recovery and trend reversal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。