Written by: Joel John, Decentralised.co

Translated by: Yangz, Techub News

The living room is filled with a foul stench; something is dying. We tried to cover it with a carpet, but the rot still pierces through the fabric—perhaps because the blood has long soaked through the felt underneath. This dying thing, we call it the internet.

In the past, the network operated due to the continuous expansion of its internal pool of attention. Between 2010 and 2025, nearly two billion people accessed the internet. However, this data is now stagnating.

Entrepreneurs who created, expanded, and sold companies during the Web2 era have always been mining a continuously expanding resource—human attention. With each new user coming online, spending a third of their day staring at glowing screens, we gain more homogeneous resources to mine. Accumulate enough data, and we can market precisely to individuals.

The internet is both a machine for creating desire and an engine for facilitating transactions. Its gears drive the web of collaboration while also nurturing dissenting voices. By capturing tiny shares from massive transactions, it has birthed this trillion-dollar economic machine that relies on attention. This is the foundation of today’s surveillance economy.

So, where does this crisis come from? What is strangling Web2? Three parallel core forces are at play.

Continuous content consumption has created a market with an oversupply of attention but insufficient demand. Not all attention holds equal value. When everyone can enjoy fifteen minutes of fame, does fame itself still matter? What if those fifteen minutes are compressed into ten seconds? If attention cannot generate intent to act, what is its value? What if everyone becomes anxious fragments?

The expansion of AI-generated content means that the human experiences that once nourished creative fragments are becoming redundant. Artists drew inspiration from pain, torment, hope, and desire, but when you compress all of that into a few prompts, the output is merely garbage fed to the human brain. We may be sliding toward the peak of mental obesity. The ominous signs have already appeared: Meta launched a social network focused on AI-generated content, and OpenAI is also developing similar products. The generation that grew up after Meta's rise has a lower literacy rate, and a higher rate of depression. If you think millennials are better off, consider that they are in the largest cohort of single 40-year-olds in history (perhaps this is a feature rather than a flaw—but that topic is for another discussion).

The younger generation of internet citizens is completely withdrawing from the web. The New York Times asserted in a June article that thinking has become a new luxury, and being constantly online is akin to a new form of smoking.

In other words, under the triple assault of content oversupply, attention decay, and mental health crises, the internet is undergoing a transformation. Today, anyone can be an influencer, but they must be equipped with content filters, publishing calendars, and aesthetic systems to attract audiences. When everyone is performing, there are no performances worth watching. This means we will witness the birth of a new type of internet—it will gradually detach from the zeitgeist and reshape forms of expression.

The shift in the attention economy is not a new phenomenon. Print media seized power from ancient compilers and priests, handing it over to writers; and when the internet empowered individuals to build audiences from home—once a privilege exclusive to newspapers—traditional media was consumed. Niche independent blogs were devoured by large social platforms that consolidated interpersonal networks. Remember WordPress? What about Tumblr?

Now, as social media approaches saturation, people are growing weary of constant entertainment, and long-form content may see a revival. The happy "treadmill" of human attention pushes us forward, and we seem to have reached a new shore.

This article aims to explore how this transformation will come about. My argument is based on three core points:

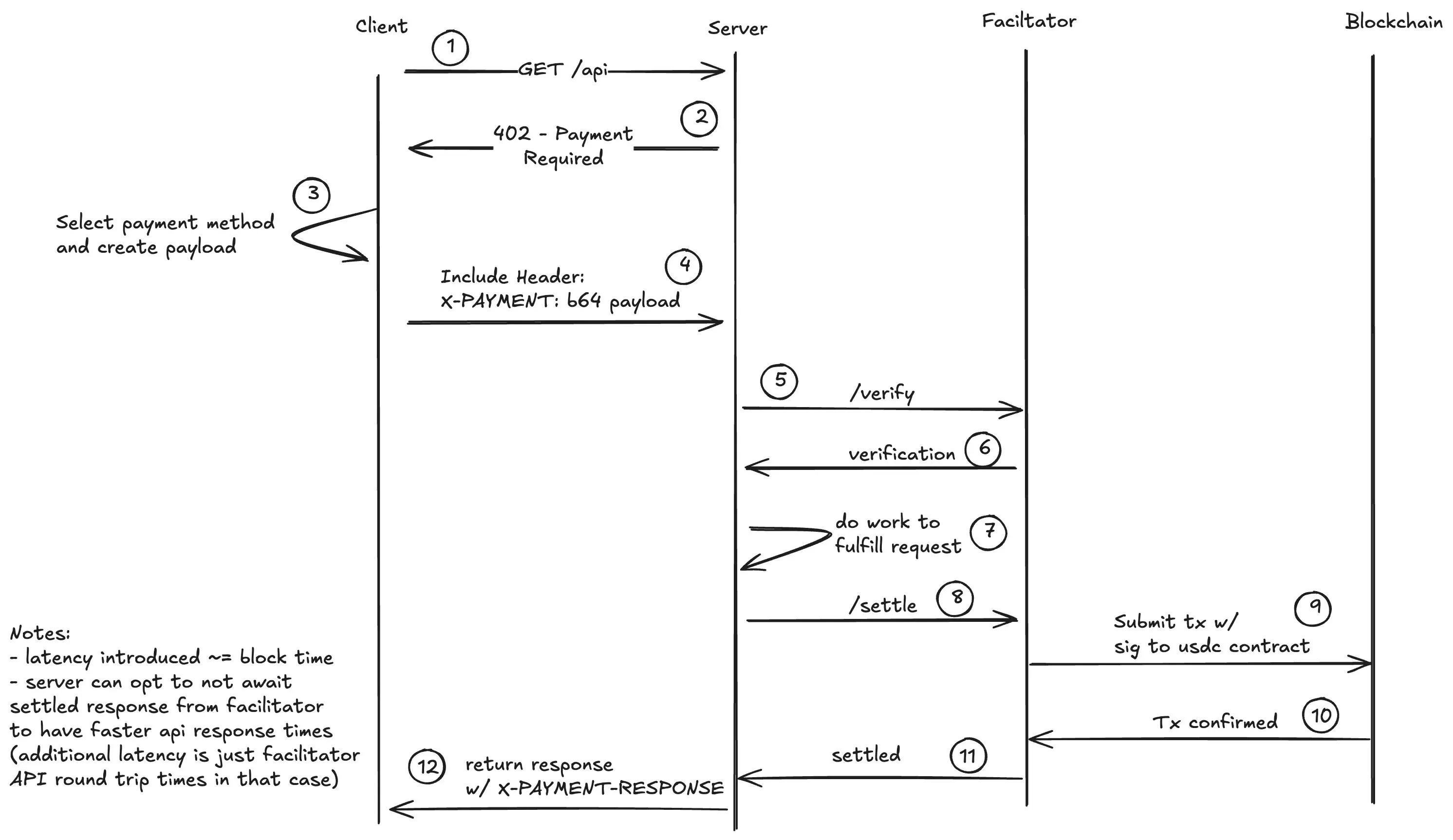

Advertising became the driving force of the internet because, in its early days, there was a lack of payment mechanisms. Most people in the early 21st century did not have debit cards or bank accounts. With electronic wallets not yet widespread, businesses could only rely on attracting attention.

