Author: Yangz, Techub News

At 2 AM on October 30, the Federal Reserve announced a 25 basis point interest rate cut, lowering the target range for the federal funds rate to 3.75%-4.00%, in line with market expectations. This marks the second rate cut of the year and, along with the decision to end quantitative tightening (QT) in December, serves as a clear signal of a shift towards a more accommodative monetary policy.

As usual, this news, traditionally viewed as positive by conventional financial theory, triggered a "buy the rumor, sell the news" reaction in the cryptocurrency market. Following the announcement, Bitcoin's price fell from $111,800, hitting a low of $109,200, with a drop of over 2% in just one hour. As of the time of writing, Bitcoin has slightly rebounded to around $110,900.

This classic "buy the rumor, sell the news" market behavior has long been a fixed script in the crypto market surrounding major macro events. Since the market flash crash on "October 11," Bitcoin's price has been oscillating between $103,000 and $116,000. Now that the rate cut expectation has materialized, the market is calm; will the future trend be consolidation or a breakout?

Expectation Fulfillment and "Hawkish Rate Cut"

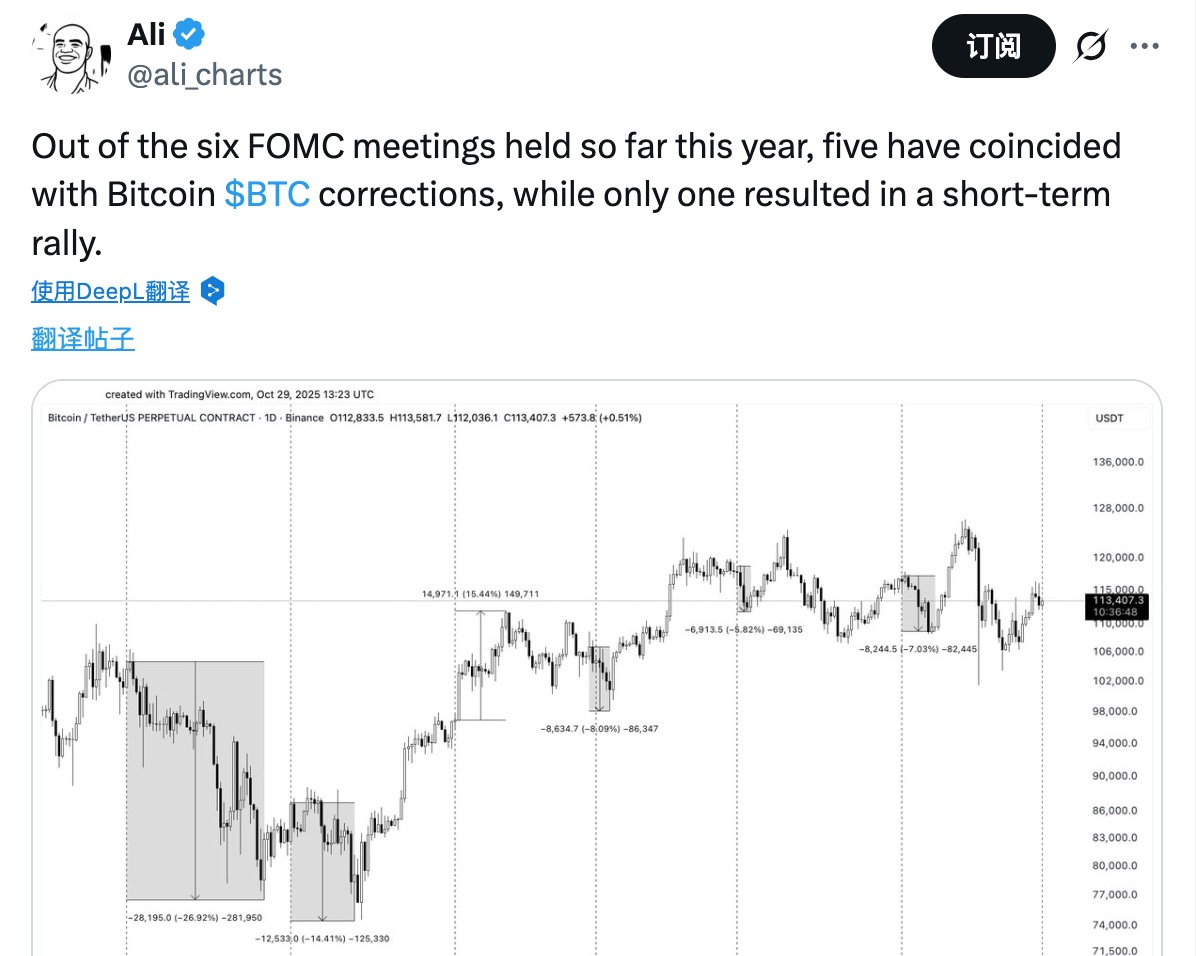

The most direct interpretation of this rate cut by the market is that "good news is fully priced in, which is bad news." Before this meeting, the probability of a 25 basis point cut had been fully priced in by the market. As analyst Ali Martinez pointed out: "In the six FOMC meetings this year, five were accompanied by a Bitcoin pullback." This has formed a discernible pattern—traders tend to position themselves ahead of uncertainty and take profits after the news is released to avoid the volatility risk that follows the "shoe dropping."

