Master Discusses Hot Topics:

At 2 AM tonight, the Federal Reserve's interest rate cut will be finalized. Although a 25 basis point cut has long been anticipated and is not a surprise, the key question is not whether rates will be cut, but where the money will flow afterward.

Traditional finance has been locked in by high interest rates this year, and now that the interest rate spread is loosening, the first to run is not the stock market but liquidity. Whether liquidity recognizes you depends on where the volatility is high and the yield elasticity is strong.

Gold has been pressed down recently and has not held up, indicating that safe-haven buying is starting to loosen. Last month, after the rate cut, Bitcoin surged directly; this is not a coincidence, it’s a clear signal that funds are ready to flow here.

So, in the last two months of this year, there is a probability that Bitcoin could rise to 120K again. But to be clear, if it can't break through this time, then don’t expect any windfall in November and December.

So stop fantasizing about continuous rate cuts, balance sheet expansions, or a collective change in the dot plot. If Powell wants to manipulate this process, he can't even control his own people, let alone the Federal Reserve. Therefore, I can only take it step by step and won't preemptively imagine a prosperous era.

Returning to the market, Bitcoin has been adjusting for over two months since its high of 124.4K on August 14. Can I say it has ended? I won't jump to conclusions; it is essentially still a correction of the main upward wave from 74.5K.

Looking at the rise from 103.5K, this rebound pattern is not complete. To put it bluntly, we are still in an adjustment phase; a rebound is not a reversal, and this must be firmly understood. Regarding yesterday's decline, to be honest, I couldn't find any significant bearish news.

At such times, there’s no need to force an explanation; the market is simply a natural pullback after excessive speculation. The 116K level is not a strong resistance; it feels more like an emotional threshold. If we are to talk about pressure, we need to look at the 120K line, which is where the main force will decide whether to give face.

Last night, on the 12-hour chart, as soon as the price touched the upper Bollinger Band at 115.8K, it was immediately smashed down. The daily Bollinger upper band has also dropped to around 116.2K. In other words, this is a natural ambush area for bears; every time you push up, they pull you back down. After the rate cut tonight, volatility will be significant, and both bulls and bears can profit.

Now, regarding sentiment, this rebound is entirely driven by Asian funds. U.S. capital sentiment is at a low, not participating. Once U.S. capital sentiment rebounds from the bottom, that will be the real acceleration point for the market.

Historical patterns show that when Asian funds take the lead, it is usually short-lived, chasing highs, smashing lows, and net doing the opposite; this is an old habit. However, this time is special because U.S. capital is currently at a low and could replenish positions at any time. When that happens, looking back at now, you will find this is the starting area, not the top.

Ethereum, on the other hand, is moving cleaner than Bitcoin; 3710 can temporarily be considered a phase low, with major resistance at 4450. The key today is whether it can stabilize above 3917, as the deeper the break, the more severe the rebound will be after the Federal Reserve's decision in the early morning.

Master Looks at Trends:

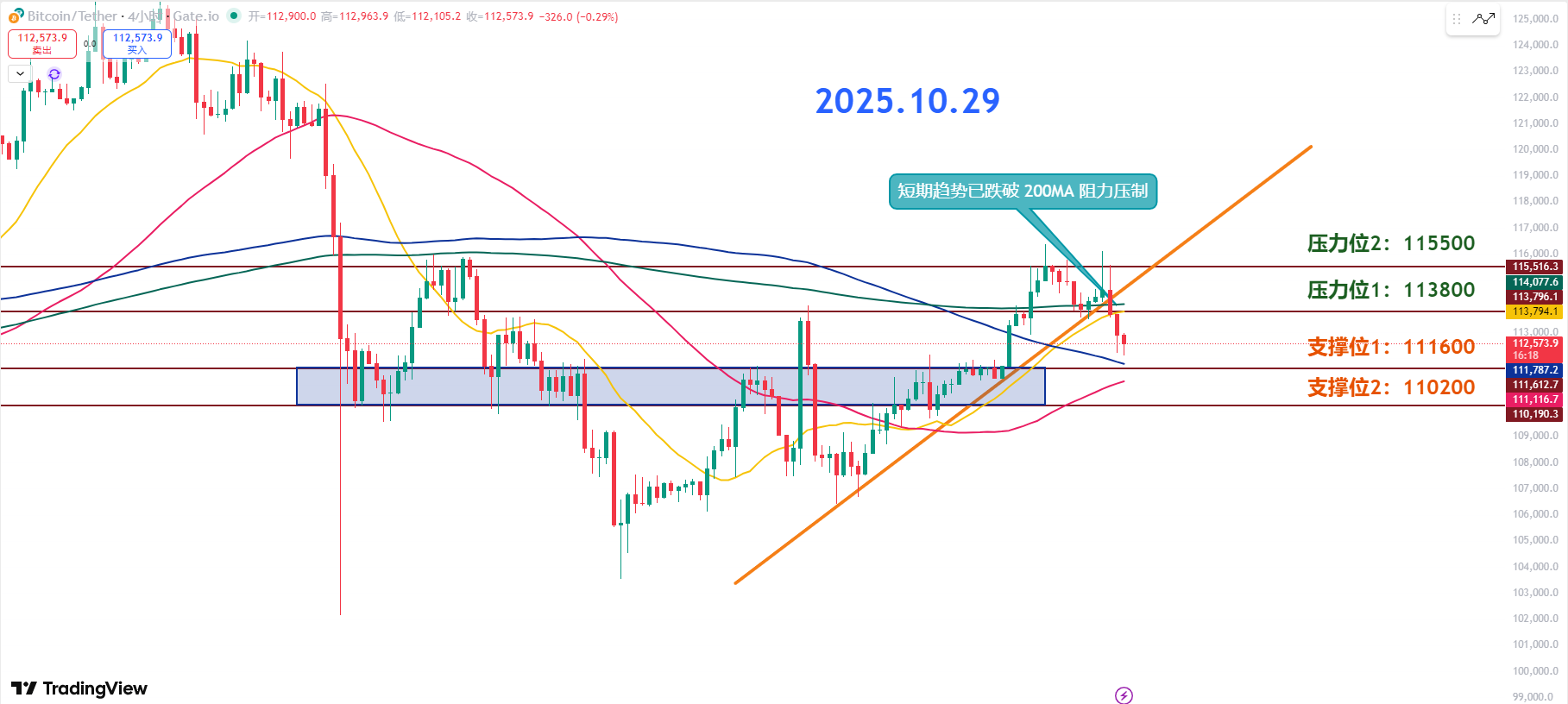

Resistance Levels Reference:

Second Resistance Level: 115500

First Resistance Level: 113800

Support Levels Reference:

First Support Level: 111600

Second Support Level: 110200

Yesterday, Bitcoin surged above 116K and then retraced, leading to profit-taking that directly broke the short-term upward trend line, constraining the bullish momentum. Currently, market sentiment is clearly leaning downward.

The current upward trend line has been pierced, and the 200MA has now become a ceiling. Short-term selling pressure has entered, and the CME gap area of 111.6K ~ 112.5K is currently a key support zone; if this level does not hold, don’t talk about a rebound.

To regain bullish momentum, it must at least reclaim above 115.5K; otherwise, any rise will be a false rebound. 113.8K is the first critical level to confirm after a rebound, while 111.6K is a dense area of previous large transactions and the bottom of the CME gap.

If 110.2K breaks again, then prepare for a drop; after the drop, any rebound can only be treated as a short-term play, with a longer-term trend leaning more bearish. The first resistance at 113.8K overlaps with the 200MA, making it a strong pressure point, while the second resistance at 115.5K is the line of life and death for the trend.

The first support at 111.6K is the most critical support today; if it holds, we can expect a technical rebound. The second support at 110.2K, if held, can allow for short-term bottom fishing; if broken, it’s a new low warning, so don’t catch falling knives.

10.29 Master’s Segment Pre-Set:

Long Entry Reference: Not currently referenced

Short Entry Reference: Short in the 113800-114000 range, add to shorts at 114800, target: 111600-110200

If you truly want to learn something from a blogger, you need to keep following them, rather than making hasty conclusions after just a few market observations. This market is filled with performative players; today they screenshot long positions, tomorrow they summarize short positions, making it seem like they "always catch the top and bottom," but in reality, it’s all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don’t be blinded by exaggerated data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This article is exclusively planned and published by Master Chen (WeChat Official Account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article or in the comments are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。