The "value" of the internet largely comes from transactions. As foundational technologies like stablecoins and single sign-on wallets (such as Privy, Para) drive the evolution of transaction systems, we will witness more consumer-facing business models supporting instant transactions emerging in social networks.

A new wave of companies will arise in this transition from the attention economy to the transaction economy.

Builders of Web3 social networks and payment systems, whether intentionally or unintentionally, have prepared building blocks for the internet's rebirth. This article is my attempt to piece these fragments together.

The Large-Scale "Distraction Weapons"

Apple's QR code payment and Amazon's one-click checkout precisely capture the same psychological mechanism—human impulse. When payment actions become frictionless, we rarely think about the effort required to earn that money.

When there is no need to use physical currency, people often spend more. Did the shift from handwritten notes to text messages have a similar effect? The tap of sending an emoji can never compare to the search for precise words to convey emotions.

Our primitive "monkey brain" has interacted with physical cash for less than four hundred years. In agrarian societies, value transfer often occurred through labor. If you had to protect a cow and ensure it was fed, you wouldn’t provide milk to everyone in the village. You would only do so for friendly neighbors, as an act of kindness.

We live in a world detached from the labor required for value creation. This is certainly wonderful—no one wants to return to the deep mountains where our ancestors toiled—but it is also a psychological blind spot worth noting. The more convenient transactions become, the shallower our understanding of the risks and variables involved. This is precisely why many crypto investors have lost everything due to leverage.

Experiencing extreme risk with no friction is both a systemic flaw and a design feature.

In the early 21st century, platforms could hardly track how attention converted into actual transactions. If I saw an iPod ad in the early 2000s and asked my father to bring one back from the UK, the platform displaying the ad had no way to track that transaction (India had strict restrictions on electronic product imports, which was how I and many teenagers got our first iPod nano).

The disconnection between content consumption and transaction traceability is a key issue in the evolution of the internet. Attribution technology in advertising solved this problem in the early 2010s. Our podcast conversation with Antonio Martinez details its origins, and I recommend his book “Chaos Monkeys” for background on attribution systems.

Since at least the early 2010s, cookie technology has enabled cross-platform transaction tracking. You can see Facebook posts, receive Google ads, and ultimately make purchases on Amazon—the attribution systems tracking the purchasing path have become sophisticated enough to reconstruct the entire user journey, and advertisers know that the key to facilitating transactions lies in repeatedly showing similar content to users to stimulate desire, which is precisely why the internet continually reinforces our existing viewpoints.

Once the algorithm captures preferences, we are repeatedly exposed to similar content.

Platforms like Twitch go a step further, allowing users to directly purchase emotes and tips. In this process, we have created the creator economy—where the ability of creators to maintain attention becomes a commodity in itself.

On the seventh day, God rested and scrolled through Instagram. — The New Yorker

The current form of the creator economy resembles a socialist system without benefits. Audiences enjoy the content, platforms own the audiences, but creators must continuously output to maintain their existence—modern serfs are serving the algorithm.

As a generation becomes trapped in meaningless job shackles, more and more people turn to digital platforms to find gig work to make a living. This should be a wonderful thing, allowing more people to activate their creativity and find meaning, community, and livelihood; however, the underlying infrastructure may struggle to support such a vision. Creators are tempted by algorithmic traffic, and people may simply be replacing the agony of cubicles with the drudgery of serving algorithms.

This is akin to jumping from the frying pan into the fire.

The internet needs better monetization pathways. What we see in the creator economy, prediction markets, and the attempts made by the Zora team are early prototypes aimed at solving these issues. Can individuals make a living with just a small audience, without having to cater to platform incentives or compete with other creators?

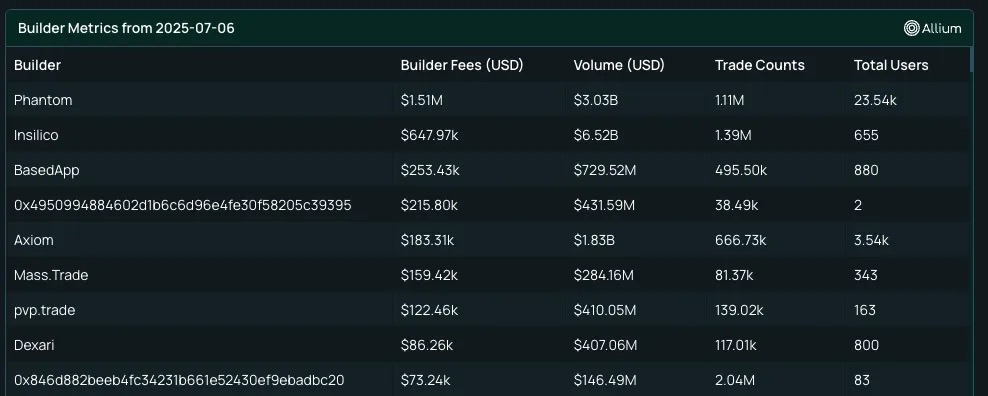

Cryptocurrency debit cards and wallets have shown early prototypes. In the past month, Phantom, Rainbow, Kast, and Based have all integrated Hyperliquid perpetual contracts into their products. While the world has yet to notice, a subtle shift has already occurred: these wallets no longer rely on advertising monetization but instead profit from transaction fees of hyper-financialized products.

Kast and Based, originally debit card issuers, chose to integrate perpetual contracts because they understand that this can enhance user lifetime value. According to data, Based and Phantom generated six-figure revenues through Hyperliquid integration from fewer than a thousand active users.