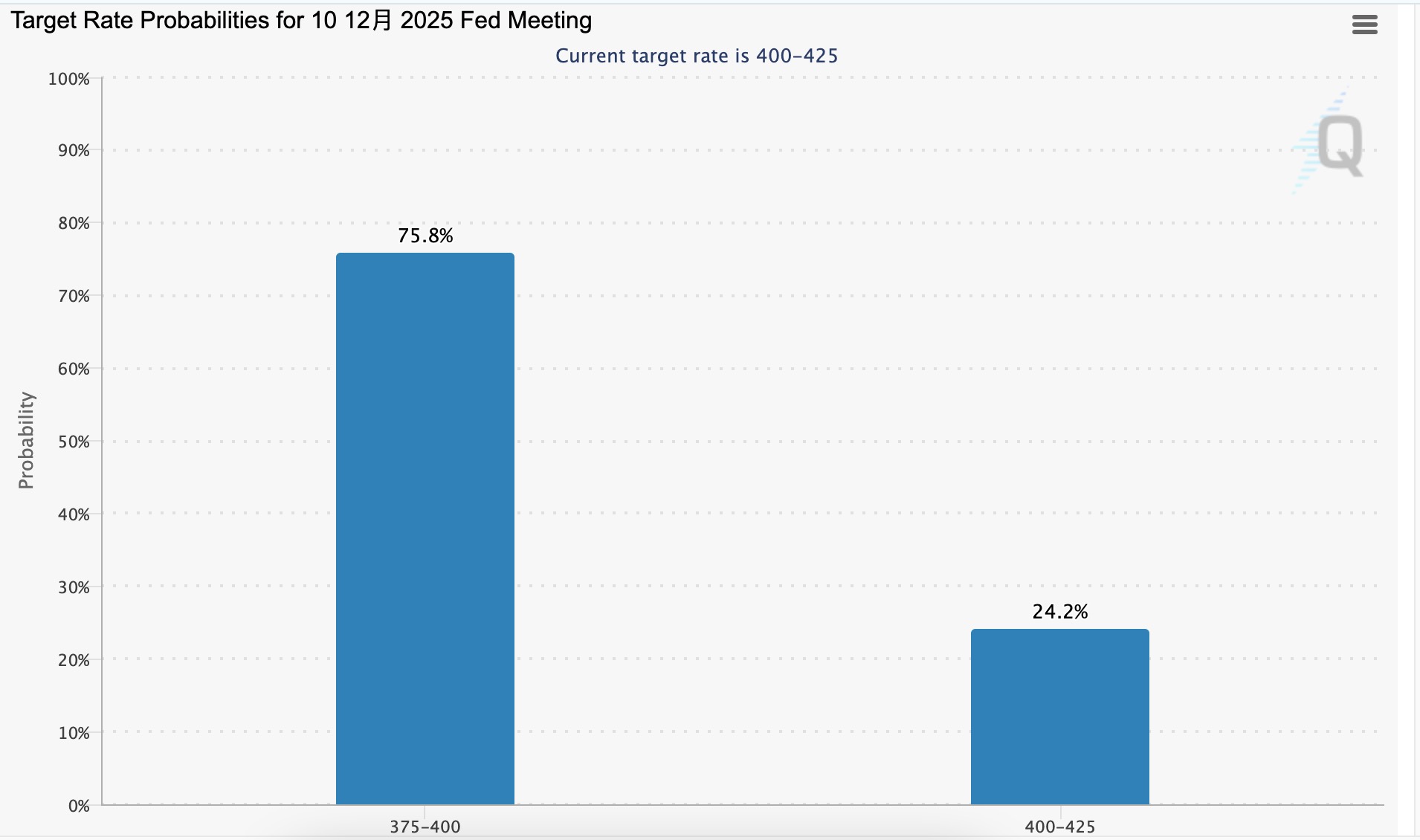

A more critical factor is that the Federal Reserve's rate cut is interpreted by the market as having a "hawkish tone." Chairman Powell's statements at the press conference were crucial; he emphasized that "a rate cut in December is far from a done deal" and revealed that there are "serious disagreements" within the committee regarding the next steps. This undoubtedly dampened the market's enthusiasm for a prolonged rate-cutting cycle. Following the meeting, the market's expectations for a December rate cut also declined. According to CME's "FedWatch," the probability of the Federal Reserve maintaining rates in December is currently as high as 75.8%.

Additionally, as of the time of writing, predictions on Polymarket regarding the Federal Reserve's December rate decision show a 69% probability of a further 25 basis point cut (down 16%), a 30% probability of maintaining rates (up 18%), and a 1% probability of a cut of 50 basis points or more (down 1%).

Macroeconomic Headwinds: Worrisome "Behind the Scenes"

While rate cuts are seen as an important catalyst for driving the crypto market upward, they are not a panacea. Investors should pay more attention to the economic landscape behind the rate cuts and the world "after the cuts." Currently, several macroeconomic headwinds are causing investors to remain cautious rather than blindly optimistic.

Weak Labor Market and Inflation Dilemma: The Federal Reserve's statement noted "slowing job growth and a slight increase in the unemployment rate," while also acknowledging that "inflation has risen since the beginning of the year and remains relatively high." This combination of "slowing growth + stubborn inflation" has raised subtle concerns about stagflation risks in the market. In this environment, while rate cuts can lower the opportunity cost of holding non-yielding assets (like gold and Bitcoin), the economic slowdown itself may weaken the profit outlook for risk assets, putting investors in a dilemma.

