Author: FinTax

I. Bitcoin Price Surge

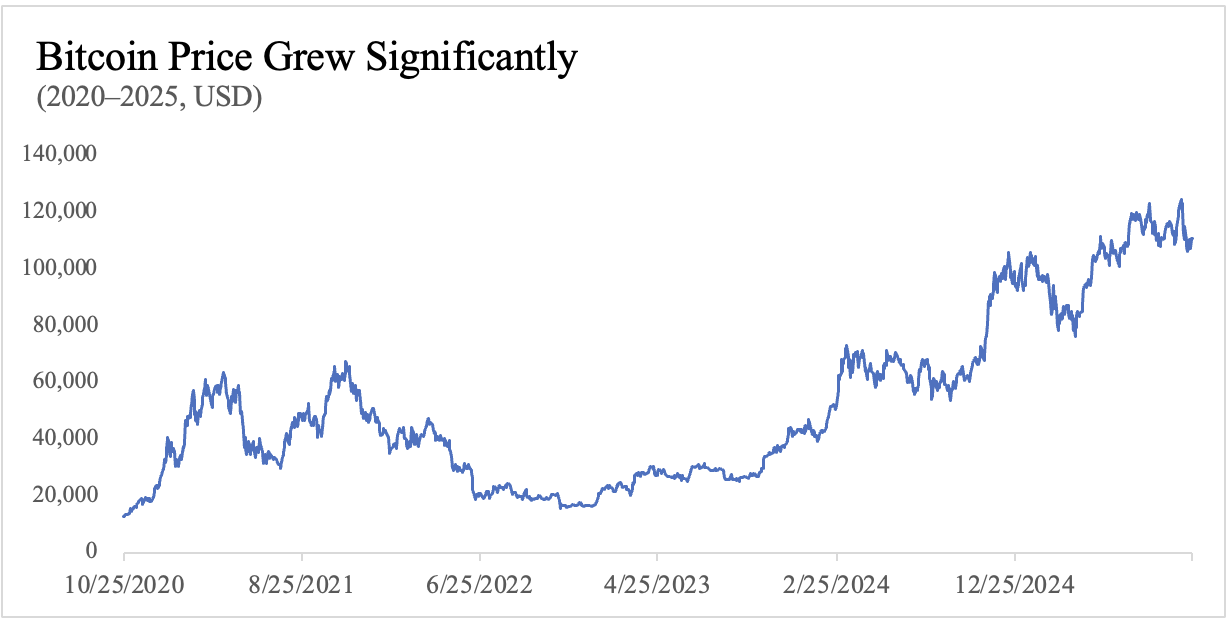

In recent years, the price of Bitcoin has experienced several rounds of strong increases. At the beginning of 2023, the price of Bitcoin was only about $20,000, but now it has long surpassed the $100,000 mark and has maintained a high level, nearly quintupling in price. The continuous rise of Bitcoin over more than two years reflects the global liquidity environment, institutional allocation demand, and the trend of digital assets entering the mainstream financial system.

Data source: Yahoo Finance, Chart created by FinTax

II. High Returns Accompanied by High Tax Burden

However, the other side of the price surge is the reality that Bitcoin investors face when cashing out—due to tightening tax regulations in various countries, there is significant tax pressure on the income from cashing out BTC.

Taking the United States as an example, the IRS treats cryptocurrencies as assets. Therefore, when selling, trading, or disposing of crypto assets, the income is considered capital gains or ordinary income and is taxed at the relevant tax rates. Specifically:

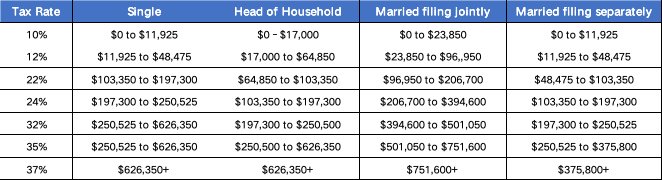

If the cryptocurrency is held for less than a year, short-term capital gains tax must be paid, with the tax rate calculated according to ordinary income tax rates, which vary based on individual annual income, ranging from 10% to 37%.

The federal income tax rates for the 2025 tax year are:

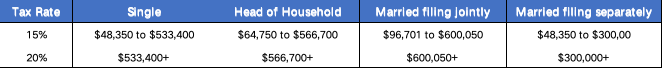

If the cryptocurrency is held for more than a year, long-term capital gains tax must be paid, which is subject to preferential tax rates. Most taxpayers will pay tax rates of 0%, 15%, or 20%.

The long-term capital gains tax rates for cryptocurrency in 2025 are:

III. New Tax Planning Ideas Based on Accelerated Depreciation Policies

However, the significant tax burden does not mean that taxpayers completely lose planning space. By reasonably utilizing the provisions of the U.S. tax law system, it is still possible to reduce effective tax burdens while remaining compliant. For example, the "accelerated depreciation" policy stipulated in §168(k) of the U.S. tax law allows taxpayers to deduct the entire cost of fixed assets such as mining machines or servers in the year of purchase, significantly reducing taxable income. The specific provisions are as follows:

(k) Special allowance for certain property

(1) Additional allowance

In the case of any qualified property—

(A) the depreciation deduction provided by section 167(a) for the taxable year in which such property is placed in service shall include an allowance equal to 100 percent of the adjusted basis of the qualified property, and

(B) the adjusted basis of the qualified property shall be reduced by the amount of such deduction before computing the amount otherwise allowable as a depreciation deduction under this chapter for such taxable year and any subsequent taxable year.

To illustrate the effect of this tax planning method, consider a U.S. mining company that earns $1 million in 2024 and invests $500,000 in mining machines that year. Assuming the corporate income tax rate is 21%.

If the §168(k) accelerated depreciation policy is applied: the company can deduct the entire $500,000 cost in that year, resulting in an income tax of approximately:

(100−50)×21% = $105,000

If conventional five-year straight-line depreciation is used: the company can only deduct $100,000 per year, resulting in an income tax of approximately:

(100−10)×21% = $189,000

It is important to note that using the accelerated depreciation method requires consideration of the cost situation for the year to avoid profit loss and subsequent carryover losses. Another simple example: a U.S. mining company invests $500,000 in mining machines in 2024 but earns only $400,000 that year.

If the §168(k) accelerated depreciation policy is still applied:

The company can deduct the entire $500,000 cost in that year, but due to lower income, this will result in a book loss of $100,000 (NOL, Net Operating Loss). Although the current profit is negative and no income tax is owed, this also means the company cannot withdraw or distribute profits, even if there is still cash flow on the books. Additionally, under current regulations, the NOL carried forward to the next year can only offset 80% of the taxable income for that year, so blindly using accelerated depreciation in low-profit years is not a wise move.

IV. Conclusion

Overall, while the continuous rise in Bitcoin prices has brought considerable investment returns, it has also highlighted tax issues increasingly. Faced with the dual pressures of tightening regulations and rising tax burdens, blindly avoiding risks is not advisable. Instead, understanding and effectively utilizing the compliance policy provisions in current tax laws for tax planning is a more rational choice. The §168(k) "accelerated depreciation" policy, for example, provides a legitimate path for the capital-intensive crypto industry to reduce taxes and optimize cash flow. This case also reaffirms that conducting systematic planning within a compliance framework and leveraging the design of the system to alleviate tax burdens is the key approach for cryptocurrency investors to achieve sustainable development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。