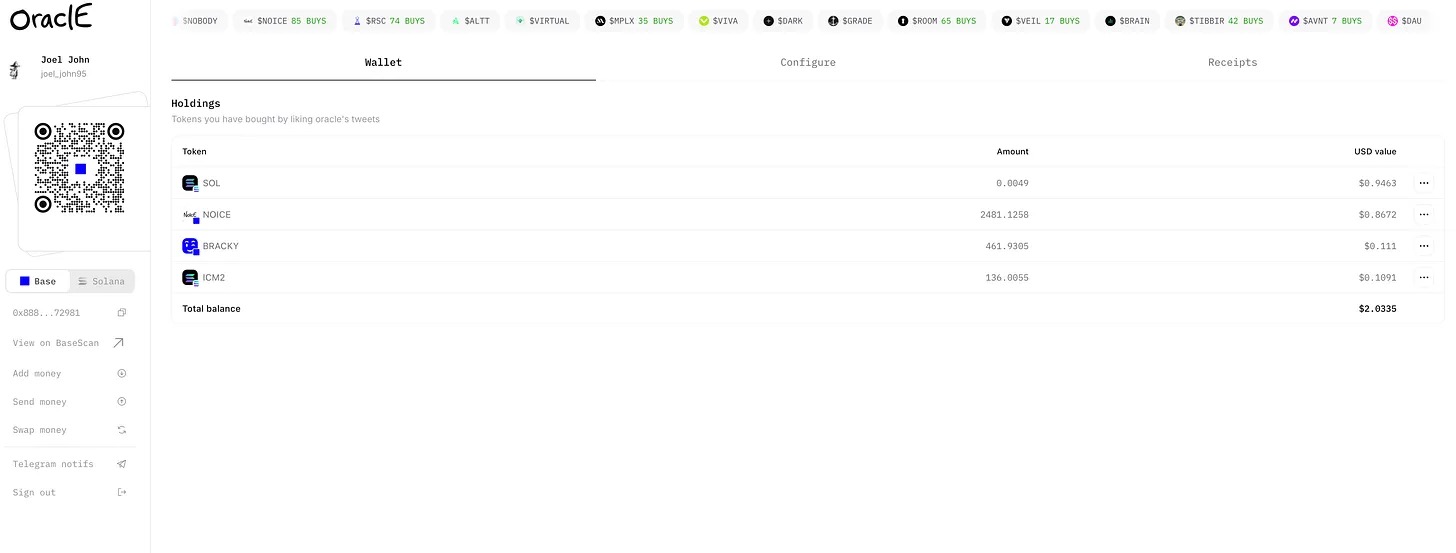

The integration of perpetual contracts and wallets signals a trend for the future. This is the rise of markets in the information flow, witnessing the real-time compression of the time required for attention to convert into transactions. If you don’t believe it, look at the Oracle developed by $noice: users can purchase assets with one click, without even needing a third-party platform button—just liking a tweet with a funding label will automatically complete the purchase. A single click completes the transaction, costing less than $0.01. This is the prototype of future social networks. While this product has many commendable aspects, the following point is its most outstanding feature.

I built this meme coin index from the information flow just by liking a tweet—this is the easiest transaction I’ve ever completed on social media. The Noice team is brewing the most wildfire-like innovation in the entire crypto space.

It allows us to complete value transfers to third parties through a familiar interaction method—similar to liking a tweet. No need to sign transactions, refresh wallets, or perform cross-chain operations; just one click. So, what is its uniqueness?

Farcaster Frames, while a revolutionary underlying component, relies on an independent social graph that is still in its infancy. Platforms like Twitter already have a massive user base. By opening transactions through embedded APIs, they can directly utilize Twitter's social graph without requiring users to leave the platform.

Twitter is well aware of the transformation it faces. In June, there was a proposal to embed prediction markets on its platform. Although it has not materialized months later, prediction markets have already experienced explosive growth.

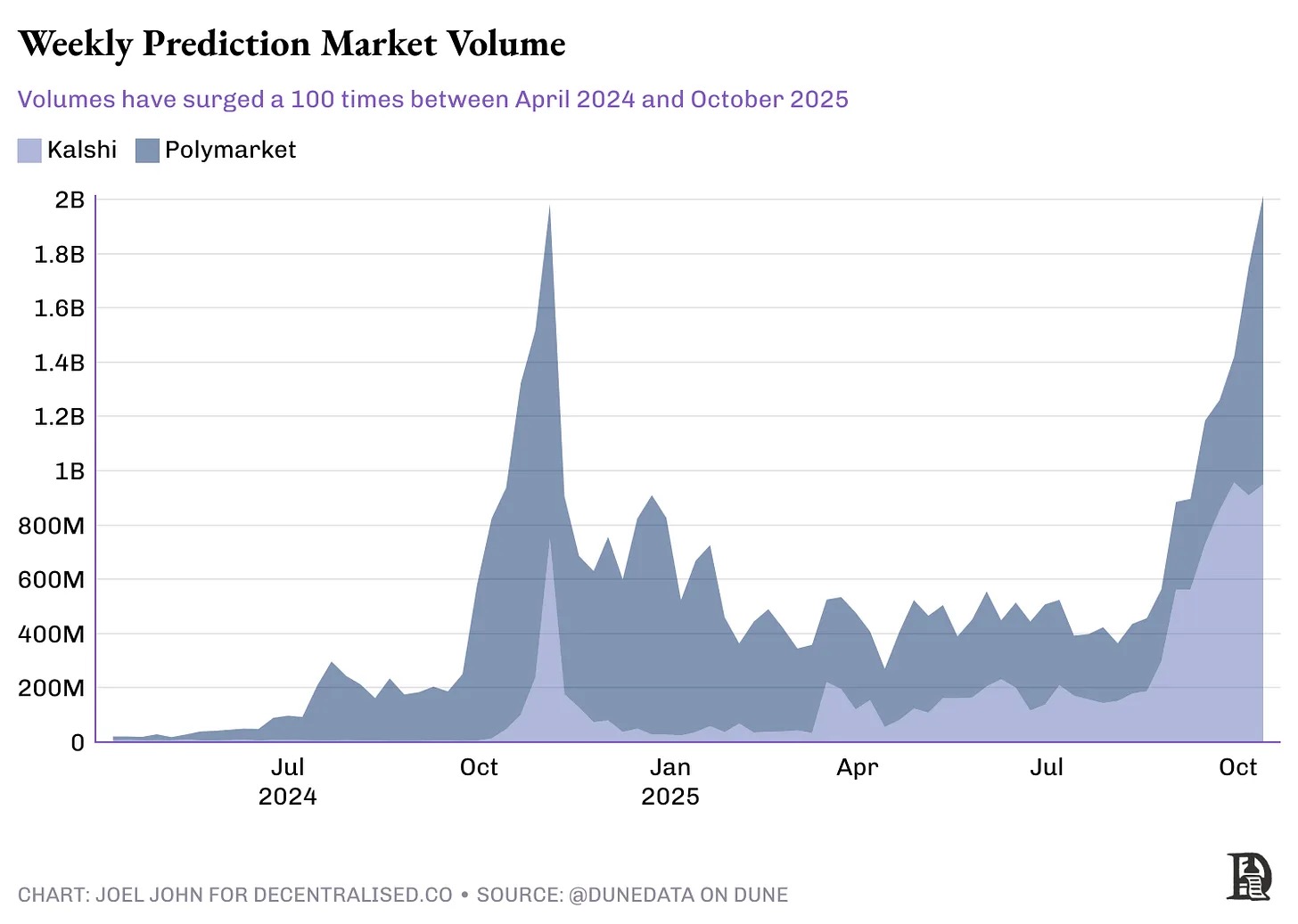

Look at the two charts below: until April 2024, the weekly trading volume of prediction markets was only about $20 million; by October 2025, that number had approached $2 billion! Over 6 million transactions per week, with an average bet amount of about $300.