Data Black Hole and Policy Uncertainty: The U.S. government shutdown has led to the absence of key economic data (such as weekly unemployment reports), forcing the Federal Reserve to change its wording in the statement from "existing indicators" to "available indicators." Powell also admitted that the lack of data could justify pausing rate adjustments. This "data fog" has made the future policy path extremely opaque, increasing market uncertainty and volatility.

Geopolitical Concerns and Industry Bubble Fears: Investors' focus has extended beyond the rate cuts themselves to the more distant future. The current wave of layoffs in U.S. companies, the long-term impact of Trump's tariff wars, and whether there is a speculative bubble in the AI sector all contribute to a wall of macroeconomic headwinds that suppress the overall risk appetite in the market. Notably, at the time of writing, the presidents of China and the U.S. conveyed friendly cooperation signals during their meeting in Busan, South Korea.

Long-Term Foundation: Why the Bull Market Logic Remains Solid?

Despite the short-term volatility and various macroeconomic headwinds, the long-term logic supporting the market has not been shaken, and a more solid foundation is quietly being laid by institutions, policies, and capital.

Capital Influx: Crypto ETFs Have Become an Irreversible Trend

Crypto ETFs have developed into a continuous influx of capital. According to ichaingo data, as of October 29, U.S. Bitcoin spot ETFs have seen a cumulative net inflow of $4.1 billion this month, with total assets under management reaching $149.98 billion, accounting for 6.75% of Bitcoin's total market cap; while Ethereum spot ETFs have seen net inflows this month that, although not as high as in July and August, have nearly tripled compared to September's $286 million, with total assets under management reaching $26.6 billion, accounting for 5.58% of Ethereum's total market cap.

