Written by: KarenZ, Foresight News

In the rapidly changing competition of the cryptocurrency market, a remarkable reversal has just occurred within the x402 ecosystem.

Last week, PING, which was regarded as the "star token" of the x402 protocol, has seen its market cap advantage surpassed by the payment infrastructure of the x402 protocol. According to the latest data, PayAI's market cap broke $50 million this morning, increasing more than tenfold in just four days. Meanwhile, PING has experienced a pullback after an initial surge, currently sitting at a market cap of $34 million.

This is not just a competition between two projects, but a critical moment for the entire x402 ecosystem and even the decentralized payment infrastructure sector, transitioning from speculation to practicality.

PING's Highlights and Predicament

PING, as the first token issued on Base through the x402 protocol, experienced its "highlight moment" last week, surging over 20 times in just two days from October 23 to 24, with its market cap briefly exceeding $80 million.

This exponential growth attracted a large number of industry investors and brought unprecedented market attention to the x402 protocol itself, successfully opening a traffic gateway for this emerging track.

However, the lack of value support makes such enthusiasm difficult to sustain. Essentially, PING is a pure Memecoin, lacking practical application utility and real usage scenarios, and is even compared by some community users to "inscription" type assets—its rise is more dependent on market speculation rather than being driven by value creation, representing a typical frenzy of traffic dividends rather than long-term growth based on value.

PayAI Breakthrough: The "Pragmatic" of x402 Infrastructure

In stark contrast to PING's speculative nature, PayAI has broken through as an x402 protocol Facilitator, achieving a clear infrastructure positioning and practical value, becoming a core target for the shift in ecosystem value.

What is an x402 Facilitator? x402 Facilitators are service providers that support processing x402 payments on Solana and EVM networks, providing unified endpoint access to validate and settle payments on the HTTP resource chain under the x402 protocol.

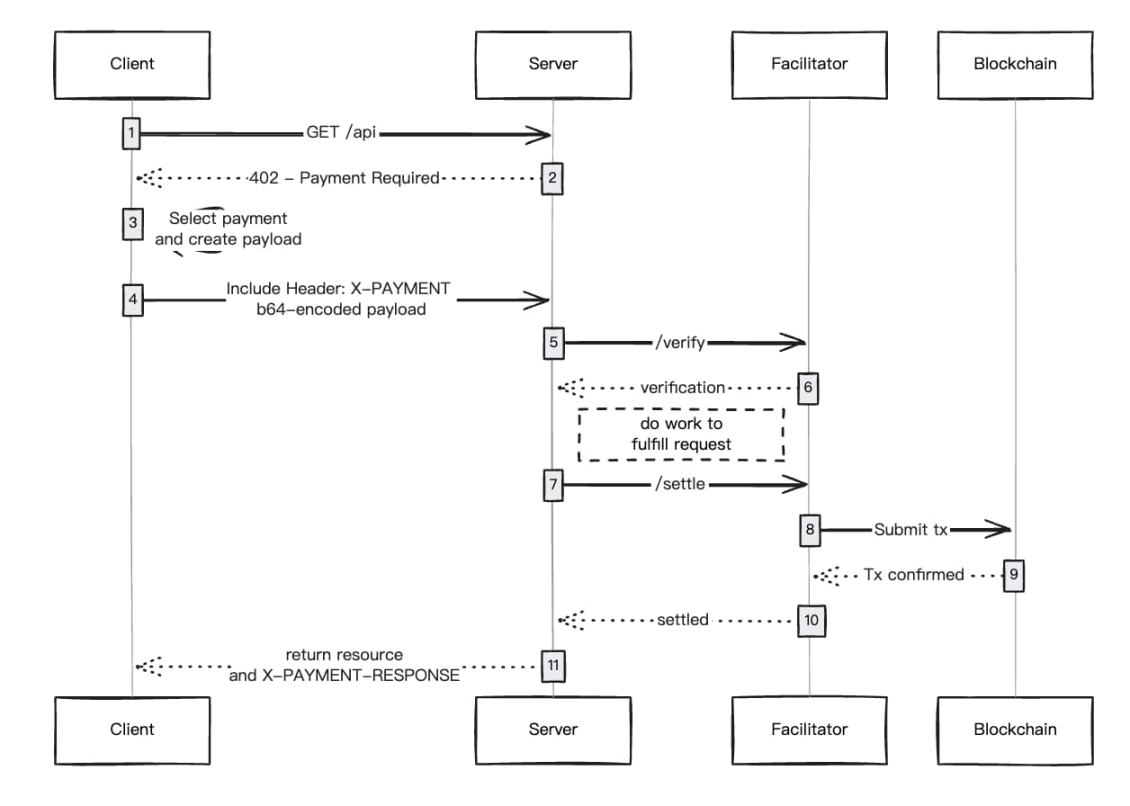

These Facilitators form the core infrastructure layer of the x402 payment ecosystem, responsible for validating and settling on-chain payments for HTTP resources using the x402 protocol:

- Supporting different blockchain networks (such as Solana, Base, etc.).

- Facilitators bear network fees and handle validation/settlement.

- No API keys required. Plug and play.

- Designed for human and agent use cases, from pay-per-use APIs to AI agents, payments can be settled within one second after blockchain confirmation.