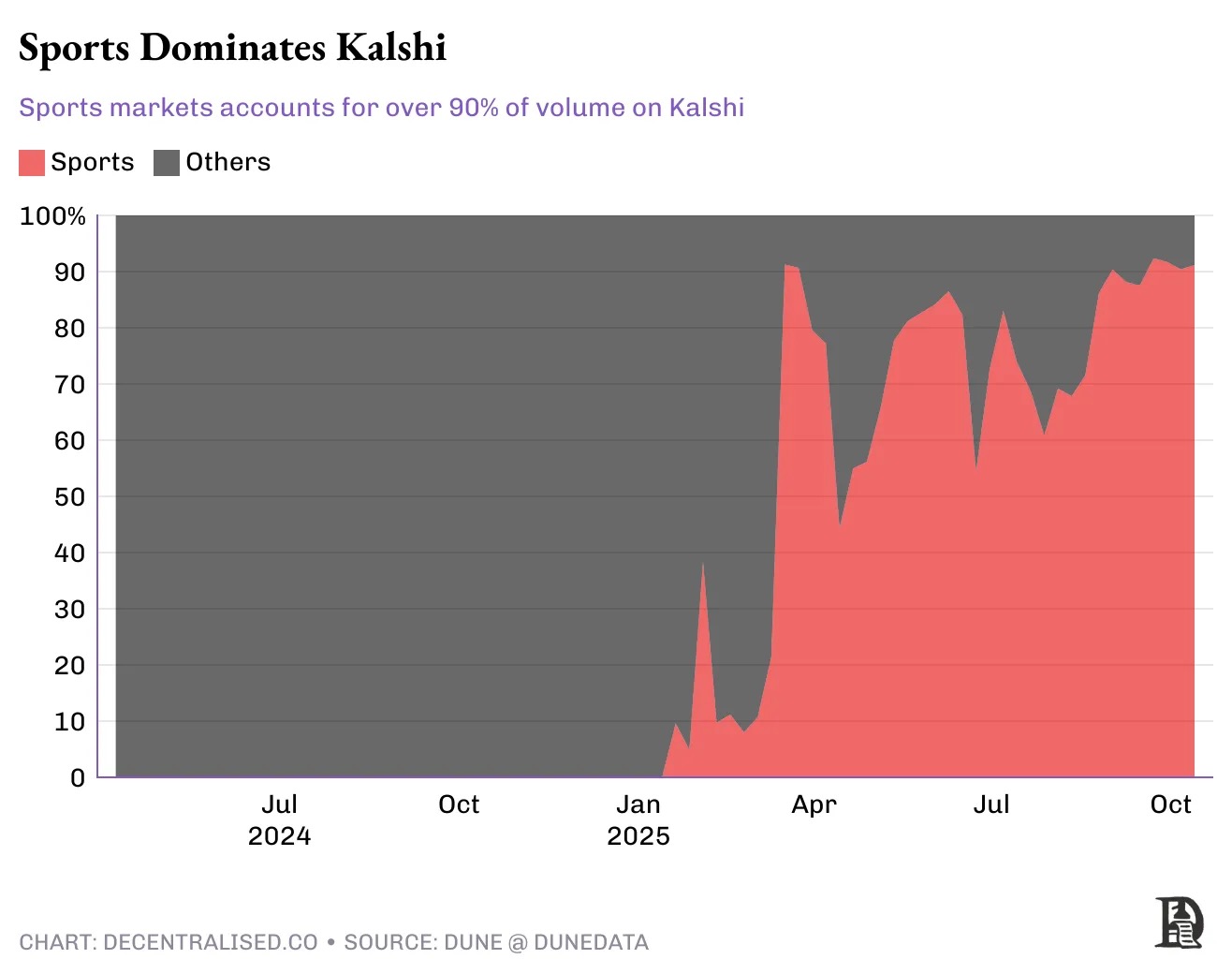

Of the approximately $950 million in bets on the Kalshi platform, $877 million is concentrated in sports events. One-third of the betting volume on Polymarket also comes from the same category. Compared to just 1,030 users in April 2025, Polymarket attracted nearly 150,000 users last week. In other words, we are witnessing the rise of on-chain embedded markets based on cultural genes.

The market is efficiently pricing this transformation. When Facebook had 360 million users, it raised $200 million at a valuation of $10 billion (equivalent to about $15 billion today after inflation adjustment). Now, Polymarket, led by the parent company of the New York Stock Exchange, is valued at $9 billion—this comparison is significant.

This contrast precisely captures the trajectory of the internet's evolution from an attention paradigm to a transaction paradigm.

The gaming economy has already completed this transformation. They serve the same functions as social networks, providing meaningful entertainment, building community belonging, and selling digital goods. Games like Roblox are essentially large-scale trading systems packaged as entertainment products, with 111 million daily active users having accumulated about 27 billion human hours of engagement.

Why is this data so staggering? Unlike Memecoins, these markets possess fairness characteristics, and their value decay rate is much slower. Memecoins can only maintain community engagement when prices rise, while the gaming economy has a Lindy effect, demonstrating much longer vitality.

Prediction markets represent a new paradigm that combines both characteristics. Without compromising platform integrity, whales or insiders may not have an advantage, as users can usually predict the range of outcomes. Therefore, we are at a critical juncture: products with distribution capabilities are attempting to embed these primitive components, aiming to enhance user lifetime value while reducing customer acquisition costs.

The crypto space is racing to integrate perpetual contracts, prediction markets, on-chain stocks, and cultural goods (such as sports markets or Pokémon cards), which is a move towards mainstream expansion for the industry. What does this mean for our fellow creators—whom I previously referred to as "serfs" working in digital farms?

One evolutionary path for the creator economy is to empower creators to establish personal markets. If you predict that Trump will visit China next month, creators can embed prediction markets in their content to profit from user trades based on their analysis. But the challenge lies in the fact that when the medium of expression requires transaction support to be relevant, the nature of dialogue will change. In the future, there will be "influencers" whose value is determined by their market-making ability. Where will art go? Who will speak for the stories?

What is the value of a long article that prevents someone from self-harm? Does it really need a prediction market to price it?

I have yet to find the answer, but understanding the direction of market dynamics is ultimately beneficial.

What is the value of truth?

The essence of human existence is the eternal quest for truth. Philosophy questions the meaning of life, biology analyzes the mechanisms of life, mathematics calculates the duration of existence, and poetry and art provide joy throughout the life journey. Truth is inherently subjective, but regardless of the purpose, the market is one of the most powerful tools to help us reach a consensus on truth, aside from science. Blockchain channels, as financial conduits, mean that we can now price truths on a global scale.