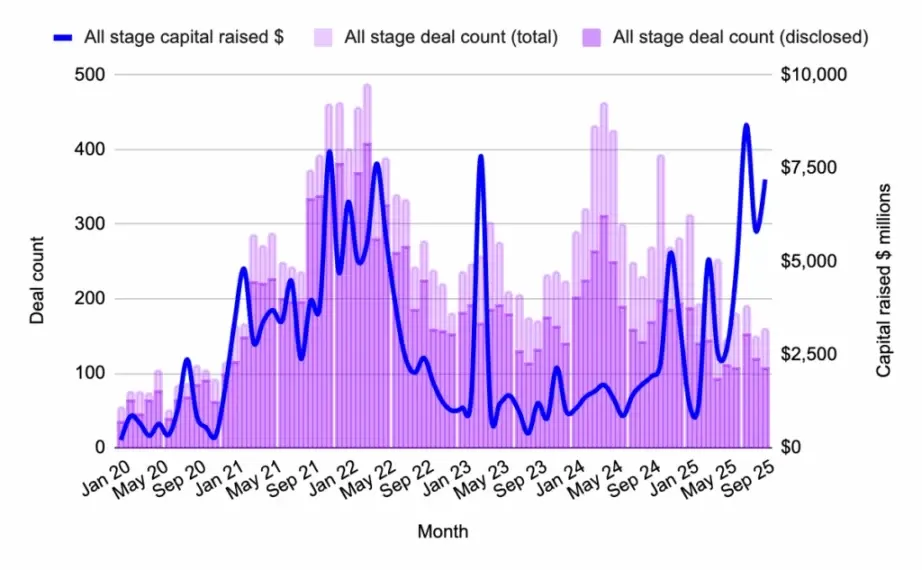

Additionally, on October 28, the first batch of altcoin ETFs in the U.S. officially launched, covering Solana, Litecoin, and Hedera. According to The Block, the total trading volume of these SOL, LTC, and HBAR ETFs on their first day reached $65 million, with Bitwise Solana Staking (BSOL) trading volume reaching $56 million, and $10 million in the first hour of trading, setting a record for the highest trading volume on the first day of an ETF this year. The entry of giants like Bitwise and Grayscale signifies that regulatory and market recognition of the crypto asset class is expanding. This is not only a victory for projects like SOL and LTC but also opens up broader imaginative space for the entire industry—a multi-asset, multi-strategy crypto ETF era is approaching.

DAT Model Slows, but Remains an Indispensable Force

Tightening regulations are injecting rationality into the heated "Digital Asset Treasury (DAT)" model. Recently, major securities exchanges in the Asia-Pacific region have shown an increasingly cautious stance towards listed companies transforming into DAT companies, clearly delineating compliance boundaries for this trend.

The Hong Kong Stock Exchange has raised inquiries with at least five listed companies planning to transform into DAT companies, questioning whether their strategies violate the "prohibition on holding large amounts of non-operational liquid assets" in the Listing Rules. Meanwhile, the Bombay Stock Exchange in India rejected Jetking Infotrain's preferential allotment application because it planned to invest part of the raised funds into crypto assets; the Australian Securities Exchange has explicitly stated that listed companies cannot allocate more than 50% of their assets to cash or cash-like assets, institutionally limiting the asset structure of the DAT model.

Despite the tightening regulatory environment, the asset allocation paradigm represented by DAT continues to advance. In terms of DAT representing Strategy, it has increased its holdings of 390 Bitcoins at an average price of $111,000 from October 20 to 26, bringing its total holdings to 640,808 Bitcoins; additionally, the American Bitcoin, supported by the Trump family, recently announced an increase of 1,414 Bitcoins, with total reserves reaching 3,865 Bitcoins; Nasdaq-listed Solana Company (HSDT) announced it has increased its holdings by about 1 million SOL in the past two weeks, with current holdings exceeding 2.3 million SOL.

From the perspective of market evolution, the current regulatory intervention does not negate the value of crypto assets but is guiding DAT from "concept speculation" to "compliant operation." In the short term, regulatory clarity has suppressed the rapid replication of the DAT model; in the long term, however, it paves the way for mature companies with real cash flow, clear business models, and robust treasury management strategies.