From the perspective of the x402 payment process logic, the client calls the protected resource and constructs the payment payload; the Resource Server publishes payment requirements, validates/settles the payment, and fulfills the request; the Facilitator server validates the payment payload and executes the settlement through standard endpoints; finally, the blockchain network executes and confirms the payment.

Eating into Coinbase's Share, Becoming the Second Largest Facilitator in the x402 Ecosystem

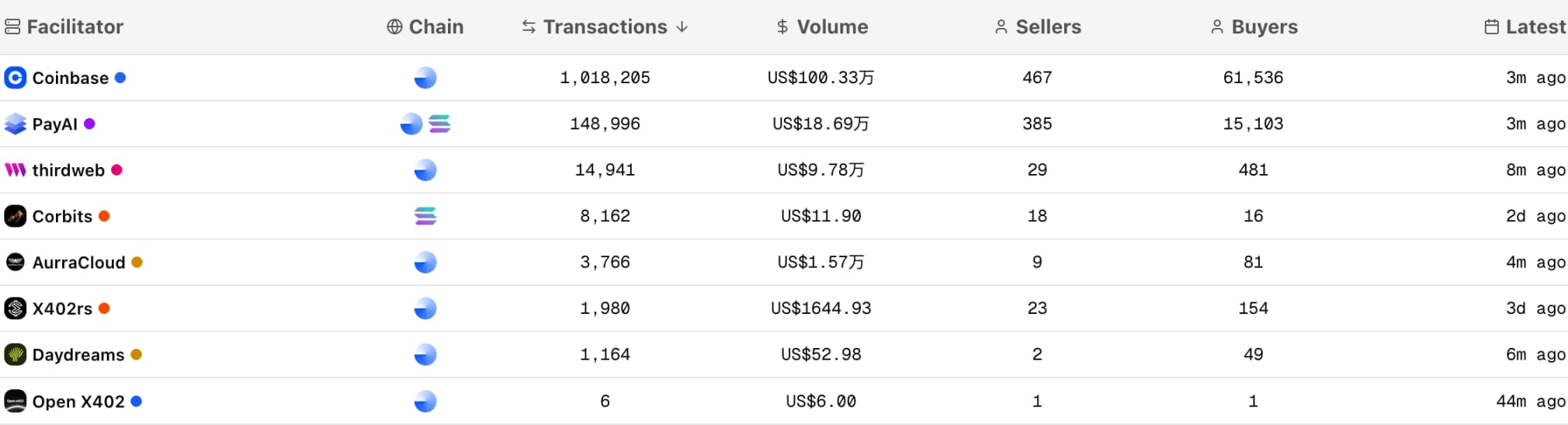

This role has made Facilitators the most valuable participants in the x402 ecosystem. Among these x402 Facilitators, PayAI is gradually eating into Coinbase's dominant position. According to x402scan data, PayAI has processed over 14% of x402 transaction volume, becoming the largest Facilitator aside from Coinbase. In contrast, Coinbase's market share has declined from an early absolute dominance to about 77%.

Chart source: x402scan

From the perspective of ecosystem participants, the number of PayAI sellers has reached over 82% of Coinbase, with the gap continuing to narrow.

In the x402 ecosystem, sellers provide API or content monetization services, and the x402 protocol offers them a solution for "frictionless microtransaction monetization"—allowing them to earn revenue directly from customers without mandatory subscriptions or advertising.

The scale of sellers directly determines the market potential of the x402 ecosystem: more quality sellers mean buyers have richer choices, which will attract more traffic, forming a positive cycle of "more sellers → influx of buyers → ecosystem prosperity," and PayAI's rapid penetration on the seller side is laying a solid foundation for its ecosystem position.

PayAI Token Economics and Utility

In terms of PayAI token economics, the total supply of tokens is 1 billion, with all tokens circulating at launch.

The PayAI team will purchase 20% of the token supply at the time of token release and transfer it to the project treasury. These funds will be used for operations, marketing, and future token releases, such as community rewards and partnerships. Specifically, half of the treasury tokens will provide liquidity to generate fees, while the other half will vest linearly over one year.

So what utility does the PAYAI token have? According to official documentation, the expected uses of PAYAI include:

- Reducing platform fees when executing service contracts between AI agents.

- Increasing visibility for buyer or seller agent listings.

- Participating in future platform governance (e.g., voting on feature proposals, agent ratings).

- Paying arbitration fees in dispute resolution (to be launched in the future).

Deep Reflection

The ebb and flow of momentum between PING and PayAI actually reflects an important issue: the x402 ecosystem is transitioning from concept to reality, shifting from speculation to practicality.

The first issued token, PING, received a "bonus premium," which is a common market psychology. However, as the market cools, investors begin to ponder: what exactly am I investing in? If PING is merely a minting game akin to inscriptions, then its value foundation is quite weak.

In contrast, PayAI, as a payment infrastructure under the x402 Facilitator identity, anchors two core values: "transaction traffic" and "ecosystem necessity," proving the fundamental value of the project with actual market share and application scenarios, naturally gaining continuous recognition from capital.

In this process, we see further maturation in the x402 field—market participants are beginning to determine project status based on actual transaction traffic and fundamental value, rather than blind speculation. This is undoubtedly a positive signal for the entire x402 ecosystem and the open payment ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。