Do you think Trump will tweet “covfefe” again? You can place a bet on it. In fact, foundational components like Liquid allow you to open chat rooms at any time and set up bets with friends on anything—whether someone can lose weight, find true love, or complete a to-do list, as long as there is an oracle to verify the truth. The specific operational mechanisms are not the focus here; the key is that we now possess foundational components that enable us to achieve two major functions:

The ability to create markets for any matter instantly

The ability to achieve global settlement and distribution of value

The combination of these two allows viewpoints to be priced, traded, and settled on a global scale. This is akin to how blogs once allowed thoughts to cross borders, with the difference being that what we have now is not isolated viewpoints, but vibrant markets.

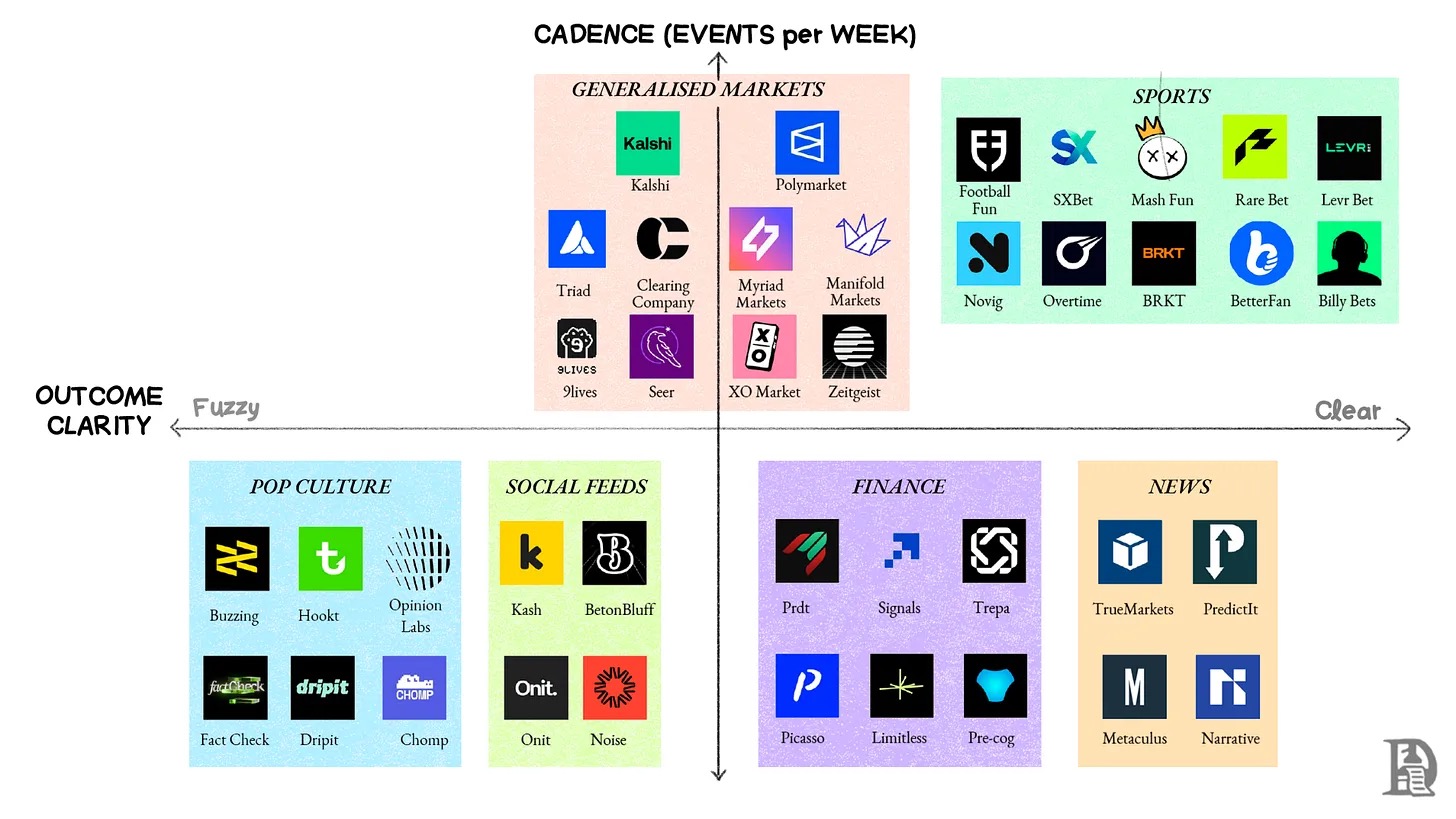

As for how the market will evolve, it is akin to asking about the ultimate form of blogs and personal websites. If currency becomes a medium of expression, the essence of the market will cover the breadth and depth of human interests. Referring to the market map above, markets can generally be divided by the frequency of event adjudication and the clarity of outcomes.

Most markets have clear results (for example, there is no dispute that Trump served as President of the United States), but some markets may have subjectivity. For instance, a prediction market about who is better between J Cole and Kendrick Lamar may be determined by popularity—Kendrick's fans could vigorously promote his lyrical talent, creating buzz in various ways.

The core point is that on-chain prediction markets will evolve towards reaching consensus or pursuing objective truth, both of which are necessary. Current popular culture and "sentiment aggregation" products often lack clarity in determining outcomes, while markets focused on sports, politics, and finance have clear conclusions.

For example, the essence of a democratic system is to seek consensus, but voters for the losing party may gain nothing.

Many markets dealing with ambiguous outcomes can be termed binary markets: win or lose. Their gaming mechanism is quite sophisticated: participants are not only betting on their own perceptions but also on the collective consensus. Capital incentives essentially force individuals to "buy into" specific positions.

My core assertion is that when such incentive mechanisms scale (which has become the norm), the nature of internet dialogue and interaction will shift from pursuing viral dissemination to facilitating transactions.