DAT, as a structural force, has not disappeared but is entering a more rational and sustainable new stage of development under the dual drive of regulation and the market. In the future, a batch of high-quality, highly compliant DAT companies will emerge, further enhancing the pricing weight and allocation status of crypto assets in mainstream capital markets.

Continued Entry of Traditional Financial Giants

A true paradigm shift is also occurring behind the scenes on Wall Street. Recent developments indicate that traditional financial giants are no longer just testing the waters but are systematically advancing the integration of crypto assets into their business: Mastercard plans to acquire crypto infrastructure company Zerohash for $1.5 to $2 billion, aiming to strengthen its digital asset settlement capabilities within its payment network; Morgan Stanley supports its financial advisors and clients in flexibly incorporating cryptocurrencies into their multi-asset investment portfolios; JPMorgan plans to allow institutional clients to use Bitcoin and Ethereum as collateral for loans, promoting the evolution of crypto assets into qualified collateral.

These initiatives indicate that cryptocurrencies are upgrading from "marginal speculative assets" to "qualified collateral" and "standard allocation options," with traditional financial pipelines fully opening up to crypto assets.

Policy Tailwind: Regulatory Ice Continues to Melt

Trump's pardon of Binance founder Changpeng Zhao (CZ) is a highly symbolic signal at the policy level. Coupled with the White House's clear statement that "the cryptocurrency war is over," it creates unprecedented policy certainty for the industry's development. Meanwhile, the White House's cryptocurrency affairs head David Sacks revealed that "this year we are fully capable of passing cryptocurrency market structure legislation with bipartisan support, which will ultimately bring much-needed regulatory clarity to the cryptocurrency industry and solidify the success of the GENIUS Act signed by President Trump earlier this year."

Industry Evolution: Transitioning from "Adolescence" to "Adulthood"

In terms of industry evolution, multiple dimensions indicate that the market is maturing. The a16z report titled "2025 State of Crypto" points out that with the total market capitalization of cryptocurrencies surpassing $4 trillion for the first time and stablecoins becoming mainstream, the cryptocurrency industry is bidding farewell to its "adolescence" and entering its "adulthood." Additionally, as Arthur Hayes mentioned in “Long Live the King”, the driving factor behind Bitcoin has shifted from the "four-year halving cycle" to the "global liquidity cycle." Under the ongoing credit expansion in both the U.S. and China, the bull market foundation for Bitcoin is transitioning from a narrative of scarcity to a broader narrative of liquidity, indicating that a new analytical framework of "the four-year cycle is dead, liquidity cycle is eternal" is taking shape.

Conclusion: Grasping Long-Term Trends Amid Short-Term Volatility

The Federal Reserve's "hawkish rate cut" acts like a prism, reflecting the complex landscape of the current market: there are expectations for improved liquidity alongside concerns about the economic outlook; there is both the pain of short-term technical selling pressure and the witnessing of the increasingly solid foundation of long-term value.

The ongoing fluctuations in Bitcoin are both a natural response to macroeconomic uncertainty and a necessary buildup before the formation of a new trend. Although the "good news is fully priced in" script is playing out again, a deeper observation of the market's underlying structure reveals that the cornerstone supporting Bitcoin's long-term value is continuously being solidified: the sustained inflow of capital into crypto ETFs is building a stable demand base, the systematic layout of traditional financial institutions is opening mainstream capital channels, the clarification of regulatory policies is clearing obstacles for industry development, and the industry's evolution from "adolescence" to "adulthood" signifies that the entire ecosystem is maturing. More importantly, market perception is undergoing a fundamental shift—from relying on the "halving narrative" to embracing the "liquidity cycle," this paradigm shift provides a broader perspective for understanding Bitcoin's value.

As the market noise settles, the core elements driving value will ultimately stand out—the direction of global liquidity tides, the continuous evolution of technology adoption, and Bitcoin's ultimate positioning as a store of value in the digital age will continue to guide the market's long-term trajectory. In this era of volatility and opportunity, short-term fluctuations will eventually become footnotes in the market's evolution, while a steadfast long-term trend is steadily unfolding in the consensus of every holder.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。