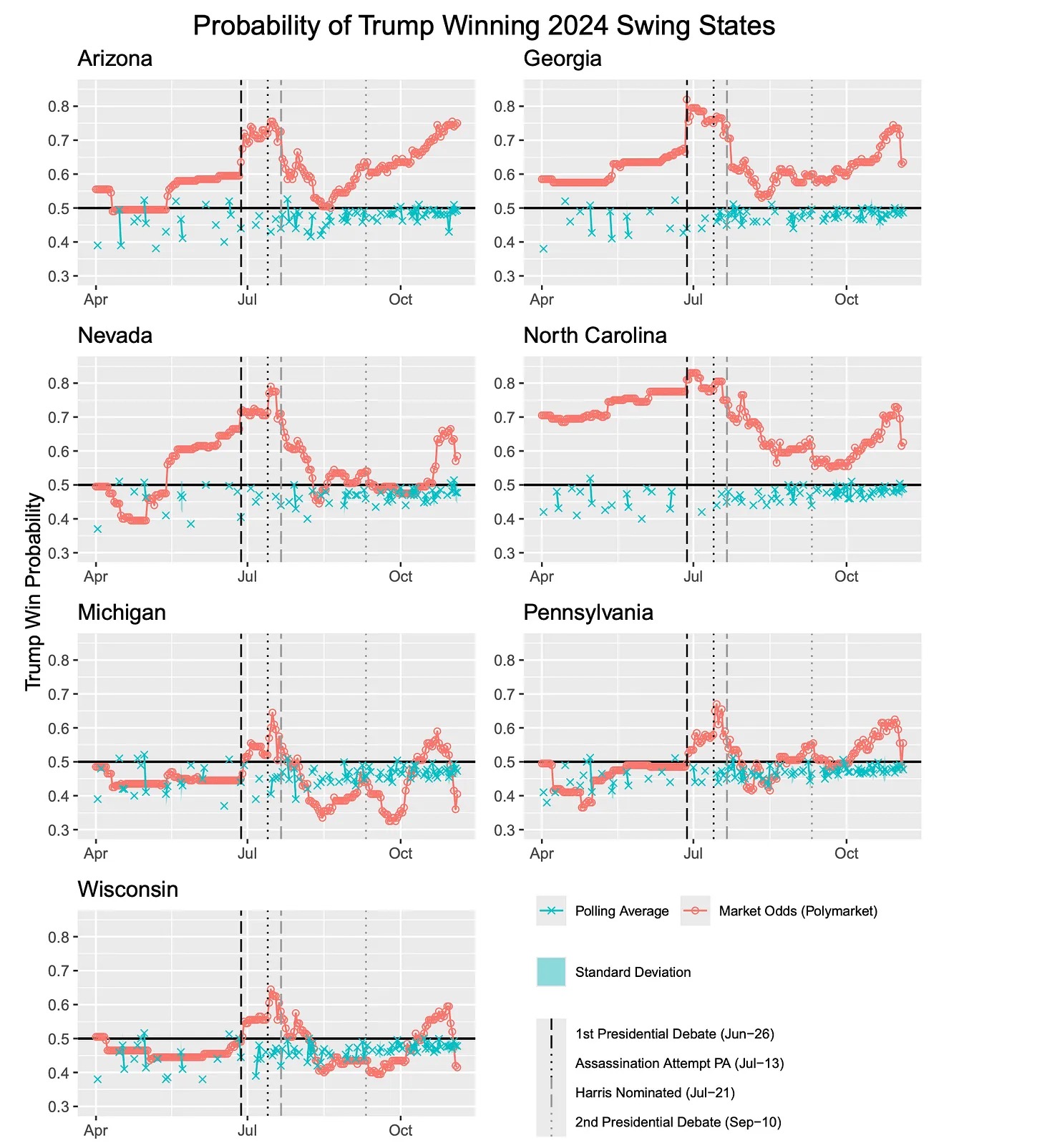

Platforms like Manifold and Zeitgeist gauge trend popularity through user social behaviors (such as market discussion threads). While popularity contests themselves are not new, they can reveal truths in unprecedented ways. Prediction markets like Polymarket continuously outperform traditional polls when assessing the probabilities of events like "Trump winning swing states." In fact, during the research for this article, I came across a paper discussing the U.S. military's exploration of using prediction markets to assess security threats here.

This is precisely the most intriguing aspect of the transformation. We often equate the crypto world with speculation, but that is akin to asserting that the internet is entirely about pornography—according to some estimates, it was indeed so in the early days. In the 1990s, internet bandwidth and revenue largely came from adult content. However, market forces and capital incentives ultimately constructed the attention economy, giving rise to many internet giants like Meta and Alphabet.

The crypto world has always struggled to reach the average internet user. No one wakes up in the morning pondering the TPS of layer two networks or how validation nodes collapse with AWS outages. What people truly care about are sports, music, and politics. Embedded prediction markets are blurring the lines between social engagement and on-chain transactions for ordinary people, which is precisely why prediction markets are crucial to the industry.

Endless Content, Elusive Satisfaction

Incentives (and cash) dominate everything around me.

Embedded markets may become the foundational business model supporting various content on the internet. In a conceivable future, all exchanges (like Coinbase or Nasdaq) will become content platforms, and all content platforms will, in turn, become exchanges.

Retail speculation on meme assets and derivatives is a hallmark of the late-stage internet. People gather on platforms like Reddit, X, and Telegram, partly because capital incentives are at play.

If this is indeed the future we are heading towards, the boundaries between financial platforms and social networks will gradually blur, and the boundaries of our wallets and minds will dissolve.

Coinbase's recent acquisition of UpOnly and Echo is a harbinger of this transformation. The controllers of the New York Stock Exchange may already understand: what will ultimately replace the Google ad market is prediction markets.

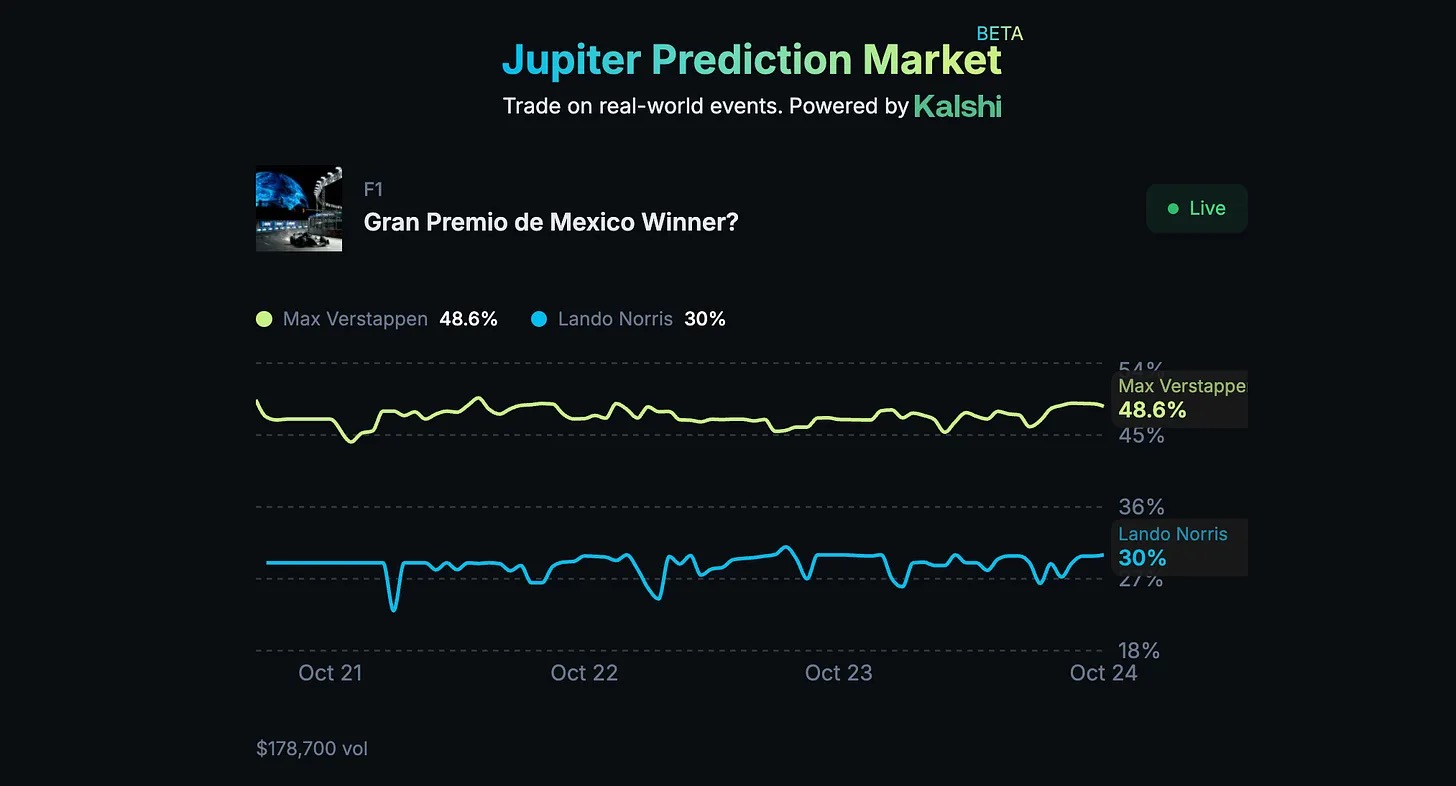

Jupiter's direct integration of Kalshi into its liquidity pool is an example of exchanges transforming into content platforms.

In an age of AI proliferation, human creativity requires incentives. Embedded markets are one of the pathways to achieve this.

Current prediction markets attempt to serve both product and distribution roles simultaneously. They build trading venues and then expend effort to pull attention back to the platform, such as through odds screenshots on X, quotes from influencers, and price reporting bots in Discord chats. These operations can be intermittently effective because real-time markets are inherently shareable, but users often discover information outside the platform, losing trading intent during the transition, leading products to optimize for virality (markets suitable for screenshots) rather than authenticity (rigorous rules, quick settlements).

The embedded model decouples these roles: the market remains the product, while existing media becomes the distribution channel. Prediction markets improve the two most challenging dimensions of media—credibility and practicality. They transform assertions into tangible objects: real-time probabilities that include rules, sources, and countdowns. Reporting is no longer filled with ambiguous paragraphs and selective quotes but carries dynamically updated values that evolve with the facts, settling when the truth is revealed. This transformation allows reporting to be publicly falsifiable, and readers no longer simply consume viewpoints but witness the entire process of beliefs being priced and settled with evidence.

The embedded model allows this upgrade to reach users' existing attention domains. Real-time odds under headlines eliminate the drop-off of intent during transitions, and policy articles carrying belief trend lines transform "statements from all parties" into "price fluctuation trajectories and causes."

News organizations thus gain credibility and new revenue sources: even with average conversion rates, their value surpasses advertising space—because value is anchored in user behavior rather than exposure. If two out of every hundred readers complete a $15 transaction, a 2% fee means that a thousand reads are worth about $6, which is higher than traditional CPM and deeply aligned with the content itself. Creators exchange emotional provocation for precise calibration, and visible prediction records become a balance sheet across content, with embedded traffic sharing far surpassing the pursuit of the next viral headline.

This is precisely why Polymarket is committed to developing embedded toolkits, allowing any social platform to conveniently reference odds data. Both Substack and X support embedding features, enabling creators to enhance reporting depth with odds. Writers like Matt Levine reference odds in their writing, browsers like Perplexity display odds as search results, and news portals like Axios use Polymarket charts to substantiate their reports.

Live Reporting by Large Language Models

At this point, we have discussed how humans trade around events. Markets can only continue to operate efficiently. When buyers and sellers engage in transactions, they are essentially predicting future price movements. If there are no market makers, how can embedded markets enhance efficiency? Currently, even experienced hedge funds lack sufficient liquidity to participate in these markets.

Currently, agents excel in information aggregation. We internally use Kaito and AskSurf to filter relevant information, and large news organizations are integrating AI to optimize content consumption and information integration. So, what if we could use agents to trade?

We believe that as prediction markets mature, agent systems will play a key role in providing liquidity and executing trades. There are already robots building positions by scanning YouTube transcripts of key events like Powell's speeches. In the future, we will witness a new form of real-time media, prediction markets, and agents collaborating to extract more precise information.

In fact, there are various possible paths for the interaction between agents and prediction markets.

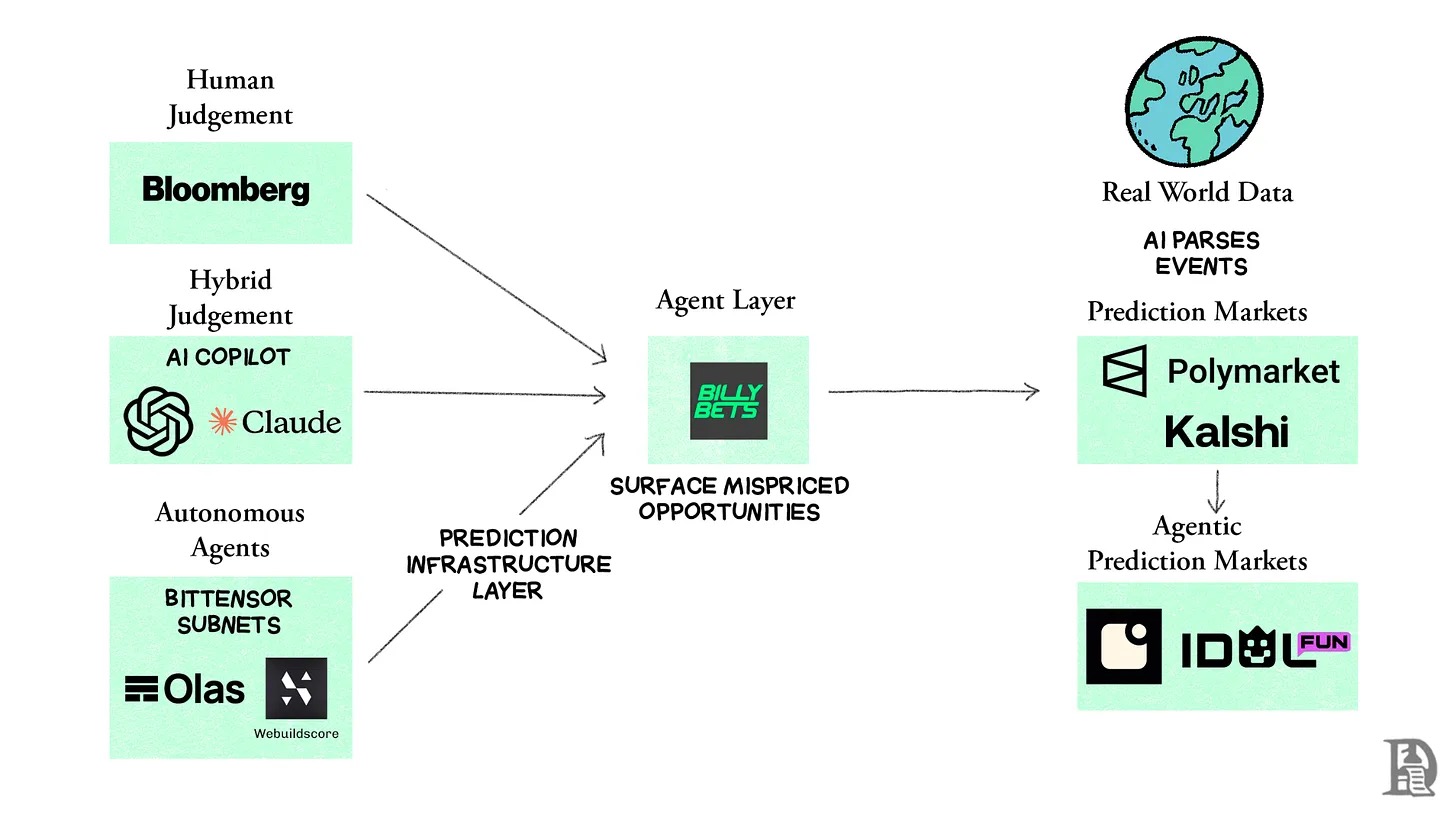

Human Judgment—Political analysts and sports bettors cultivate future insights by reading publications like Bloomberg Businessweek and watching live events. The key is to maintain high-frequency information input, sharpen cognition with in-depth commentators, and apply insights to prediction markets.

Hybrid Judgment—Analysts use AI to gather information and verify probability forecasts before entering the market. Users can directly converse with preferred large language models. Some teams are developing specialized "co-pilot" systems to assist decision-making: for example, selecting funding amounts and strategy preferences on the Billybets platform, the system will automatically place bets as needed.

Autonomous Agents—Self-optimizing AI systems generate optimal signals through competition. Networks like Bittensor and Olas have already incubated specialized subnets like Score, Zeus, and Mantis, focusing on sports, weather, and macroeconomic fields. Their operation resembles an evolutionary quantitative trading desk: thousands of models continuously predict, re-weighting after each real-world validation. Webuildscore trains models using event videos and statistical data, predicting at speeds surpassing traditional bookmakers.

Aggregation Layer—Using AI to detect mispricing opportunities across prediction markets. Agents can instantaneously inject liquidity into mispriced markets. If Kalshi prices Manchester United's win probability at 60% while other markets are at 40%, the AI agent will place a reverse bet on Kalshi.

Agent Prediction Markets—In these derivative markets where the market itself is the subject, autonomous agents become the prediction objects. Fraction AI provides agents with $100,000 in virtual funds for trading, while humans bet on which agent performs better. The market thus transforms into a scoreboard of intelligence levels.

In fact, there already exist real-time markets where agents bet on each other's performance (check it out here), vividly showcasing the interaction between crypto-native components, AI agents, and markets. If someone wants to customize a dedicated trading agent? If someone believes in chaos theory and wants to short a politician's related market? Or wants to optimistically long a favorite musician? This requires tools that can digest information and build positions on your behalf—often under the premise of limited funds.

Talus is committed to realizing the final stage of agent prediction markets. Its Nexus platform allows anyone to quickly deploy AI agents on-chain. According to them, AI agents will permeate prediction markets comprehensively, as they possess the two essential characteristics for agent survival: information density and price sensitivity. In a high-frequency information environment, trading advantages may appear and disappear within minutes. Human predictors are fundamentally unable to monitor thousands of events simultaneously, such as political, sports, and macro data. In contrast, AI agents can analyze hundreds of information streams, extract potential correlations, and react instantly to signal changes. For specific operational mechanisms, refer to the Nexus technical documentation.

Agents can provide event pricing context and inject liquidity. This will transform quarrels and attacks on social media into quantifiable probabilities and compress the amount of data needed to form opinions into a single value. Whether this is the best decision-making method remains to be seen, but if the agent network truly rises, prediction markets will undoubtedly play a key role.

Social Paradox

For the past few weeks, I have been reading William Hippel's "Social Paradox." This work brilliantly explains how humans seek a balance between autonomy and dependence: long-term isolation can lead to (literally) stagnation and demise, while excessive clustering may result in a loss of self. The core of healthy relationships lies in respecting this dual need for connection and autonomy.

This paradox also extends to our information intake. We want to know about friends' updates and share spontaneous creations (it is this instinct that initially pushed us online), yet being bombarded with unsolicited information leads to mental exhaustion. The modern workplace demands that we continuously consume information online, and most people may never be able to go completely offline. Some works even assert that the human experience is nearing its end—we are merely zombies plugged into an information network, operating an economic system for which we have not signed a contract.

So, will prediction markets be the antidote? Not necessarily. Prediction markets (especially embedded markets) are essentially a gradual evolution of the network economy. Driven by agents, stablecoins, and composable markets, we are moving towards a world where all information can be priced. This should mean that fake news will gradually fade away, and exaggerated statements will find it hard to thrive. Creators will not need to produce in bulk, and individuals can gain capital market endorsement for the viewpoints they consume. This is undoubtedly a step forward.

At the same time, most things worth appreciating may never be monetized. Business has the power to amplify beauty, but it also possesses the ability to destroy it simultaneously. Most human artistic works worthy of legacy were not created for mass distribution; they were born out of a need to escape or express—sometimes both. Would it be better to set up a prediction market for "Romeo and Juliet"? I cannot say, perhaps Romeo himself would have insights.

Despite the excitement of prediction markets, certain corners of our attention will ultimately resist commercialization. For instance, handwritten love letters never contain advertisements.

To borrow a saying from a philosopher I admire: freedom often resides in the gap between stimulus and response. Not all media content will inspire transactions, and not all art forms need pricing. The internet has already shown this divide: on Twitter, people optimize for viral dissemination, while creators on Substack build connections with users through email lists and speak freely. Close-knit communities are the resistance against the high-speed crushing of the contemporary attention economy.

How will this dynamic evolve when prediction markets are embedded in media?

I do not know, but for now, the trend is clear: the foundational components of the advanced attention economy are already in place, and we are witnessing the birth of a trading economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。